Image source: UI gallery

Wen Bronco Finance Wu Lijuan

Edited by Gao Yan

Recently, the State Intellectual Property Office ruled that Mindray's utility model patent ZL200720170903.X, a utility model patent for "flow sensor and flow sensor installation assembly" for ventilators and anesthesia machines, was declared invalid because it lacked inventive step.

Ten years ago, Mindray Medical (300760. SZ) and Komen, the two major pharmaceutical and medical device giants, because of this patent infringement, you sue me, I sue you, each has its own winners and losers.

Ten years later, Mindray's patent was invalidated, and Komen won the game temporarily. According to the provisions of the Patent Law, if Mindray is not satisfied with the invalidation decision, Mindray may file a lawsuit with the Beijing Intellectual Property Court within three months from the date of receipt of the relevant notice.

In fact, the lengthy patent lawsuit between Mindray Medical and Komen is only the tip of the iceberg in the "business war" between Mindray Medical and Komen. In the important field of intellectual property patents, the offensive and defensive road between enterprises continues to be staged. Behind their Internet "fighting" and lawsuits, there is a battle for the trillion-dollar medical device market.

If a patent is judged to be invalid, how much impact will it have on the "first brother of medical devices"?

This patent mainly relates to the flow sensor component, which is used to detect the gas flow rate in the patient circuit and the volume of the patient's inhalation, which can be applied to a variety of products, such as anesthesia machines, ventilators, etc.

Source: National Intellectual Property Network

Komen Medical's current core product is ventilators, which is also Mindray's area of strength.

Source: Zhongcheng Digital

According to statistics from Zhongcheng Digital, a data service provider in the medical device industry, the market share of Mindray's ventilators increased year by year from 2020 to 2021 during the epidemic, reaching 35.87% in 2022. By 2023, Mindray's market share will decline to 31.91%, and the market share in the first half of 2024 will be basically the same as that in 2023. The market share of Komen's ventilators has increased a lot in recent years, from 2.28% in 2020 to 13.67% in 2023.

Latecomers are catching up, and Mindray Medical, which has always been a leader in the industry, is also under pressure.

And the battle between the two giants over this patent has been going on for 10 years.

Zhang Yi, CEO and chief analyst of iiMedia Consulting, believes that the invalidation of the patent will have little impact on Mindray's existing products in the short term, but in the long run, it will intensify the fierce competition in the industry.

Shen Meng, director of Xiangsong Capital, said that patent invalidation, especially patent invalidation with a wide range of applications, can reduce the payment of patent fees, and can have obvious benefits to product development and performance, but in the long run, it is still necessary to increase independent research and development and innovation capabilities to ensure the foundation for long-term growth of enterprises.

After 10 years of marathon lawsuits, Coman won one game

In April 2014, Mindray filed a patent infringement lawsuit with the Shenzhen Intermediate People's Court, alleging that Komen Medical had infringed its utility model patent for "flow sensor and flow sensor mounting assembly", and applied for freezing Komen's bank account with the factory as security. Koman did not compromise and filed a request to the State Intellectual Property Office a few months later for the invalidation of Mindray's patent.

As a result, the parties began a lengthy lawsuit against the patent.

According to the statistics of "Enterprise Patent Watch", the patent has also experienced seven invalidation challenges before the State Intellectual Property Office, of which four invalidation decisions have been issued. And in 2016 and 2017, it was declared invalid twice. During this period, the two companies clashed in court many times, and after several judgments, in 2021, the State Intellectual Property Office again made a partial invalidation decision on the patent.

As to whether the patent of this product is valid and infringing, the two parties have gone through the administrative and civil trials and retrials of the Shenzhen Intermediate People's Court, the Guangdong Provincial High People's Court, the Beijing Intellectual Property Court, the Beijing High People's Court, and the Supreme People's Court.

This latest ruling means that Komen Medical has temporarily pulled back a game.

In the latest patent invalidation judgment, Koman mainly put forward new reasons and evidence for whether the technology of several utility model patents that had been disputed before had inventive step. For example, we found literature corresponding to some older models to fight against Mindray's patents.

Zhang Cuiying, a lawyer at Jingshi Law Firm, said that China's patent law stipulates that inventiveness refers to the fact that the invention has outstanding substantive features and significant progress compared with the prior art. In judicial practice, the inventive step requirements of utility model patents are relatively low, and more emphasis is placed on technological improvement and practicability. Invention patents require a higher level of technological innovation, and the technical requirements and scope of protection are more stringent, and of course, the protection of invention patents is also more competitive and long-term value.

The medical device industry is facing serious problems such as industry centralized procurement and homogenization, and the fundamental reason for homogenization is that there is no protection of intellectual property rights.

Lawyer Zhang Cuiying said that in the process of reviewing a specific utility model patent application or invalidation, the patent examiner will consider the uniqueness and progress of the technical solution, the comparison and evaluation factors with the prior art, the specific application scenarios of the technology, the solution of technical problems and the actual performance of the technical effect, etc., to evaluate whether the utility model patent has inventive step.

Sixty percent of the judicial cases are plaintiffs, and Mindray Medical and its peers are in a patent war

According to the "China Medical Device Supply Chain Development Report (2024)" released by the China Federation of Logistics and Purchasing, in 2023, the market size of China's medical device industry will reach 1.18 trillion yuan, a year-on-year increase of 10.28%, and the circulation market will reach 1.36 trillion yuan, a year-on-year increase of 6.25%.

For a long time, Mindray Medical has been a well-deserved leading enterprise in the field of monitoring equipment, ventilators, anesthesia machines, defibrillators and other equipment.

According to the "2023 Forbes Global Billionaires List" released in April 2023, Li Xiting, the richest man in Singapore, who is currently the chairman and legal representative of Mindray Medical, ranks 103rd on the list with a wealth of $16.3 billion.

Komen Medical is not currently listed, but the company's total assets have exceeded 5 billion yuan, and Komen Medical currently has no external shareholders, which is wholly owned by the Yi Yong family of Guilin Xing'an, so the wealth of the Yi Yong family is at least more than 5 billion yuan.

Although Mindray Medical's total market value is about 290 billion yuan, it is a well-deserved "first brother of medical devices", but the impact of industry such as centralized procurement price reduction and medical anti-corruption has also made it inevitably impacted.

Looking back at the dispute between the two companies, the quarrel has also been going on for a long time, and the grievances between the two sides may be traced back to 2013 at the earliest.

In 2013, Massimo, United States a manufacturer of blood oxygen monitoring devices, filed a patent infringement lawsuit against Mindray for patent infringement. Later, Mindray fought back against Massimo in a patent lawsuit in China, in which Komen, as the Chinese seller of Massimo, was also affected.

According to industrial and commercial data, from 2014 to 2023, there were more than 40 judicial cases between Mindray Medical and Komen related to disputes over infringement of invention patents and trade secret infringement.

In 2018, at the critical stage of Mindray's listing, Komen filed eight lawsuits against Mindray for patent infringement of Mindray's ventilators in Liuzhou and Nanning, Guangxi, but ultimately Komen withdrew the lawsuits himself.

As a high-investment, high-R&D, high-risk technology-based industry, suing peers for patent infringement has become a norm in the field of medical devices. Litigation around intellectual property rights is not only to protect its own innovation patents, but also to become a tool for enterprises to expand their market share.

Although it is the leader in the industry, in recent years, in the face of the encroachment of brands such as Komen, Paulette, and Libon Instruments on the market, Mindray has to brace itself and use various means to protect its market interests.

Tianyancha information shows that among the 316 judicial cases related to Mindray Medical, 22.8% of the cases involved were disputes over infringement of invention patents, while 12.7% of the cases were related to Koman, and 65.8% of the cases were plaintiffs. At present, Mindray has 137 cases that are still in the first instance civil trial stage.

Founded in 1993, Bolaite is a national high-tech enterprise integrating R&D, production and sales of medical devices, with business segments covering three major fields: life information and support, kidney disease and health care. On August 14, 2023, Paulaite announced three patent litigation cases, in which the plaintiffs were all Mindray Medical, and Mindray Medical claimed a total of 30 million yuan from it. However, in August this year, after friendly negotiation, Mindray withdrew the lawsuit, and the two parties reached a comprehensive settlement.

It is true that patent litigation can protect an enterprise's unique technology and innovation, and maintain an enterprise's advantage in the market competition. However, for the medical equipment industry, having strong R&D strength and innovation is the means to maintain its vitality.

Zhang Yi believes that in order to build a good threshold for Mindray Medical, in addition to litigation battles, it must also start from two aspects: one is the market side, that is, the brand and marketing channels, to build barriers and thresholds. Secondly, it is necessary to strengthen product innovation, and the patents formed in product innovation can be protected, but the continuous improvement of product quality and meeting the needs of the market are the most important.

The growth rate of performance continued to slow down, and the market value fell by 319.1 billion

Mindray's main products cover three major areas: life information and support, in vitro diagnostics (IVD), and medical imaging.

Mindray was founded in 1991, went public in 2018, and is headquartered in Shenzhen. In the year of listing, Mindray Medical's revenue and net profit both hit a high point, with revenue exceeding 20 billion yuan and net profit exceeding 7 billion yuan for the first time.

In the five years from 2018 to 2022, Mindray's operating revenue growth was higher than 20%. But in 2023, Mindray's operating income dropped to 15%.

Entering 2024, although revenue and net profit hit a new high, the year-on-year growth rate fell to a new low. In the first half of 2024, the operating income will be 20.531 billion yuan, a year-on-year increase of 11.12%; The net profit attributable to the parent company was 7.561 billion yuan, a year-on-year increase of 17.37%, and an increase of 22.13% over the same period of the previous year after excluding the impact of foreign exchange gains and losses. The trend of sluggish performance growth continued, with operating income increasing by 12% in the first quarter of 2024; By the first half of the year, the growth was only 11%.

Source: wind

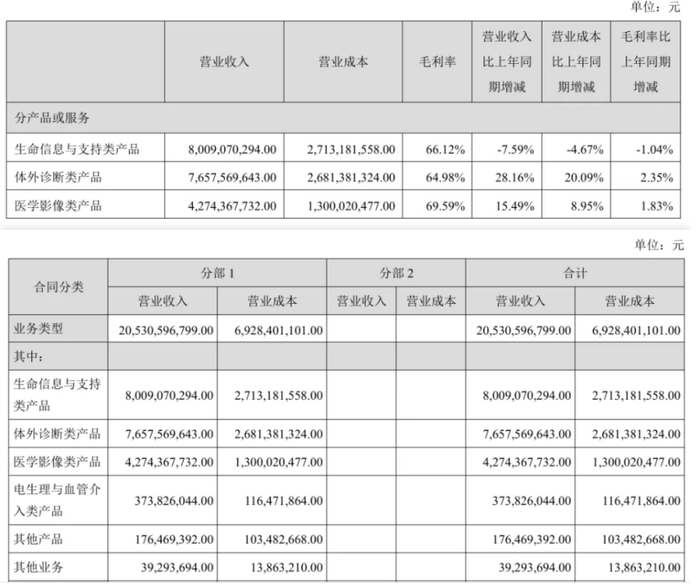

In the first half of 2024, Mindray's life information and support business achieved operating income of RMB8 billion, a year-on-year decrease of 7.59%, which is Mindray's largest business, accounting for 39%. Mindray said: "In the first half of the year, bidding and procurement activities continued to be postponed, which put greater pressure on this business line. However, the total backlog of procurement demand has not been affected, and the postponed procurement projects will still be released in the future. ”

Source: Juchao Information

In addition, the operating income of in vitro diagnostics and medical imaging products increased by 28.16% and 8.95% year-on-year respectively. Mindray said that in the long run, under the influence of policies such as industry rectification, centralized procurement of reagents, and DRG (disease diagnosis-related grouping), the localization rate and concentration of the domestic in vitro diagnostic industry are accelerating, which is an important positive factor for the company, and the company's market share is expected to reach a new level in the future.

The centralized procurement policy, coupled with the decline in performance growth after the end of the epidemic, Mindray Medical's share price has been sluggish in recent years. At the end of August, the total market value fell below 290 billion yuan, and the stock price fell to a new low of 220.94 yuan per share on August 29. As of September 13, it closed at 231.67 yuan / share, compared with the highest point of 488.2 yuan / share, the stock price has been cut in half, and the latest market value is 280.9 billion yuan, which is 319.1 billion yuan lower than the highest peak of more than 600 billion yuan after the listing of A-shares.

Despite the slowdown in growth, Mindray's performance in the industry is also impressive. According to the research report of Zhongtai Securities, the revenue of listed medical device companies in the first half of 2024 will be 130.539 billion yuan, a year-on-year decrease of 2.26%, and the non-net profit will be 20.64 billion yuan, a year-on-year decrease of 9.3%. An important reason for the contrarian growth of Mindray is that Mindray attaches great importance to technology research and development.

From 2020 to 2022, Mindray's R&D expenses were 2.096 billion yuan, 2.726 billion yuan, 3.191 billion yuan, and 3.779 billion yuan, accounting for 9.97%, 10.79%, 10.51%, and 10.82% of revenue in the same period, accounting for 6 consecutive years. R&D investment in the first half of 2024 will reach 1.94 billion yuan, accounting for 9.4% of operating revenue in the same period.

However, if calculated in terms of amount, the R&D expenses of domestic pharmaceutical companies are less than a fraction of Johnson & Johnson's R&D expenses. Medical device industry website medicaldesign recently released its Medtech Big 100 – a list of the world's largest medical device companies, with the world's top 100 medical technology companies spending $28.9 billion on R&D in fiscal 2023, an increase of $2.5 billion (10%) from last year's analysis. Among the 74 companies that disclosed R&D spending, Johnson & Johnson Medical Technology topped the list with $3.1 billion.

In addition to high R&D investment, global medical device giants will choose to expand their product lines through mergers and acquisitions. Li Xiting, chairman of Mindray Medical, once disclosed such a set of data at the 2022 World Health Expo: "The revenue of global giants' mergers and acquisitions generally accounts for 60%, and Mindray Medical's acquisition business accounts for only 10% after many large-scale international mergers and acquisitions, and mergers and acquisitions will be accelerated in the future." ”

From a medical equipment agent to today's "first brother of medical devices", the reason why Mindray Medical can become "Mindray" is inseparable from its enthusiasm for international mergers and acquisitions.

Since its successful listing on the New York Stock Exchange in 2006, becoming China's first medical device company to be listed on the U.S. stock market, Mindray has started the process of "buying, buying, buying".

In 2008, Mindray Medical acquired Datascope, the world's third-largest monitoring product manufacturer, for $202 million in cash, and also acquired Artema, a well-known brand in the field of respiratory gas detection in Sweden, in the same year. In 2013, it acquired Zonare, a United States ultrasound diagnostic company, for US$105 million (equivalent to 1.57 billion yuan), and also acquired Ulco, a Australia company, in the same year. In addition, Mindray Medical has also acquired Shenzhen Science and Technology Co., Ltd., Suzhou Wison, Changsha Tiandiren, Hangzhou Guangdian and other enterprises in China to enrich its business pipeline.

As one of the core businesses supporting Mindray's long-term development in the future, Mindray has also increased its global layout in the IVD field in recent years, and has continued to increase its core raw materials, technologies, and supply chain. In 2021, the company acquired Haipeptide Bio, a world-renowned company in the field of IVD raw materials; On November 30, 2023, the company completed the acquisition of 75% of the shares of DiaSys in Germany, a world-renowned IVD brand, and the integration is progressing smoothly.

At the beginning of 2024, Mindray Medical invested 6.652 billion yuan in the acquisition of Huitai Medical (688617.SH), entering the cardiovascular track and firing the first shot of "A control A" cash merger and acquisition on the Science and Technology Innovation Board.

As the "first brother of medical devices", Mindray Medical's stock price is still fluctuating weakly recently, and whether it can continue to find new growth points after the slowdown in performance growth will be one of the important issues it faces. Are you optimistic about the development of Mindray? Leave a message and let's chat!

Ticker Name

Percentage Change

Inclusion Date