In 2024, the price war in the domestic PV industry will intensify, with polysilicon, modules, and cells from the middle and upper reaches to downstream power stations. The sharp drop in the price of lithium carbonate has caused a chain reaction, driving the prices of downstream energy storage cells and systems to continue to fall, and the quotation of some energy storage cells has even been reduced to below 0.5 yuan/Wh (excluding tax).

Since the beginning of this year, China's photovoltaic energy storage companies have moved to the Middle East, and their business has blossomed in an all-round way. On July 16, a number of companies disclosed the results of their projects in the Middle East. JinkoSolar (SH688223, share price 7.5 yuan, market value 75 billion yuan), TCL Zhonghuan (SZ002129, stock price 8.73 yuan, market value 35.3 billion yuan), Envision Group announced that Saudi Arabia's sovereign wealth fund PIF (Saudi Public Investment Fund) and other companies signed agreements to invest in related projects in Saudi Arabia. Sungrow Power Supply (SZ300274, stock price 70.3 yuan, market value 145.7 billion yuan) successfully signed the world's largest energy storage project with Saudi Arabia ALGIHAZ, with a capacity of up to 7.8GWh.

What is the outlook for the PV storage market in the Middle East? Can Nugget Middle East effectively alleviate the cost pressure caused by the price war in the domestic PV industry?

Lv Jinbiao, co-secretary general of the SEMI China Photovoltaic Standards Committee, told the "Daily Economic News" reporter that China's advanced manufacturing industry has joined forces with the Middle East sovereign fund, which has greatly reduced the political risk of going overseas. In addition, passing through the Middle East also has the opportunity to make up for the lack of the United States market. Chinese enterprises should still give full play to their professional advantages and win-win cooperation, rather than being so "rolled" as in China.

Chinese PV storage companies move to the Middle East

Chinese photovoltaic giants have formed a group to dig into the Middle East. Judging from the scale and amount of investment projects, the intensity of this year's layout in the Middle East is the highest in the past.

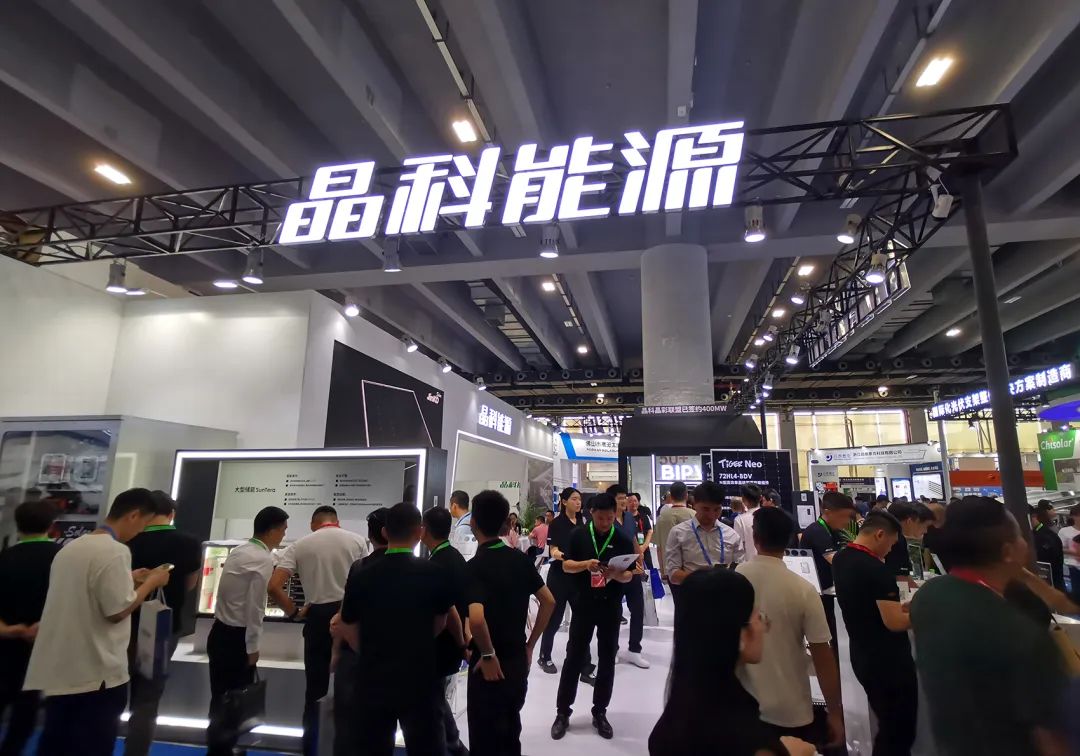

On July 16, a number of photovoltaic companies officially announced that they had reached a cooperation with the Saudi Public Investment Fund (PIF). Among them, JinkoSolar will establish a joint venture in Saudi Arabia to build a 10GW high-efficiency cell and module project, with a total investment of about US$985 million. "The project is likely to become the largest overseas manufacturing base for China's PV cell and module industry, and JinkoSolar's largest overseas investment project to date," the company said. It is understood that in 2023, JinkoSolar's market share in the Middle East will exceed 50%, including more than 70% in Saudi Arabia.

Image source: Photo by reporter Kong Zesi

TCL Zhonghuan will establish a joint venture in Saudi Arabia to build a 20GW photovoltaic crystal wafer factory with an annual output, with a total investment of about 2.08 billion US dollars. After landing, it will become the first photovoltaic crystal wafer project in Saudi Arabia and the largest crystal wafer factory overseas.

Envision Technology Group will establish a joint venture company for wind power equipment in Saudi Arabia to carry out local production and manufacturing of wind turbines and key components. "The joint venture will help Saudi Arabia's wind value chain achieve its goal of 75% local production by 2030 and contribute to the clean energy transition in the Middle East." The company said.

Sungrow, a leading inverter company, also announced on the same day that it had signed an energy storage project with Saudi Arabia's ALGIHAZ, with a capacity of 7.8GWh, which will be delivered next year. You must know that in 2023, Sungrow's energy storage system will be shipped globally to 10.5GWh. In terms of energy storage system shipments, Sungrow has ranked first among Chinese enterprises for 8 consecutive years.

In addition, in early July this year, Zhu Gongshan, chairman of GCL Group, met with the Minister of Investment of the U.A.E. to discuss the establishment of an overseas industrial base for FBR granular silicon in the U.A.E.. In mid-June, Junda Co., Ltd. (SZ002865, share price 36.64 yuan, market value 8.4 billion yuan) announced that it would invest US$700 million in Oman to build a 10GW high-efficiency photovoltaic cell project.

For a time, photovoltaic companies in the cold winter were hotly discussed by the market. Affected by this good news, the A-share photovoltaic sector opened higher on July 17, JinkoSolar once rose 6%, and TCL Zhonghuan and Arctech (SH688408) rose more than 4% intraday.

The Middle East market has become a new highland for going overseas

The Middle East, which usually includes parts of West Asia and North Africa, is known for its oil prominence. Geographically, the Middle East has vast deserts and plateaus, and the vast majority of the region has a tropical desert climate with plenty of sunshine throughout the year. Saudi Arabia, one of the largest economies in the Middle East and the world's largest oil exporter, has been seeking to optimize its energy mix in recent years.

The direct reason for Chinese PV companies to move to the Middle East market may be related to Saudi Arabia's "Vision 2030". PIF is one of the world's most influential sovereign funds, and has undertaken the mission of helping Saudi Arabia's renewable energy transition and realizing the Kingdom's "Vision 2030", and is committed to the development of renewable energy such as wind power, photovoltaics, hydrogen energy, and energy storage.

Saudi Arabia's Vision 2030 proposes that by 2023, Saudi Arabia will achieve 58.7GW of renewable energy generation capacity, including 40GW of photovoltaic power. By 2030, 50% of energy efficiency consumption will come from renewable sources.

According to Infolink Consulting statistics, in 2023, the photovoltaic demand in the Middle East will be about 20.5GW~23.6GW, and the market demand led by Turkey, Saudi Arabia and U.A.E. has increased significantly. In addition, in order to increase the proportion of new energy structure and maintain the stability of the power grid, under the supervision of the Saudi Ministry of Energy, Saudi Arabia has formulated a BESS (battery energy storage) project plan of 24GWh from 2024 to 2025.

In addition, the move to the Middle East is also related to the friendly policies of the region. The staff of the secretary office of the board of directors of TCL Zhonghuan told the reporter of "Daily Economic News": "Saudi Arabia (project) is mainly aimed at overseas markets, mainly to avoid geopolitical problems. "In May this year, the United States officially launched a new round of anti-dumping investigation on photovoltaic products in four Southeast Asian countries, and related enterprises are facing overseas trade policy risks, affecting the market layout in Southeast Asia.

Talking about why Saudi Arabia is located, Qian Jing, vice president of JinkoSolar, said: "First of all, (Saudi Arabia) is located in the center of the Middle East, and it is also a hub connecting Europe and Africa. Saudi Arabia is very friendly to new energy investment, and has introduced a series of incentives in order to win the entry of leading new energy companies like Jinko. The skills and working attitude of Saudi employees are advantageous in the Middle East, Saudi Arabia itself has huge potential in the new energy market, and the government's determination to transform energy is firm. ”

Image source: Photo by reporter Kong Zesi

Lv Jinbiao told the "Daily Economic News" reporter: "China's advanced manufacturing industry and the Middle East sovereign fund have joined forces to deeply participate in the new energy transformation of the Middle East, which has greatly reduced the political risk of going overseas. In addition, passing through the Middle East also has the opportunity to make up for the lack of the United States market. Of course, the relocation of photovoltaic manufacturing should include the cooperation of the entire industrial chain, equipment, spare parts, and auxiliary materials can be supported by trade first, while the main industrial chain should still be formed to land, and Chinese enterprises should still give full play to their professional advantages and win-win cooperation, rather than such a 'volume' in China. ”

In fact, it is not only this year that Chinese PV storage companies have noticed the huge potential of the Middle East market. JinkoSolar Chairman Li Xiande previously revealed that the company has entered the Middle East market since 2011 and has now covered most countries in the Middle East and has a 45% market share in the Middle East. Sungrow has entered the Middle East market since 2017. In its 2023 annual report, TCL Zhonghuan will include the Middle East in the industrial layout of key countries or regions in the world and carry out research on project implementation.

Can we break the dilemma of the domestic price war?

Can the rapid growth of market demand in the Middle East effectively alleviate the domestic price war dilemma?

At present, the supply of the photovoltaic main chain is facing oversupply, and the profitability of the manufacturing end is under pressure. Polysilicon prices have bottomed out, wafer overcapacity has become prominent, N-type penetration has accelerated, and the profit margins of the entire main industry chain have been pushed to the extreme. On the one hand, enterprises are facing a cash flow crisis; On the other hand, shutting down production lines and reducing operating rates have become the mainstream, and the "leftover" PV is king.

The staff of the secretary office of the board of directors of TCL Zhonghuan Company told reporters: "(After the completion of the Saudi project), Saudi Arabia, Europe and United States are our target markets, and the profit expectation is definitely higher than that in China, but it is also necessary to consider that the cost of building overseas factories will also be higher than that in China, which needs to be determined according to the price of silicon wafers, the status of orders and the supply chain at that time." The procurement of polysilicon is uncertain at present, but it is likely that overseas polysilicon will be used, and it is uncertain whether it will be local or European polysilicon. The reporter learned that about 98% of the world's monocrystalline silicon production capacity is in China, and the overall market share of TCL Zhonghuan's silicon wafers in 2023 will reach 23.4%.

Qian Jing revealed that JinkoSolar's product technology route and selection after it is put into production in Saudi Arabia will be the industry's most advanced next-generation TOPCon technology, and the efficiency of the first batch of cells planned to be offline will reach more than 27%, and the yield target will be 99%. As for whether JinkoSolar will set up energy storage projects in the Middle East in the future, a reporter from "Daily Economic News" called JinkoSolar's office of the board secretary and learned that energy storage is a related business that the company is cultivating, and the overall revenue accounts for a relatively small amount.

What impact will the competition of photovoltaic companies in the Middle East have on the competitive landscape of the industry?

Lv Jinbiao told reporters: "The homogenization of domestic high-quality production capacity, the total production capacity of leading enterprises has exceeded global demand. At present, when the cash flow continues to be lost, only the leading enterprises can take the lead in suspending production at bases with relatively high costs, reduce production loads, and reduce losses, so that the price can return to value. Fighting for cash flow continues to lose blood, and any good overseas investment plan is just on paper. ”

Disclaimer: The content and data of the article are for reference only and do not constitute investment advice. Investors act accordingly at their own risk.

Reporter Zhang Baolian

Editor: Dong Xingsheng, Sun Zhicheng, Gai Yuanyuan

Proofreading He Xiaotao

|National Business Daily nbdnews Original article|

Reprinting, excerpting, copying, mirroring, etc. without permission is prohibited

Ticker Name

Percentage Change

Inclusion Date