Image source: UI gallery

Text: Bronco Finance, Liu Qinwen

Edited by Wu Lijuan

In 1987, Zong Yanmin, who was only 23 years old and worked in a light bulb factory in Jinan, probably would not have imagined that he would one day become the "richest man" in the land of Jinan.

Zong Yanmin's wealth comes from Tianyue Advanced (688234. SH)。 Relying on Tianyue's advancement, Zong Yanmin has not only successfully appeared on various wealth lists, but now he is accelerating the IPO of Hong Kong stocks. Recently, Tianyue Advanced submitted the "Prospectus" to the Hong Kong Stock Exchange, seeking the layout of "A+H" dual capital platform.

However, Tianyue Advanced's performance changed after its A-share listing in 2022, and it will not turn a profit until 2024.

A-shares have lost money for two consecutive years after listing, and it is expected to turn losses into profits in 2024

At the beginning of 2025, AI products such as DeepSeek, ChatGPT, Kimi, and Doubao have shown their swords, and the market competition is becoming increasingly fierce, and an AI war is on the way.

The vigorous development of AI has not only promoted technological innovation, but also driven the overall prosperity of the upstream and downstream industry chains. AI training and inference require a lot of computing resources, and silicon carbide devices can improve power efficiency and reduce heat dissipation requirements due to their high switching frequency and low losses, thereby supporting more computing power.

In addition to AI, silicon carbide substrates can also be widely used in electric vehicles, AI data centers, photovoltaic systems, AI glasses, rail transit, power grids, home appliances, and advanced communication base stations. Tianyue Advanced is mainly responsible for the R&D and industrialization of silicon carbide substrates.

"In terms of practice, silicon carbide has been widely used in actual production, such as in new energy vehicles, silicon carbide semiconductors can be used to drive motors, inverters, etc., and its high-efficiency and energy-saving characteristics can significantly improve the mileage of new energy vehicles." Wang Chishen, an independent economist, said.

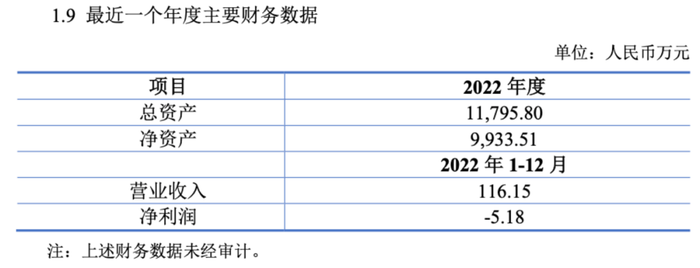

However, Tianyue Advanced cannot escape the cyclical impact of the industry, and its performance has changed after the listing of A-shares.

In 2021, before listing, Tianyue Advanced achieved operating income of 494 million yuan, an increase of 16.25% over the same period of the previous year; The net profit was 89.9515 million yuan, a year-on-year increase of 114.02%. However, in 2022 after listing, the operating income will decline by 15.56% to 417 million yuan, and turn from profit to loss, with a huge loss of 175 million yuan, a year-on-year plunge of 294.8%.

In 2023, Tianyue Advanced's revenue will increase by 199.9% to 1.25 billion yuan, but it has not stopped its losses, with a net profit of -45.7205 million yuan.

Source: wind

In 2024, it will finally turn losses into profits again, according to the performance report, Tianyue Advanced is expected to achieve revenue of 1.75 billion yuan to 1.85 billion yuan in 2024, an increase of 39.92% to 47.92% year-on-year; The net profit attributable to the parent company was 170 million yuan to 205 million yuan, an increase of 471.82% to 548.38% year-on-year.

"The company has realized the batch supply of 4-8 inch substrate products, and in 2024, the company's capacity utilization rate will gradually increase, the production and sales of products will continue to grow, the scale effect will gradually appear, the cost will be gradually optimized, and high-quality conductive silicon carbide substrate products will accelerate their 'going to sea'. Operating income and gross profit of products increased significantly compared with the same period last year. Tianyue advanced explained.

The rapid increase in revenue and the smooth turnaround were due to the rapid increase in sales of silicon carbide substrates. In the first three quarters of 2022, 2023 and 2024, the sales volume of Tianyue's advanced silicon carbide substrates will be about 63,800, 226,300 and 251,500 respectively. The sales revenue from silicon carbide substrates was RMB326 million, RMB1.086 billion and RMB1.053 billion, accounting for 78.2%, 86.8% and 82.2% of the total revenue, respectively.

However, it is worth noting that the average selling price of its silicon carbide substrates has been declining year by year, with RMB 5,110, RMB 4,798.1 and RMB 4,185 per piece in the first three quarters of 2022, 2023 and 2024, respectively.

The shareholders have cashed out 400 million, and the A-share private placement will be transferred to Hong Kong for IPO after the termination

In fact, Tianyue Advanced's listing on the A-share market can be described as very smooth, and the shareholders behind it are even more "star-studded".

In August 2019, Hubble Investment, an investment arm under Huawei, invested in Tianyue Advanced at a price of 12.23 yuan per registered capital, subscribed 111 million yuan, and held 7.05% of the shares before listing.

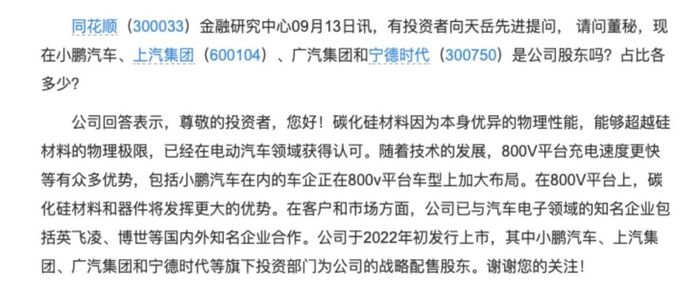

At the time of its listing in 2022, a number of leading companies in the industry participated in Tianyue's advanced strategic placement.

According to the prospectus, SAIC and Xiaopeng Motors were allocated 600,900 shares, accounting for 1.4% of the number of shares issued, and the allocated amount was 49.7512 million yuan.

At the same time, Guangdong Guangqi Qihao Equity Investment Partnership (Limited Partnership) was allocated 588,914 shares, accounting for 1.37%, and the allocated amount was 48.7562 million yuan. The fund's partners include GAC Capital Co., Ltd., a wholly-owned subsidiary of GAC Group, with a 99.6552% stake. As an important investment platform of GAC Group, GAC Capital has been committed to the in-depth layout of the automotive industry chain since its establishment in April 2013.

In addition, CATL, through its wholly-owned subsidiary, Ningbo Meishan Bonded Port Area Winning Investment Co., Ltd., also participated in the placement and was allocated 600,900 shares, accounting for 1.4%, with an amount of 49.7512 million yuan. Founded in April 2017 with a registered capital of 500 million yuan, Winner Investment is an important strategic investment platform for CATL.

In September 2024, on the investor interactive platform, Tianyue Advanced also responded, "The investment departments of Xpeng Motors, SAIC Group, GAC Group and CATL are the company's strategic placement shareholders." ”

Source: Straight Flush

There are also sponsors Guotai Junan and Haitong Securities, both of which arranged for their subsidiaries Guotai Junan Zhengyu Investment Co., Ltd. and Haitong Innovation Securities Investment Co., Ltd. to participate in the co-investment, and the number of co-invested shares was 2.81% of the public shares of Tianyue Advanced, that is, 1.2079 million shares, respectively, with an allocation amount of 99.9999 million yuan, and a restriction period of 24 months.

However, after the restriction period, on October 9, 2024, Tianyue Advanced disclosed its shareholding reduction plan. Liaoning Zhongde, Haitong New Energy and Haitong Innovation plan to reduce their holdings by a total of no more than 12,891,300 shares, or 3% of the total share capital, through centralized bidding and block trading.

On January 27, 2025, the three shareholders completed the reduction of shareholdings, and according to the announcement, during the implementation of the shareholding reduction plan, a total of 7.87 million shares of the company were reduced, accounting for 1.8315% of the total share capital, and a total of about 434 million yuan was cashed out.

Behind the cash-out of shareholders is Tianyue Advanced's losses for two consecutive years in 2022 and 2023.

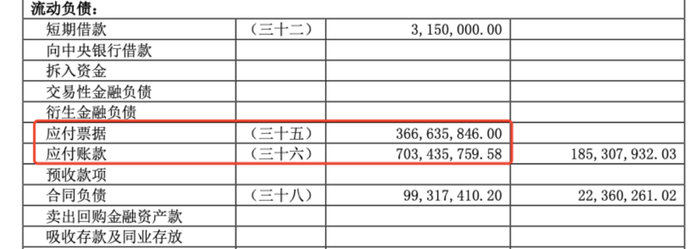

Secondly, Tianyue Advanced's asset-liability ratio increased from 10.48% in 2022 to 24.38% in 2023, of which current liabilities increased from 313 million yuan to 1.304 billion yuan. The increase in current liabilities was due to notes payable and accounts payable, which amounted to $366 million and $703 million respectively in 2023, totalling $1,069 million.

Source: Annual report

In addition, the 2023 annual report shows that Tianyue Advanced A-share initial listing raised 3.558 billion yuan, over-raised 1.203 billion yuan, and 700 million yuan of the over-raised funds were used for permanent replenishment/loan repayment.

In addition, from the first quarter of 2024, the net cash flow generated by Tianyue Advanced operating activities will turn negative for three consecutive quarters, respectively -39.06 million yuan, -82.0409 million yuan and -52.2012 million yuan.

To this end, Tianyue Advanced also launched a fixed increase plan at the same time. On April 12, 2024, Tianyue Advanced deliberated and passed the "Proposal on Requesting the General Meeting of Shareholders to Authorize the Board of Directors to Issue Shares to Specific Targets in a Simplified Procedure", agreeing to issue shares to specific targets with a total financing amount of no more than RMB 300 million and no more than 20% of the net assets at the end of the most recent year.

According to the announcement, the net funds raised this time will be used for: 8-inch automotive-grade silicon carbide substrate preparation technology improvement project.

However, after eight months, combined with the actual situation and the company's development plan and many other factors, in order to safeguard the interests of the company and all shareholders, Tianyue Advanced chose to terminate the private placement plan on December 28, 2024.

Source: Announcement

After the termination of the private placement, Tianyue Advanced started the Hong Kong stock IPO plan non-stop and submitted the "Prospectus" on March 10, 2025.

The actual controller has become the "richest man in Jinan", and the Zong family has laid out financial and other fields

Tianyue Advanced, which gave up the private placement of A-shares and sought a "A+H" layout, is backed by the Zong family from Jinan.

Born in 1964, Zong Yanmin graduated from Qilu University of Technology with a bachelor's degree. After 15 years of working in the Jinan light bulb factory, the Jinan light bulb factory closed down, and Zong Yanmin once said that after the factory closed, "I started the road of entrepreneurship with an unemployment certificate in hand." ”

In 2002, 38-year-old Zong Yanmin established Jinan Tianye Construction Machinery Co., Ltd. to act as an agent for Volvo brand excavators and other engineering equipment. After several years of hard work, the company has become the leader of the construction machinery sales industry in Shandong Province, according to Zong Yanmin, to achieve the scale of "annual sales revenue of more than 3 billion yuan, profit of one or two hundred million yuan".

At present, Jinan Tianye still exists and operates smoothly, with more than 330 employees, 200 technical service engineers, 36 sales and service outlets, large-scale exhibition venues, maintenance workshops, parts warehouses, recycling centers, training centers, used car trading centers, etc. At present, Zong Yanmin is still serving as the chairman.

In 2010, Zong Yanmin started a second venture and founded Tianyue Advanced, according to the "Jinan Daily", in 2010, by chance, Zong Yanmin learned that after 10 years of hard work, Professor Jiang Minhua of Shandong University successfully cultivated silicon carbide monocrystalline in the laboratory, but until his death in 2011, he did not realize industrialization, so he contacted many parties and bought this technology.

In the hands of Zong Yanmin, after continuous research and development, Tianyue Advanced has achieved mass production of materials. In 2015, Tianyue's advanced 4-inch silicon carbide substrate completed mass production, and in 2011, it achieved mass production of 6-inch silicon carbide substrate.

In 2019, Tianyue's advanced semi-insulating silicon carbide substrate products had a global market share of 18%, rising to 30% a year later, second only to international leaders II Lu (35%) and Cree (33%).

With the development of the business, Tianyue quickly became a unicorn enterprise and launched a listing plan. In May 2021, Tianyue Advanced sprinted to the A-share Science and Technology Innovation Board, and after two rounds of inquiries, it successfully landed on A-shares on January 12, 2022, with an issue price of 82.79 yuan per share. It rose slightly by 3.27% on the day of listing, and fell by 4.11% the next day, falling below the issue price. During the listing period, Tianyue Advanced's share price once rose to 137.5 yuan per share, but as of March 17, 2025, Tianyue Advanced closed at 71.85 yuan per share in A shares, down 47.75% from the highest value, with a total market value of 30.875 billion yuan.

Source: Baidu Stock Market

With the listing of Tianyue Advanced on the A-share market, Zong Yanmin also appeared on the Hurun Report. In 2022, with a wealth of 13 billion yuan, it was listed on the "2022 Hurun Report" for the first time, ranking 473rd on the list, ranking first in Jinan, Shandong. However, the value of wealth will drop to 7.5 billion yuan in 2023.

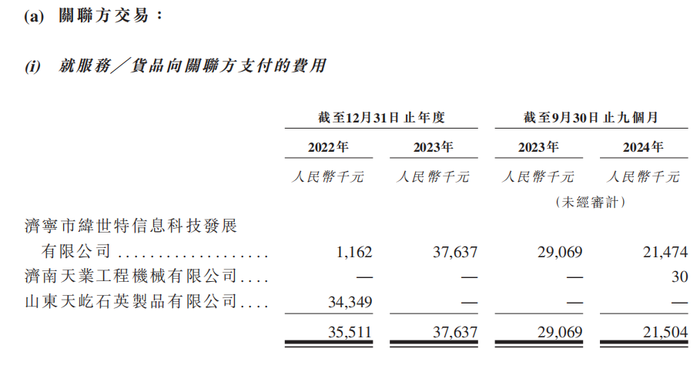

While Zong Yanmin became the "richest man in Jinan", he did not forget his family. According to the prospectus, from 2022 to the first nine months of 2024, Tianyue Advanced purchased 1.162 million yuan, 37.637 million yuan and 21.474 million yuan from Jining Weishite Information Technology Development Co., Ltd. (hereinafter referred to as "Weishite") respectively.

Source: "Prospectus".

Weishite was established in January 2018 with a registered capital of 20 million yuan, and the actual controller is Zong Xinjun, the second brother of Zong Yanmin.

In addition, Tianyue Advanced is the only customer of Weishite. The revenue in 2022 and 2023 will be 1.1615 million yuan and 37.6376 million yuan respectively, and the net profit will be -51,800 yuan and 6.0713 million yuan respectively.

Source: Announcement

The Zong family also has a layout in the financial field.

Zong Xinjun, through Jinan Xinghuo Technology Development Co., Ltd., indirectly holds 88.2% of the shares in Jining JETCO Non-Financing Guarantee Co., Ltd. (hereinafter referred to as "Jining JETCO"), and another person surnamed Zong, Zong Qingqing, serves as executive director, general manager and legal representative.

Jining JETCO is mainly engaged in litigation preservation guarantees, bid guarantees, advance payment guarantees, project performance guarantees, final payment repayment guarantees, raw material credit purchase guarantees, equipment installment payment guarantees, property preservation guarantees, lease contract guarantees, etc.

Tianyancha shows that Jining JETCO has a total of 190 judicial cases, 52.63% of which are caused by disputes over the right of recovery, and the amount of cases involved as a plaintiff is 56.5548 million yuan.

Source: Tianyancha

In addition, Zong Xinjun also indirectly holds 25.71% of the shares in Shandong Ruinuo Hydraulic Machinery Co., Ltd., serving as the chairman and general manager and legal representative. Mainly engaged in the research and development, manufacturing and sales of hydraulic machinery, the production covers an area of 10,000 square meters, and is a new four-board enterprise.

From technology introduction to industrialization, from A-share listing to seeking secondary listing of Hong Kong stocks, the Zong family has shown a keen business sense and strategic vision. However, in the face of fierce market competition and continuous technological innovation, Tianyue Advanced still needs to continue to make efforts. What else do you know about the business story of the Zong family? Welcome to leave a message below to discuss.

Ticker Name

Percentage Change

Inclusion Date