Solid-state battery refers to the battery with solid-state material for electrolyte, the core of which lies in the use of solid-state electrolyte, replacing the electrolyte and separator in the traditional liquid battery, as a new type of battery technology, with high safety, high energy density, environmental friendliness and other significant advantages, it will become an important development direction of battery technology in the future.

Dangsheng Technology: In the early stage, it has carried out the R&D layout of solid-state lithium battery technology, made breakthroughs in key technologies in the development and application of cathode materials and solid-state electrolyte materials for solid-state batteries, and formed a number of patents, and successfully introduced solid-state battery customers such as Ganfeng Lithium Battery, Qingtao, Weilan New Energy, and Huineng to achieve mass sales

Dangsheng Technology was listed on the Shenzhen Stock Exchange on April 27, 2010 with the stock code 300073. The company's main business is the research and development, production and sales of lithium battery cathode materials and multiple precursors such as lithium iron phosphate (manganese) phosphate and lithium cobalt oxide.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers multiple materials, lithium cobalt oxide, intelligent equipment and other products; The products are widely used in consumer electronics, Internet of Things, RFID and medical and health fields.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

Xiangfenghua: a professional supplier of advanced graphite materials for lithium battery anode in China, and an indirect supplier of Tesla

Xiangfenghua was listed on the Shenzhen Stock Exchange on September 17, 2020 with the stock code of 300890. The company's main business is mainly engaged in the research and development, production and sales of lithium battery anode materials.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers graphite anode materials and other products; The products are widely used in power (electric vehicles, such as new energy vehicles, electric bicycles, etc.), 3C consumer electronics and industrial energy storage.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

Sanxiang New Materials: The company has a large scale advantage, technical advantages, and industrial chain synergy advantages in the field of zirconium oxychloride, zirconium chloride and other zirconium materials, and will actively do a good job in the layout and upgrading of the industrial chain, and provide products to Qingtao Energy as zirconium-based materials

Sanxiang New Materials was listed on the Shanghai Stock Exchange on August 1, 2016 with the stock code 603663. The company's main business is to focus on the research and development, production and sales of new industrial materials such as zirconium products and new materials for casting and reforming.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers zirconium series products, new materials for casting and reforming, and other products; The products are widely used in zirconium products, casting modified materials and lightweight new materials.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

PTL: The company's new silicon carbon material can be used as an anode material for semi-solid/solid-state batteries, and has begun trial production in small batches

PTL was listed on the Shanghai Stock Exchange on November 3, 2017 with the stock code 603659. The company's main business is anode materials and graphitization processing; separators and coatings, PVDF and binders, composite current collectors, aluminum-plastic packaging films, nano alumina and boehmite; Front, middle and rear sections of new energy batteries, cathode and anode materials, base films, automation equipment in the field of new photovoltaics, etc.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers lithium battery materials and equipment and other products; Products are widely used in batteries, new energy vehicles, Tesla, lithium batteries and other fields.

In recent years, the company's operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

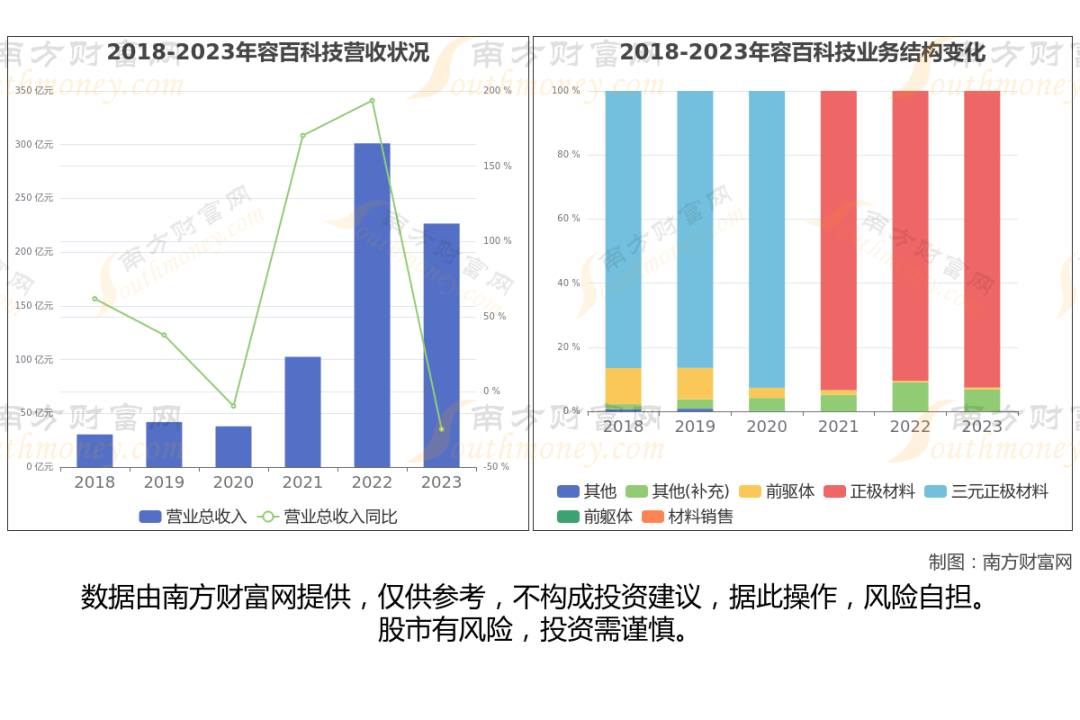

Ronbay Technology: The company has technical reserves and patent layout for modified high-nickel/ultra-high-nickel cathode materials suitable for all-solid-state batteries, and the existing cathode production line is compatible with the production of solid-state battery cathode materials, and has the mass production capacity of solid-state battery cathode materials

Ronbay Technology was listed on the Shanghai Stock Exchange on July 22, 2019 with the stock code 688005. The company's main business is mainly engaged in the research and development, production and sales of multi-materials, lithium manganese iron phosphate materials, sodium electric materials and multi-precursors.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers ternary cathode materials and their precursors and other products; The products are widely used in electric vehicles, electric two-wheeled vehicles, energy storage equipment and electronic products.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

Tianci Materials: The company has a patent layout for some semi-solid/solid-state battery electrolytes

Tianci Materials was listed on the Shenzhen Stock Exchange on January 23, 2014 with the stock code 002709. The company's main business is the research and development, production and sales of new fine chemical materials.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers fine chemical new materials and other products; Products are widely used in chemicals, power battery recycling, sodium-ion batteries, solid-state batteries, silicones, hydrogen energy, new energy vehicles, fluorine chemicals, Tesla, lithium batteries, new materials and other fields.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

Fengyuan shares: The company is also actively deploying new front-end materials such as solid-state batteries, cobalt-free batteries and sodium-ion batteries, which can enrich the company's product categories and improve its core competitiveness

Fengyuan shares were listed on the Shenzhen Stock Exchange on July 7, 2016 with the stock code 002805. The company's main business is oxalic acid business and lithium battery cathode material business.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers oxalic acid and series products, lithium battery cathode materials and other products; The products are widely used in new energy vehicles, energy storage, consumer electronics, chemical raw materials and other fields.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

Enjie shares: At present, Jiangsu Sanhe, which is controlled by the company, is actively promoting the commercialization process of semi-solid state

The company was listed on the Shenzhen Stock Exchange on September 14, 2016 with the stock code 002812. The company's main business is to provide a variety of packaging and printing products, packaging products and services; Lithium battery separator film, aluminum-plastic film, water treatment film and other fields.

According to the data of the industrial chain of Southern Fortune Network, the company's product line covers film products, packaging and printing products, paper product packaging and other products; The products are widely used in solid-state batteries, new energy vehicles, lithium batteries and other fields.

In recent years, the company's business structure, operating income, net profit attributable to the parent company, gross profit margin and net profit margin are as follows

:

The above data is compiled and provided by Southern Wealth Network, for reference only, does not constitute investment advice, according to this operation, at your own risk, the stock market is risky, investment needs to be cautious.

Ticker Name

Percentage Change

Inclusion Date