MGI (688114) disclosed the shareholder inquiry transfer plan on April 6, and the five initial shareholders planned to reduce their holdings by a total of 7,710,300 shares, accounting for 1.85% of the total share capital.

The transfer is organized and implemented by CITIC Securities, and the transferee is limited to professional institutional investors who meet regulatory requirements, and the transferred shares need to be locked for 6 months.

The five original shareholders of the initial offering reduced their holdings

According to the announcement, the shareholders involved in the reduction include five institutions, including CPE Investment (Hong Kong) 2018 Limited and CHD Biotech Co-invest Limited. Among them, CPE Investment plans to transfer 6.072 million shares, accounting for 1.46% of the total share capital and 23.02% of its shareholding, which is the largest shareholder of this reduction.

Tianjin Kunpeng Management Consulting Partnership (Limited Partnership), Earning Vast Limited and Ascent Cheer Limited plan to transfer 714,700 shares, 667,500 shares and 117,800 shares respectively, accounting for 6.73% of their respective shareholdings; CHD Biotech reduced its holdings by 138,000 shares, accounting for 23.02% of its shares. The five shareholders all declared that there was no illegal reduction of shareholdings, and the shares had been released from the restriction on sale and the ownership was clear.

The transfer price is determined by a market-based inquiry mechanism, and the reserve price is set at 70% of the average stock price in the 20 trading days before the announcement date. CITIC Securities will place shares according to the principles of price priority, quantity priority and time priority: if the effective subscription amount exceeds the planned reduction amount, the lowest price of the cumulative effective subscription will be used as the transfer price; If the subscription is insufficient, it will be executed at the lowest valid price.

According to the data, MGI's current total share capital is 417 million shares, and as of April 3, 2025, the five shareholders hold a total of 49.28 million shares, accounting for 11.8% of the total share capital, and the proposed reduction accounts for 15.6% of its total holdings.

In terms of the qualifications of the transferee, it is limited to professional institutions that meet the requirements for investors under the STAR Market, including public funds, securities firms, qualified foreign investors and private fund managers who have completed filing. CITIC Securities confirmed in the verification opinion disclosed at the same time that none of the five shareholders were the actual controllers or directors, supervisors and senior executives of the company, the shares were frozen without pledge, and the internal decision-making procedures had been completed, which met the requirements of the "Self-Regulatory Guidelines for Listed Companies on the Science and Technology Innovation Board of the Shanghai Stock Exchange No. 4" and other rules.

The announcement also warned of the risk that if the transferor's shares are judicially frozen or the market environment changes abruptly during the transfer, the plan may be suspended. The reduction will be completed through a non-transaction transfer and will not involve centralized bidding or block trading in the secondary market.

As of the third quarter of 2024, MGI's largest shareholder is BGI Technology, holding 153 million shares, with a shareholding ratio of 36.81%; The second largest shareholder is Tibet Huazhan Venture, with a shareholding ratio of 9.97%; The third largest shareholder is CPE Investment, the largest shareholder in this reduction, with a shareholding ratio of 6.35%.

Continued losses in 2024

MGI is mainly engaged in the R&D, production and sales of products in the field of life sciences and biotechnology, such as gene sequencers and laboratory automation business-related instruments and equipment, reagents and consumables. In 2022, the revenue of the year of listing will be 4.2 billion yuan, and the profit will increase by 319% to 2.026 billion yuan, but the performance in 2023 will turn from profit to loss, and the net profit attributable to the parent company will be -607 million yuan, a year-on-year decrease of 130%.

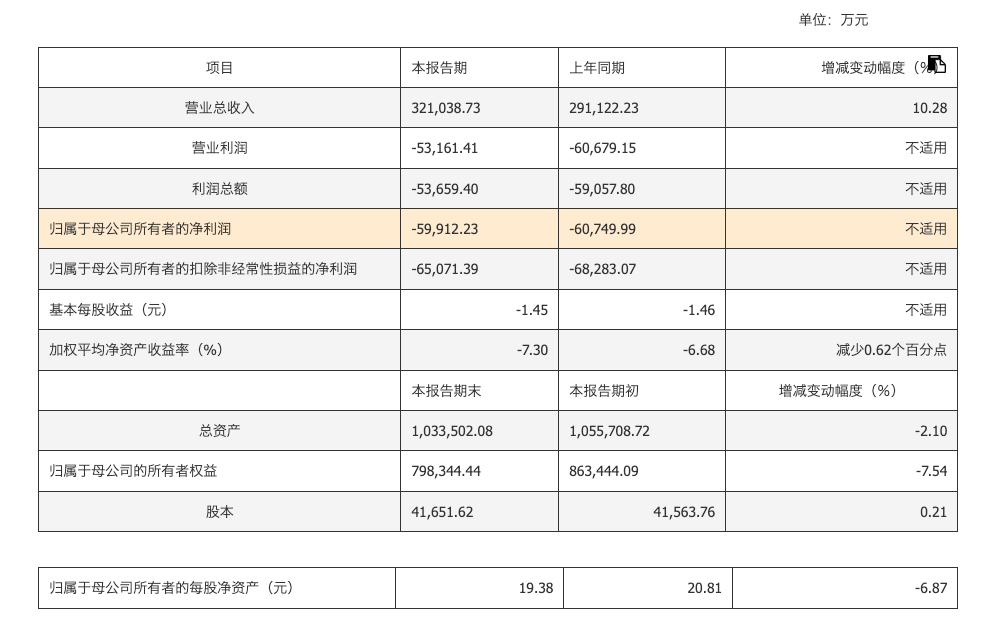

In 2024, the company will achieve a total operating income of 3.210 billion yuan, a year-on-year increase of 10.28%; net profit attributable to owners of the parent company was -599 million yuan, and the loss narrowed by 1.38% year-on-year; The net profit after deducting non-profits was -651 million yuan, a year-on-year decrease of 4.70%. At the end of the reporting period, the company's total assets were 10.335 billion yuan, a year-on-year decrease of 2.10%; the owner's equity attributable to the parent company was 7.983 billion yuan, a year-on-year decrease of 7.54%; Net assets per share decreased from 20.81 yuan to 19.38 yuan, a decrease of 6.87%.

The

change in performance was mainly driven by three factors: relying on the technical advantages of gene sequencers and precise market strategy, the company seized the opportunity of the recovery of overseas demand in the fourth quarter, and promoted a significant increase in installed capacity and sales of supporting equipment; Selling expenses increased by 13 percentage points year-on-year, mainly due to increased investment in marketing and channel expansion; Affected by the fluctuation of the exchange rate of the US dollar and the euro, the exchange loss of foreign currency monetary items increased year-on-year.

At the close of trading on April 3, MGI's share price was 79 yuan per share, with a total market value of 32.9 billion yuan.

Ticker Name

Percentage Change

Inclusion Date