Image source: UI gallery

Interface News reporter Zhang Yi

After the failure of the IPO, Shanghai Xinnuo Communication Technology Co., Ltd. (hereinafter referred to as Xinnuo Communication) became a listed company of Gaoling Information (688175. SH).

Gaoling Information, a communications company, announced on December 6 that the company is planning to purchase 71.98% of the shares of Xinnuo Communications by issuing shares and paying cash, and at the same time raise matching funds. The Company will also seek to purchase another 28.02% stake in Sino Communications during the suspension period to achieve the acquisition of 100% of its equity. The company's shares will be suspended from the same day, and the suspension time shall not exceed 5 trading days.

According to public information, Sino Communications submitted a prospectus (declaration draft) in June 2023 to be listed on the Science and Technology Innovation Board, and in June this year, the company withdrew its IPO application.

Jiemian News compared the two companies and found that the revenue scale of Gaoling Information and Xinnuo Communication in 2021 and 2022 is basically the same, both around 500 million yuan; The profitability of Xinnuo Communications is slightly inferior.

However, the two companies are trending differently. At that time, the performance of Gaoling Information was already in a downward trend, while the net profit of Xinnuo Communication was doubling. Until this year, the former has been unsustainable, there have been losses, the latter's performance is not yet known, the chairman of the target company Xie Hu said that "has achieved quite good results."

Gaoling Information launched mergers and acquisitions at the company's most difficult moment, and put the expectation of boosting performance on Xinnuo Communications, which will also be listed on the curve.

However, why Xinnuo Communications withdrew its independent IPO and chose to be acquired is to be disclosed or the answer will be revealed. It is worth noting that the share price of Gaoling Information suddenly rose sharply at midday on the last trading day before the suspension, and once rose by more than 10% during the session. The company rose 7.59% throughout the day, closing at 21.11 yuan per share, with the latest market value of 2.7 billion yuan.

So, can the merger of the two companies achieve the effect that one plus one is greater than the sum of its parts?

Why is Sino Communications "curve listed"?

The main counterparties of Gaoling Information are the actual controllers of Xinnuo Communications, namely Xie Hu and Li Lin, as well as 4 employee shareholding platforms. The intention of the remaining shareholders of Sino Communications to be finalized has not yet been finalized. At the same time, the transaction price is undecided.

According to public information, other corporate shareholders of Xinnuo Communications include Caitong Innovation Investment Co., Ltd. and Shanghai Linsong Industrial Internet Venture Capital Fund Partnership (Limited Partnership), with shareholding ratios of 6.07% and 3.12% respectively. The former is a wholly-owned subsidiary of Caitong Securities, and the latter is an investment platform under local state-owned assets in Shanghai.

According to preliminary calculations, this transaction is expected to constitute a major asset restructuring, but it will not lead to a change in the actual controller of the company and will not constitute a restructuring and listing.

Business synergy, performance boost, and stock price stimulation, Gaoling Information's merger and acquisition of Xinnuo Communications may bring these three effects.

First of all, look at the main business. Although the focus is different, both companies are in the field of information and communication, and the synergies between the two companies are strong.

Gaoling Information is an enterprise engaged in special communication equipment, environmental protection Internet of Things application products, and network and information security products.

Biaoxinnuo Communication is a R&D technology company in Shanghai with network communication and network security as the "double engine". It was established in 2006 with a registered capital of 54.5 million yuan. According to the official website, the company has more than 500 employees.

The main customers of Sino Communications include China Telecom, China Mobile, China Unicom and other operators, as well as private network customer groups such as radio and television, electric power and railway.

Source: Xinnuo Communication official website

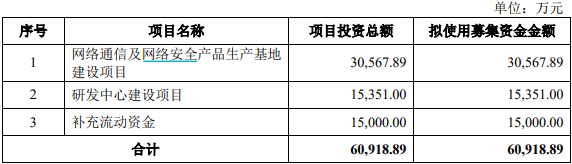

In June 2023, the IPO application submitted by Sino Communications was accepted by the Shanghai Stock Exchange, and the company plans to raise 609 million yuan, which will be mainly used for the construction project of network communication and network security product production base and R&D center construction project, and supplement working capital. The sponsor is Guotai Junan Securities.

Source: Xinnuo Communications Prospectus (Declaration Draft).

From the perspective of Sino Communications, why did the company stop at IPO and choose "curve listing"?

From the submission of the prospectus to the withdrawal of the application, Sino Communication has only experienced one round of inquiries from the exchange.

At that time, the issues that the exchange was concerned about included the company's products, core technologies, potential intellectual property disputes, shareholder equity, actual controllers, etc.

Notable among them is the patent dispute between Sino Communications and Huawei. According to the draft application form, from March 2022 to January 2023, Huawei sent two emails to claim that Sino Communication's OTN products and PON products were suspected of infringing 80 of Huawei's patents.

After being inquired, Sino replied that through communication, the company has no intellectual property disputes or potential disputes with Huawei.

Nowadays, the choice of "curve listing" may be related to the current policy direction.

If Xinnuo Communications chooses to IPO, first, there is uncertainty in the IPO review process and listing time, and shareholders will need to wait for a long time.

Mergers and acquisitions are being supported and encouraged by policies. On September 24, the China Securities Regulatory Commission (CSRC) issued the Opinions on Deepening the Reform of the M&A and Restructuring Market of Listed Companies (the "Six Articles on M&A") to promote the healthy development of the M&A and restructuring market for listed companies.

At the recent investor exchange meeting, Jiang Xiaohui, secretary of the board of directors of Gaoling Information, said that extension mergers and acquisitions are indeed one of the effective ways for companies to expand their business scale, improve their operating performance and anti-risk capabilities, and regulatory policies also support listed companies to enhance the value of listed investment through mergers and acquisitions. "The company will actively pay attention to and follow up."

Second, if the IPO is successful, the actual controller, employee stock ownership plan and other shareholders of Sino Communications will need to face a short period of one year, as long as three years or even longer before they can slowly exit.

For the shareholders of Xinnuo Communications, once the restructuring is completed, the transaction method of paying cash can allow some shares to be cashed out immediately, and they also hold the shares of Gaoling Information issued by private placement.

However, in this way, the valuation of Sino Communications may be discounted compared with the IPO. At that time, the listing criterion selected by Sino Communications was expected to be "a market value of not less than 1 billion yuan".

Gaoling Information seeks 100% of the shares of Xinnuo Communications, and its current market value is 2.7 billion yuan. As of the end of the third quarter of 2024, the company's monetary funds and transactional financial assets were 1.212 billion yuan.

Can it save the declining performance?

Secondly, judging from comparable financial data, one rise and one fall, Xinnuo Communication may be able to thicken the profit of Gaoling Information.

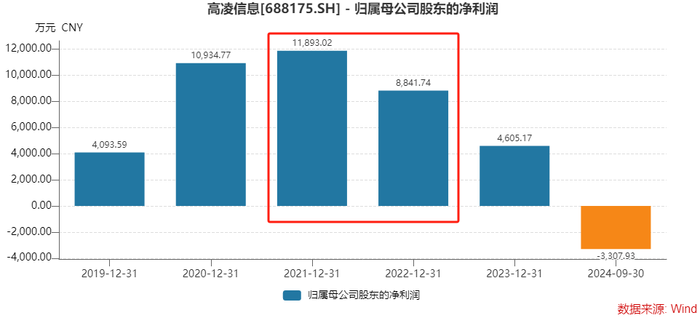

Gaoling Information was listed in March 2022, and its net profit has exceeded 100 million yuan for two consecutive years before listing, but in the past three years, its performance has been much worse than before.

In terms of operating income, the company's revenue growth rate in 2022 will drop to less than 5%, and it will drop by more than 30% in 2023; The net profit attributable to the parent company will decline by 25.66% in 2022 to 88.4174 million yuan, and it will almost "halved" to 46.0517 million yuan in 2023.

In the first three quarters of 2024, Gaoling Information's operating income fell by about 38% to only 118 million yuan, and the net profit attributable to the parent company was a loss of 33.0793 million yuan.

Regarding the decline in performance this year, Jiang Xiaohui said that the decline in the company's military communication business this year is mainly affected by the reform of the military system, and the procurement demand is sluggish. "The decline in performance in the first three quarters is mainly due to the decrease in the amount of new contracts in 2023, which leads to pressure on the overall acceptable performance in 2024; Some of the maintenance equipment orders that were expected in the third quarter were not issued at the beginning of the quarter, resulting in fewer projects that could enter the acceptance stage in the third quarter, and therefore the quota declined. ”

Jiang Xiaohui said that the future direction of turnaround is military communications, and the company will promote the implementation of original military telecommunications network orders; The second is the content security business. "The specific turnaround time is difficult to predict." Therefore, Gaoling Information urgently needs to change the status quo with the help of epitaxial mergers and acquisitions.

On the other hand, the performance of Sino Communications in the past two years is unknown, but the information disclosed in its prospectus shows strong profitability growth in 2021 and 2022.

The operating income of Xinnuo Communication in the past two years was 413 million yuan and 576 million yuan respectively, with a year-on-year growth rate of 87.79% and 39.39%; The net profit in the same period was 26.8211 million yuan and 63.9685 million yuan, with a year-on-year growth rate of 202.42% and 138.50%.

It can be seen that in the comparable years of the two companies, the scale of revenue is comparable, but in terms of net profit, Xinnuo Communication is accelerating to catch up.

Jiemian News learned that in the past two years, Xinnuo Communication has also "achieved quite good results".

At the annual summary meeting at the beginning of 2024, Xie Hu, chairman of Sino Communications, concluded that the network communication industry faced severe challenges last year, but the company achieved fairly good results. "In 2023, we added two new subdivided products that exceeded 100 million yuan, and the annual revenue of many offices hit a record high, especially in the fourth quarter of 2023, the company's orders grew rapidly, laying a good foundation for the company's business growth in 2024."

If Xinnuo Communication can maintain positive growth in the past two years, then it will be easy to catch up with one rise and one fall. The results will be known only if the data to be disclosed in the M&A plan.

Can it stimulate a broken stock price?

Thirdly, judging from the stock price trend, the share price of Gaoling Information has never stood on the IPO issue price, and it is in urgent need of stimulation.

The issue price of Gaoling Information was 51.68 yuan per share, but due to no fundamental support, the company's stock price broke on the first day of listing. Since its listing, the highest stock price was 51 yuan/share on the first day, and the lowest stock price fell below 15 yuan/share (after the resumption).

Recently, the share price of Gaoling Information has come out of a wave of market with the trend of A-shares, and the company's latest closing price is 30.55 yuan / share (after the right to reset), which is still six discounts from the issue price.

However, in the afternoon before the suspension, the company's stock price suddenly rose in volume, from the highest in the morning near the flat to more than 10%. After the market, the company disclosed major restructuring and merger information.

As of the disclosure date of the announcement, the transaction is still in the planning stage, and there is still great uncertainty about whether it can be implemented in the end.

However, the restructuring will inevitably form a certain stimulus to the stock price, and the stock price of Gaoling Information may have a certain performance after the resumption of trading. However, it should be noted that the original shareholders of Gaoling Information who have lifted the ban are planning to reduce their holdings in the company.

Since March 2023, when the ban on the one-year initial restricted shares of Gaoling Information was lifted, its original shareholders have continued to cash out.

In the second half of 2024, Gaoling Information disclosed a total of three announcements on shareholding reduction plans. The shareholders who plan to reduce their holdings include Zhuhai Hanhu Naland Equity Investment Fund Partnership (Limited Partnership) (hereinafter referred to as Hanhu Naland), Hefei CLP Guoyuan Direct Investment No. 1 Equity Investment Partnership (Limited Partnership), Shenzhen Kewei Rongfa Enterprise Management Partnership (Limited Partnership) and Jiaxing Zhanxin Gaoling Equity Investment Partnership (Limited Partnership).

Among them, Hanhu Naland's shareholding ratio has dropped from 8.97% at the beginning of Gaoling Information's listing to 3.60% at the latest level.

In March and September 2025, the three-year initial restricted shares of Gaoling Information will be lifted, and the stock price will be put under further pressure.

When asked whether the management would consider reducing its holdings, Gaoling Information responded, "After the lifting of the ban on the company's employee stock ownership platform, different personnel face different restrictions on reducing their holdings, and the company does not encourage the management to reduce its holdings quickly after the lifting of the ban." ”

Gaoling information weekly K-line (post-weighting).

Ticker Name

Percentage Change

Inclusion Date