Today, the market is completely crazy!

The

Hang Seng Tech Index broke through the 6,000-point mark in one fell swoop and closed up 4.47% as of the afternoon, hitting a record high in nearly three years.

SMIC, as one of the sentiment leaders in the current round of Hong Kong stocks, has risen nearly 130% since the low point in December last year.

The semiconductor sector of A-shares also undertook a wave of funds at the end of today, with Chengdu Huawei and Brite shares having a 20% daily limit, and VeriSilicon, Tianyue Advanced, Changguang Huaxin, Aojie Technology, and Jinghe Integration following up.

Among them, Tianyue advanced (688234. SH) just submitted to the Hong Kong Stock Exchange two days ago, seeking a dual listing of A+H.

The company is the leading silicon carbide substrate in China, with the second largest market share in the world and the first domestic manufacturer in 2023.

Among the companies that have recently been listed in Hong Kong, the electronics industry occupies a large weight, in addition to Tianyue Advanced, there are Longsys, Goertek, Fengyuan Technology, Jiehuate, Hehui Optoelectronics, etc.

In January 2022, Tianyue Advanced landed on the Science and Technology Innovation Board and became the "first stock of silicon carbide substrate", raising a total of 3.558 billion yuan, with a net fundraising of 3.203 billion yuan after deducting related expenses, and an over-raising of 1.2 billion yuan.

The first announcement of Tianyue Advanced in Hong Kong is December 28, 2024, and it is only 2 months from the announcement to the submission of the form.

Next, let's explore the advanced situation of Tianyue in detail.

01

Focusing on silicon carbide substrates, it is necessary to raise funds to expand the production capacity of large-size substrates

Tianyue Advanced was founded on November 2, 2010 by founder Zong Yanmin, headquartered in Jinan, Shandong.

From 2010 to 2020, the predecessor of the company has completed several rounds of capital contribution and equity transfer, and was restructured into a joint stock limited company in November 2020. In January 2022, Tianyue Advanced landed on the A-share Science and Technology Innovation Board.

At present, Zong Yanmin directly and indirectly controls 38.48% of the company's interests and serves as the chairman of the board of directors, executive director and general manager of the company.

In addition, Huawei Hubble holds a 6.34% stake in the company.

Zong Yanmin, 61, graduated from Shandong Institute of Light Industry (now Qilu University of Technology) in July 1987 with a bachelor's degree in silicate engineering. In March 2020, he was rated as a senior engineer by the Shandong Provincial Engineering and Technical Qualification Senior Review Committee.

He has more than 35 years of experience in semiconductor material technology research and development, industrialization and business management. Prior to founding Tianyue Advanced, he also founded Jinan Tianye Construction Machinery Co., Ltd., where he served as Chairman of the Board and General Manager until October 2020 and has continued to serve as Chairman of the Board thereafter.

Since its establishment, Tianyue Advanced has focused on the R&D and industrialization of silicon carbide substrates.

In 2015 and 2021, it successively completed the mass production of 4-inch and 6-inch silicon carbide substrate products;

In 2023, it will have the mass production capacity of 8-inch silicon carbide substrates;

In 2024, the industry's first 12-inch silicon carbide substrate will be launched;

As of September 30, 2024, the company has set up two production bases in Shandong and Shanghai, with a total annual design capacity of more than 400,000 silicon carbide substrates in 2024.

From January to September 2022, 2023 and 2024 (reporting period), the sales revenue of Tianyue advanced silicon carbide substrates will be 326 million yuan, 1.086 billion yuan and 1.053 billion yuan respectively, accounting for 78.2%, 86.8% and 82.2% of the company's total revenue respectively.

Silicon Carbide substrate sample of the company, source: prospectus

As for the reasons for seeking a listing on the Hong Kong Stock Exchange, the prospectus said that the move aims to accelerate the company's internationalization and overseas business expansion, improve the company's ability to obtain funds from the international market, and further enhance the company's financial strength and competitive advantage.

The proceeds will be used primarily to expand the capacity of silicon carbide substrates of 8 inches or larger to meet the growing demand for high-performance semiconductor materials.

02

Revenues grew steadily, while product prices declined

Benefiting from the increase in demand in downstream new energy vehicles, photovoltaic energy storage and other fields, Tianyue Advanced's revenue has grown steadily in recent years.

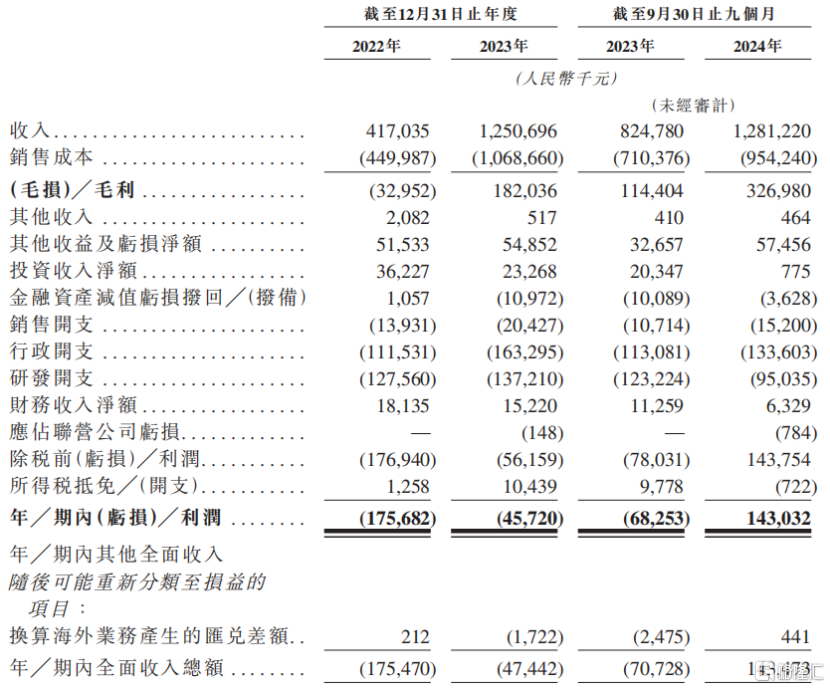

In terms of financial data, during the reporting period, the company's revenue was 417 million yuan, 1.251 billion yuan and 1.281 billion yuan respectively. Revenue in 2023 increased by 199.9% compared to 2022, and revenue in the first three quarters of 2024 increased by 55.3% compared to the same period in 2023.

The

main reason for the revenue increase from January to September 2024 is the increase in revenue generated by silicon carbide products after the mass production of 8-inch silicon carbide products; The Shanghai production base will be put into operation in May 2023; and rising market demand.

In terms of net profit, the company will lose 176 million yuan and 46 million yuan in 2022 and 2023 respectively, and achieve a net profit of 143 million yuan from January to September 2024.

On February 23, Tianyue Advanced released the latest performance report. In 2024, the company will achieve revenue of 1.768 billion yuan, a year-on-year increase of 41.37%, net profit attributable to the parent company of 180 million yuan, and non-net profit of 158 million yuan, both of which will turn losses into profits year-on-year.

the company's key financial data; Source: Prospectus

In terms of gross profit margin, the gross loss ratio was 7.9% in 2022, increased to 14.6% in 2023, and further increased to 25.5% in the first three quarters of 2024.

It is worth noting that during the reporting period, the sales volume of Tianyue advanced silicon carbide substrates were about 63,800 pieces, 226,300 pieces and 251,500 pieces, respectively, and the average selling prices were 5,110 yuan, 4,798.1 yuan and 4,185 yuan per piece, respectively, and the prices decreased.

According to the prospectus, from 2019 to 2024, the global silicon carbide substrate market price has declined, mainly affected by factors such as intensified market competition, cost optimization brought about by mature technology, and gradual expansion of production capacity.

In the future, with the accelerated iteration of silicon carbide substrate products and the continuous rise in demand due to the rapid development of downstream applications, the price decline of the same size substrate is expected to gradually narrow.

In this regard, Tianyu Semiconductor, the leader of silicon carbide epitaxial wafers that we wrote about earlier, is also facing the risk of falling product prices. (For details, see Huawei Bet!) Dongguan semiconductor unicorn sprint IPO).

Tianyu Semiconductor said in the prospectus that after 2025, the average selling price of silicon carbide epitaxial wafers in China will decline faster than the global average selling price.

From the perspective of R&D investment, during the reporting period, Tianyue Advanced R&D expenditure was 128 million yuan, 137 million yuan and 95 million yuan respectively.

The

year-on-year decrease from January to September 2024 was mainly due to the company's successful transition from the initial R&D stage to the mass production stage of 8-inch silicon carbide substrates in 2023, and the R&D investment has begun to translate into increasing commercial success.

As of September 30, 2024, the company has established business relationships with more than half of the world's top 10 power semiconductor device manufacturers (in terms of 2023 revenue).

From 2022 to January to September 2024, the proportion of the company's sales revenue from markets outside Chinese mainland to the company's total revenue in the same period increased from 12.6% to 40.4%.

During the reporting period, the top five customers accounted for 65.0%, 51.3% and 53.2% of the total revenue in the same period, accounting for a relatively large proportion.

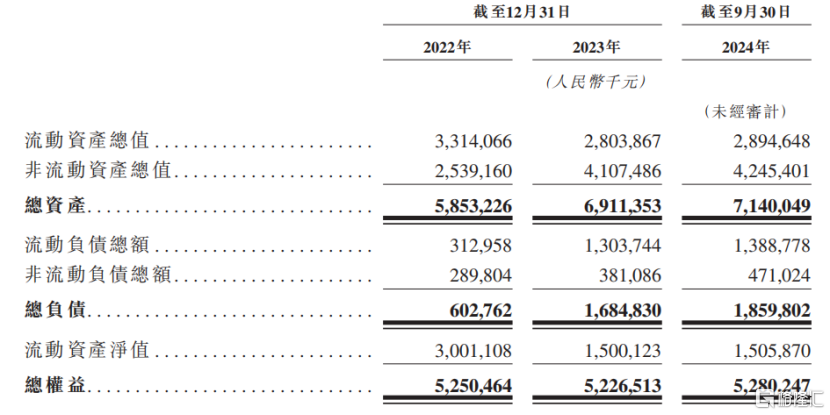

Similar to other foundries in the semiconductor industry, Tianyue Advanced has built a large number of fixed assets, and the capital expenditure incurred for the construction of production bases reached 3.185 billion yuan during the reporting period.

As of September 30, 2024, the total value of the company's non-current assets was RMB4.245 billion, of which property, plant and equipment amounted to RMB3.822 billion, accounting for 53.53% of the total assets.

Company Balance Sheet, Source: Prospectus

03

The

silicon carbide substrate industry has a good prospect, and the company's market share is the second in the world

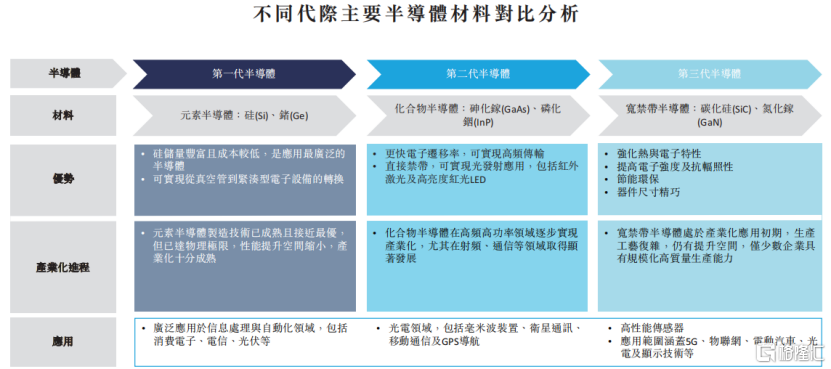

From the perspective of the development trend of semiconductor materials, silicon carbide materials have taken the lead in promoting the transformation of the semiconductor industry, and gradually replacing and supplementing silicon-based technology.

Compared with silicon-based semiconductors, wide bandgap semiconductors represented by silicon carbide and gallium nitride have outstanding performance advantages from the material end to the device end, which is an important direction for the development of the semiconductor industry in the future, and is known as the third generation of semiconductors.

Among them, silicon carbide exhibits unique physical and chemical properties.

Silicon carbide is a compound composed of carbon and silicon, which has the characteristics of high band gap, high breakdown electric field strength, high electron saturation drift rate and high thermal conductivity, and is a key material for reducing costs and increasing efficiency in many industries.

These properties give SiC significant advantages in high-performance applications such as xEVs and photovoltaics, especially in terms of stability and durability.

Silicon carbide materials are mainly used to make silicon carbide substrates and epitaxial wafers, among which silicon carbide substrates are widely used in power semiconductor devices, radio frequency devices, optical waveguides, filters, heat dissipation components and other fields, covering xEV, photovoltaics, energy storage, power grids, rail transit, communications, AI glasses, smart phones and other industries.

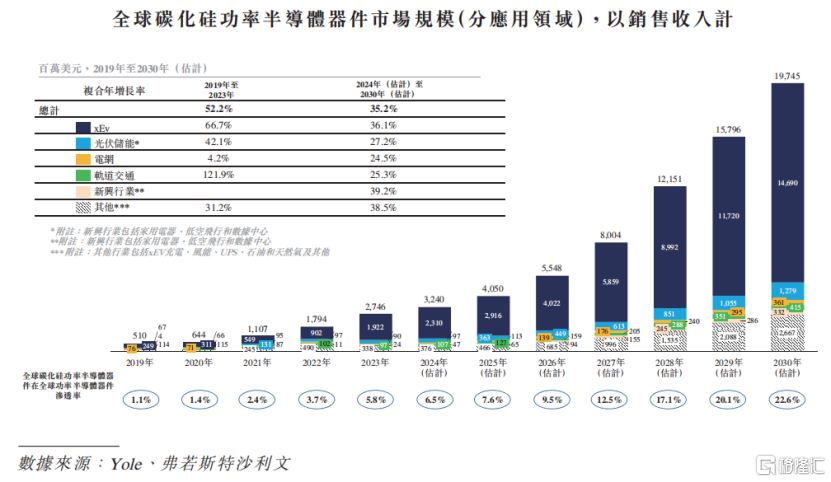

From 2019 to 2023, the silicon carbide power semiconductor device market has grown significantly, and its penetration rate in the global power semiconductor device market has increased from 1.1% to 5.8%, and it is expected to reach 22.6% in 2030.

In terms of application field, the compound annual growth rate of silicon carbide power semiconductor devices in the xEV field will be as high as 66.7% from 2019 to 2023, and it will still reach 36.1% from 2024 to 2030, continuing to lead the market growth.

In addition, the growth rate of photovoltaic energy storage, power grid, rail transit, and emerging application fields is also considerable.

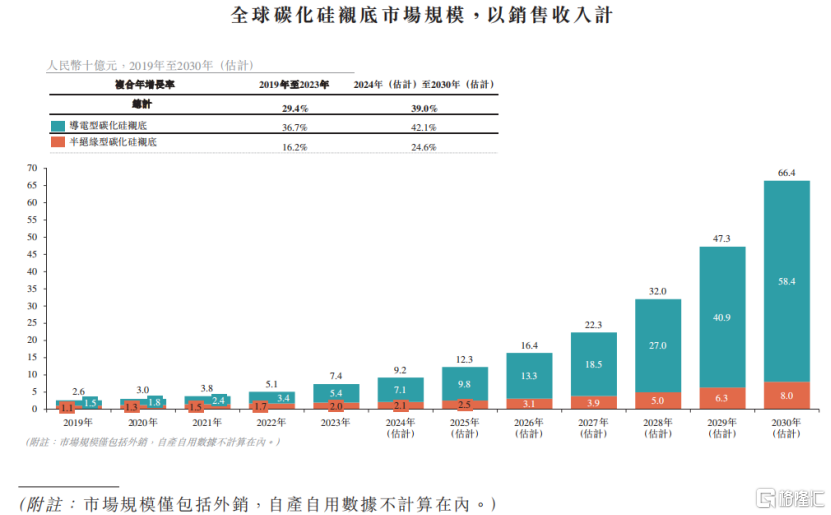

In terms of sales revenue, the global silicon carbide substrate market will grow from 2.6 billion yuan in 2019 to 7.4 billion yuan in 2023, with a compound annual growth rate of 29.4%. It is estimated that by 2030, the market size is expected to grow to 66.4 billion yuan, with a compound annual growth rate of 39.0%.

The global silicon carbide substrate market in which the company operates is highly competitive, characterized by rapid technological developments, rapidly changing customer needs and preferences, frequent new product introductions, and the emergence of new industry standards and practices.

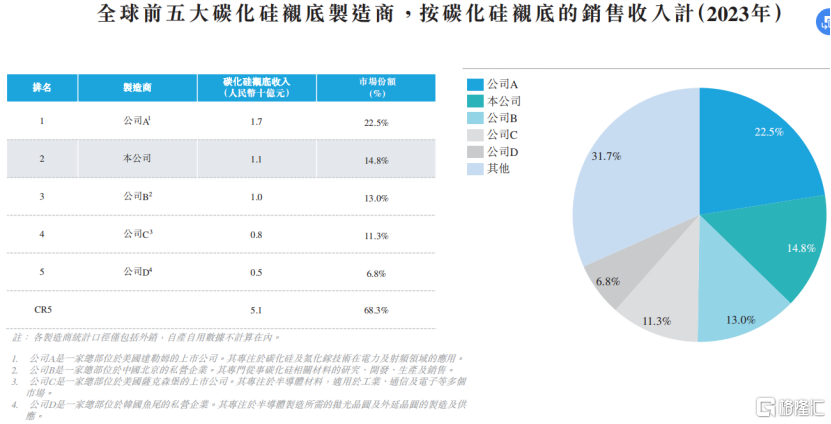

In terms of silicon carbide substrate sales revenue, the total market share of the top five market participants in 2023 will be 68.3%, with a high market concentration, and overseas leading companies represented by Wolfspeed and Coherent occupy a dominant position.

In 2023, Tianyue Advanced will have a market share of 14.8%, ranking second in the world in terms of market share and first among Chinese enterprises.

In the future, we will continue to pay attention to whether Tianyue Advanced can accelerate its overseas business expansion through Hong Kong stock listing and further increase the company's market share.

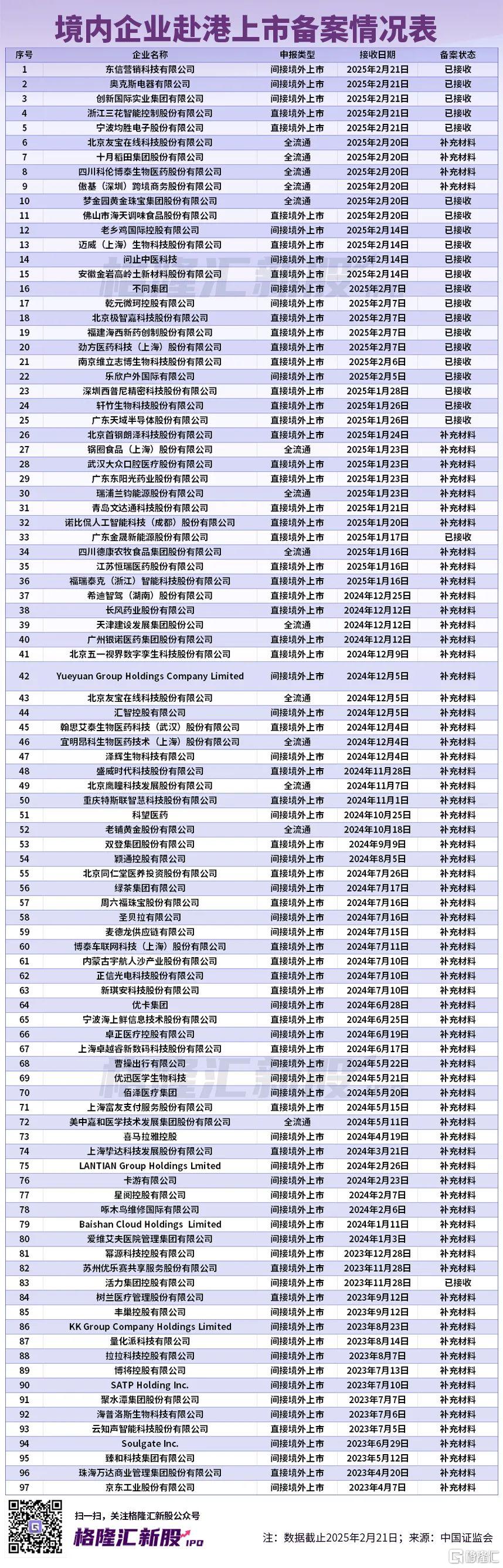

According to the statistics of Gelonghui new shares, since 2025, 20 A-share listed companies have ushered in a new trend of listing in Hong Kong, and the relevant table can be found in yesterday's article "8 years of loss of 12.2 billion, semiconductor display panel small giants hit A+H listing!" 》。

Correspondingly, the process of filing for overseas listings is also advancing, and as of February 21, a total of 97 domestic companies have filed for listing in Hong Kong.

Ticker Name

Percentage Change

Inclusion Date