NO.1 Li Qiang attended the opening ceremony of the 2024 annual meeting of the China Development Forum and delivered a keynote speech

Premier Li Qiang of the State Council attended the opening ceremony of the 2024 Annual Meeting of the China Development Forum in Beijing on March 24 and delivered a keynote speech. Li Qiang said that today's Chinese economy has been deeply integrated with the world economy. We will continue to create a first-class business environment of marketization, rule of law and internationalization, further deepen the reform of key areas and key links, strive to improve the efficiency of government services, protect the legitimate rights and interests of all kinds of enterprises in accordance with the law, steadily promote institutional opening up, and constantly link the world with a higher level of openness.

NO.2 Zheng jiajie: promote equipment update in 7 major areas

on March 24, Zheng zhajie, director of the national development and reform Commission, said that we will promote equipment renewal in seven major fields, including industry, agriculture, construction, transportation, education, culture and tourism, and medical treatment, which is expected to form a huge market with an annual scale of more than 5 trillion; to carry out the upgrading of durable consumer goods such as automobiles, household appliances and household appliances, which is expected to release the market potential of trillion scale; to promote the transformation from dual control of energy consumption to dual control of carbon emissions, an additional investment of at least 2 trillion yuan per year will be required before 2030. Both Chinese and foreign enterprises can share dividends and win new advantages in development. (CCTV News)

NO.3 China controls the expulsion of Philippine vessels invading Renai Reef

According to news released by the Ministry of National Defense on the 24th, the spokesperson of the Ministry of National Defense Wu Qian answered reporters' questions about the Philippines' invasion of Renai Reef. Wu Qian: On March 23, a Philippine ship trespassed into the waters adjacent to China's Renai Reef in an attempt to carry out replenishment to its illegal "beach-sitting" warship. The Chinese coast guard has regulated, blocked and driven away Philippine ships in accordance with the law and regulations, and resolutely eliminated the Philippine infringement and provocative plot. This incident was entirely triggered by the provocation and trouble-making of the Philippine side, and China's handling was reasonable, lawful, and professional. It needs to be emphasized that China has indisputable sovereignty over the Nansha Islands, including Ren'ai Reef, and their adjacent waters, and China's sovereignty and territorial integrity are inviolable. China is willing to properly resolve the dispute with the Philippines through dialogue and negotiation, but the Philippines has renegotiated and betrays its promise in a vain attempt to reinforce the illegal "sitting beach" warship of Ren'ai Reef into a permanent facility. China will never sit idly. We are telling the Philippines to stop making any remarks that may lead to the intensification of conflicts and escalation of the situation, and to stop all infringing and provocative acts. If the Philippines repeatedly challenges China's bottom line, China will continue to take resolute and decisive measures to firmly safeguard its territorial sovereignty and maritime rights and interests.

NO.4 Wang Wentao Meets with Chairman of the Board of Directors of AMD

According to the website of the Ministry of Commerce, on March 24, Minister of Commerce Wang Wentao met with Su Zifeng, Chairman and CEO of AMD Semiconductor. The two sides exchanged views on Sino-US economic and trade relations, AMD's development in China and other issues. Wang Wentao said that China's active participation in international cooperation is a stabilizing force in the supply chain of the global semiconductor industry chain. The development of the semiconductor industry requires global cooperation. It is hoped that the United States and China will work together to provide enterprises with clear security boundaries and stable expectations.

NO.5 geomagnetic storm warning issued

according to CCTV news, the reporter learned from the China Meteorological Administration that geomagnetic activities may occur on March 24, 25 and 26, of which moderate or higher geomagnetic storms or even geomagnetic storms may occur on March 25, and geomagnetic activities are expected to last until the 26th. According to West China Metropolis Daily, ordinary people do not need special protection from geomagnetic storms, and the intense solar activity has nothing to do with the intensity of ultraviolet radiation. "Sunscreen is completely irrelevant to solar storms and geomagnetic storms. It is only needed when the atmosphere is thin and the ultraviolet radiation is strong on the plateau." He Fei said that but geomagnetic storms do have some effects, such as on navigation.

NO.6 the price of crayfish in many places has decreased compared with last year

The price of crayfish in many places this year has declined compared with last year. Mr. Xie (pseudonym), a crayfish wholesaler in Jingzhou, Hubei, told Hongxing Capital Bureau on March 24 that last year, Zhongqing (medium-sized crayfish) was about 1kg in 40 yuan, and now it sells 1kg in 29 yuan. Mr. Rao, a crayfish wholesaler in Nanning, Guangxi, also said: "This year's crayfish is cheaper than last year. Last year, Zhongqing 35-40 yuan per catty, and now Zhongqing 30 yuan per catty. This year, the shrimp came out earlier because of the warming climate." However, the Red Star Capital Bureau noted that the price of crayfish on March 24 increased compared with the previous few days. Both Mr. Xie and Mr. Rao believe that crayfish prices are not expected to fall until around mid-April. Mr. Xie said: "because shrimp fry has become finished shrimp." Mr. Rao said: "At that time, a large number of crayfish began to mature, and the output would rise, so it would naturally be cheaper."

NO.7 No casualties in the wildfire in Qinglong, Guizhou

the reporter learned from the propaganda Department of Qinglong County Party Committee in Guizhou Province that at about 19:00 on March 23, 2024, a mountain fire broke out at the junction of Datian Community in Chama Town, Qinglong County and ethnic Village in Huagong Town. the fire spread to Chama Town and Huagong Town. Qinglong County Party committee and government organized more than 200 cadres and masses from emergency, fire control, forestry, town and village departments to participate in the fire fighting. Rescuers put out the fire by cutting and cutting the isolation protection belt and putting out the fire on the spot by fire engines. As of 23:30 on March 24, the fires in ethnic villages in huagong town and dongqing village in cha ma town had been controlled. Among them, there is still a residual fire at the steep slope of Lanshe slope in Datian Community of Chama Town. Because the average wind force at the scene of the incident was above level 8, the rocks were steep, and there were many suspended rocks. Hundreds of firefighters were still stationed at the scene to observe the fire. The wildfire occurred without casualties. The cause of the fire is under investigation. (CCTV News)

NO.8 fat donglai responded that 985 girls did not enter the interview

According to a report from China Blue News on the 24th, an undergraduate who graduated from a 985 college claimed that he had applied for a fat Donglai and did not even enter the interview. In response, Fat Donglai customer service said that the girl's work experience did not match, "she is the experience of food retail, not food production". In addition, they also have requirements for the understanding of corporate culture. When choosing the best, they cannot say that others are not good, but that there are more suitable . 209 people who have passed will also need to be interviewed, and some people will have to be screened.

NO.9 uniform men restaurant conflict incident aroused heated discussion

According to the Guizhou Radio and Television Public Channel "People's Concern" report, on March 22, a man in uniform in Yulin, Shaanxi, had an argument with a cart driver who was dining in the restaurant while eating in the restaurant. During the quarrel, the uniformed man got up and poured his meal into the trash can in front of the cart driver, then loudly questioned the cart driver: " didn't you see me in uniform?" and asked the cart driver to pick up the surface of the trash can and eat it, then let the driver go, seeing that he didn't act, the man grabbed the driver's neck and let him eat the food in the trash can. Reported that the whole process, the cart driver did not act excessively. Finally, the restaurant owner came out and stopped the two in time. According to the restaurant owner, the man for the fish river toll station staff. On March 23, Shaanxi traffic control yuwu branch issued a notice saying: in view of this situation, our branch and the local police station set up a joint investigation team. According to the investigation, made a decision to suspend the personnel involved, accept further investigation, and asked the toll stations of our branch to draw inferences from one instance to strengthen the internal management of employees.

NO.10 International News

180 injured in Russian concert hall attack

According to CCTV news reports, on the 24th local time, the Russian Moscow State Health Department stated that the terrorist attack on the Moscow State Concert Hall has caused 180 injuries. Of these, 142 were hospitalized and 32 have been discharged. Another 38 received outpatient treatment. According to the latest statistics released by the Russian investigation Commission, the terrorist attack on the concert hall of the Moscow region has killed 137 people. In addition, according to CCTV International News on March 24, Russian media recently released a video of President Putin's handling of an emergency after he just learned of the terrorist attack on the Moscow Oblast Concert Hall. According to another report, Putin will hold a Russian Federation Security Conference on the terrorist attack next week. On the 24th local time, the Basman District Court in Moscow, Russia, conducted a trial on whether to formally arrest four persons suspected of being directly involved in the terrorist attack on the Moscow Oblast Concert Hall. There are currently 2The suspect appeared in court. . The Russian Investigative Committee called for the formal arrest of the two men on charges of involvement in terrorist acts by groups.

Russian fighters intercept U.S. bombers in the Barents Sea

The Russian Ministry of Defense announced on the 24th local time that an air target was detected over the Barents Sea that day and was approaching the Russian border. The Russian military dispatched a MiG -31 fighter jet to identify air targets, and the crew confirmed that the targets were two US Air Force B- 1B strategic bombers. After detecting the approach of the Russian fighter, the US strategic bomber corrected its flight path, distanced itself, and then turned away from the Russian border. The Russian Ministry of Defense emphasized that the flight of Russian fighter jets strictly complied with international rules for the use of airspace over neutral waters and complied with safety measures. (CCTV News)

NO.1 Cook: Apple will continue to invest in the Chinese market

apple (AAPL, stock price:172.28 us dollar, market value: 2.66 trillion yuan): according to CGTN, the 2024 annual meeting of the China development forum was held at the Diaoyutai state guesthouse on March 24. Before the opening ceremony, Apple CEO Cook said in an exclusive interview with CGTN host Tian Wei that he loves China and the Chinese! According to Guoshi through train, Cook said in an interview at the opening ceremony that we will continue to invest in the Chinese market. In addition, according to CCTV Financial News, Cook said that Apple's Apple Vision Pro headset products will be launched on the Chinese market within this year. At the same time, the company is continuing to increase investment in research and development in China.

Comments: Cook, as the leader of Apple, has an important position in the Chinese market. His statement shows that Apple attaches great importance to the Chinese market.

NO.2 China Evergrande withdraws debt restructuring application

China Evergrande (HK03333, Share Price:0.163 HK $, Mkt Cap:22 hk $100 million): China Evergrande announced at the hong kong stock exchange on the evening of March 24 that the company, jingcheng and space base had previously applied to the us court under chapter 15 of title 11 of the us code for recognition of their respective overseas debt restructuring agreements in hong kong or the british virgin islands (as the case may be). In view of the appointment of the joint and separate liquidator (joint and separate liquidator) of the company, it is expected that the agreement arrangement will not be carried out in the current way. According to the joint and separate liquidator's understanding, the legal advisers of the former foreign representatives of the company, Jingcheng and Tianji have submitted documents to the US court on March 22, 2024 to withdraw the respective Chapter 15 applications of the company, Jingcheng and Tianji.

NO.3 extreme krypton car response show car suddenly started hit people

polar krypton car: on March 24, a netizen released a video saying that at the 2024 Nanjing international new energy automobile exhibition, the polar krypton car on display suddenly started and injured two people, including a child. At 19 o'clock, the reporter contacted the official staff of the exhibition. The staff member said that the person who was hit was unhindered and had been sent to medical treatment. As for why the vehicle was started, the public security department has also intervened. At about 20 o'clock, in response to the accident, Krypton responded: due to a mistake in the management of the participating vehicles, the exhibition model was not opened as required, resulting in 5 people being injured at the scene. (New Yellow River)

Comments: The accident questioned the safety management of Krypton at the exhibition and aroused social concern.

NO.4 Wanda swiped the screen, the latest response has come

Dalian Wanda commercial management group co., ltd : on March 24, the news that "Wang jianlin's Dalian Wanda commercial management over 16.2 billion yuan equity has been frozen" swept through the real estate circle. In response to this, people familiar with the matter said in response to a reporter from China Securities News that the equity freeze was due to a dispute between a project of Dalian Wanda Commercial Management Group Co., Ltd. and a bank over an operating loan. The bank applied to freeze the equity of Dalian Wanda Commercial Management Group Co., Ltd. held by Xindameng before the lawsuit. Wanda has reached an agreement with the bank on the dispute, and the frozen shares will be unfrozen soon.

Comments: As a well-known real estate company in China, the freezing of the equity of Dalian Wanda Commercial Management Group Co., Ltd. has attracted market attention. Although the unfreezing of equity will have a limited impact on it, this incident still reminds companies to pay attention to compliance operations and avoid similar disputes.

NO.5 lei jun: plans to announce the price of millet SU7 at the press conference

Xiaomi Group-W(HK01810, Share Price: HK $14.80, Market Cap:3692 hk $100 million ): Xiaomi group chairman lei jun tweeted that many people were asking why Xiaomi SU7 did not announce the price for a long time? The entire auto industry new car release cycle is relatively long, from the first release to the official listing, as long as six months. The price is announced at the official product launch. Xiaomi SU7 has only 3 months from technology release to product launch. We plan to announce it at the 28th conference.

Comments: Xiaomi's entry into the automotive industry has attracted much attention, and Xiaomi SU7 is its first model. The announcement of the price will have a certain impact on consumers and competitors, which has aroused the public's attention and thinking about Xiaomi's entry into the automobile industry.

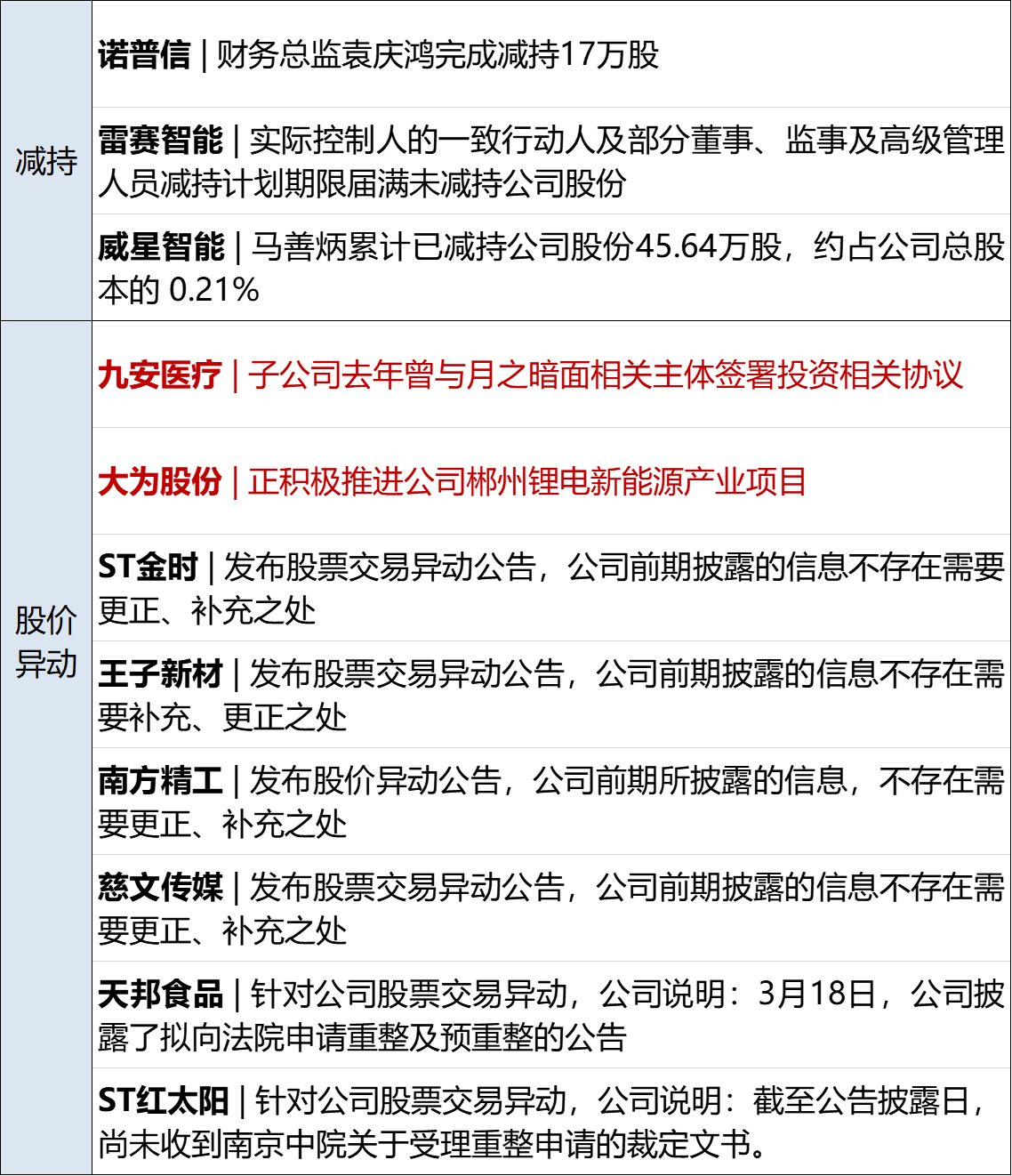

NO.6 Jiuan Medical responds to stock price changes

jiuan medical (sh 002432, stock price:51.69 yuan, market value: 25.3 billion yuan) announced on the evening of August 24, 2023, jiuan medical , its wholly-owned subsidiary, Jiuan Hong Kong, signed an investment-related agreement with the dark side of the month, with an investment amount equivalent to about US $10 million. At the same time, in March 2024, Tianjin Jiusheng No. 1 Management Consulting Partnership (Limited Partnership), in which Jiuan Medical participated in the investment, signed an investment-related agreement with the relevant subjects of the dark side of the month, with an investment amount equivalent to about US $20 million. After the completion of the above-mentioned investment in the dark side of the month, the proportion of equity in the subject company is very low, and the amount involved accounts for only 0.98 per cent of the company's latest audited total assets.

Comments: Jiuan Medical's investment in the dark side of the month is small, the proportion of equity is also low, and the impact is expected to be limited. The surge in share prices may be the impact of the market's bullishness on Kimi concept stocks.

NO.7 Zhongtai Chemical: Zhongtai Group, the controlling shareholder, was filed by the CSRC

China-Thailand chemical (SZ002092, stock price:4.79 yuan, market value: 12.4 billion yuan): on March 24, China-Thailand chemical was suspected of organizing and disclosing information, the CSRC decided to file a case against Zhongtai Group, the controlling shareholder of the company. According to the announcement disclosure, from 2021 to 2023, Sino-Thai Group illegally occupied Sino-Thai Chemical funds accumulated more than 8.4 billion yuan; from 2020 to 2022, Sino-Thai Chemical financial data disclosure is inaccurate, the cumulative inflated revenue of 7.285 billion yuan.

Comments: The incident has had a significant impact on the financial position and reputation of Zhongtai Chemical, investors need to be alert to corporate governance risks and tighter industry regulation.

NO.8 ZF Supply Chain Withdraws from China? Untrue

German ZF Group: At the 2024 China Development Forum, Stephen von Schukman, director of the global auto parts supplier giant German ZF Group, said: Any talk and hype about supply chain withdrawal is not true. We have a lot of investment and we have long-term plans. (CGTN Press Corps)

Comments: ZF is a global leader in auto parts suppliers, and its statement shows its firm confidence in the Chinese market.

N O.9 Huawei P70, suddenly spread good news!

Huawei: on March 24, a reporter from china securities journal learned exclusively from Huawei's mobile phone supply chain company that the company has begun to supply Huawei's P70 series of high-end flagship phones in bulk. Industry chain sources told reporters that Huawei's P70 series shipping target guidelines are relatively optimistic. The agency recommends focusing on Huawei's P70 series of industrial chain companies.

Comments: As a well-known mobile phone brand company, Huawei's new product shipments bring positive news to supply chain companies. Focus on Huawei P70 series industry chain companies may benefit from this.

NO.10 Tris-Energy responds to equity transfer

Tritona (SH688599, stock price:24.37 yuan, market cap:531 billion yuan): recently, Trine Light disclosed some equity transfer matters within the concerted parties, and some investors mentioned that Wu Chunyan, the transferee of shares, was a "Singaporean". In this regard, the reporter interviewed Trine Light Energy exclusively, and Wu Qun, the company's secretary of the board of directors, responded: "Wu Chunyan only owns the permanent right of abode in Singapore, and is still of Chinese nationality, and needs to strictly abide by the regulations on the Administration of Foreign Exchange in the People's Republic of China and other relevant laws and regulations. Equity transfer has nothing to do with overseas transfer of assets." (China Securities Journal)

Comments: This news involves the transfer of shares and overseas transfer of assets of Trine Light Energy. The response of the company's board secretary has positive significance for the market to solve the doubts and help to eliminate the market's worries about the loss of assets of the company.

Investment interaction

Last week's stock market summary:

Hongxin Securities concluded that last week, the-share Shanghai Composite Index fell 0.22 percent to 3048.03 points, the Shenzhen Component Index fell 0.49 percent to 9565.56 points, and the ChiNext Index fell 0.79 percent to 1869.17 points. Value style sector representative index SSE 50, CSI 100, CSI 300 fell 0.99 percent, down 0.61 percent, down 0.70 percent, growth style sector representative index of small and medium-sized 100, CSI 500, CSI 1000 rose 0.58 percent, down 1.28 percent, up 0.72 percent. Last week, the average daily turnover of A shares in the two cities was 1082.307 billion yuan, up 4.26 from the previous week.

This week's stock market forecast:

Bohai Securities analysis pointed out that economic data showed strong momentum after the start of the year, A- share fundamentals were facing revaluation, and A- share upside space was also opened. The neutral stance of the overseas Fed has not had an impact on the external liquidity environment. Therefore, in the outlook, A- shares may show a volatile rise under the support of strong economic data and a stable overseas environment. The main resistance of the market comes from the exchange pressure after the weekly rise of the index, and the exchange behavior of some funds may become a lag factor in the development of the market.

Nearly 3.1 billion restricted shares were lifted from listing this week

According to Wind statistics, this week (March 25 to March 29), the number of A- share restricted shares listed totaled 3.092 billion shares. Based on Friday's closing price, the market value was about 42.256 billion yuan, both compared with this week. The month-on-month increase. Individual stocks, the release of the market value of the larger Beitani, Suneng shares, and Lin Weina, Jiulian Technology, Haitian shares, Haitong Development, Planet Graphite and other listed companies.

Two new shares will be issued this week

Wind data shows that this week (March 25 to March 29) there will be 2 new shares issued, with a total of about 66.832 million shares issued, and a total of 1.659 billion billion yuan is expected to be raised. Specifically, Zhongrui shares were issued on March 25. On March 29, Canxin shares were issued.

There is another new listing this week. Guangfeng Technology issued a voluntary disclosure announcement on the evening of March 21, showing that the company's shareholding company Hubei Gobiga Optoelectronics Technology Co., Ltd. will publicly issue shares to unspecified qualified investors and will be listed on the Beijing Stock Exchange on March 25, 2024. According to the listing notice, Gobiga listed issue price of 10 yuan/share, with the securities code "835438" landing on the North Stock Exchange. Guangfeng Technology said that as of the date of the announcement, the company holds 2 million shares of Gobiga.

click on the query , a key to identify the meat and thunder stocks, play new worry .

citic construction investment : on the supply side, the prices of Australian mines and lepidolite have risen, the spot price of Australian mines CIF has risen to 1100 us dollars/ton, the domestic price of 2%-2.5 mica concentrate has risen to 2190 yuan/ton, the cost has risen and the production is limited by environmental protection. the operating rate of lithium salt plants is still low, the supporting price is still strong, and the spot price is high, low price spot is hard to find. Demand side, March enterprise production recovery trend is good, April production continued to pick up, laying the foundation for high consumption in the second quarter, power battery terminals and energy storage demand have risen, current lithium price supply and demand fundamentals support are strong, terminal consumption cash continue to support lithium prices high.

Every reporter: Wang Fan, Liu Mingtao

every editor: chen pengcheng yuan dong

Disclaimer: The content and data of the article are for reference only and do not constitute investment advice. Investors operate accordingly at their own risk.

Ticker Name

Percentage Change

Inclusion Date