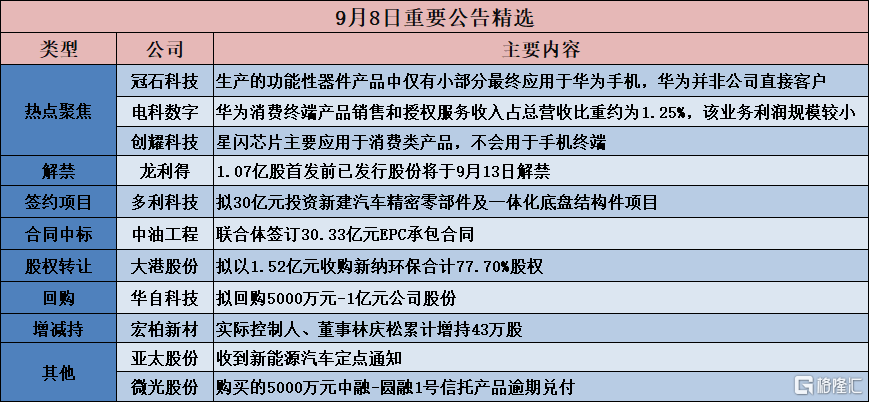

[Hotspot Focus]

electric technology digital (600850.SH): Huawei's sales of consumer terminal products and authorized services account for about 1.25 percent of total revenue, and the profit scale of this business is relatively small

Electric Digital (600850.SH) announced that in 2022, the company's Huawei consumer terminal product sales and authorized service revenue accounted for about 1.25 of the company's total operating income. The profit scale of this business is small and is not expected to have a significant impact on the company's operating performance.

chuangyao technology (688259.SH): star flash chip is mainly used in consumer products and will not be used in mobile phone terminals

chuangyao technology (688259.SH) announced that recently, some investors have paid more attention to the company's star flash products. the company hereby explains: at this stage, the project of the company and consumer product customers to jointly develop wireless terminal equipment equipped with star flash chips is still in the project approval stage, and there is no clear timetable for the products to be put into the market. The company's star flash chip is mainly used in consumer products, such as wireless mice, keyboards, wearable devices, will not be used in mobile phone terminals.

crown stone technology (605588.SH): only a small part of the functional device products produced are finally applied to Huawei mobile phones, and Huawei is not a direct customer of the company

Guanshi Technology (605588.SH) announced that the company's stock trading price has increased significantly in the near future. On September 8, 2023, the company closed at 55.73 yuan per share, up 33.36 from the closing price of 41.79 yuan per share on September 4, 2023. The short-term increase is relatively large, but the company's fundamentals have not changed significantly.

As far as the hot concept of recent market attention is concerned, the company's direct customers are mainly BOE, Foxconn, Huaxing Optoelectronics, Rainbow Optoelectronics and other display panel manufacturers. Only a small part of the functional device products produced by the company are eventually applied to Huawei Mobile phones, Huawei is not a direct customer of the company. This part of the business income accounts for about 1%-2% of the company's operating income, which is relatively small and has no significant impact on the company's performance.

[contracted items]

jinzai food (003000.SZ): proposed to build jinzai group snack food smart industrial park project

Jinzai food (003000.SZ) announced that the company held the 16th meeting of the second board of directors and the 16th meeting of the second board of supervisors on September 8, 2023, deliberated and passed the proposal on the company's proposed foreign investment and signing the project investment contract, and agreed to sign the project investment contract with the Management Committee of Beihai Economic and Technological Development Zone, Promote the implementation of relevant projects of the company. The foreign investment matters in the company's board of directors to consider the authority without the need to submit the company's shareholders' meeting for consideration. The name of the project is Jinzai Group Leisure Food Wisdom Industrial Park Project. The total investment of the project is 0.28 billion yuan.

Guangdong hydropower (002060.SZ): energy investment company plans to build 500 MW agricultural optical storage integration project in Bailang county, Tibet

Guangdong Hydropower (002060.SZ) announced that recently, guangdong Yueyue Hydropower Energy Investment Co., Ltd. (referred to as "Energy Investment Company"), a wholly-owned subsidiary of Guangdong Hydropower Second Bureau Co., Ltd., a wholly-owned subsidiary of Guangdong Hydropower Construction and Installation Co., Ltd., signed a tripartite agreement with the People's Government of Bailang County, Tibet Autonomous Region, and Bailang. After Zangqiyuan Agricultural Technology Development Co., Ltd. (referred to as "Bailang Agricultural Science") signed the "Framework Cooperation Agreement on Investment Promotion and Investment Promotion and Investment in Bailang County 500 Zhaowong Integrated Project in Tibet. The Energy Investment Company plans to invest in the construction of a 500 MW agricultural optical storage integration project in Bailang County, Tibet Autonomous Region, with a total investment of about 2.5 billion yuan.

Guangdong hydropower (002060.SZ): Xinjiang Guangdong hydropower plans to build a 100 MW new energy power generation project in Lanzhou new area of Gansu province

Guangdong Hydropower (002060.SZ) announced that recently, Xinjiang Guangdong Hydropower Energy Co., Ltd. (referred to as "Xinjiang Guangdong Hydropower"), a wholly-owned subsidiary of Guangdong Hydropower Second Bureau Co., Ltd., signed the "Xinjiang Guangdong Hydropower Energy Co., Ltd. New Energy (Wind Power, Photovoltaic) Power Generation Project Contract" with the Lanzhou New District Management Committee of Gansu Province. Xinjiang Guangdong Hydropower Co., Ltd. (hereinafter referred to as the "project company"), a wholly-owned subsidiary of Lanzhou Guangdong Hydropower Energy Co., Ltd., plans to invest in the construction of a 100MW new energy power generation project in Lanzhou New Area, Gansu Province, with a total investment of about 0.5 billion million yuan. The 100MW centralized photovoltaic power generation new energy project has been filed by Lanzhou New Area Economic Development Bureau (Bureau of Statistics).

Runbei Aviation Branch (001316.SZ): Proposed construction of advanced aviation composite material research and development center and production base

Runbei Aviation Branch (001316.SZ) announced that in order to further improve the company's research and development strength in the field of new aviation materials, expand the production capacity of self-developed products, and improve the core competitiveness of enterprises. Runbei Aviation Technology Co., Ltd. intends to sign the "Runbei Aviation Science and Technology" Advanced Aviation Composite R & D Center and production Base Project "with the people's Government of Pingyao Town, Yuhang District, Hangzhou City. It is planned to register and set up a wholly-owned subsidiary in Pingyao Town, Yuhang District, Hangzhou City, Zhejiang Province (referred to as" Pingyao Town ") as the main body of implementation to invest in the construction of advanced aviation composite research and development center and production base. The total planned investment of the project is about 0.18 billion yuan, and the source of funds is the company's own/self-raised funds.

dolly technology (001311.SZ): it is planned to invest 3 billion yuan in the project of new automobile precision parts and integrated chassis structural parts

Dolly Technology (001311.SZ) announced that in order to promote the development layout of Chuzhou Dolly Automotive Technology Co., Ltd. in the field of new energy vehicle lightweight business and improve the supporting scale for customers, the company plans to cooperate with Jiangsu Jintan Economic Development Zone Management Committee Signed the "Automobile Precision Parts and Integrated Chassis Structure Project" Investment Cooperation Agreement, the company intends to invest in the new "automobile precision parts and integrated chassis structure project" in Jiangsu Jintan Economic Development Zone ". The total investment of the project is planned to be 3 billion yuan, which will be implemented in two phases. The specific investment progress company will make overall planning and can be adjusted according to the actual situation such as industry development and the company's financial situation.

huicheng shares (688403.SH): it is proposed to invest about 1 billion yuan in the construction of huicheng phase ii project to expand advanced packaging and testing capacity and other fields

Huicheng shares (688403.SH) announced that the company and Anhui Hefei Xinzhan High-tech Industrial Development Zone Management Committee (referred to as "Hefei Xinzhan High-tech Zone Management Committee") intend to sign a project investment cooperation agreement. The company plans to invest in the construction of Huicheng Phase II project in Hefei Comprehensive Bonded Zone, Hefei Xinzhan District. The project covers an area of about 57 acres and is planned to be invested and constructed in stages. The total investment in the first phase is about 1 billion yuan, which is mainly used to expand advanced packaging and testing capacity, and to extend the production line process to on-board chip packaging and testing based on existing technologies. The investment plan for the subsequent phase of the project will be determined through separate negotiations depending on the company's first phase of production and market environment. The company intends to invest about 0.6 billion yuan in the first phase of the project for the new vehicle display chip project.

[Contract winning]

CLP Environmental Protection (300172.SZ): Signed the contract for the cogeneration project in 51.65 million yuan Kekedala Economic Development Zone

CLP environmental protection (300172.SZ) announced that recently, CLP environmental protection co., ltd. and China energy construction group Shanxi electric power construction co., ltd. kekedala branch (hereinafter referred to as "kekedala branch") signed the "kekedala economic development zone 2 × 50MW cogeneration project flue gas furnace, semi-dry desulfurization, dust removal and denitrification equipment procurement contract", the total contract is 51.65 million yuan (including tax).

PetroChina project (600339.SH): consortium signs 3.033 billion yuan EPC contract

PetroChina Engineering (600339.SH) announced that recently, our wholly-owned subsidiary Huanqiu Engineering Company and its wholly-owned subsidiary Liujian formed a consortium to jointly sign a general contract with Guangxi Petrochemical for the design, procurement and construction of propylene oxide/styrene (including ethylbenzene) plant engineering for PetroChina Guangxi Petrochemical Refining and Chemical Integration Transformation and Upgrading Project, with a contract amount of 3.033 billion yuan.

huajin capital (000532.SZ): subsidiary signed 20.76 million yuan plant renovation construction contract

huajin capital (000532.SZ) announced that Zhuhai huaguan capacitor co., ltd. (hereinafter referred to as "huaguan capacitor" or "party a"), a subsidiary of the company, has leased buildings 11 and 12 of zhizao industrial park in dawan district as the relocation sites for its new factories due to the needs of business and production (see "announcement on leasing business and production sites and related transactions of subordinate subsidiaries", announcement no 2023-011). According to the preliminary preparation, Huaguan Capacitor has completed the design and cost consultation of the new plant decoration project, and selected Zhuhai Huafa Jinglong Construction Co., Ltd. (referred to as "Jinglong Construction" or "Party B"), which has the first-class qualification of architectural decoration engineering and effective safety production license, as the successful bidder of the new plant decoration project, it is proposed to sign the "Construction Contract for Decoration Project of Buildings 11 and 12 in Area D of Zhizao Industrial Park in Dawan District of High-tech Zone" (hereinafter referred to as "Factory Decoration Construction Contract") with Jinglong Construction. The tentative total price (including tax) of the contract is about RMB 20.76 million yuan, including provisional deposit of RMB 1.016 million yuan.

[ Equity Acquisition]

dagang shares (002077.SZ): plans to acquire a total 77.70 equity of xinna environmental protection for 0.152 billion yuan

Dagang Co., Ltd. (002077.SZ) announced that in order to implement the strategy of "double main business" and speed up the strategic layout of the main business of environmental protection resources service, the company plans to sign an agreement with Jiangsu Tiannai Technology Co., Ltd. (hereinafter referred to as "Tiannai Technology"), Zhang Jianyu, Xia Ronghua, Li Yadong and Xiang Jun, shareholders of Zhenjiang Xinna Environmental Protection Materials Co, to acquire a total of 77.70 of the shares of Xinna Environmental Protection in cash of 0.152 billion yuan.

keli sensor (603662.SH): it is proposed to acquire 52.77% equity of huahong technology for 65 million yuan to acquire its control

keli sensor (603662.SH) announced that the company plans to use its own capital of 65 million yuan to issue shares to the company through Fuzhou huahong intelligent technology co., ltd. (hereinafter referred to as "huahong technology" and "target company"), the company has agreed to transfer part of the shares of the target company held by 5 natural person shareholders of the target company and accept voting rights.The combined way of entrustment, the total control of the voting rights of 22.4263 million shares of Huahong Technology, accounting for 52.77 of the total number of voting shares of Huahong Technology after the completion of the targeted issuance of shares, to obtain control of Huahong Technology.

golden flower shares (600080.SH): it is planned to transfer 8.39 equity of heavy medicine Shaanxi company to Shaanxi xiangfeng

for 14.18 million yuanJinhua shares (600080.SH) announced that the company intends to transfer 8.39 of its equity in Shaanxi company, a participating company, to Shaanxi Xiangfeng. the transaction price is based on the net assets confirmed in the 2022 audit report of the target company, and the transaction amount is 14.18 million yuan after negotiation between both parties. Based on the overall strategic layout of the Company, the transaction further optimizes the business structure of the Company, which is conducive to the concentration of resource advantages, focusing on the development of the main business, improving the operational efficiency of the Company's assets and promoting the long-term development of the Company, in line with the interests of the Company and all shareholders.

[Unblocking]

longli de (300883.SZ): 0.107 billion shares issued before the first issue will be lifted on September 13

Longlide (300883.SZ) announced a reminder announcement on the listing and circulation of issued shares before the initial public offering. The number of restricted shares lifted this time is 0.107 billion shares, accounting for 30.9546 of the company's total share capital. The date of listing and circulation of the restricted shares is September 13, 2023 (Wednesday).

microelectrophysiology (688351.SH):25 million restricted shares were lifted on September 18

Microelectrophysiology (688351.SH) announced that the number of restricted shares listed and circulated by the company is 24.999997 million shares, and the date of listing and circulation is September 18, 2023.

[Repo]

huazi technology (300490.SZ): to buy back shares of 50 million yuan -0.1 billion yuan company

Huazi Technology (300490.SZ) announced that it intends to use its own or self-financing funds to repurchase the company's RMB common shares of A shares in a centralized bidding transaction for the implementation of employee stock ownership plans or equity incentives. The total amount of funds to be used for the repurchase is not less than RMB 50 million, not more than RMB 100 million, and the repurchase price is not more than RMB 21 per share.

okeyi (688308.SH): plans to buy back the company's shares at 30 million yuan to 60 million yuan

Ou Keyi (688308.SH) announced that the company intends to use its own funds to buy back the company's shares in a centralized bidding transaction, and intends to use all the repurchased shares for equity incentive or employee stock ownership plan at an appropriate time in the future. The total amount of repurchase funds shall not be less than RMB 30 million yuan (inclusive) and shall not exceed RMB 60 million yuan (inclusive). The repurchase price shall not exceed RMB53/share (inclusive).

taijing technology (603738.SH): plans to buy back the company's shares at 50 million yuan to 0.1 billion yuan

Taijing Technology (603738.SH) announced that the company intends to use its own funds to buy back part of the company's shares in a centralized bidding transaction to implement equity incentives or employee shareholding plans. The total amount of repurchase funds shall not be less than 50 million yuan (inclusive) and shall not exceed 100 million yuan (inclusive), and the repurchase price shall not exceed 22.48 yuan/share (inclusive).

Shandong mining machinery (002526.SZ): to buy back 33 million yuan -49.5 million yuan of company shares

Shandong Mining Machinery (002526.SZ) announced the announcement of the plan to buy back the company's shares by means of centralized bidding transaction, and intends to buy back the shares for employee stock ownership plan or equity incentive. The total amount of funds to be repurchased shall not be less than RMB 33 million (inclusive) and shall not exceed RMB 49.5 million (inclusive); the repurchase price or price range shall not exceed RMB 3.30 per share; the repurchase period shall not exceed 12 months from the date of approval of this plan by the board of directors.

[increase or decrease]

Shanghai shuba (603200.SH): some directors and senior managers increased their total holdings by 108500 shares

Shanghai Shuba (603200.SH) announced that a total of 4 directors and senior managers increased their holdings of 108500 shares of the company through centralized bidding transactions, accounting for 0.06 of the company's total share capital at that time.

McGrady Technology (603990.SH): Chairman of Supervisory Board Increases 216000 Shares Accumulatively

McGrady Technology (603990.SH) announced that as of September 8, 2023, the chairman of the board of supervisors, Mr. Li Biao, had a total of 266,426 shares (of which 216,020 shares were increased by centralized bidding, with a total increase of RMB 4,067,365.55 yuan; As the company implements the 2022 annual equity distribution, the number of shares held by Mr. Li Biao as of the date of equity distribution has been increased by 50,406), the cumulative change in shareholding represents 0.0870 per cent of the Company's current total share capital. Mr. Li Biao will continue to increase its holdings in accordance with the relevant plan, in the plan to increase the implementation of the company's shares.

hongbai new materials (605366.SH): actual controller and director Lin Qingsong increased his holdings by 430000 shares

Hongbai Xincai (605366.SH) announced that Lin Qingsongsheng, the actual controller and director of the company, has accumulated 430000 shares of the company through centralized bidding through the trading system of Shanghai Stock Exchange, accounting for 0.07 of the total share capital of the company, with a total increase of 3.55421 million yuan (excluding transaction costs).

guanhao hi-tech (600433.SH): some directors and senior executives increased their total holdings of 450000 shares of the company

Guanhao Hi-Tech (600433.SH) announced that from September 7 to 8, 2023, the company's chairman Xie Xianlong, director and general manager Li Fei, director Zhang Hong, deputy general manager Liu Lixin, deputy general manager Zhu Hao, financial director Liang Min, and board secretary Ding Guoqiang increased their shares by 450000 shares through the centralized bidding trading system of the Shanghai Stock Exchange, accounting for 0.0244 of the company's total share capital. As of the disclosure date of this announcement, the above-mentioned increase in holdings has not proposed a subsequent increase in holdings.

San 'an Optoelectronics (600703.SH): indirect controlling shareholder San 'an Group has increased its holdings by 5.676 million shares

San'an Optoelectronics (600703.SH) announced that the company has received a notice from Fujian San'an Group Co., Ltd. (hereinafter referred to as "San'an Group"), an indirect controlling shareholder. As of the disclosure date of this announcement, San'an Group has accumulated 5.676 million shares of the company through the Shanghai Stock Exchange trading system, accounting for 0.1138 of the company's total share capital, with a cumulative increase of 90.9559 million yuan (excluding handling fees).

[Other]

gac group (601238.SH): 196761 cars sold in August fell 9.68 year on year

GAC group (601238.SH) announced that the output of cars in August 2023 was 192567, down 12.19 percent from a year earlier, and the cumulative output this year was 1,562,069, down 2.65 percent from a year earlier. Car sales in August were 196,761, down 9.68 percent from a year earlier, and the cumulative sales this year were 1,550,665, down 2.34 percent from a year earlier.

Microlight (002801.SZ): overdue payment of some trust products

microlight shares (002801.SZ) announced that on June 9, 2023, the company purchased zhongrong-yuanrong 1, a trust product issued by zhongrong trust, with an amount of 50 million yuan and a maturity date of September 7, 2023. as of the disclosure date of this announcement, the company has not yet received the trust product principal and investment income.

Asia Pacific shares (002284.SZ): received new energy vehicle fixed-point notice

Asia Pacific shares (002284.SZ) announced that it has recently received a fixed-point notice from a customer of a new power brand in China. the company will provide a front brake with steering knuckle assembly, a rear brake with steering knuckle assembly (with EPB) and an electronic brake integration module (IBSonebox) for a new energy SUV model of the customer. According to the customer's plan, the life cycle of the above project is 5 years, and mass production is expected to begin in 2024, with a total life cycle sales amount of about 1.733 billion yuan.

SAIC (600104.SH): the total sales volume of 423319 vehicles in August decreased by 17.33 year on year

SAIC (600104.SH) released its August production and sales express, with a total sales volume of 423319 vehicles, down 17.33 percent from a year earlier.

Ticker Name

Percentage Change

Inclusion Date