Source: UI Gallery

Interface News reporter Mu Yue

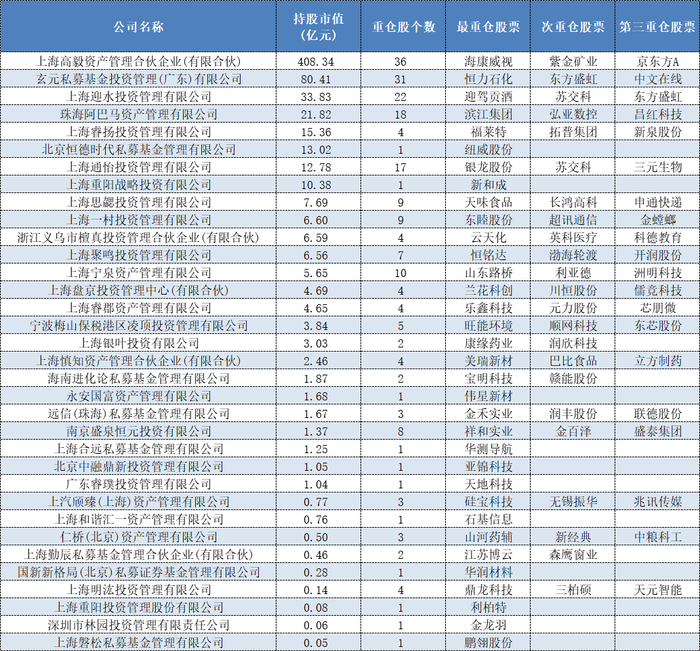

With the disclosure of the 2024 semi-annual report of listed companies, the latest holdings of tens of billions of private placements have also surfaced.

Wind data shows that up to now, a total of 34 10 billion private equity products have appeared in the top ten circulating shareholders of listed companies that have disclosed semi-annual reports, with a total market value of 66.072 billion yuan at the end of the period, a decrease of 6.759 billion yuan compared with the total market value of the 34 10 billion private equity products in the first quarter.

Jiemian News further combed and found that the top 10 10 billion private equity products with the total market value of the positions appeared in the top 10 circulating shareholders reported by 141 stocks, with a total market value of 61.023 billion yuan.

Table: Tens of billions of private placements reported positions

Data source: Wind, interface news

The total market value of the reported positions of Gaoyi Assets' products is far ahead, with a total of 40.834 billion yuan. Specifically, the total market value of "Gao Yi Linshan No. 1 Yuanwang No. 1" helmed by well-known fund manager Feng Liu is 20.566 billion yuan, the "Gao Yi Xiaofeng No. 2", "Gao Yi Xiaofeng Hongyuan" and "Xiaofeng No. 1 Ruiyuan" managed by Deng Xiaofeng hold a total of 19.395 billion yuan, and the "Gao Yi Liwei Select Weishi", "Gao Yi Qingrui No. 6 Ruixing No. 1" and "Gao Yi Guolu No. 1" managed by other fund managers under the company hold 454 million yuan, 303 million yuan and 116 million yuan respectively.

Feng Liu added 4 new stocks in the report, namely Conch Cement (600585. SH), Tongkun Co., Ltd. (601233. SH), Jianyou Co., Ltd. (603707. SH) and Chenguang Biotechnology (300138.SZ), the reference market value of the position at the end of the period was 413 million yuan, 375 million yuan, 255 million yuan and 63 million yuan respectively.

At the same time, 6 stocks were increased by Feng Liu in the second quarter, including its largest heavy stock Hikvision (002415. SZ), compared with the increase of 1 million shares at the end of the first quarter, the total market value of the position at the end of the period was 12.735 billion yuan. From the perspective of the proportion of holdings, Feng Liu's most fierce increase in holdings in the second quarter was Angel Yeast (600298. SH), the number of shares held increased from 8.5 million shares in the first quarter to 35 million shares, and the market value of the position reached 978 million yuan, followed by Shengyi Technology (600183.SH), the number of shares increased from 15 million shares in the first quarter report to 50 million shares, and the market value of the position reached 1.053 billion yuan. Ruifeng New Materials(300910.HK) SZ), Dongcheng Pharmaceutical (002675. SZ), Titan Technology (688133. SH) and other companies also received Feng Liu's increased holdings in the second quarter.

In addition, Feng Liu reduced his stake in Baofeng Energy (600989. SH), Shunxin Agriculture (000860. SZ), withdrew from Dashenlin (603233. SH), Shanghai Jahwa (600315. SH) is one of the top 10 outstanding shareholders. As for Longbai Group (002601. SZ), Tong Ren Tang (600085. SH), Zhongju High-tech (600872. SH) and Kanghua Biotechnology (300841.SZ), Feng Liuzhong's reported positions were the same as at the end of the first quarter.

Table: Feng Liuzhong reports his position

Data source: Wind, interface news

Deng Xiaofeng concentrated on reducing his holdings of 11 "favorite stocks" in the second quarter of this year, including his long-time largest heavy stock, Zijin Mining (601899. SH), which is also the fifth consecutive quarter since the first quarter of 2023 to continue to reduce its holdings in the stock.

Deng Xiaofeng reported that the market value of his position was as high as 1.545 billion yuan, 927 million yuan and 632 million yuan respectively Aluminum Corporation of China (601600.SH) and China Jushi (600176. SH) and Huafon Chemical (002064.SZ) also suffered varying degrees of reduction in the second quarter. In addition, YTO Express (600233. SH) was reduced by 32.78%, and Huaqin Technology (688281. SZ), Jianxingyuan (600380. SH), Jianghai Co., Ltd. (002484. SZ), NOVOSENSE (688052. SH), Tofflon (300171. SZ), Jinhe Industry (002597. SZ) and many other stocks were also reduced.

Although the overall reduction is mainly underweighted, in the second quarter of this year, there are still some stocks that have been increased by Deng Xiaofeng, such as its second and third largest heavy stocks BOE A (000725.SZ) and TCL Technology (000100.SZ).

As of the time of the interim report, "Gao Yi Xiaofeng No. 2" and "Gao Yi Xiaofeng Hongyuan" held a total of 683 million shares and 388 million shares of BOE A and TCL Technology respectively, with a reference market value of 2.794 billion yuan and 1.676 billion yuan at the end of the period, respectively. It should be noted that "Gao Yi Xiaofeng Hongyuan" has previously appeared in the top ten circulating shareholders of BOE A and TCL Technology, but briefly withdrew from the top ten circulating shareholders of the above two stocks in the first quarter of this year, until it reappeared in the middle report.

In addition, Yunlu Co., Ltd. (000807. SZ) also received Deng Xiaofeng's increase in holdings in the second quarter, as for another heavy stock Dinglong shares (300054. SZ), the total number of positions of Deng Xiaofeng's products in the second quarter was the same as that at the end of the first quarter. At the same time, Deng Xiaofeng's products also withdrew from Ruike Laser (300747. SZ) and Lianlong (300596.SZ) among the top 10 outstanding shareholders.

Table: Deng Xiaofeng's position is reported

Data source: Wind, interface news

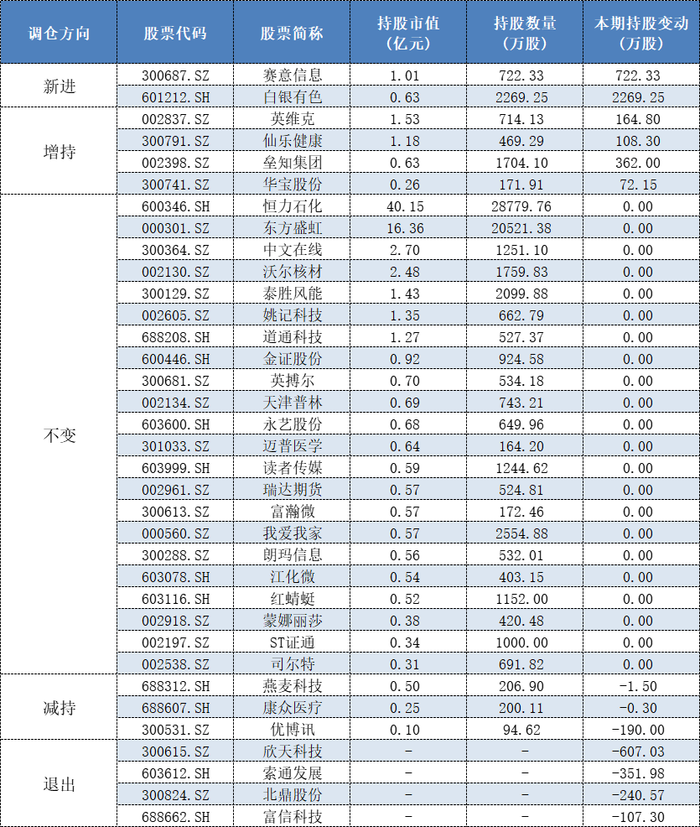

Xuanyuan Investment's products also appeared in as many as 31 stocks reported in the top ten circulating shareholders, with a total market value of 8.041 billion yuan, of which 22 stocks held the same number as the first quarterly report, including the company's top two heavy stocks Hengli Petrochemical (600346.SH) and Oriental Shenghong (000301. SZ), the market value of the position at the end of the period was 4.015 billion yuan and 1.636 billion yuan respectively.

In terms of new entrants, Xuanyuan Investment selected SIE Information (300687. SZ) and Silver Nonferrous Metals (601212.SH), with a market value of 101 million yuan and 63 million yuan at the end of the period, respectively.

At the same time, Xuanyuan Investment also reduced its holdings of three stocks, namely Oat Technology (688312. SH), Kangzhong Medical (688607. SH) and Youboxun (300531.SZ), of which the number of shares held by Youboxun dropped sharply from 2,846,100 shares at the end of the first quarter to only 946,200 shares, a reduction ratio of 66.76%. In addition, Xuanyuan Investment also withdrew from Xintian Technology (300615. SZ), Solton Development (603612. SH), Beiding Co., Ltd. (300824. SZ), Fuxin Technology (688662. SH) and other individual stocks among the top 10 circulating shareholders.

Table: Xuanyuan Investment's reported positions

Data source: Wind, interface news

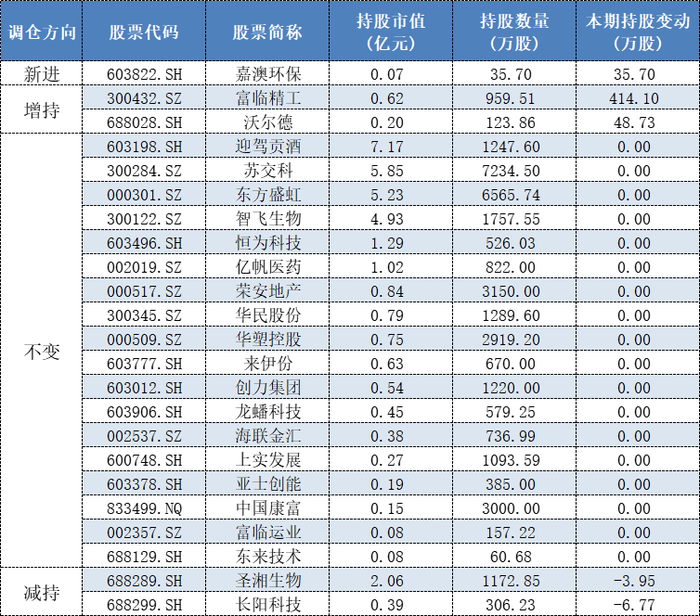

Yingshui Investment's products appeared in the top ten circulating shareholders of 22 stocks, with a total market value of 3.383 billion yuan, of which 17 stocks held the same number as at the end of the first quarter, including Yingjiagongjiu (603198.SH) and Jiangsu Jiaoke (300284. SZ) and Dongfang Shenghong (000301.SZ).

At the same time, Yingshui Investment has newly entered Jiaao Environmental Protection (603822. SH), increased its stake in Fulin Precision (300432. SZ) and World (688028.SH), reducing their positions in Shengxiang Biotechnology (688289.SH) and Changyang Technology (688299.SH).

Table: Yingshui Investment's reported positions

Data source: Wind, interface news

Abama Assets' products appeared in the top ten circulating shareholders of 18 stocks, with a total market value of 2.182 billion yuan, of which 16 stocks held the same number of stocks as at the end of the first quarter, increased their holdings of Changhong Technology (300151.SZ), reduced their holdings of Yingtang Intelligent Control (300131.SZ), withdrew from Jiadu Technology (600728.SH), Wall Nuclear Materials (002130. SZ), Cooltech Power (300153. SZ), silver nonferrous (601212. SH) and Hesheng Silicon Industry (603260.SH) and many other stocks are among the top ten circulating shareholders.

Table: Reported positions in Abama Assets

Data source: Wind, interface news

In addition, the total market value of tens of billions of private equity positions such as Ruiyang Investment, Hengde Times Private Equity, Tongyi Investment, and Chongyang Strategy ranged from 10 billion to 1.6 billion yuan.

Among them, Ruiyang Investment reduced 3 of the 4 heavy stocks, namely Follett (601865. SH), Tuopu Group (601689. SH), Xinquan Co., Ltd. (603179. SH), while increasing its stake in Foster (603806. SH); Hengde Times private equity increased its holdings in Neway shares (603699. SH); Chongyang Strategy continues to adhere to NHU (002001. SZ), the number of shares held was the same as that of the first quarter.

Among the 17 heavy stocks held by Tongyi Investment, 14 of them held the same number of shares as the first quarter, reducing their holdings in Jiangsu Jiaoke (300284. SZ), Jinshi Yayao (300434. SZ), Zhengwei New Materials (002201. SZ), withdrew from Fengle Seeds (000713. SZ), Wall Nuclear Materials (002130. SZ), Yayun Co., Ltd. (603790. SH) and Xinli Financial (600318.SH) and other top 10 circulating shareholders of individual stocks.

Table: Ruiyang Investment, Hengde Times Private Equity, Tongyi Investment, Chongyang Strategy, etc

Data source: Wind, interface news

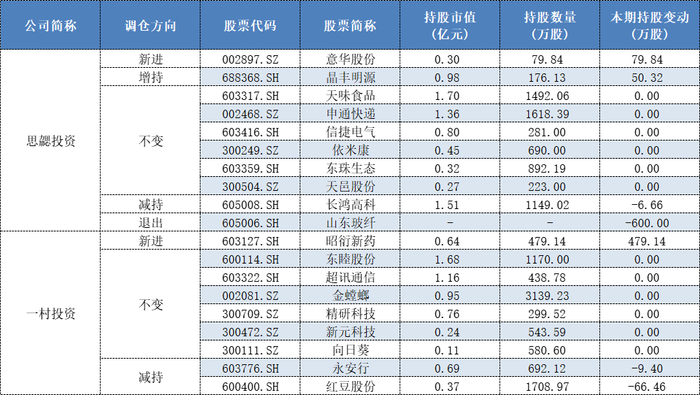

The market value of the positions held by Siyi Investment and Yicun Investment also reached 769 million yuan and 660 million yuan, and the two private equity interim reports both appeared in the top ten circulating shareholders of 9 stocks.

Among them, Siyi Investment has newly entered Yihua shares (002897. SZ), however, the market value of the position at the end of the period was only 30 million yuan, increasing its holdings of Jingfeng Mingyuan (688368.SH), reducing its holdings of Changhong Hi-Tech (605008.SH), and the number of positions of the remaining 6 stocks remained unchanged, and at the same time withdrew from the top ten circulating shareholders of Shandong Glass (605006.SH).

A village investment in the new Zhaoyan new drug (603127. SH), the market value of the position at the end of the period was 64 million yuan, reducing the holdings of Yongan Bank (603776.SH) and Hongdou shares (600400.SH), and the number of positions of the remaining 6 stocks remained unchanged.

Table: Position status reported by Siyi Investment and Yicun Investment

Data source: Wind, interface news

However, it should be noted that due to the limitations of the data disclosed in the periodic report, the actual operation of the above-mentioned private placement of relevant stocks cannot be fully reflected, and investors need to make prudent choices to avoid blindly "copying homework".

Ticker Name

Percentage Change

Inclusion Date