Since the application for the IPO on the main board of the Shanghai Stock Exchange was accepted in March 2023, Jiangyin Huaxin Jingke Technology Co., Ltd. (hereinafter referred to as Huaxin Jingke) has replied to the first round of review inquiry letters and supplemented the 2023 annual financial information, and is still "suspended" for review due to the expiration of financial information.

Huaxin Jingke's main products are precision stamping cores, which are the core components of motors, transformers, ignition coils and other products. From 2020 to 2022, the company's gross profit margin declined for three consecutive years due to changes in product structure and the price of raw material silicon steel. However, in 2023, the gross profit margin of the company's main business will increase from 18.97% to 24.59%, a large increase.

On December 19, Huaxin Jingke replied to the reporter of "Daily Economic News" by email: The increase in gross profit margin in 2023 is mainly due to the increase in the gross profit margin and revenue proportion of the company's main product new energy vehicle drive motor core.

However, the reporter of "Daily Economic News" checked the information and found that in 2023, the gross profit margin of comparable products of several comparable companies will mostly show a downward trend, which is quite different from the trend of Huaxin Jingke. In this regard, the company also explained.

The gross profit margin trend in 2023 is very different from that of comparable companies

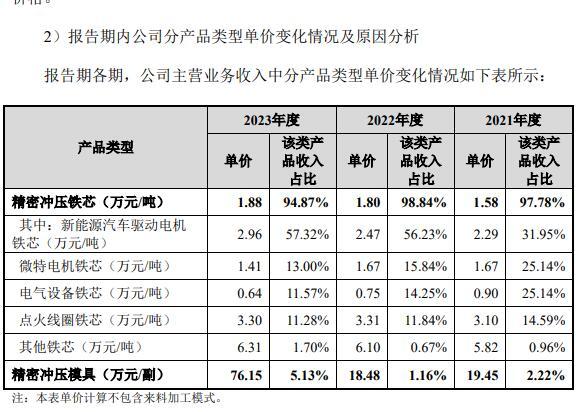

According to the latest financial data, from 2021 to 2023, Huaxin Jingke will achieve operating income of 847 million yuan, 1.192 billion yuan and 1.189 billion yuan respectively, and net profit of about 72.6262 million yuan, 114 million yuan and 156 million yuan respectively. Among them, about 95% of the main business revenue comes from precision stamping core products.

Image source: Prospectus (declaration draft), screenshot of the reply to the first round of inquiries

From the perspective of performance, in 2023, the company's revenue will decline slightly, but the net profit level will continue to grow. This is related to the significant increase in the company's gross profit margin in 2023.

From 2019 to 2022, the gross profit margin of Huaxin Jingke's main business was 25.12%, 24.77%, 19.82% and 18.97% respectively, and it has declined year-on-year for three consecutive years since 2020, mainly affected by changes in the product structure of precision stamping cores and fluctuations in raw material prices.

According to the company, under the cost-plus pricing model, the gross profit margin of the core of the drive motor of new energy vehicles is at a medium to low level, and the gross profit margin of the core of the ignition coil is high; In 2020, the revenue of ignition coil cores accounted for a relatively high level, and the company's gross profit margin was at a high level; With the increase in the proportion of revenue from the core of the drive motor of new energy vehicles, the gross profit margin declined.

In 2023, the gross profit margin of Huaxin Jingke's main business jumped to 24.59%, an increase of 5.62 percentage points compared with 2022. It should be noted that the proportion of the main business income of the core of the drive motor of new energy vehicles continues to increase, from 56.23% in 2022 to 57.32%.

In this regard, Huaxin Jingke replied in writing to the reporter of "Daily Economic News" on the 19th, saying that in 2023, the core products of the drive motor of new energy vehicles using in-mold dispensing technology have been delivered in large quantities to large customers such as BMW in Germany. From 2021 to 2023, the gross profit margin of the company's new energy vehicle drive motor core products will be 21.17%, 16.15% and 21.83% respectively.

The reporter noticed that the gross profit margin trend of Huaxin Jingke in 2023 is quite different from that of comparable companies in the same industry. Huaxin Jingke's main business income mainly comes from precision stamping cores, and it lists 5 listed companies as comparable companies in the same industry, of which 4 companies' gross profit margins of comparable products will decline year-on-year in 2023.

In 2023, the overall gross profit margin of Zhenyu Technology (SZ300953) and Huaxin Jingke is 16.44%, a year-on-year decrease of 0.49 percentage points.

In 2023, the gross profit margin of Longsheng Technology (SZ300680) and Huaxin Jingke is 12.01%, a year-on-year decrease of 3.50 percentage points.

Huaxin Precision believes that the comparable products of Tongda Power (SZ002576), Shenli (SH603819) and Huaxin Precision are stator and rotor punching and iron core (Tongda Power's comparable products also have finished stator and rotor), and in 2023, the gross profit margin of stator and rotor punching and iron core (heart) of the two companies will be 14.75% and 9.08% respectively, a year-on-year decrease of 2.40 percentage points and 2.88 percentage points, respectively.

While these comparable products are not identical, some of them have seen the same reason for the year-over-year decline in gross margins – company price cuts.

The price of raw materials has dropped, and why the unit price of new energy products has risen

Zhenyu Technology's 2023 annual report did not clearly explain the reasons for the decline in the gross profit margin of motor cores that year, but the gross profit margin of this product continued to decline year-on-year in the first half of 2024. In response to investors' questions in September 2024, the company said that the slight year-on-year decrease in ironcore gross profit was mainly due to product price reductions and increased depreciation.

Shenli Co., Ltd. said in the 2023 annual report: "As the price of silicon steel raw materials is in a downward channel, customers quickly adjust the purchase price accordingly, and the industry competition is intensifying, resulting in a decrease in the company's current external product prices, resulting in a decrease in revenue and a decline in gross profit margin; In addition, the expansion of the motor market slowed down, and the number of customer orders decreased compared with the same period last year, of which the number of orders from foreign customers declined more, so the company's performance declined slightly. ”

One of the important raw materials for the production of precision stamping cores is silicon steel, and it can be seen from the statements of the above comparable companies that in 2023, silicon steel will be in a price reduction market, and some companies' corresponding products will take price reduction measures.

However, the unit price of Huaxin Jingke's precision stamping core has risen, with 15,800 yuan/ton, 18,000 yuan/ton and 18,800 yuan/ton from 2021 to 2023, respectively, mainly due to the increase in the unit price of the core of the drive motor of new energy vehicles, which is 22,900 yuan/ton, 24,700 yuan/ton and 29,600 yuan/ton respectively.

Image source: Screenshot of the first round of inquiry responses

In this regard, Huaxin Jingke explained that in 2023, although the prices of various silicon steels will remain at a low price level since the second half of 2022, in terms of the core of the drive motor of new energy vehicles, the company will mainly supply medium and high-end iron core products with in-mold dispensing technology to new large customers in 2023, and some export products will be transported by air, and the unit price will be relatively high, which will drive the overall unit price level in 2023.

Huaxin Jingke replied to reporters on the 19th: From 2021 to 2023, the unit cost of the company's new energy vehicle drive motor core will be 18,100 yuan/ton, 20,600 yuan/ton and 23,100 yuan/ton respectively, all showing an upward trend, and the unit price increase matches the change in unit cost.

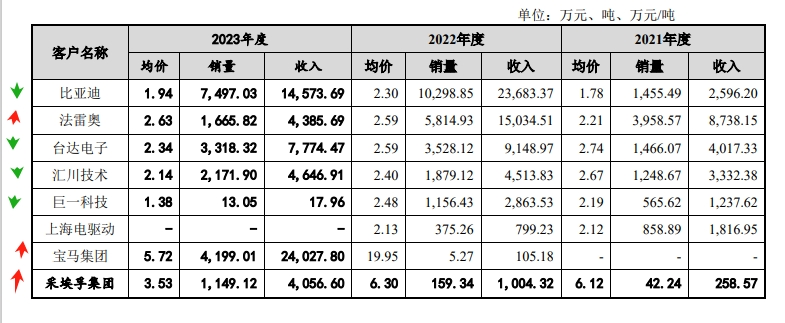

The reporter noted that from 2021 to 2023, the top five customers of Huaxin Jingke's new energy vehicle drive motor cores will total 8. The company's sales volume and unit price to some major customers fluctuate greatly.

Among them, the company's sales to BMW Group and ZF Group increased in 2023, which was the main reason for the increase in revenue from new energy products. In 2023, the company's sales to the BMW Group will increase from 5.27 tons in 2022 to 4,199.01 tons, and its revenue will increase from 1,051,800 yuan to 240 million yuan, becoming the largest customer of new energy products in 2023, and the sales volume to the ZF Group will increase from 159.34 tons to 1,149.12 tons.

However, in terms of average sales unit price, in 2023, the average price of the company's products sold to the BMW Group will decrease from 199,500 yuan/ton in 2022 to 57,200 yuan/ton, and the average price of products sold to ZF Group will decrease from 63,000 yuan/ton to 35,300 yuan/ton, which is a significant decline.

On the other hand, in 2023, the average sales price of Huaxin Precision to customers such as BYD (SZ002594), Inovance Technology (SZ300124), JEE Technology (SH688162), and Delta Electronics will all decrease, but the average sales price of BMW Group and ZF Group will be relatively high, so the overall average price of the core of the drive motor of new energy vehicles will increase.

It is still unknown whether the upward trend in the unit price of the above products can be sustained.

Image source: Screenshot of the first round of inquiry responses

Respond to fundraising to increase production capacity

According to the IPO plan, Huaxin Jingke plans to raise 712 million yuan, of which 445 million yuan will be used for the expansion project of the core of the drive motor for new energy vehicles, and the number of new production capacity is large.

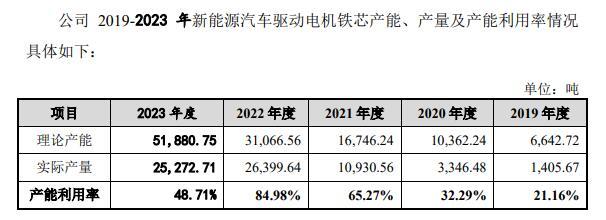

However, the capacity utilization rate of Huaxin Jingke's new energy vehicle drive motor core is not high. From 2021 to 2023, the theoretical production capacity of this product will be 16,700 tons, 31,100 tons and 51,900 tons, respectively, and the capacity utilization rate will be 65.27%, 84.98% and 48.71%, respectively.

It is worth mentioning that in 2023, Huaxin Jingke will significantly increase the production capacity of new energy vehicle drive motor cores, but the output and sales volume will decline that year, of which the output will decrease from 26,400 tons in 2022 to 25,300 tons, and the sales volume will decrease from 24,000 tons in 2022 to 20,400 tons.

Image source: Screenshot of the first round of inquiry responses

The company's sales to major customers also fluctuated significantly. In 2023, the company's sales to major customers such as BYD, Valeo, Delta Electronics, and JEE Technology will decline significantly.

In 2023, the revenue of new energy vehicle drive motor core products will maintain year-on-year growth, but why will the sales volume decline?

Huaxin Jingke explained that the company has independently developed in-mold dispensing technology, and related products have been supplied to BMW Group and ZF Group in large quantities in 2023. For example, the corresponding projects of the Company's existing batch supply products with JEE Technology and Shanghai Electric Drive Co., Ltd. have ended, and the new designated point is still in contact, which affects the short-term income level; The competition in the low-end market is fierce, and the company comprehensively weighs the product profit requirements, customer strategic positioning and other factors to undertake orders.

Is it reasonable to significantly increase production capacity in 2023 in the context of declining sales?

In order to meet the incremental needs of existing customers and the new needs of intended customers, since the second half of 2022, the company has used its own funds to invest in the "new energy vehicle drive motor core expansion project" fundraising project to reserve production capacity in advance. Among them, the production capacity will increase rapidly in 2023, which will reduce the capacity utilization rate. With the relevant fixed-point projects entering the mass production stage, the company's new energy vehicle drive motor core capacity utilization rate is expected to continue to increase.

Cover image source: Visual China

Ticker Name

Percentage Change

Inclusion Date