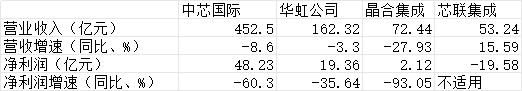

Recently, the four major domestic wafer foundries have disclosed their 2023 financial results. SMIC (688981.SH, stock price 41.18 yuan, market value 327.467 billion yuan), Hua Hong Company (688347.SH, stock price 28.63 yuan, market value 49.15 billion yuan), Jinghe Integration (688249.SH, stock price 13.30 yuan, market value 26.68 billion yuan), and SMIC Integration (688469.SH, stock price 4.60 yuan, market value 32.41 billion yuan) have revenues of 45.25 billion yuan, 16.232 billion yuan, 7.244 billion yuan and 5.324 billion yuan respectively, revenue growth was -8.6 per cent, -3.3 per cent, -27.93 per cent and 15.59 per cent, respectively.

It can be seen that among the four major wafer foundries, only the core integration revenue has maintained growth. From the perspective of revenue ratio, core integration is mainly based on power devices. The company said: "The demand for power devices in sub-tracks such as new energy vehicles and landscape energy storage continues to maintain high growth."

However, core-linked integration is the only one of the four foundries to lose money. In 2023, SMIC, Huahong, Jinghe Integration and Core Integration net profit was 4.823 billion yuan, 1.936 billion yuan, 0.212 billion yuan and -1.958 billion yuan, respectively; the net profit of the first three decreased by 60.3, 35.64 and 93.05 percent year-on-year, respectively.

SMIC and Hua Hong are highly comprehensive

From the perspective of revenue scale, SMIC and Huahong both exceed 10 billion yuan, with a large volume. According to their respective 2023 financial reports, SMIC and Hua Hong have a monthly production capacity of 806000 pieces and 391000 pieces respectively (about 8 inches of production capacity, about 8 inches equal to 12 inches of wafers multiplied by 2.25).

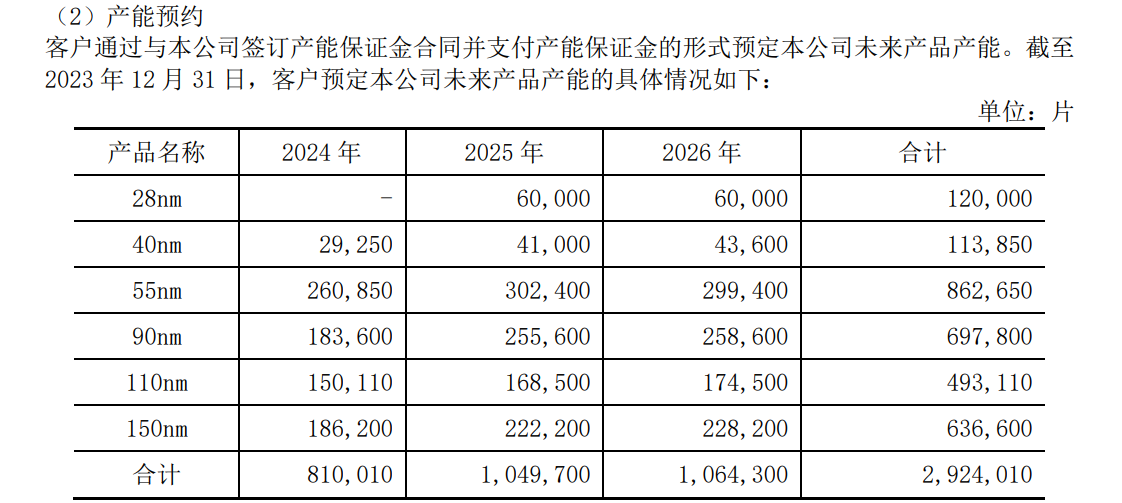

By the end of 2023, core-linked integration has built two 8-inch silicon-based wafer production lines, with a total monthly production of 170000 wafers. However, Jinghe Integration did not disclose wafer production capacity in its annual report, but it said in its production capacity reservation that as of December 31, 2023, the customer's expected production capacity in 2024 was 810000 pieces, equivalent to 67500 pieces/month. Since the crystal integration is a 12-inch production line, the equivalent 8-inch production capacity is about 151900 pieces/month.

Source: Jinghe Integration 2023 Annual Report

in terms of product structure, SMIC said that the company has been focusing on the development of integrated circuit process technology for many years, providing 8-inch and 12-inch wafer foundry and technical services to global customers, which are applied to different process technology platforms and have the mass production capacity of multiple technology platforms such as logic circuit, power supply/analog, high voltage drive, embedded non-volatile storage, non-volatile storage, mixed signal/radio frequency, image sensor, etc, it can provide customers with integrated circuit wafer foundry and supporting services in different fields such as smart phones, computers and tablets, consumer electronics, interconnection and wearable, industrial and automotive. Through long-term cooperation with well-known customers at home and abroad, it has formed a clear brand effect and gained good industry recognition.

It can be seen that SMIC is involved in multiple segments and can flexibly switch capacity between platforms.

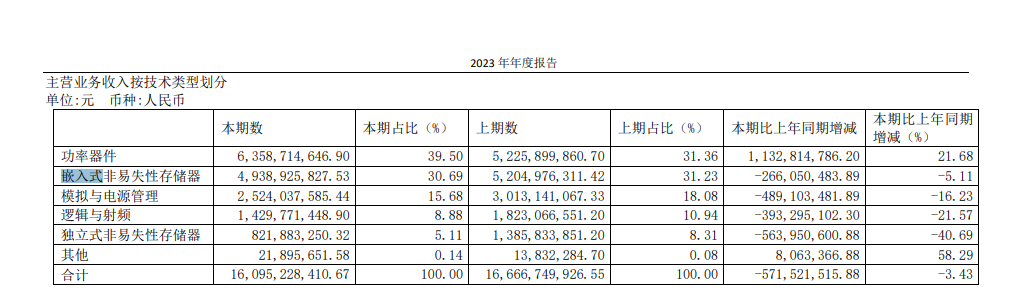

Compared with SMIC, Hua Hong is also involved in multiple segments, but it is clearly inclined to power semiconductors and storage. In 2023, Huahong's power device revenue accounted for the highest, up to 39.50 percent, embedded non-volatile memory, stand-alone non-volatile memory accounted for 30.69 percent and 5.11 percent, respectively. Power semiconductors and storage together account for up to 75.30 percent.

It is worth mentioning that although SMIC is more comprehensive, it does not involve power semiconductors. In other words, Hua Hong's highest share of the power semiconductor business, SMIC is not involved.

Perhaps this has something to do with the integration of SMIC. The securities before SMIC integration were referred to as "SMIC integration". SMIC International Holdings Co., Ltd., a wholly-owned subsidiary of SMIC, holds 14.10 per cent of the shares of SMIC integration and is its second largest shareholder.

Core-linked integrated products are mainly IGBT (Insulated Gate Bipolar Transistor) and MOSFET (Gold Oxygen Half Field Effect Transistor), both of which are power semiconductors. In short, SMIC's missing product is the strength of core integration.

Source: Hua Hong Company's 2023 Annual Report

crystal combination, core combination "specialization" single field

SMIC, Huahong company is a comprehensive wafer foundry manufacturers, and crystal integration, core integration is still a single field. Crystal integrated specialized DDIC (panel display driver chip), core-integrated specialized power devices.

from the perspective of application product classification, the main products of crystal integration, such as DDIC, CIS(CMOS image sensor), PMIC (power management chip) and MCU (micro control unit), account for 84.79, 6.03, 6.04 and 1.71 of the main business income respectively. As can be seen, the vast majority of revenue in 2023 is contributed by DDIC.

However, Crystal Integration is also actively expanding other businesses, such as CIS. On April 9, Crystal Integration announced that its 55nm single-chip, high-pixel back-illuminated image sensor (BSI) was in mass production. It is reported that the overall pixel of the chip has been raised to 50 million level.

Crystal integration products are concentrated in DDIC, while core integration is concentrated in power semiconductors. It is reported that of the two 8-inch silicon-based wafer production lines integrated with the core connection, IGBT products produce 80000 pieces per month, MOSFET products produce 70000 pieces per month, MEMS (Micro Electro Mechanical System) products produce 15000 pieces per month, and HVIC (High Voltage Insulator Coating, 8-inch) products produce 5000 pieces per month. The average annual capacity utilization rate of the company's 8-inch wafer foundry products exceeds 80%.

It can be seen that the main production capacity of core-linked integration is IGBT and MOSFET, two high-power semiconductors. At present, power semiconductors are moving from silicon-based MOSFETs and IGBTs to SIC (silicon carbide) systems.

Regarding silicon carbide, Core Integration said that the company has invested in the research and development of SiC MOSFET chip and module packaging technology and capacity building since 2021, and has completed three rounds of technology iterations in only two years. SiC MOSFET devices and modules for in-vehicle main drive inverters will be mass-produced in 2023. As of December 2023, the company's 6-inch SiC MOSFET production line has achieved a monthly output of more than 5000 pieces. In 2024, the company will also plan to build the first 8-inch SiC MOSFET experimental line in China.

Source: Daily Economic News Photo by Liu Guomei

Ticker Name

Percentage Change

Inclusion Date