In 2025, the competition in the photovoltaic industry has shifted from "price fighting" to "patent encirclement".

JinkoSolar (SH688223) and LONGi Green Energy (SH601012) launched patent attacks and defenses around the world, and Trina Solar (SH688599) claimed 1 billion yuan from Canadian Solar (SH688472) The lawsuit shook the industry.

On the surface, it is patent protection, but in fact, some photovoltaic manufacturers use intellectual property rights as a weapon to compete for the right to define technology and the right to speak in the market. Behind this scuffle, there is not only the "life-and-death battle" between TOPCon and BC technology routes, but also the deep anxiety of Chinese photovoltaic companies in technological upgrading and global expansion.

When patents become a tool for business competition, industry innovation ecology and global trust crises may ensue.

"The phenomenon of fighting each other and internal friction with patent disputes should be stopped as soon as possible." Lv Fang, Secretary-General of the Photovoltaic Special Committee of the China Green Supply Chain Alliance, stressed in an interview with the reporter of "Daily Economic News" that this round of photovoltaic cycle is long, nearly two years, and is about to see the dawn. Dawn is a road that requires everyone to work together to get out, not before dawn everyone closed their eyes to fight each other, internal friction, the entire industry ecology is damaged, so how can the photovoltaic industry come tomorrow, where to the next boom cycle?

"Patent war" fighting

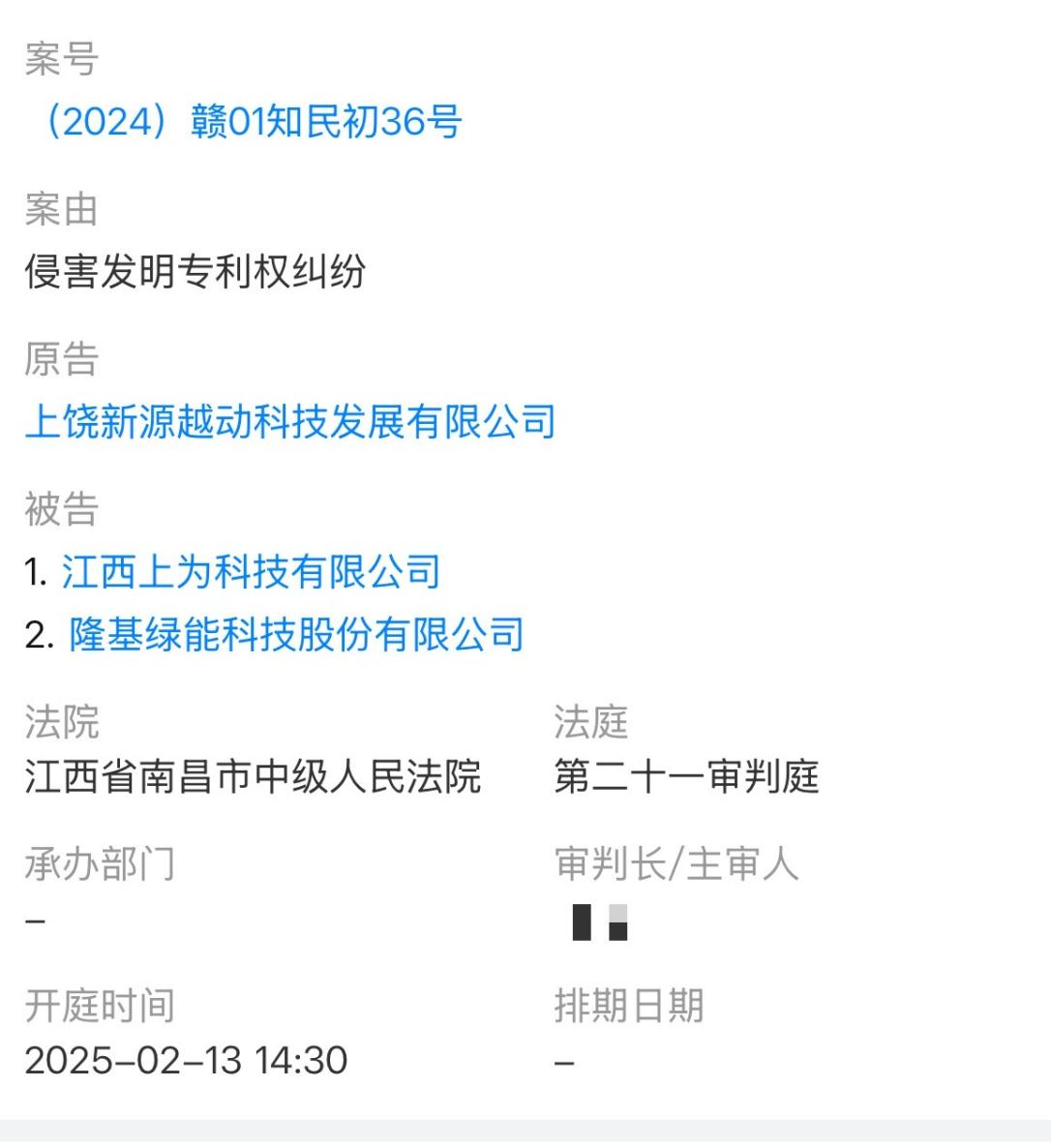

On January 3, 2025, JinkoSolar filed a lawsuit against LONGi Green Energy with the Nanchang Intermediate People's Court of Jiangxi Province for infringement of relevant invention patent rights, demanding that the latter stop the infringement and compensate for economic losses, thus kicking off the annual patent war.

Source: Tianyancha

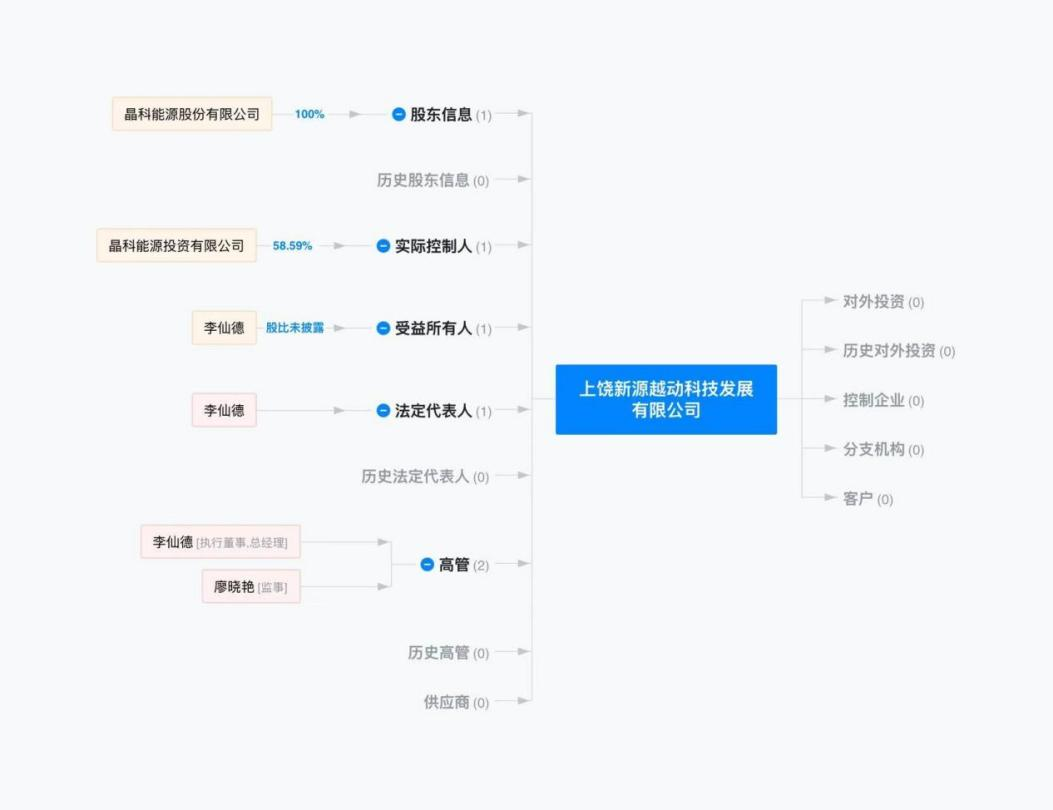

The plaintiff is JinkoSolar's wholly-owned subsidiary, Shangrao Xinyuan Yuedong Technology Development Co., Ltd. (hereinafter referred to as "Shangrao Xinyuan Yuedong"), formerly known as "Shangrao Jinko Green Energy Technology Development Co., Ltd.", which was established in July 2022 and its legal representative is Li Xiande, chairman of JinkoSolar.

Source: Tianyancha

It is worth noting that the company was also the subject of JinkoSolar's acquisition of some of its PV patents from LG Group.

According to public reports, in 2022, LG Group announced that it would fully withdraw from the photovoltaic manufacturing field, and in September of the same year, the group transferred a batch of photovoltaic patents to Shangrao Xinyuan Yuedong, which are mainly concentrated in the United States, Europe and China.

According to third-party data, LG Group transferred a total of 745 patents to JinkoSolar. In March 2024, JinkoSolar successively transferred 323 of its patents to Trina Solar and JA Solar (SZ002459).

The three are in the same TOPCon camp, and they are authorized and shared between patents, forming the "Jingjingtian" alliance that is widely rumored by the outside world. In addition to forming a group to reduce costs, the three photovoltaic manufacturers have also started an increasingly fierce "patent war".

At the beginning of the year, JinkoSolar launched a "war" against LONGi Green Energy in Nanchang, and the relevant patents involved in the case were concentrated in the field of TOPCon cell technology and module technology. In early December last year, JinkoSolar also sued LONGi Green Energy and Suzhou Lingyuan Photovoltaic Technology Co., Ltd. for patent infringement in the Intermediate People's Court of Suzhou City, Jiangsu Province.

In addition to China, the gunsmoke between the two sides has also spread overseas, and JinkoSolar has sued LONGi Green Energy for infringement in Australia, Japan and other places, demanding a ban on sales and compensation.

Every time the reporter noticed, the showdown between photovoltaic manufacturers is not only Jinko and LONGi, but also the "patent battle" between Trina Solar and Canadian Solar has also attracted much attention.

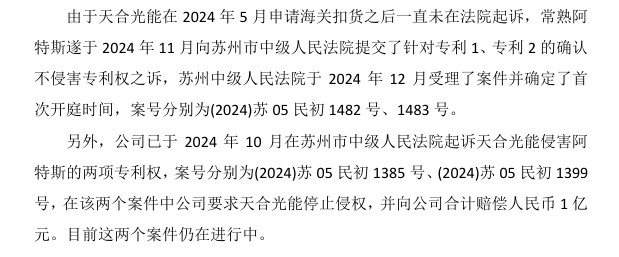

In May 2024, Trina Solar filed an application with Shanghai Customs to seize the outbound container of Changshu Canadian Solar on the grounds of suspected patent infringement, resulting in the detention of the relevant PV module products by the customs. On July 12, the customs issued a Notice of Release of Detention (Sealing) to release the relevant goods.

Trina Solar said that Canadian Solar was detained and released because it had paid a deposit, while Canadian Solar argued that the goods did not infringe the patent rights mentioned by Trina Solar.

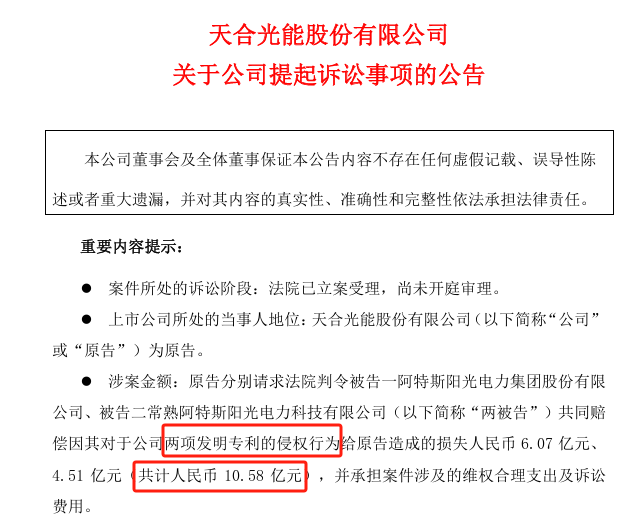

On February 10, 2025, Trina Solar disclosed a patent lawsuit against Canadian Solar and its wholly-owned subsidiary, Changshu Canadian Solar Power Technology Co., Ltd., for infringement of invention patents, with a claim amount of more than 1 billion yuan.

Source: Trina Solar's announcement

In response, Canadian Solar said in the announcement that the company had done a thorough research and analysis of Trina Solar's two patents involved in the case, and believed that there was strong evidence to prove that the two patents should be invalid, and that the company's products and processes did not infringe the two patents.

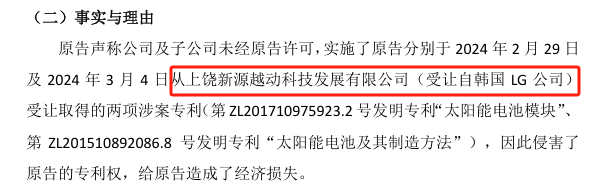

According to the announcement, the two patents that Trina Solar sued Canadian Solar for "infringement" happened to come from JinkoSolar's previous purchase of LG Group's patents.

Source: Canadian Solar announcement

In addition, in July and August 2024, JA Solar filed patent infringement lawsuits against CHINT Xinneng and several of its companies in Europe before the Munich Division of the UPC (Unified European Patent Court) and the District Court of Hamburg, Germany, respectively.

It is not difficult to see that the competition in the photovoltaic industry is becoming increasingly fierce, in addition to using the "price war" to seize market share, the "patent war" is also becoming a "sharp weapon" for enterprise competition.

Interestingly, according to the 2024 module shipment list compiled by InfoLink, the top 7 manufacturers are JinkoSolar, LONGi Green Energy, JA Solar, Trina Solar, Tongwei (SH600438), Chint New Energy, and Canadian Solar.

Among the top 7 manufacturers, only Tongwei has not been affected by this "patent war", and the remaining 6 manufacturers have basically formed a 1V1 confrontation.

"Looking back over the past 20 years, there have been very few cases like this in terms of patents. In China, such situations will break out in 2024. From the perspective of time, this just reflects the serious 'involution' of the industry and the situation that the industry cycle is at the bottom. At this stage, enterprises have tried their best to compete for the market. Lu Fang said bluntly in an interview with reporters. In particular, when price competition is unsustainable and the industry is at a low point, enterprises will inevitably seek other means of competition, which is also the reason for the recent emergence of patent disputes. ”

Get passively involved

In the face of sudden patent lawsuits, manufacturers such as LONGi Green Energy and Astor also passively fought back.

In January this year, a relevant person from LONGi Green Energy responded to reporters, saying, "The company is one of the enterprises with the largest number of patents in the photovoltaic field, has a relatively complete layout in various technical fields, and also respects the intellectual property rights of other companies." The company will actively investigate and respond, and if necessary, it will also file counterclaims against TOPCon and other technical products. ”

The reporter flipped through its 2024 semi-annual report and found that as of the end of the reporting period, LONGi Green Energy had obtained 3,166 authorized patents of various types and nearly 200 BC technology patents.

This is also the confidence of its counterattack.

The reporter noted that on January 21, 2025, LONGi Green Energy countersued Jinko in the United States for infringing TOPCon technology patents. It filed a lawsuit against JinkoSolar and its subsidiaries for patent infringement of TOPCon and other photovoltaic module products in the United States, demanding that JinkoSolar and its subsidiaries prohibit the sale of infringing products in the United States and compensate for losses.

On February 11, 2025, LONGi filed a counterclaim again.

The reporter learned that LONGi Green Energy sued JinkoSolar for patent infringement in the Intermediate People's Court of Jinan City, Shandong Province, demanding that the manufacture, sale, and promise to sell the alleged infringing products should be stopped immediately. The Jinan Intermediate People's Court has accepted the lawsuit.

This lawsuit is also seen as a counterattack by LONGi Green Energy against JinkoSolar in China after the counterclaim in the United States.

"LONGi not only holds BC technology patents, but also has deep accumulation in various photovoltaic technologies such as TOPCon. We were one of the first companies to invest in the research and development of TOPCon technology, and we have continued to cultivate and deepen our layout for more than ten years, so we have also quickly fought back after the patent lawsuit. LONGi Green Energy further said.

It is reported that LONGi Green Energy only has 30GW of TOPCon production capacity in Inner Mongolia, and the company's production capacity is accelerating to BC. In contrast, JinkoSolar has been leading the way in TOPCon capacity. In the first three quarters of 2024, JinkoSolar's module shipments reached 67.65GW, with N-type modules accounting for about 85%. The cost of the mutual litigation between the two parties is also worth pondering.

Regarding the recent litigation matters, on March 4, a reporter from "National Business Daily" contacted JinkoSolar for further interviews.

It replied by email that JinkoSolar has long attached great importance to the protection of intellectual property rights and R&D and innovation, and is one of the companies with the largest number of patent applications and authorizations in the photovoltaic industry. The protection of intellectual property rights is not only the need for enterprises to protect their own interests, but also the key to promote the healthy development of the industry.

In addition, Canadian Solar also revealed in the announcement that it had sued Trina Solar for infringement of Canadian Solar's two patents in the Suzhou Intermediate People's Court in October 2024, with case numbers [2024] Su 05 Min Chu No. 1385 and [2024] Su 05 Min Chu No. 1399, in which the company demanded that Trina Solar stop the infringement and pay a total of RMB 100 million in compensation to the company. As of 11 February, the two cases were still ongoing.

Source: Canadian Solar announcement

Qu Xiaohua, Chairman of Canadian Solar, said at the recent China Photovoltaic Storage Original Technology Forum, "China's photovoltaic has entered the era of 'dark forest', and patents have become a weapon for involution. ”

It said that over the past 24 years, Canadian Solar has accumulated more than 4,000 granted patents. "Every year, we encounter several patent lawsuits initiated by foreign companies, and we have not lost a single lawsuit. It also opposes the malicious competition of photovoltaic companies in the name of patent protection. ”

The conflict of interests behind it

Looking at the essence of the phenomenon, behind the intensification of the "patent war" in the photovoltaic industry, in fact, is the anxiety of the iteration period of new and old technologies, as well as the competition for market share and profit margins.

PV is a typical technology-intensive industry with a very high dependence on innovation and technology.

Under the technological innovation and rapid iteration, many different battery technology routes have emerged in the market, such as HJT, TOPCon, BC, etc. Since the second half of 2023, there has been a debate about which is the best battery technology for TOPCon (tunneling oxide passivation contact) or BC (back contact).

Among them, manufacturers represented by JinkoSolar, Trina Solar, and JA Solar have a deep layout in TOPCon technology.

In terms of the number of patents, JinkoSolar's official website disclosed that it has applied for nearly 4,200 patents, authorized more than 2,800 patents, and has 462 industry-leading N-type TOPCon-related technology patents.

However, according to public information and relevant reports, some of its patents were purchased from South Korea's LG Group, and it needs to strengthen its control through litigation. In March 2024, JinkoSolar successively transferred some of its patents to Trina Solar and JA Solar.

In September 2023, LONGi Green Energy proposed to vigorously develop photovoltaic BC cells, and said that in the next 5 to 6 years, BC cells will be the absolute mainstream of crystalline silicon cells, and the company's next products will gradually adopt the BC technology route.

As a platform technology, BC can be combined with TOPCon, HJT and other technologies to achieve better efficiency. At the same time, BC can also be combined with perovskite cells to form tandem cells.

Overall, BC technology has a great tendency to rise. According to the China Photovoltaic Industry Association, in 2024, the average conversion efficiency of TOPCon, HJT, and XBC will reach 25.4%, 25.6%, and 26.0%, respectively. From the perspective of average cell conversion efficiency, XBC has the highest efficiency, followed by HJT, and TOPCon has the lowest.

In addition, at present, the world's major photovoltaic module manufacturers have laid out TOPCon technology and production line products, so patent litigation in the field of TOPCon technology is relatively common. In contrast, in terms of BC technology, the leading photovoltaic manufacturers in China have certain core patent reserves.

In October 2024, LONGi's HPBC 2.0 module broke the 36-year-long monopoly of overseas PV brands on the efficiency record of crystalline silicon modules with an efficiency of 25.4%, setting a world record for the highest PV module.

It is worth noting that some photovoltaic manufacturers have been deploying next-generation products, and many leading companies have also set their sights on BC cells with high technical thresholds and complex processes, but with higher conversion efficiency.

For example, Ouyang Zi, chief technology officer of JA Solar, previously publicly stated that JA Solar's R&D focus will gradually shift to BC and tandem cells. Considering the maturity of the current technology, it is a reasonable expectation to first BC and then stack.

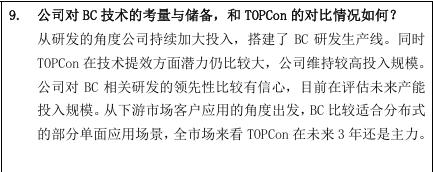

JinkoSolar revealed at an investor event, "From the perspective of R&D, the company will continue to increase investment and build a BC R&D production line." "BC technology is more suitable for single-sided application scenarios and can be used as a branch technology route layout".

Source: JinkoSolar announcement

An industry lawyer who has been engaged in "patent litigation" for a long time told every reporter that patent wars are becoming more and more frequent, and the underlying logic is still commercial competition. From the perspective of the patent itself, the characteristic of a patent is that it is open for protection, and the most typical feature is that it has exclusivity, which can also be called monopoly or exclusivity. Possessing this patent certificate can monopolize this technology, which is why there are always various "patent wars" now.

"Especially when patents show a huge competitive advantage in the market, then the 'patent war' will break out more violently."

Judging from the "patent war" that broke out in the photovoltaic industry, on the one hand, the photovoltaic companies that initiated the lawsuit were basically the photovoltaic companies of the TOPCon technology route, and some manufacturers used patents as litigation chips to consolidate their positions. In particular, the globalization of patent wars shows that this kind of competition has gone beyond technology itself and has become a tool for companies to compete for overseas high-margin markets.

"After achieving a ban on the sale of competing products through patent litigation to expand their market share, to a certain extent, they are excluding competitors." The above-mentioned lawyer admitted to reporters, "The patent war is very long, and once the ban is won, it is a very big loss." Especially like now it is the photovoltaic giants that occupy the market, once which market is banned, it is an immeasurable loss, it is difficult to enter the market, but losing the market is a matter of an instant. ”

Overseas markets have always been the hardest hit area for Chinese PV companies affected by patents, and many patent lawsuits have been filed against overseas markets, and some manufacturers have also been subject to patent lawsuits initiated by foreign companies.

The

latest news is that, according to public reports, at the end of February 2025, the American photovoltaic giant FirstSolar announced that it had launched a patent infringement lawsuit against China's leading photovoltaic companies, and the lawsuit was aimed at the current mainstream TOPCon cell technology.

Regarding the layout of the technology route in the U.S. market, the reporter noted that Li Zhenguo, founder and president of LONGi Green Energy, previously revealed that LONGi Green Energy will not deploy the TOPCon technology route in the U.S. market, which is mainly based on the complexity of patents in the field of technology in the United States and other places. "At present, LONGi Green Energy's business in the United States is still dominated by PERC technology, and the next step will definitely be to take the BC route with an original technology moat."

On the other hand, the purpose of litigation may be to achieve cross-licensing of patents.

A person close to LONGi Green Energy told reporters that Jinko and LONGi had been in contact before, hoping to reach a consensus on patents. However, due to the fact that Jinko was obviously aiming for BC technology, in addition to asking LONGi to pay for its so-called TOPCon patents, it also asked LONGi to authorize all the patents it currently has, including the BC technology that is under review, and finally the two parties did not reach an agreement.

In response to the above information, on March 5, when the reporter called JinkoSolar again for verification, it did not respond positively in the reply to the reporter's email, but only said that the relevant litigation is still ongoing, and the company will continue to advance the litigation in accordance with local legal procedures.

Li Zhenguo said in the interview that although from a legal point of view, patent litigation is a normal commercial rights protection behavior, when filing a lawsuit, he still needs to ask himself: "What is the original intention of doing this?" What does it mean for the development of the PV industry and industry, as well as for the international image of the PV industry as a whole? ”

"The technology in the photovoltaic field is iterating rapidly, and TOPCon is currently mature and has a relatively high market share, but it may be backward in the future." The lawyer told reporters, "But if you really want to force other manufacturers to exchange technology through patent litigation, then this kind of business strategy is relatively not so fair." ”

Industry impact geometry

With the increasingly fierce "patent war", it has gradually become an important means of competition between photovoltaic enterprises.

This kind of behavior of treating patents as commercial competition not only violates the original intention of the patent system to encourage innovation, but also has a profound negative impact on the development of the entire photovoltaic industry.

First, frequent patent disputes may be interpreted as "non-market competition", damaging the reputation of "Made in China" and hurting the entire PV industry.

Lv Fang told reporters that "patent war" has become a common phenomenon in the photovoltaic industry, showing a situation of multiple companies facing each other. In addition to some disputes between enterprises in the patent itself, patents have also been extended, such as commercial warfare, technical warfare, public opinion warfare, etc., forming a set of business competition strategies with patents as the core. "In particular, the impact of the 'public opinion war' is extremely bad, it is not only a harm to a product and an enterprise, but also a harm to a country and the photovoltaic industry."

Second, patent litigation is often time-consuming and labor-intensive, and enterprises need to invest a lot of human, material and financial resources to deal with litigation.

The above-mentioned lawyer admitted to every reporter that especially in the litigation initiated in overseas markets, the high litigation costs, such as lawyer fees, litigation fees, appraisal fees, etc., are actually a very big burden for a company. If it is really banned, there may be the problem of market loss, and the company faces stock price fluctuations, which are all indirect losses and chain reactions.

Source: VCG41N1396093242

In other words, if these resources are used for R&D, they can promote enterprises to make greater breakthroughs in technology; For production, it can improve production efficiency and expand production scale. However, because of patent litigation, these resources are consumed a lot, which hinders the development and iteration of high-quality technologies to some extent.

Lu Fang also said that the current situation does not allow companies to be distracted by patent issues, which is time-consuming, costly, and energy-consuming. Especially in terms of public opinion, all kinds of influences are coming, and the energy of enterprises is often dispersed a lot, and it is difficult to really focus on innovation, breakthroughs and product iterations, which not only affects the mood of enterprises, but also damages the brand image, and many enterprises cannot afford to spend it in the end.

Third, the "patent war" has an immeasurable impact on the overall iteration of original technology.

"After the giants monopolize the market, there is no incentive to innovate, if the company that has mastered the technology is defeated, in fact, the overall industry competitiveness will decline rapidly." The above-mentioned lawyer said.

At the same time, frequent litigation has exacerbated the separation between technology confidentiality and collaboration, and companies are more inclined to closed innovation rather than open cooperation. This is contrary to the PV industry's long-term goal of reducing costs and accelerating the energy transition through technology sharing.

The

patent system is an important system for the protection of innovation, and its purpose is to encourage enterprises to carry out technological innovation, by giving innovators a certain period of patent protection, so that they can obtain returns from innovation, so as to stimulate the enthusiasm of enterprises for innovation, and by no means by purchasing patents, suppressing competitors, and trying to inhibit high-quality innovation.

Back to the roots of innovation

The endgame of the patent war should not be the endgame of a zero-sum game, but the future of the industry. This also raises a question: when will photovoltaic patents return to the source of innovation?

Every time the reporter notices that for the recent frequent "patent wars" in the industry, some photovoltaic manufacturers have publicly shouted, calling on the industry to stop involution and return to the source of innovation.

A few days ago, the China Photovoltaic Storage Original Technology Forum was held, and more than 20 industry organizations jointly launched the "Proposal on Actively Promoting Independent Innovation and Original Technology Development in the Optical Storage Industry" by leading enterprises such as LONGi Green Energy, Canadian Solar, and Aiko Technology, as well as the Photovoltaic Special Committee of the China Green Supply Chain Alliance, Jiangsu Photovoltaic Industry Association, Suzhou Photovoltaic Industry Association and other associations.

Li Zhenguo, founder and president of LONGi Green Energy, said at the China Photovoltaic Storage Original Technology Forum that it is necessary to be vigilant against the vicious competition that may occur due to the difficulties of enterprises in the current round of the photovoltaic industry cycle.

Li Zhenguo said: "We should contribute wisdom and strength to enterprises and the photovoltaic industry through the cycle through independent innovation and China's original technology, instead of setting obstacles to the high-quality development of the photovoltaic industry through commercial purposes' and 'inferior quality and low price', and discrediting the international image of China's photovoltaic industry and bringing irreversible impact." The more complex the international situation today, the more we must shoulder the responsibility and responsibility of the enterprise. ”

Qu Xiaohua, Chairman of Canadian Solar, also pointed out, "PV is China's business card and one of the most important high-tech industries in China. In the past 20 years, due to few patent disputes, China's photovoltaic has been able to develop together. At the current moment when the photovoltaic industry is warm and cold, some Chinese photovoltaic people use patents to come, buy, and buy to engage in internal friction, and crack down on thousands of people who are broad and profound, which will definitely hinder the development of China's original technology. ”

"The key core technology is not to come, to buy, or to buy." Qu Xiaohua said that only by mastering the key core technologies in our own hands can we fundamentally guarantee the country's economic security, national defense security and other security. We must dare to take the road that our predecessors have not taken, strive to realize the independence and controllability of key core technologies, and firmly grasp the initiative of innovation and development in our own hands.

Cover image credit: VCG41N1396093242

Ticker Name

Percentage Change

Inclusion Date