Image source: UI gallery

Text: Huaxia Energy Network

Double happiness is coming.

Tianneng Co., Ltd. (SH: 688819) recently released its semi-annual report like a shot in the arm, sweeping away the haze of declining profits in the first quarter, achieving revenue of 21.622 billion yuan in the first half of 2024, ranking third among peer companies that have disclosed financial reports, and net profit of 1.194 billion yuan, an increase of 9.3% year-on-year.

The hero behind the good performance is the strong support of the traditional lead-acid battery business.

The benefits of lead-acid batteries also come from the policy aspect. The Ministry of Commerce and other five departments jointly issued the "Implementation Plan for Promoting the Trade-in of Electric Bicycles", which increased subsidies for consumers who exchange for lead-acid battery bicycles. At a time when lithium batteries continue to erode the market, this "amnesty order" has undoubtedly made lead-acid batteries dead wood.

As the "leader" of lead-acid in China, Tianneng Co., Ltd. has made frequent moves in the field of new energy in the past two years, laying out lithium batteries, fuel cells, sodium batteries and other fields. However, the new business did not bring the expected growth, but became a "drag bottle". Some investors bluntly said: "I would like to suggest that Zhang Tianren is the chairman, and the lead-acid battery that he is good at is stronger than anything else, and he has less ambition, but the ambition and strength are inconsistent, and it will be ...... backfire."

Today, the lead-acid battery business continues to improve, but the lithium battery business is a headache. Standing at the crossroads, how to choose?

The transformation of lead-acid faucets is troubled

Changxing, Zhejiang, is a small county located at the junction of Jiangsu, Zhejiang and Anhui next to Taihu Lake, which makes it famous because nearly half of the country's lead-acid batteries are produced here. And Tianneng shares are the "boss" here.

The legendary story of Tianneng Co., Ltd. began in 1986 as a small battery factory.

In the wave of reform and opening up, Zhang Tianren, an ordinary accountant, with extraordinary courage and foresight, took over this small factory with heavy debts. He saw the huge business opportunity for the popularization of electric bicycles, resolutely invested in research and development, and cooperated with Fudan University to successfully launch a new generation of electric power-assisted special batteries, filling the gap in China.

At the end of the 1990s, the electric bicycle market rose, and Tianneng Co., Ltd. successfully seized the market opportunity with the "valve-regulated sealed lead-acid battery" and a new environmentally friendly electric vehicle battery with a single mileage of more than 100 kilometers.

In 2007, Tianneng shares were listed on the Hong Kong Stock Exchange as "China's first power battery stock", ushering in a brilliant peak.

Since then, lead-acid batteries have become the main business of Tianneng shares, and the status of the rivers and lakes has gradually stabilized. According to the financial report, in the first half of this year, Tianneng Co., Ltd. achieved revenue of 21.622 billion yuan, and the lead-acid battery business segment achieved revenue of 20.132 billion yuan, accounting for 93.13% of revenue, and the gross profit margin was as high as 18.05%, ranking first among all business sectors.

The lead-acid battery business is doing well, why should Zhang Tianren consider transformation?

Since its listing in 2007, Tianneng has seen good growth in net profit and revenue. However, its performance suffered a "Waterloo" in 2013 and 2014. In 2013, the net profit plummeted by 80.95% year-on-year, and in 2014, it suffered a direct loss of 300 million.

The loss for two consecutive years is mainly affected by the fluctuation and crisis of the lead-acid power battery industry.

In 2012, a number of blood lead incidents broke out in China, seriously affecting people's lives and the national environment. The "lead-acid battery industry access conditions" promulgated by the state has become a sharp tool for rectifying the battery industry, and many small and medium-sized enterprises have fallen into business difficulties due to financial constraints and have been forced to shut down, and the integration of the industry has accelerated. Tianneng shares have been hit harder.

At the same time, since 2014, the penetration of lithium electronic power batteries in the two-wheeled vehicle market has accelerated, accelerating the erosion of the lead-acid battery market. Compared with lead-acid batteries with low cycle life, high emission pollution and long charging time, lithium batteries are obviously more in line with the current concept of long-lasting, clean and environmentally friendly travel.

Therefore, in the face of a single lead-acid battery business with huge policy risks, Zhang Tianren also realized the seriousness of the problem, and began to transform and upgrade the industrial chain of Tianneng Group to accelerate the layout of the lithium battery industry.

However, the benefits of the transition are not clear. The data shows that in the past two years, the revenue of Tianneng's lithium-ion battery business has been less than 5%, and it has gradually decreased, and in the first half of 2024, it will only be 0.85%. Moreover, the gross profit margin of the business has been negative, especially in 2013, the gross profit margin was as high as -14.83%.

However, now, with the lead-acid battery ushering in the "amnesty order", Tianneng shares can be said to have fallen from the sky. So, in today's market pattern, does Tianneng have a reason to give up the lithium-ion battery business?

A "partial student" who aims to be "all-round and excellent

".The answer is probably no.

Tianneng Co., Ltd. said in its 2022 annual report, "The company regards the energy storage business as an important breakthrough in the development of the company's lithium battery business, and will also gather a series of resources such as the company's market, brand, and technology to accelerate the penetration of the lithium battery energy storage market." ”

Previously, Tianneng was very optimistic about the continuous growth of lithium battery production capacity, and expected that 60%-80% of the production capacity will be used for energy storage business.

Tianneng is a lithium battery, which is intended to have a broader energy storage market space.

Since the beginning of the listing, Zhang Tianren has laid out the potential market of energy storage early with keen market insight. In its 2020 annual report, Tianneng has made an accurate prediction of the huge explosive potential of the energy storage industry, clearly pointing out that "energy storage is the key to promoting the development of renewable energy" and an urgent need to achieve the goal of carbon neutrality.

Since then, Tianneng has paid more and more attention to the energy storage business. In 2021, the company listed the energy storage business separately for discussion for the first time; In 2022, it was the first time to mention the advantages of new energy storage, especially electrochemical energy storage, which is efficient, rapid construction and strong technical adaptability. In July 2023, Tianneng Co., Ltd. officially established the Energy Storage Division to fully undertake the development strategy of the company's energy storage system ecology, demonstrating its firm determination and far-reaching layout in the field of energy storage.

Tianneng Co., Ltd. mainly lays out large storage and industrial and commercial energy storage, and has successfully received a number of large orders in Europe and the United States, and has also made gains in the Asia-Pacific region. In order to further enhance its competitiveness, Tianneng Co., Ltd. will acquire 40% of the shares of Tianneng Shuaifu with its own funds of 210 million yuan equivalent to US dollars in 2023, realizing a wholly-owned holding of this company. This acquisition not only opened up the industrial chain of Tianneng shares, but also reached more customers.

It's a pity that the so-called "got up early in the morning and caught up with the late set", now in the energy storage market, whether it is the ranking of battery cell shipments, or the top ten list of system shipments, Tianneng shares have not been on the list, with the increasing concentration of the energy storage market, it is more difficult to be among the forefront.

In addition to the energy storage business, Tianneng has also made a key layout in the field of sodium batteries and fuel cells.

In the field of sodium batteries, Tianneng has developed a variety of sodium battery application modules in combination with different application scenarios, including national standard vehicle modules, heavy truck parking battery modules, electric motorcycle battery modules and home storage modules. At the same time, its annual output of 2GWh high safety and wide temperature range sodium-ion electric bicycle battery industrialization project will also be implemented in Changxing County, with a total investment of up to 300 million yuan.

In the hydrogen power business, Tianneng has also shown strong technical strength and market expansion capabilities.

In 2023, the company launched two systems and a stack, both of which are ready for loading. In terms of the market, Tianneng Co., Ltd.'s 40 sets of fuel cell system buses have been put into operation in Shuyang, Jiangsu, and plans to carry out the demonstration operation of loaders and heavy trucks and promote the expansion of the bus and municipal vehicle markets around two different areas of hydrogen and non-hydrogen rich.

It is worth mentioning that in the most popular solid-state battery field recently, Tianneng shares have also been seen. As early as April this year, the company's self-developed 511Wh/kg "solid-state battery" passed the certification of the National Testing Center, and revealed that the company has conducted a lot of forward-looking research in the field of solid-state batteries.

On the whole, Tianneng shares want to be a well-rounded three-good student, but at present, it is like a "partial student". Emerging businesses have failed to bring much increment to the company's performance, and it is difficult to become the "second growth curve" for the time being.

According to the data, as of the end of June 2024, the total liabilities of Tianneng shares were 26.062 billion yuan, an increase of 13.97% over the same period last year. Under the high debt, it is worth considering whether the investment in emerging businesses can be supported.

The pain of attrition is unbearable

On the same day as the results announcement, there was also an announcement on the resignation of senior executives of Tianneng Co., Ltd. - Chen Qinzhong resigned as the assistant general manager of the company. A year ago, his predecessor, Zhang Renbai, also resigned for personal reasons.

In recent years, Tianneng has continued to make efforts in the field of new energy, but whether its core technical team is stable is directly related to the progress of new business.

It is reported that since 2021, many core technical personnel of Tianneng Co., Ltd. have resigned for personal reasons, which is particularly prominent in the field of lithium and hydrogen batteries.

In November 2021, the core technical staff of Tianneng Co., Ltd. resigned to Debo for personal reasons. As a Ph.D. in physical chemistry and a senior engineer, Xiang Debo has worked in R&D at Peking University Pioneer Technology Industry Co., Ltd. and AVIC Lithium (now China Innovation Airlines), and served as the deputy director of Tianneng Shuaifu for four years.

Then, in October 2022, Tianneng announced the resignation of another core technician, Li Guohua. Li Guohua used to be the chief technology officer of the new energy division of Tianneng Co., Ltd. and the president of the lithium battery research institute.

Entering 2023, the core technical personnel of Tianneng Co., Ltd. will flow frequently.

In March, core technician Chen Fei applied for resignation for personal reasons. As a senior engineer majoring in applied chemistry, Chen Fei has participated in a number of R&D work of the company's lead and lithium battery related products. In the same month, Tianneng announced the resignation of core technical personnel Sun Wei. Sun Wei is a Ph.D. student majoring in physical chemistry, and served as the technical director of Tianneng Shuaifude, mainly responsible for the material development and structural design of the company's lithium battery-related products.

This year, Tianneng shares once again suffered a double loss of core technical personnel.

In March, Shi Liyong and Li Wei resigned on the same day. As a senior engineer majoring in chemical engineering and technology, Shi Liyong has participated in the material development and project management of the company's lithium battery-related products, and has led a number of important industrialization projects. Li Wei is a doctoral student of Canada, who served as the director of Lishen battery process equipment, and mainly led the construction and commissioning of lithium battery production line process equipment after joining Tianneng Co., Ltd.

In July, Xu Chunchuan, the company's chief hydrogen energy technology expert and vice president of the Academia Sinica, also applied for resignation due to personal reasons. Xu Chunchuan is a doctoral student of United States, majoring in physics, and worked as a senior engineer at Ford Motor Company, and his departure has undoubtedly affected Tianneng's research and development work in the field of hydrogen batteries.

The lithium battery and hydrogen battery businesses, which have high hopes, have failed to retain "cattle people", and most of them have not been on the job for a long time.

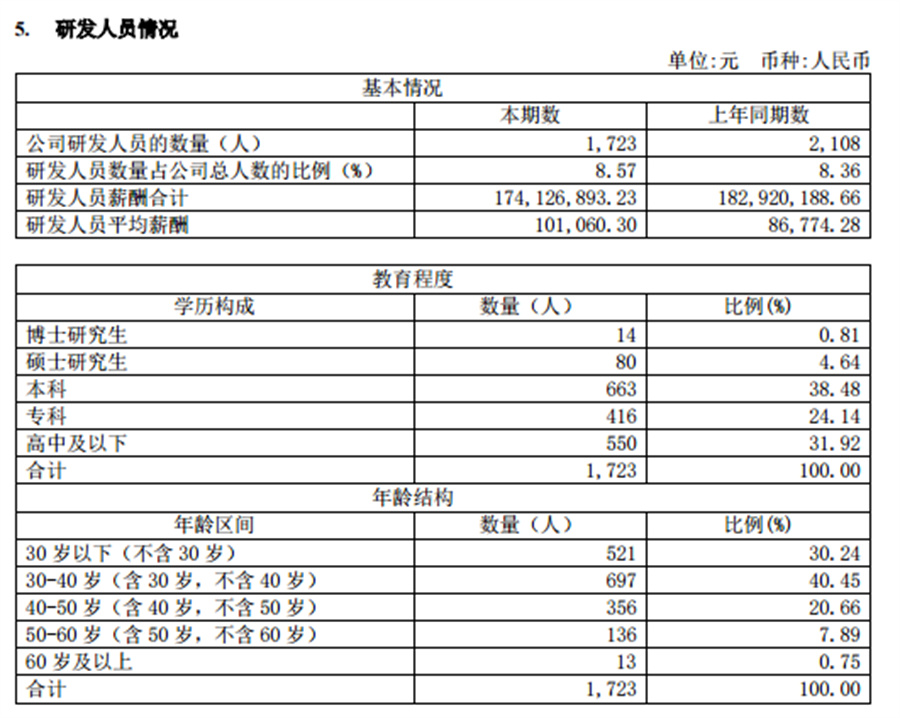

According to the data, as of the end of June 2024, the company has 1,723 R&D personnel, accounting for 8.57% of the total number of employees, far below the standard of 10% required by the Science and Technology Innovation Board.

According to the 2024 semi-annual report, R&D personnel have the highest proportion of bachelor's degrees, at 38.48%. followed by high school or less, accounting for 31.92%, and doctoral students accounting for 0.81%. Accordingly, the remaining more than sixty percent of the R&D personnel have a college degree or below.

In terms of the number of people, the number of R&D personnel decreased by 385 year-on-year in the first half of this year.

Tianneng shares also mentioned in the semi-annual report that the sustainable development of battery manufacturing enterprises, relying on a number of core technologies and professional research and technical personnel...... "if there is a loss of the company's core technology talents due to intensified talent competition in the future, or insufficient protection measures lead to the leakage of core technology, there will be a risk of damage to the company's performance." ”

The pursuit of diversified development strategy is the only way for leading enterprises to maintain growth, but in the fierce competition of new energy business, technological advantages will inevitably become a moat for companies to step up construction. For this 10 billion leader, how to stabilize the core technical team and maintain R&D and business continuity is a great test.

Ticker Name

Percentage Change

Inclusion Date