∙ Bull Point Line Surface>

Font size

A- share trading officially closes in 2023.

On December 29, the-share market ushered in the last trading day of 2023, and the Shanghai and Shenzhen stock indexes both ended their full-year trading in red.

However, judging from the performance of A shares for the whole year, the major indexes all closed down. According to Big Wisdom VIP data, the Shanghai Composite Index is down 3.7 per cent for the year, the CRE 50 index is down 11.24 per cent for the year, the Shenzhen Composite Index is down 13.54 per cent for the year and the GEM index is down 19.41 per cent for the year.

At the individual stock level, the performance of A- shares in 2023 is still commendable. Wind data show that a total of 2870 stocks made positive returns for the year, more than half.

It is worth mentioning that, thanks to the year-end rally, the North Securities 50 Index performed well throughout the year, rising 14.92 per cent in 2023. Among them, the North Stock Exchange stock Kaihua Materials (831526) is the year's biggest stock with a year-on-year increase of 571.83.

In addition, The Paper noted that with the implementation of the full registration system, as many as 7 of the top 10 stocks this year are ST stocks.

Electronics led the gains

Specifically, 2870 A- shares rose in 2023, accounting for 53.80 per cent of all 5335 A- shares. Among them, 566 stocks rose by more than 50 per cent, while 177 stocks doubled their share prices for the whole year, up more than 100 per cent.

in terms of ranking, excluding the secondary new shares listed in 2023, Kaihua materials ranked first in the year, up 571.80 per cent, and was the only A- share stock that rose more than 500 per cent this year.

Wind data show that Kaihua materials is one of the earliest enterprises in China to produce electronic powder sealing materials. The leading product epoxy powder sealing materials are in a dominant position in the market, and have become an industry enterprise with a relatively complete series of domestic epoxy powder sealing materials, large scale, outstanding technical strength and marketing ability.

With the blessing of concepts such as ChatGPT, the digital economy TMT has become one of the strongest mainlines for A- shares this year. Reflected in individual stocks, communications stocks Liante Technology (301205) ranked second in the year, up to 397.95 percent.

Wind data show that Liante Technology focuses on the research and development, production and sales of optical communication transceiver modules, and has mastered a series of key technologies in optoelectronic chip integration, optical devices, optical module design and production process, and has the design and manufacturing capabilities from optical chips to optical devices and optical devices to optical modules.

huawei's auto concept stock shenglong shares (603178) is the third-largest gainer this year, also up more than 300 percent for the year, up 385.55 percent.

Wind data shows that Shenglong is a national high-tech enterprise specializing in the production of auto parts. Its main products include engine oil pumps, automatic transmission oil pumps, camshafts, and aluminum die castings. In October this year, Huawei and Selis jointly launched the new M7 model, which set off a "huge wave" in the automotive industry. Huawei's automotive concept stocks were popular in the-share market, and Shenglong shares even stepped out of the 12th board in October.

jierong technology (002855), which is also a "Huawei concept stock", ranked fourth in the year with a total increase of 377.28, thanks to the 298.60 percent increase in the 14 trading boards that appeared in September.

Wind data shows that Jierong Technology's main business is to provide the development and manufacturing of precision molds and the production of precision structural parts for the largest category of mobile phones, tablets, and wireless network cards in the global consumer electronics field.

high-tech development (000628), huami new material (836247), China aviation electric measurement (300114), new novai (300765), zhongji xuchuang (300308) and hongbo shares (002229) all rose more than 300 for the whole year, ranking fifth to tenth respectively.

Second New Stock Rally Pleasant

It is worth mentioning that the performance of sub-new stocks in 2023 is very eye-catching, especially the stocks listed on the Beijing Stock Exchange in 2023. There are 3 stocks with annual gains, which can enter the top ten in 2023.

specifically, Kunbo Seiko (873570), which was listed on the Beijing Stock Exchange on November 23, rose as much as 568.06 per cent in more than a month, ranking second for the whole year.

West Magnetic Technology (836961), which was only listed on the North Stock Exchange on December 21, rose a total of 359.24 per cent in seven trading days, ranking sixth for the whole year.

Haosheng Electronics (838701), which was listed on the Beijing Stock Exchange on July 19 this year, rose 17.13 per cent in more than five months, ranking eighth in the year.

in addition, Baili Tianheng (688506), which went public in January this year, also entered the top 10 for the whole year, up 336.51 per cent.

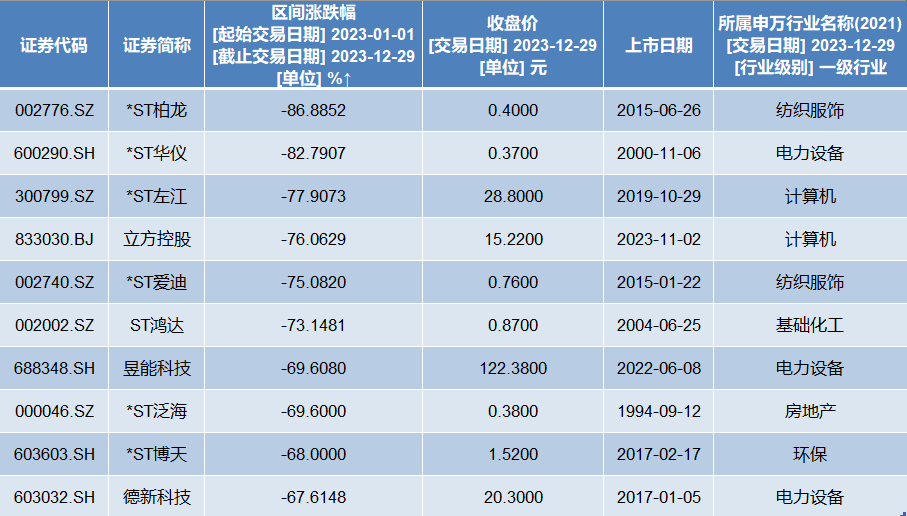

the top 10 decliners are only ST shares

In terms of decline, Wind data shows that in 2023, a total of 2455 A- shares failed to close up during the year. Among them, a total of 1072 stocks fell by more than 20%, and a total of 91 stocks fell by more than 50%.

specifically, * ST berong (002776) led the-share market down by 86.89 in 2023. * ST Huayi (600290) also fell more than 80% for the whole year, down 82.79.

* ST Zuojiang (300799), Cube Holdings (833030), * ST Aidi (002740) and ST Hongda (002002) followed closely, with declines of more than 70 per cent, down 77.91 per cent, 76.09 per cent, 75.08 per cent and 73.15 per cent respectively for the year.

Among them, Cubic Holdings, which went public on November 2 this year, is the only stock among the top ten stocks that fell this year. Although the market on the Beijing Stock Exchange was hot at the end of the year, Cubic Holdings still performed poorly in the last two months of 2023.

in addition, Yu neng technology (688348), * ST pan hai (000046), * ST botian (603603) and de xin technology (603032) all fell by more than 60% for the whole year.

Communications sector led the gains

plate, Shenwan level industry classification, the overall performance of each plate in 2023 there is no lack of bright spots, 31 plates in 18 plates to achieve a rise, accounting for more than half. Among them, 11 sectors rose more than 10%.

Specifically, the communications sector led the way in 2023, up 51.04 per cent and the only sector to gain more than 50 per cent this year.

Petroleum and petrochemicals and media followed closely, with gains of more than 30 per cent in the first half, up 33.55 per cent and 32.71 per cent respectively. The electronics and computer sectors rose more than 20 per cent in the first half of the year, up 23.26 per cent and 23.05 per cent respectively.

Coal, banks, household appliances, textiles and clothing, automobiles, machinery and equipment rose more than 10 per cent, up 18.03 per cent, 13.50 per cent, 12.45 per cent, 12.27 per cent, 11.03 per cent and 10.25 per cent, respectively.

Public utilities, national defense and military industry, medical biology, architectural decoration, light industry manufacturing, non-ferrous metals, environmental protection and other sectors will all achieve red in 2023.

In 2023, 13 sectors failed to close up. Among them, the beauty care sector led the decline, down 20.51 per cent for the year, the only sector to fall more than 20 per cent.

Power equipment, real estate, trade and retail, building materials and social services all fell more than 10 per cent for the year, down 19.04 per cent, 17.89 per cent, 15.89 per cent, 15.12 per cent and 10.36 per cent, respectively.

Agriculture, forestry, animal husbandry and fishing, food and beverage, general, basic chemicals, transportation, steel, non-bank finance and other sectors also failed to close up for the year, down 9.97 per cent, 9.61 per cent, 7.67 per cent, 6.71 per cent, 5.40 per cent, 3.23 per cent and 0.33 per cent, respectively.

Editor: Wang Jie

Ticker Name

Percentage Change

Inclusion Date