on the evening of April 8, Aimee (300896.SZ, stock price 297.8 yuan, market value 64.432 billion yuan) released its first quarter 2024 performance forecast, which is expected to realize operating income of 0.803 billion yuan to 0.826 billion yuan, up 27.5-31% year on year. Net profit to parent was 0.51 billion yuan to 0.534 billion yuan, up 23%-29% year on year.

The news helped to drive Amex's share price back up on the 9th, but it still hasn't made up for the company's 9.25 per cent decline the day before. On April 8, the medical and beauty sector of the-share market fell collectively, Jiangsu Wuzhong fell by the limit, Aimeike fell more than 10% in intraday trading, Huaxi Biology, East China Medicine and other stocks fell more than 4%, and Haohai Biotech fell more than 2%.

Some people in the industry believe that this phenomenon reflects the market's pessimism towards the medical and beauty industry with consumer attributes. The "Daily Business News" reporter noted that the increasingly saturated hyaluronic acid track and the lack of potential large items may be another reason for the decline in market confidence. At present, a new round of competition for medical and beauty leaders has been launched around the anti-decline track, but unlike the three pillars in the field of hyaluronic acid, this time they face more competitors and stricter supervision.

hyaluronic acid does not move the big three share price huaxi biological income, net profit double drop

as an entry-level product of medical beauty, hyaluronic acid has the effects of hydrating, moisturizing, filling and plastic surgery. it was once called "medical U.S. money printing machine" for cultivating three a-share listed companies, huaxi biology (688363.SH, stock price 55.53 yuan, market value 26.748 billion yuan), aimeike and haohai shengke (688366.SH, stock price 97.8 yuan, market value 16.5 billion yuan) ". At the beginning of 2021, the National Health Commission approved the use of hyaluronic acid as a new food raw material, which can be added to ordinary foods such as dairy products, beverages, and alcohol. Therefore, the era of "everything can be hyaluronic acid" has come.

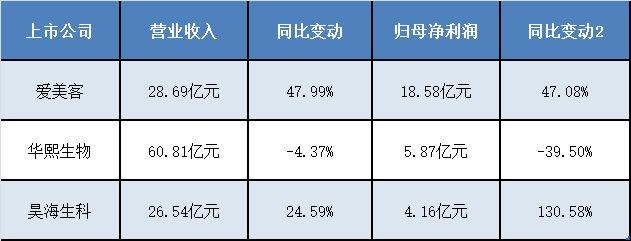

But strangely, the revenue-generating capacity of this magic ingredient is declining. According to the performance report, the global hyaluronic acid raw material leader, the domestic "hyaluronic acid first share" Huaxi Bio's operating income in 2023 was 6.081 billion yuan, down 4.37 percent from the same period last year; the net profit attributable to the parent was 0.587 billion yuan, down 39.50 percent from the same period last year, the first decline in the company's performance in nearly five years.

In this regard, the company stated that it is affected by the differences in the competitive environment, development stages and development models of each business, and management changes have different short-term impacts on each business. Among them, the raw material business still achieved steady growth, the medical terminal business maintained rapid growth, and the functional skin care business experienced a phased decline. Functional skin care products accounted for the largest proportion of the company's total operating income, so the total operating income decreased slightly compared with the same period last year.

it is worth noting that huaxi biology had previously launched the layout of c-end skin care products, which was partly due to the downward pressure of hyaluronic acid raw material prices. however, in 2022, the gross profit margin of the company's raw material products, medical terminal products and functional skin care products has declined across the board, which shows that the road of transformation is not easy.

on the other hand, aimeike and haohai shengke, who stick to the B- end market, have handed over good report cards, but each has its own troubles. Specifically, Aimeike's revenue and net profit in 2023 grew by 47.99 and 47.08 respectively compared with the same period last year. The net profit is more than 3 times that of Huaxi Biology. However, the growth rate of solution injection products with "Hi Body" as the core is gradually slowing down, and the renewable products represented by "Daytime Angel" and "Rusheng Angel" are still in the emerging development stage. The sales volume and income of Haohai Shengke hyaluronic acid products have increased significantly, net profit grew by 130.58 per cent, but gross margins on plastic and wound care products fell to 77 per cent, down 13 percentage points from four years ago.

Comparison of Mainstream Regeneration Products Source: Tianfeng Securities

In addition, due to the strong optional consumption attributes of the medical and beauty industry, market investment confidence has also declined. Although all three companies are interested in providing confidence to the market through buybacks, as of the close of trading on April 8, the shares of Aimee, Huaxi Bio and Haohai Biotech fell by 1.31 per cent, 19.98 per cent and 11.81 per cent respectively in 2024.

On April 9, Zhang Jie, the co-founder of Meibai, said in an interview with the reporter of "Daily Economic News" that medical beauty is essentially a medical behavior, and the industry's sensitivity and safety requirements are relatively high. It is "good money to drive out bad money", coupled with the country's continuous years of advocating medical beauty compliance and cracking down on industry chaos. Prudent investment is a necessary choice for investors in the current economic environment.

In addition, hyaluronic acid already belongs to the Red Sea market. As raw materials, technology, cost and other issues are gradually overcome, the bargaining power of upstream giants is gradually weakened, many players continue to enter the game of hyaluronic acid, medical beauty chain group self-operated hyaluronic acid will also lead to the lack of investment confidence of investors.

According to Qi Zuoliang, former dean of the Plastic Surgery Hospital of the Chinese Academy of Medical Sciences and vice president of the Chinese Plastic and Cosmetic Association, the number of clinical medical cosmetology visits has decreased significantly.

The next "hyaluronic acid" collagen has many competitors

in response to the decline in performance, huaxi biology put forward a solution in the announcement, that is, "continue to focus on synthetic biology, adhere to the overall positioning of biotechnology companies and biomaterials companies, build product strength with scientific and technological strength, shape brand strength, further increase cost reduction and efficiency enhancement, and promote the sustained, stable and healthy growth of the company's business".

This program points to another emerging medical beauty track-recombinant collagen. Different from animal-derived collagen, which has been widely used, recombinant collagen is a new type of collagen material, which has broad application prospects in skin barrier repair, anti-aging, and medical and aesthetic surgery. It is regarded as the next "hyaluronic acid" in the industry ".

in April 2022, huaxi biology acquired 51% of the equity of Beijing yierkang biological engineering co., ltd. and released three products of animal-derived collagen, recombinant human-derived collagen and hydrolyzed collagen (peptide) in August of that year, indicating that it plans to make collagen the second largest strategic substance after hyaluronic acid. In September last year, the record of investor relations activities released by the company also showed that Huaxi Biology has 7-8 kinds of collagen under research and has realized the preparation of macromolecular recombinant collagen.

Aimeike and Haohai Biotech also have a layout in the field of collagen. In October 2023, Aimee said on the interactive platform that it had acquired a 100 percent stake in Pecilon, which is mainly engaged in the extraction and application of animal collagen products, and is mainly engaged in the extraction and application of animal collagen products. Haohai Biotech's reserves include smart cross-linked collagen fillers, such as a number of research product pipelines, related research and development progress in an orderly manner.

However, compared with the giant creatures that started with collagen and the Jinbo creatures that specialize in "functional proteins", Aimee, Huaxi Bio and Haohai Bio do not have a first-mover advantage, and there is likely to be a synergistic risk of joining through external cooperation or outsourcing, and they need to face fierce market competition.

Collagen Products Listed in China Photo Source: Tianfeng Securities Research Report

for example, huaxi biological layout of botulinum toxin products failed for 7 years due to the thunderstorm of the partner Medytox company. Aimee's botulinum toxin type A for injection is in the stage of sorting out and applying for registration, but Fosun's botulinum toxin type A RT002 registration application has been reviewed and accepted in April 2023. Aimee's Simaglutide injection is still in the pre-clinical research stage, however, the application for the listing of type 2 diabetes indications for the nine-source gene simegrlutide injection biosilane has been accepted, and its weight loss indications have been approved for clinical use in January this year.

In addition, Aimee's gene recombinant protein drug products have not progressed as expected. According to the company's special report on the storage and use of the raised funds in 2023, the actual use of the "gene recombinant protein R & D and production base construction project" is only 310000 yuan, and the investment progress is 0.19. The project, which was originally scheduled to reach its intended serviceable status in December 2023, has been postponed for two years to December 2025.

So, do these tracks have the potential to erupt into large single products? Ming Fung Capital partner Fei Simin told reporters that the recombinant collagen has been market-proven, market share and application scenarios are still expanding; slimming drugs in the semaglutide has also been market-proven, the emergence of large single products. In addition, renewable materials such as PHA, PCL, PLLA and PDLLA currently have relatively mature productization and terminal application scenarios, as well as space for compounding with hyaluronic acid and collagen to form new materials. "Looking further to the forefront, there are still explorations in extracellular matrix, cell structural scaffolds and other dimensions in technology".

Zhang Jie believes that the recombinant collagen market is still a blue ocean, and this track is most likely to explode with large single products. With the breakthrough of collagen technology, it is an inevitable trend to reduce the cost and increase the supply.

in qi zuoliang's view, the key to opening up new tracks and obtaining large single products is innovation. none of the above products can achieve "people without me", but can only strive to achieve "people with me superior". therefore, the competition is relatively fierce and it is difficult to form real large single products.

From the volume of injection products to "photoelectric beauty" short-term difficult to contribute income

Behind the medical giant's emphasis on restructuring collagen is the rise of the anti-aging track. In January 2024, the general office of the State Council issued the opinions on developing silver hair economy and improving the well-being of the elderly, which clearly proposed the development of anti-aging industry, which should "deepen the research on skin aging mechanism, human aging model and human hair health, and strengthen the R & D and application of gene technology, regenerative medicine and laser radio frequency in the field of anti-aging".

Among them, photoelectric medical beauty based on laser radio frequency is an important part of light medical beauty. On November 8, 2023, Aimee announced that the company had signed a "distribution agreement" with Jeisys of South Korea to introduce the company's Density and LinearZ two non-invasive skin anti-aging instruments, which are already in the commercial stage in South Korea. The company officially intervened in the photoelectric medical beauty track.

previously, the enterprises that made the layout of photoelectric medical beauty through the acquisition of related enterprises also included haohai shengke, east China medicine (000963.SZ, stock price 30.25 yuan, market value 53.068 billion yuan) and beitani. Huaxi Bio's intelligent medical equipment brand "Xi Beirui" has released the "handheld dual-frequency beauty instrument", known as "focus on RF and micro-current two mainstream anti-aging technology".

Head enterprises from injection products "roll" to photoelectric medical beauty, with the track advantages and market development stage. One PartyIn the statistics of the most popular service items among Chinese medical and beauty consumers in 2022, the proportion of photoelectric medical and beauty items was 47%, 16 percentage points higher than that of injection medical and beauty items. Due to the long useful life of optoelectronic devices and the relatively simple service scenario, the relative price of optoelectronic medical beauty is lower and the gross margin performance is better.

On the other hand, according to the announcement of the State Drug Administration, radio frequency therapeutic devices and radio frequency skin therapeutic devices are managed as Class III medical devices. From April 1, 2024, RF therapeutic apparatus and RF skin therapeutic apparatus products shall not be produced, imported or sold without obtaining a medical device registration certificate in accordance with the law. This raises the threshold for market access and brings new opportunities for the reshuffle period.

feismin told reporters that photoelectric equipment and the products already owned by the giant company have a combination in the use scenario, which can help the company realize the process from product use to multi-dimensional long-term management. Moreover, the head company has a full range of empowerment capabilities, from the technology, sales channels and other dimensions, the platform company into this track of the advantages are obvious.

Zhang Jie also believes that hyaluronic acid enterprises may occupy market segments in advance by making use of abundant funds, enterprise brand influence, existing industry resources/information/channels and other resources.

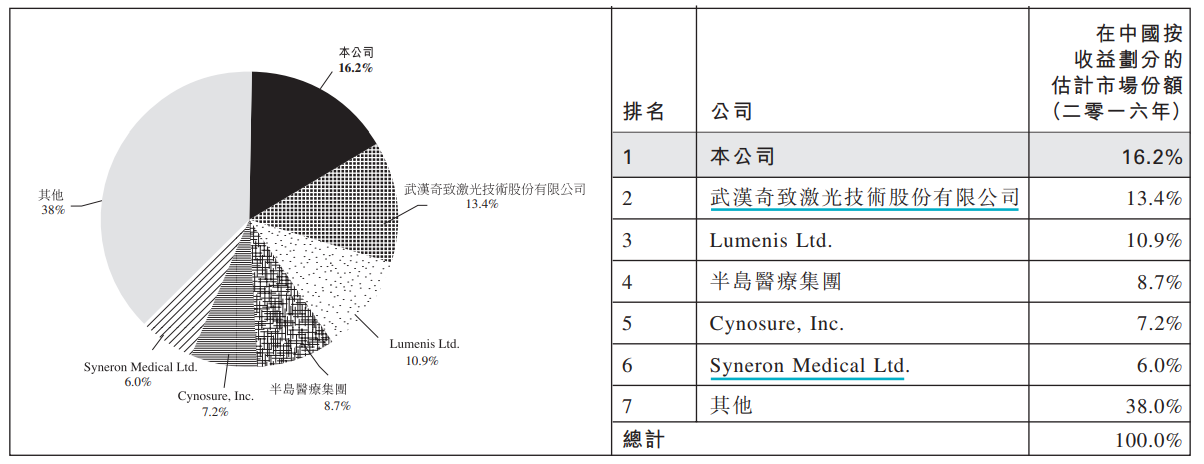

However, the photoelectric medical equipment industry is a technology-intensive industry with multi-disciplinary cross-integration, with high technical barriers and a late start in China. The industry is mainly dominated by foreign brands such as the US Saino Show (Cynosure), the US Saino Long (Candela), the Israel Feiton (Alma), the US Medical People (Lumenis) and the Eurostar.

Market Share of Major Suppliers of Energy Source Medical Aesthetic Devices in China by Revenue, 2016

Image credit: FuRui Medical Technology Prospectus

"Direct layout through investment and acquisition, lack of core technology independently developed by enterprises, is equivalent to being stuck by partners, and the sense of security may be insufficient." Zhang Jie said.

the reporter also noticed that clinical trials and NMPA registration need to be completed before photoelectric device products are approved. for most medical and beauty giants, it is still difficult for photoelectric medical and beauty to contribute revenue in the short term.

Source: Daily Economic News Photo by Liu Guomei

Ticker Name

Percentage Change

Inclusion Date