the first silicon carbide model of hongmeng zhixing camp is released, and SiC car penetration can be expected

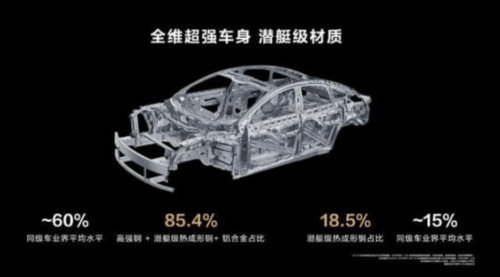

on November 28, Huawei intellectual S7 was officially released, equipped with a new generation of Huawei DriveONE 800V silicon carbide high-voltage power platform. compared with silicon-based IGBT, the assembly efficiency was improved by 4.4 and MCU power density was improved by 25%. As the first model equipped with silicon carbide in Huawei's Hongmeng Zhixing camp, Huawei Zhijie S7 may play a certain declaration effect, accelerating the penetration of SiC on the car, SiC will also become an important part of the main line of "Huawei Smart Car" in the future.

during the year, a number of 800V models equipped with SiC went on the market, and the price range dropped

according to the statistics of micro-grid, as of 23H1, 40 SiC models have been delivered in mass production worldwide, and more than 1.2 million SiC models have been delivered worldwide. Many blockbuster SiC models followed, including the intellectual S7 and the M9 supported by Huawei. New car-building forces and traditional main engine factories have all introduced SiC models. 800V silicon carbide high-voltage platforms are gradually getting on the bus as standard in the 20-300000 price range, and some brand prices have reached below 200000 yuan. The industry trend of SiC from 0 to 1 has been set, and on-board SiC is expected to further reduce the cost and accelerate the penetration of SiC from 1 to 10.

in the short term, demand exceeds supply and capacity expansion; in the long term, technology iteration, quality improvement and cost reduction

We estimate that the global demand for on-board SiC substrates will be 2.67 million in 2023. SiC as an emerging industry, short-term supply, domestic and foreign players actively expand production, planning capacity rose rapidly. However, the overall yield is low, and the planned production capacity is not equal to the actual delivery capacity. In addition, the current mainstream commercial SiC production method is PVT (physical vapor transport method), but the crystal growth speed is slow and the defect control is difficult, resulting in the high cost of SiC substrate (accounting for 50% of the manufacturing cost of SiC devices). The industry actively promotes the research and development of LPE (liquid phase method) and other methods to reduce defect density, improve yield and reduce costs. We believe that in the short term, there is no need to worry too much about the problem of SiC overcapacity, the improvement rate is the top priority of substrate enterprises, there is a long-term possibility of capacity clearance, at the same time, each also has a technological breakthrough to achieve the opportunity to overtake the corner. In terms of investment, it is recommended to give priority to companies with more mature technologies and cutting-edge technology reserves.

Related companies

Sanan Optoelectronics (600703): Sanan Optoelectronics is one of the leading companies in the domestic SiC industry. With its technology accumulation and advantages in the LED industry, San'an has a comprehensive layout of the compound semiconductor track. The company's SiC series of products have made many breakthroughs, in the power devices and RF devices and other downstream markets to achieve stable shipments. The company released the SiC MOS 1200v series of new products at the New Energy Vehicle Drive Technology Innovation Summit in September 2022. Its wholly-owned subsidiary signed a 3-year "Strategic Purchase Intention Agreement" with a total amount of RMB 3.8 billion million with the demand side in November, further demonstrating the company's leading position in the field of domestic SiC chips. The company's downstream main customers include BYD, Sunshine Power, Goodway, Great Wall, Gree, Shangneng and so on.

starr semi-conductor (603290) : the company is a leading enterprise in the localization of SiC IGBT devices. at present, its Si IGBT modules have covered 600-3300v voltage level and are widely used in photovoltaic, energy storage, automobile, frequency conversion white goods and other fields. According to Omdia, the company's global market share of IGBT is 2.5 percent in 2020, ranking 6th and the only supplier in the country to enter the top 10. The company will raise 3.5 billion yuan in 2021, mainly put into production the characteristic high-pressure process SiC chip research and development industrialization project. The construction period of this project is 3 years, which can provide the company with an annual production capacity of 360000 SiC power semiconductor chips after reaching production capacity. The 1200v SiC power module developed by the company in cooperation with Wolfspeed has been applied to the electronic control system of its new energy vehicles by Yutong Bus.

Tianyue Advanced (688234): Founded in 2010, the company focuses on the R & D and manufacturing of third-generation semiconductor SiC substrates. Its main products include semi-insulating and conductive substrates. With its years of research and development accumulation, the company has become one of the few suppliers in the world to master conductive and semi-insulating SiC substrates, and the product size is complete. According to Yole, the company will account for 30% of the global semi-insulated SiC substrate market in 2020, ranking third. In 2020, the company raised $2 billion million through an IPO. The funds are mainly invested in the construction of conductive SiC substrate project and the start-up of 8-inch conductive SiC substrate research and development, and announced the success of 8-inch conductive substrate research and development in September 2022, and is currently making continuous breakthroughs in industrialization. The company mainly provides 4-6 inch SiC products.

references:20231208-avic securities-electronic industry weekly report: silicon carbide industry trend from intellectual S7

Ticker Name

Percentage Change

Inclusion Date