Chinese Antitrust Litigation and Enforcement in the Wake of JD.com v. Alibaba

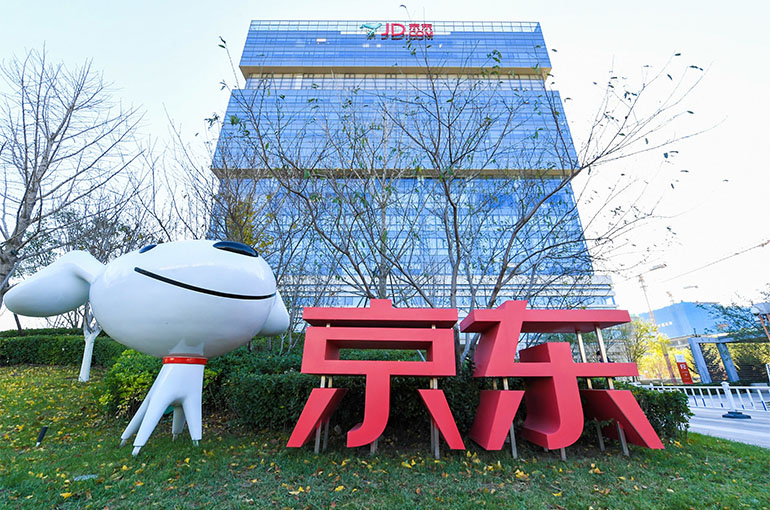

Chinese Antitrust Litigation and Enforcement in the Wake of JD.com v. Alibaba(Yicai) March 29 -- After a decade-long saga, JD.com announced at the end of 2023 that it has been awarded damages of CNY1 billion (USD140 million) by the Beijing High Court in the antitrust lawsuit against rival Tmall and its parent company, Alibaba. This represents the “climax” of the 10-year saga between the two titans which dates back to 2013 relating to Alibaba’s “choose one from two” policy. The recent litigation and investigation trends that culminated into this significant outcome are discussed in this article, with a deep dive into the impact this landmark case will have on China’s antitrust adjudication going forward.

The case itself is note-worthy on several fronts. It represents a milestone plaintiff win and the first plaintiff win in the tech space, involving the largest damages awarded in antitrust litigation in China to date. Moreover, the resolution of this case highlights the proactive approach taken by Chinese courts in addressing complex legal matters. From exerting jurisdiction in cross-border litigation to scrutinising agreements for potential anti-competitive effects, the judiciary's role in shaping antitrust enforcement is clear to see.

In the past, plaintiffs typically found it challenging to prevail in court largely due to not being able to meet the (high) evidentiary requirements. However, recent years have seen a notable shift, with courts increasingly receptive to supporting plaintiff claims on the back of prior administrative penalties, opening the door for plaintiffs. This trend underscores a growing willingness to hold market players accountable and empower plaintiffs to seek redress for anti-competitive behavior.

Overall, a trend is emerging towards a more balanced approach, which is complimented by a combination of growing sophistication, measured enforcement and increasing emphasis on compliance. Such a paradigm shift is seen not only in the tech sector which is relevant to JD.com v. Alibaba, but also across many other industries.

Antitrust litigation and enforcement developments have come hand-in-hand with other evolving regulatory oversight. Other relevant ministries also announced new privacy laws, amended regulations for international data transfer and regulated the gaming and streaming industry.

Looking ahead, the future of Chinese antitrust law promises further evolution driven by legal developments and broader policy objectives. A “new normal” for Chinese antitrust law can be expected, which builds on the past 15 years of enforcement practice, and supports the country’s recent policy objectives to boost economic growth.

Public enforcement efforts are expected to remain robust, with a focus on combating cartel behavior and abusive practices across various sectors. The past years saw active enforcement activity by State Administration for Market Regulation against anti-competitive agreements and abuse of market dominance, in particular in healthcare and other sectors concerning people’s daily life. The State Administration for Market Regulation has increasingly targeted disguised and new forms of cartel (e.g. no-poach in the HR area), continued to take a hard stance on resale price maintenance, become more sophisticated in finding a dominant market position and abusive conduct, and maintained a high level of deterrence through heavy fines for infringements coupled with frequent use of confiscation of illegal gains. Enforcements are expected to remain strong, with cartel, resale price maintenance and certain abusive practices, in particular excessive pricing and exclusionary acts, in such sectors as healthcare and consumer-facing goods high on the enforcement agenda.

Concurrently, there will be increased emphasis on corporate compliance, with firms incentivised to strengthen internal controls and adhere to antitrust regulations. Companies will be further encouraged, and better equipped, to strengthen compliance efforts, as the State Administration for Market Regulation issues more guidelines on how to achieve compliance and becomes increasingly receptive to self-rectification instead to penalty in suitable cases. In 2024, the authority is anticipated to push for rewarding companies for their effective compliance programmes and utilising "soft" measures such as providing guidance, sending warning letters and holding disciplinary talks where appropriate.

In conclusion, JD.com's triumph in the antitrust arena symbolises not only a victory for the company but also an important moment for Chinese antitrust law. As the country navigates the complexities of a rapidly evolving digital economy, the precedence set by this dispute will continue to be a testament to the legal system’s capacity to adapt to new challenges. In shaping the future of antitrust enforcement, we believe China stands poised to foster a more competitive and equitable business environment for all stakeholders.

Authors:

Fay Zhou, Antitrust & Foreign Investment Partner, Linklaters

Arthur Peng, Antitrust & Foreign Investment Partner, Zhao Sheng Law Firm, Linklaters’ joint operation partner in China

Xi Liao, Antitrust & Foreign Investment Partner, Zhao Sheng Law Firm, Linklaters’ joint operation partner in China