recently, fan daidi, founder and chief scientist of giant biology (02367), announced his resignation as executive director of the company due to work arrangement .

The "Daily Business News" reporter noticed that Fan Daidi's other identity is the dean of the Institute of Biomedicine of Northwestern University . The "recombinant collagen" of Giant Biology was 20 years ago. The scientific research results were transformed and gradually developed into a leader on the collagen track, and then entered the Hong Kong stock market last year.

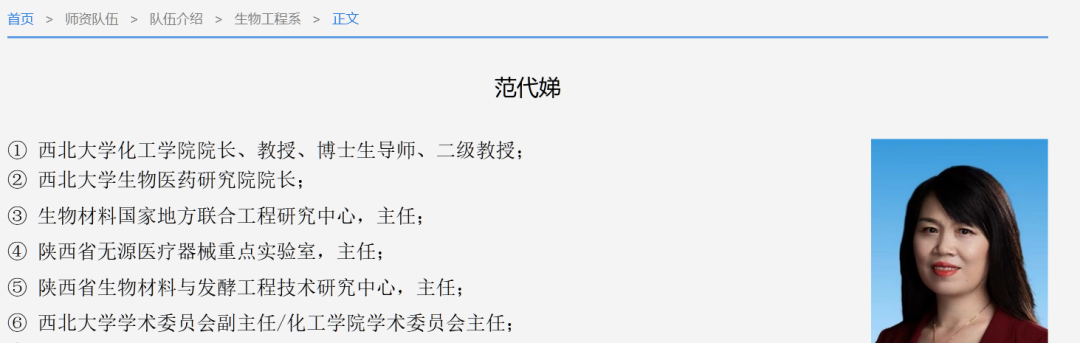

According to public information, Fan Daidi received a bachelor's degree in inorganic chemical engineering from Northwestern University in 1988 and a master's degree in chemical engineering three years later.

In 1994, she received a doctorate in chemical engineering from East China University of Science and Technology, becoming the first female doctorate in biochemical engineering in China, and then went to the National Bioengineering Center of the Massachusetts Institute of Technology as a senior visiting scholar.

Image source: Northwestern University official website

In 2000, Dr. Fan Daidi and his team successfully developed recombinant collagen technology. In the same year, Fan Daidi joined her husband Yan Jianya to establish the giant creature.

as the "first share of collagen", giant biology was "highly anticipated" when it went public. its ultra-high gross profit margin of 87.2 was called "medical beauty Mao" , and its share price doubled once after it went public.

Recently, Giant Bio seems to have performed mediocre in the secondary market, with its stock price remaining at HK $35 per share, while problems such as rising sales expenses, low R & D investment, and intensified industry competition are lingering around it.

Higher selling expenses

At first glance, the company's name Giant Bio may be unfamiliar, but its two professional skin care brands, Kefumei and Kilijin, are "well known" in the skin care market ".

the list of various shopping festivals most intuitively reflects the degree to which kefumei and keli gold are popular in the market. During the period of 2022 in double 11, the sales volume of all channels in the United States will increase by 130 year on year, winning the sales volume TOP1 of medical beauty care category in double 11 of Jingdong platform. According to the data of Tianfeng Securities Research Institute, the sales volume of tremolo platform increased by 146.3 against the trend during the 38-year promotion period in 2023. According to the company's official account, the sales volume of all channels on the US line increased by 165 year in 2023 and the 618, with the brand exposure reached 0.7 billion +.

photo source: giant biological official micro

in fact, starting from 2013, hyaluronic acid has brought the entire medical and aesthetic industry into a period of rapid development. under the catalysis of capital, the market cake is getting bigger and bigger, and the "wealth myth" of many listed companies such as huaxi biology (688303), haohai shengke (688366) and aimeike (300896) has been born ".

In recent years, collagen has become the new favorite of the track ". According to the 2020 Skin Care Industry Trend Report released by Sina Weibo's Social Marketing Research Institute, collagen ranks first in the annual discussion of skin care ingredients, higher than hyaluronic acid, niacinamide and other ingredients, becoming the TOP topic in the skin care field.

Giant Biology, located in Xi 'an High-tech Zone, is an industry giant that has grown rapidly with concepts such as "recombinant collagen" and "mechanical mask". Since 2019, it has become China's largest collagen professional skin care product company and is currently one of the enterprises with the largest recombinant collagen production capacity in the world.

according to the latest annual report, giant biology will achieve a 52.3 year-on-year growth in revenue to 2.364 billion yuan in 2022, and a 21.0 year-on-year growth in net profit to 1 billion yuan .

Giant Bio has eight major brands, of which Fumei and Kolijin are the company's core flagship brands. Among them, the United States in 2022 to achieve revenue of 1.613 billion billion yuan, up 79.7 percent year-on-year; Klijin achieved revenue of 0.618 billion billion yuan, up 17.6 percent year-on-year.

by product category, functional skin care products will bring 1.56 billion yuan of operating income to giant biology in 2022, accounting for 66% of the total revenue from 55.5. medical dressings realized operating income of 0.76 billion yuan, accounting for 32.2 from 41.3 in the previous year.

It is worth mentioning that due to the marketing transformation, the sales expenses of Giant Bio have been rising all the way, causing the market to question the remaining geometry of its creative attributes.

according to the annual report data, giant biology's sales and distribution expenses from 2019 to 2022 are 93.8 million yuan, 0.158 billion yuan, 0.346 billion yuan and 0.706 billion yuan, accounting for 29.86% of the total revenue from 9.8%, followed by a two-year drop in net interest rate, the net profit margin of Giant Bio in 2020-2022 is 69.42, 53.34 and 42.38, respectively, and the company's gross margin in 2022 is 84.4, down 2.8 percentage points from last year.

In this regard, Giant Bio explained that the company has increased its spending on online sales and marketing activities on e-commerce platforms and social media platforms to continuously expand online sales channels, comply with industry trends and seize market opportunities, thus increasing online marketing expenses.

The market doesn't seem to agree. Superimposed on the previous research and development investment is too low, industry competition and other factors, after the annual report was released, giant bio's share price started a volatile decline and remained at about HK $35/share for a long time, compared with the March 21 high of HK $58.8/share has fallen by nearly 40% .

it is worth noting that on March 23, 2023, Yan Jianya and fan daidi ranked 1153 in the 2023 Hurun global rich list with 19.5 billion wealth.

Marketing model transformation

it is reported that kelijin's product portfolio includes spray, facial mask, cream, essence, lotion and gel , and the selling price is between 109 yuan and 680 yuan. according to jingdong flagship store, the best selling product is 222 yuan's collagen smear sleep mask.

Fumei focuses on medical dressings. Jingdong flagship store shows that the price of Fumei-like collagen facial mask is 198 yuan per box, with an average of 39.6 yuan per piece. In other words, according to the gross profit rate of 84.4, the production cost of a box of facial mask is about 25 yuan .

Image source: Giant Biology official website

the reporter noticed that giant biology has a "scissors difference" in gross profit margin compared with maotai, but the net interest rate has dropped for two consecutive years. it can be said that the gap between the cost and selling price of giant biology's revenue pillar is gradually being swallowed up by marketing expenses, and in recent years giant biology's marketing mode has gradually shifted from the micro-business mode to the more expensive online mode.

In fact, the family history of giant creatures is closely related to micro-business.

during the period from 2013 to 2017 when micro-businesses emerged, Yan Jianya, founder of giant biology company, invested 80% to establish Xi' an chuangke village e-commerce co., ltd (hereinafter referred to as Xi' an chuangke village), while giant biology held 20% of the shares and sold the company's products through its mobile social platform chuangke cloud business.

I have to admit that the product is excellent on the one hand, but the early "pull the head" model has indeed become an important way for giants to become rich. According to Giant Bio's prospectus, revenue from Xi'an Maker Village will account for as much as 52.2 percent of total revenue in 2019, and none of the remaining top four major customers will account for more than 3 percent, while that figure will fall to 29.3 percent in 2021.

with the weakening of micro-business after 2019, giant biology has vigorously opened up an online direct selling mode based on DTC mode (facing consumers directly). with the help of the bonus of KOL live broadcast with goods from Wei ya and other heads, it has tilted its own channel structure to direct selling, hoping to open up the mass consumption market, enhance the influence of c-end brands and obtain more sales.

the annual report shows that in 2022, giant biology will earn 1.214 billion yuan of revenue through online direct sales of DTC stores and 0.125 billion yuan of revenue through online direct sales for e-commerce platforms, accounting for 56.6 percent of the total revenue. So far, Giant Bio has changed from dealer sales to online direct sales.

And with the flow dividend disappearing and the e-commerce channel entering the era of stock competition, Giant Bio needs to continue to pay high service fees to the platform, which further depresses the company's net profit margin.

In fact, not only the giant biology, the entire medical and beauty upstream industry are varying degrees of net interest rate decline. According to Wande data, the net interest rate of the three giants of hyaluronic acid Huaxi Bio, Haohai Biotech and Aimee in 2022 decreased by 3.55, 54.54 and 1.12 percentage points respectively.

On issues such as lower net interest rates and rising sales expenses, the reporter called Giant Biology, but the phone was not connected as of press time.

Track Gradually Saturated

the reporter noticed that giant bio relies on collagen to base itself on the "medical beauty" circle, but from the product point of view, the company's two major downstream areas of functional skin care and medical dressings have not yet drawn a gap with competitors.

According to the prospectus, Giant Bio will have a market share of 9 percent in the medical dressing market in 2021, with the first market share of 10.1 percent; in the field of functional skin care products, Giant Bio will have a market share of 11.9 percent, with the top two markets accounting for 21 percent and 12.4 percent, respectively.

in addition, the upcoming listing of the giant biological "sister flower" Fu Erjia in the prospectus released detailed data on operating costs. It is similar to the giant's business model, low cost, light research and development, heavy marketing, but also gradually layout online direct operation but still in the early stage of development.

By contrast, the size of the revenue of the Fuerjia is higher than that of the giant creature, but the net profit is not as good as that of the latter. According to the prospectus of Fuerjia, the company's revenue from 2020 to 2022 is 1.585 billion yuan, 1.65 billion yuan and 1.769 billion yuan respectively, which is less than that of Giant Bio in 2022; net profit is 0.648 billion yuan, 0.806 billion yuan and 0.847 billion yuan respectively, which is less than that of Giant Bio in the same period.

in fact, fu erjia only competes with giant creatures under the category of skin care products, and has not touched the cake of giant creatures in the sub-industry of "collagen". what can really shake the foundation of giant creatures is the "professional runner" on the track of "collagen".

According to Guotai Junan Securities, in addition to Giant Biology on the restructured collagen track, the companies that have industrialized the technology in China include Jinbo Biology, Chuangjian Medical, Juyuan Biology, Marumei (603983) and Jiangsu Wuzhong (600200).

Among them, Jinbo Bio is about to land on the Beijing Stock Exchange. The company's main business is the research and development, production and sales of various medical devices and functional skin care products with recombinant collagen products and anti-HPV biological protein products as the core. It is in a leading position in international technology in the field of recombinant collagen. Its product "Recombinant Type III Humanized Collagen Freeze-dried Fiber" is currently the only injection-grade recombinant Type III humanized collagen biomedical material.

Photo source: Jinbo Biology official website

in addition, as the popularity of hyaluronic acid industry continues to decline, three companies, Aimei Ke, Huaxi Biology and Haohai Shengke, which had previously relied on the concept of hyaluronic acid, have entered the collagen track one after another, pressing the hope of replicating the "hyaluronic acid myth" on collagen.

According to the source, collagen can be divided into animal-derived collagen extracted from bovine muscle legs, etc., and recombinant collagen re-prepared and synthesized using biological structures. Among them, animal-derived technology has become more mature, and recombinant collagen is a new product.

At present, Aimeike and Haohai Health Department are walking the route of collagen. Among them, Aimeike has previously said in interactive easy. "Recombinant collagen is in the emerging stage. Whether its recombination mode, collagen structure and activity can achieve the same effect as animal-derived collagen needs to be verified by the market and the company will continue to observe."

huaxi biology is "grasping with both hands", while conducting research on the preparation of recombinant collagen, while at the same time distributing animal-derived collagen through the acquisition of Beijing yierkang biological engineering co., ltd. Giant biology and Jinbo biology focus on recombinant collagen.

up to now, the collagen track can be said to be crowded with "friends". in order to break through the situation, giant creatures, which have won the technological dividend period by relying on the first-mover advantage of collagen, may need to increase innovation and research and development, deepen the technological moat, and actively open up the second growth curve that can "take over" Kelijin and restore the United States.

Disclaimer: The content and data of the article are for reference only and do not constitute investment advice. Investors operate accordingly at their own risk.

reporter Zhang Jing intern reporter Xia Zibo

edit he juanjuan sun zhicheng gaiyuanyuan

proofreading Lu Xiangyong

| Daily Economic News nbdnews Original Article |

Reprinting, excerpting, copying and mirroring are prohibited without permission

Ticker Name

Percentage Change

Inclusion Date