in the past week (August 14-August 18), the three major indexes of a shares fell in shock . As of the close on August 18, the Shanghai index was at 3131.95 points, down 1.80 per cent a week; the Shenzhen Composite Index was at 10458.51 points, down 3.24 per cent a week; and the gem index was at 2118.92 points, down 3.11 per cent a week.

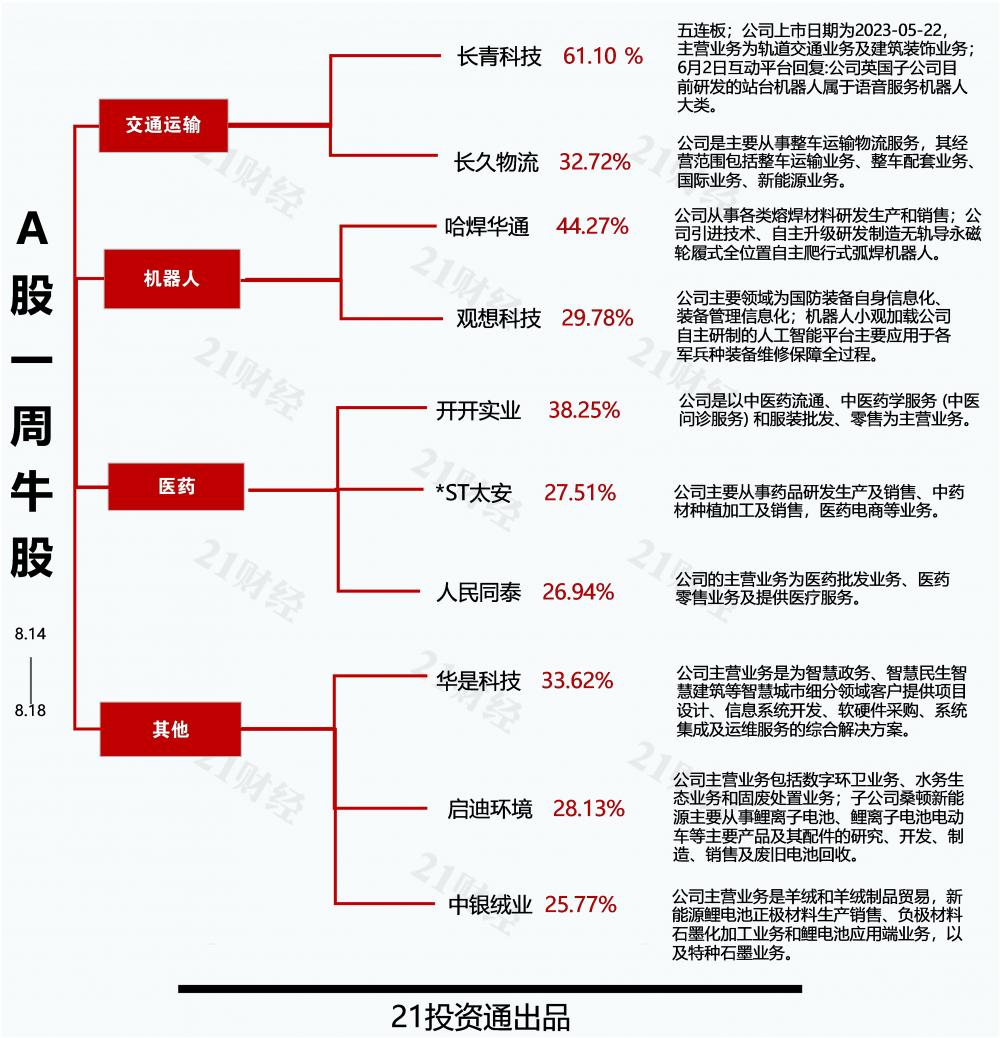

specifically, 32% of the stocks rose in the week, 46 stocks rose more than 15% and 11 stocks fell more than 15%. Environmental protection, gas, port shipping, non-automobile transportation, road and railway transportation and other sectors led the rise, while pharmaceutical commerce, traditional Chinese medicine, hotels and catering, real estate services, medical services and other sectors led the decline.

Which stocks led the rise? Which stocks led the decline? 21 Investment Link continues to see through you every week.

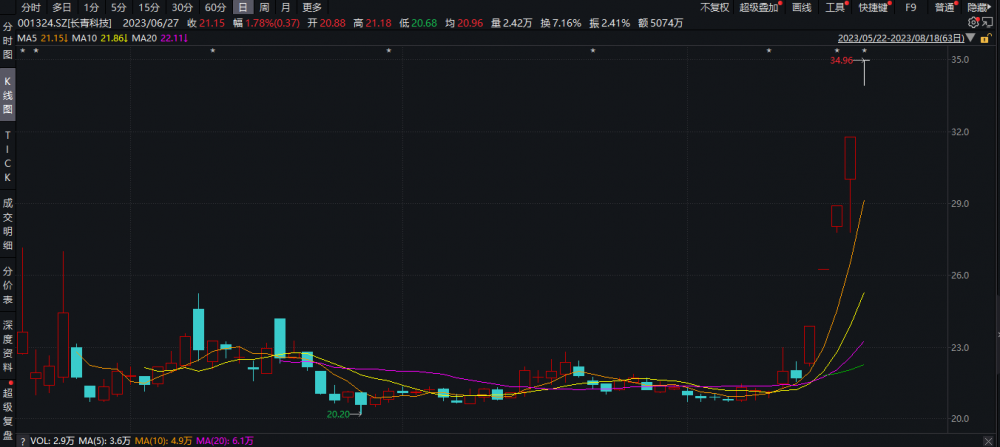

multiple positive catalysis, the best stock evergreen technology five consecutive board rose more than 60%

excluding the secondary new shares listed in the last month, in the current bull stock list, evergreen technology (001324.SZ) won the first place with a weekly increase of 61.11 , ha welding huatong (301137.SZ) ranked second with a 44.27 increase, open industry (600272.SH), huashi technology (301218.SZ) and long-term logistics (603569.SH) stocks all rose more than 30% and 25%.

the best stock evergreen technology 5 board, belongs to the non-automobile transportation industry, robot, the belt and road initiative concept stock:

Public information shows that the company's listing date is May 22, 2023, and its main business is rail transit business and architectural decoration business. The company's main products are building decoration business, sandwich composite interior products, other supporting interior products, maintenance business and spare parts, vehicle passenger information system.

Wind financial terminal shows that the closing price on August 18 was 34.96 yuan/share, a record high.

(Source: Wind Financial Terminal)

On the news, the National Railway Group recently released data showing that from January to July, the national railway completed fixed asset investment of 371.3 billion billion yuan, a year-on-year increase of 7%. This year, the national railway fixed asset investment is expected to be more than 760 billion yuan, and more than 3000 kilometers of new lines are expected to be put into operation, including 2500 kilometers of high-speed rail.

In addition, on August 16, there were many catalysts for the robot plate recently. The World Robot Conference was held in Beijing Beiren International Convention and Exhibition Center. Six main forums and related activities will be held at this conference, and more than 300 guests in the field of government, industry, university and research at home and abroad will talk about the cutting-edge development trend in the field of robotics. On the same day, the Beijing Municipal Bureau of Economy and Information Technology issued the ''Several Measures for Beijing to Promote the Innovation and Development of the Robot Industry'' and proposed to support key components such as robot operating systems, high-performance special chips and servo motors, reducers, controllers, and sensors. Enterprises form a consortium to solve the shortcomings of the robot industry and the technical problems of "stuck neck.

rail composite materials : The company is a high-tech enterprise based on sandwich composite materials, which realizes product application through rail transportation (accounting for 58.33 percent) and architectural decoration. The company 2022 export revenue accounted for 22.75 .

The company's rail transit products are used in the manufacture of dozens of domestic and foreign motor vehicle models such as Harmony, Fuxing and TGV trains, and its customers include major global rail transit vehicle manufacturers such as CRRC, Alstom and Bombardier.

The aluminum honeycomb composite panel developed by the company is its first localization application in domestic rail transit.

the belt and road initiative : on August 17, it was stated on the interactive platform that the main customers served by the company are China Central Vehicle and China Construction. The business of these enterprises covers many countries and regions along the belt and road initiative, and the company's chances of participating in supporting the belt and road initiative project will also be improved.

robot : on June 6, it was stated on the interactive platform that the platform robots currently developed by the British subsidiary belong to the category of voice service robots. in addition to the current platform information, train information and other inquiry service functions, service functions such as ticket purchase will be gradually increased in the future according to customer needs.

Industry, in the three major indexes in the past week are lower than the background, transportation plate subdivision direction of non-automotive transportation but against the market rise, road and rail transport plate followed closely behind .

Shenvan Hongyuan Securities pointed out that railway investment is back to growth, passenger traffic exceeded pre-epidemic levels. In January-July this year, the country's railways completed fixed asset investment of 371.3 billion billion yuan, up 7 percent year-on-year, and the country's railways sent 2.176 billion passengers, up 114.81 percent year-on-year, with cumulative passenger traffic exceeding the same period before the epidemic for the first time, up 2.21 percent from the first seven months of 2019. Among them, the national railway sent 0.406 billion passengers in July, up 79.65 percent year-on-year and 14.04 percent over the same period in 2019. Looking ahead to the second half of the year, we expect railway investment and passenger traffic to continue to grow steadily, and the demand for new railway equipment and maintenance is expected to continue to increase.

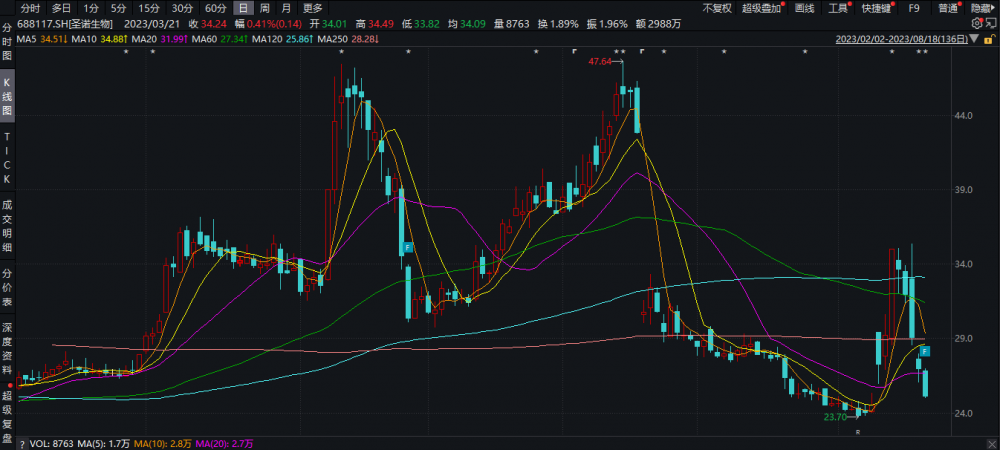

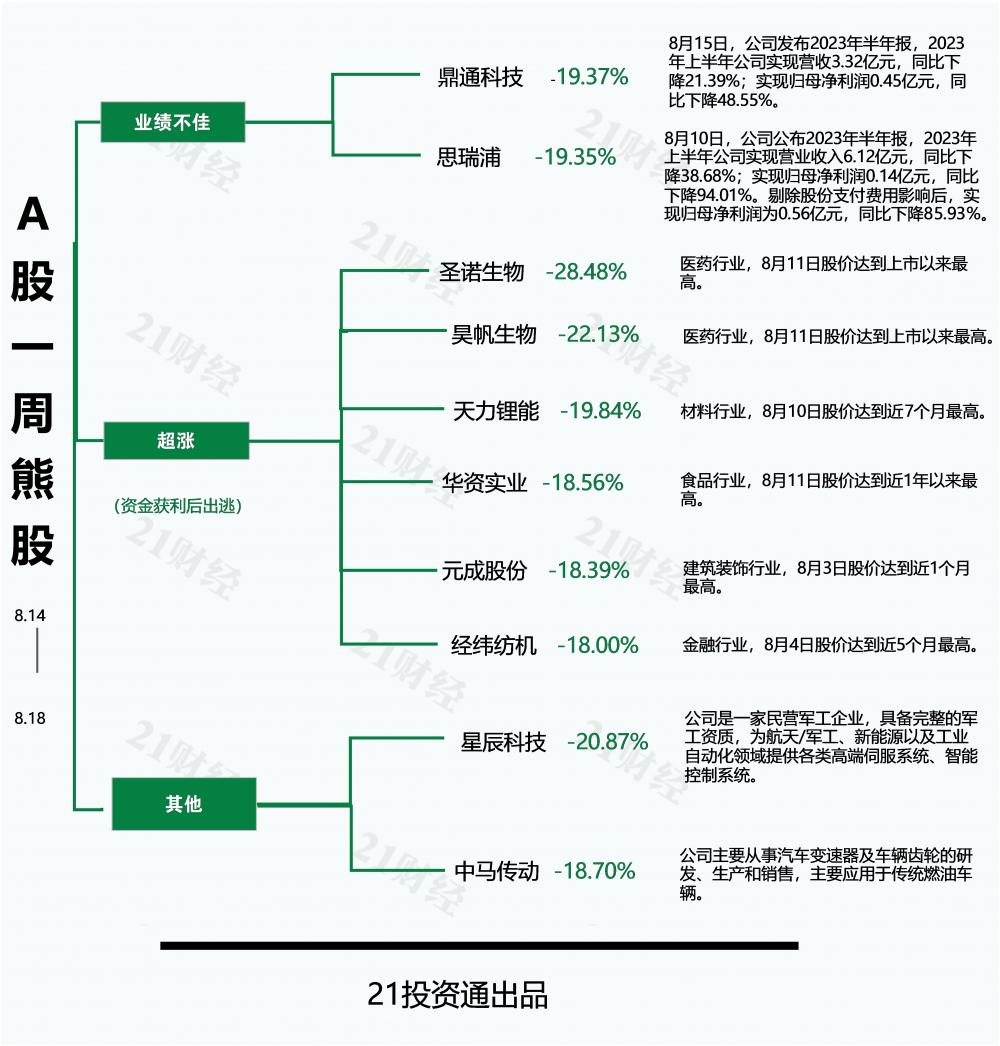

the major shareholders of shengnuo biology have thrown out the plan to reduce their holdings, and the hype of "magic medicine for weight loss" has stalled

excluding the secondary new shares listed in the latest week, saint biology (688117.SH) became the most bear stock in the current period with a decline of 28.48 . Haofan Bio (301393.SZ), Star Technology (832885.BJ), Tianli Lithium Energy (301152.SZ), Dingtong Technology (688668.SH), Srepu (688536.SH) and other stocks fell more than 18% on a weekly basis.

the most bear stock shengnuo biology belongs to the pharmaceutical and biological industry, weight-loss drug concept stock:

Public information shows that the company is a pharmaceutical company focusing on the field of peptide drugs, the main business for peptide innovative drug CDMO services (refers to research and development and production of customized services), customers include cutting-edge biology, Baiaotai, Paige biology, Jinbo biology, all-living Ruichuang and so on. At the same time, the company also has independent research and development, sales of peptide raw materials and preparation products. In June 2021, the company was listed on the SSE.

Wind financial terminal showed that on August 9, the concept of weight-loss drugs suddenly changed, and shengnuo biology was hit by capital speculation, with a sharp rise of 10.93 on that day. As of August 11, in just three trading days, shengnuo biology has soared by 42.9 yuan . After a brief surge, since August 14, San Nuo Biology has fallen for five consecutive days , giving up almost all of the previous week's gains. As of the close of trading on August 18, Shengnuo Bio's share price was reported at 25.06 yuan, with a total market value of 2.8 billion yuan.

related links: perspective on bull and bear stocks for a week: diet drug concept stocks "wind up", the best stock keyuan pharmaceutical stock doubled in 4 days; The performance rose sharply, but the iron track fell by 20CM

(Source: Wind Financial Terminal)

after the concept went hot, saint bio received questions from investors about the diet drug business .

shengnuo biology said at that time that the company was concerned that the market had recently paid attention to diabetes and weight loss drugs liraglutide and smaglutide, but the generic drug project of liraglutide and liraglutide injection of the company was still in the clinical phase I stage in China and smaglutide was now in the preclinical research stage. The company's Liraglutide bulk drug was filed in the United States in October 2015, at present, there is no customer procurement for the production and sales of preparations, and the foreign preparation customers of Simaglutide API have not yet obtained production approval documents, and the API sold is only used for preparation research and development. The current direct contribution of these two varieties to sales and profits is small .

It is worth noting that Sunno Bio has a shareholder reduction . On August 17, the company announced on the same day that shareholder Lepu Medical issued a shareholding reduction plan. Due to capital requirements, it plans to reduce its holdings of the company's shares by means of centralized bidding and block transactions by no more than 2.912 million shares, means No more than 2.6 of the company's total share capital .

according to the current stock price estimation, Lepu medical has cashed out about 70 million yuan. Prior to the release of the reduction plan, Lepu Medical held 9.072 million shares of Sunno Bio, accounting for 8.1 of the company's total share capital. The shares are derived from before the listing of Sunno Bio.

However, from Lepu Medical's own observation, the company's revenue declined slightly in the first quarter of this year, and the net cash flow from operating activities was negative. In the secondary market, Lepu Medical's share price has fallen by more than 20% since the end of May. In addition, the company also announced in late July that it intends to spin off its holding subsidiary Bingkun Medical to be listed on the Shenzhen Stock Exchange's Growth Enterprise Market.

on August 18, shengnuo biology released its semi-annual report. According to the data, the company achieved revenue of 0.174 billion yuan during the period, an increase of 3.78 percent over the same period last year; realized net profit of 20.148 million yuan, an increase of 8.9 percent over the same period last year; realized non-net profit of 9.258 million yuan, a decrease of 38.18 percent from the same period last year .

regarding the change in net profit after deduction, the company explained that is a new loan of 0.15 billion yuan this year, resulting in an increase in financial expenses compared with the same period last year, followed by an increase in management expenses, as well as the payment of disposal expenses for unrecyclable waste organic solvents, packaging barrels, etc. and environmental protection consulting services.

Ticker Name

Percentage Change

Inclusion Date