Why Donald Trump Won and What His Victory Means for China

Why Donald Trump Won and What His Victory Means for China(Yicai) Nov. 11 -- Although he was running neck-and-neck in the polls with Kamala Harris, it came as no surprise that Donald Trump won this year’s presidential election.

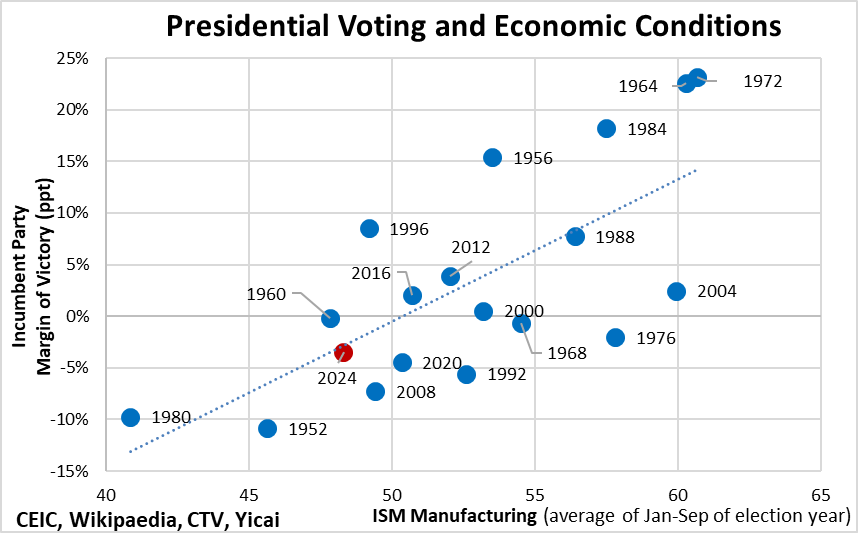

Historically, there has been a fairly strong correlation between voting behaviour and the state of the economy. The higher the reading for the January-to-September average of the , the larger the incumbent’s margin of victory.

This year, the nine-month average was 48.1 which points to a mild contraction in manufacturing output. The historical experience, indicated by the trend line, suggested that Mr. Trump would collect 2.5 percentage points more popular vote than Ms. Harris, as voters blamed the Democrats for faltering economic conditions. In the event, Mr. Trump outpolled Ms. Harris by 3.5 percentage points (Figure 1).

Figure 1

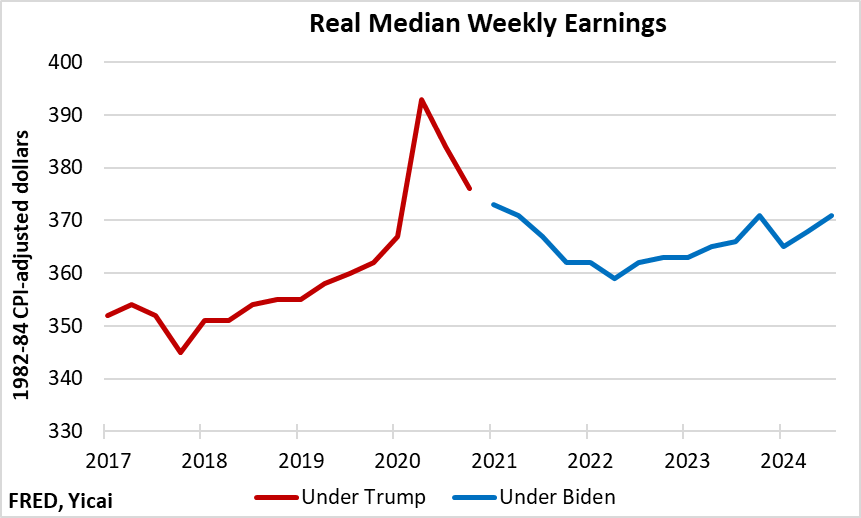

There are various channels through which the state of the economy filters through to voters. Perhaps the most immediate is via wages. Economic growth was robust during Mr. Trump’s first presidency. As a consequence, real median weekly earnings grew by 6.8 percent between the first quarter of 2017 and the fourth quarter of 2020. In contrast, real earnings have declined by 0.5 percent under the Biden Administration (Figure 2).

Figure 2

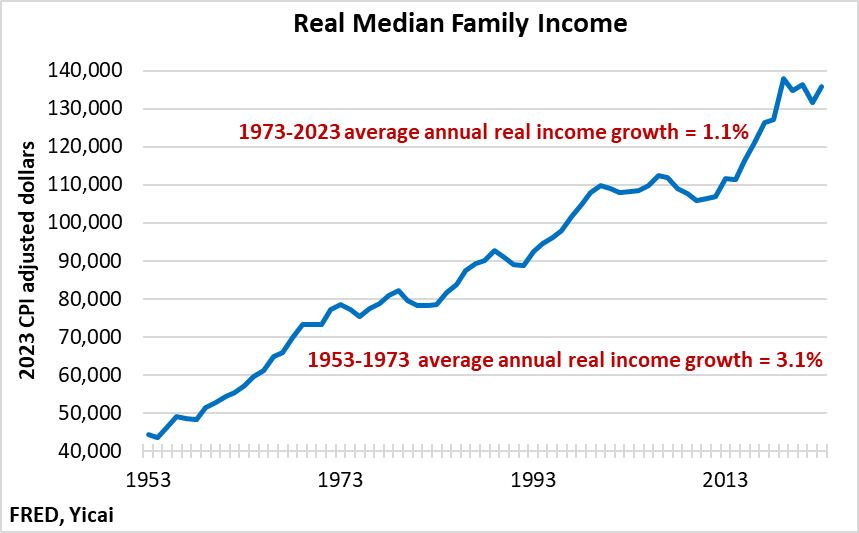

Falling earnings since 2021 have to be seen in terms of the longer-run slowdown of household income growth. Expectations of achieving the American dream have been painfully ratcheted down. Between 1953 and 1973, US family incomes rose by 78 percent in real terms. But they only grew by 73 percent In the following 50 years (Figure 3).

Figure 3

In assessing the election, New York Times columnist Tressie McMillan Cottom recently , “The reality is that the American dream is a fiction of a historical aberration. I never felt that Harris made a strong, clear argument that she could start to fix it.” “Trump’s message is that he can fix it.” Ms. Cottom said, “It is wrong, but it is a clear message.”

So how will Mr. Trump’s second attempt to make America great again impact China?

One of Mr. Trump’s marquee policy proposals is tax reductions to stimulate growth with the fiscal shortfall funded by imposing tariffs on imports. He has a 60 percent tariff on imports from China and a 10-20 percent levy on purchases from all other countries.

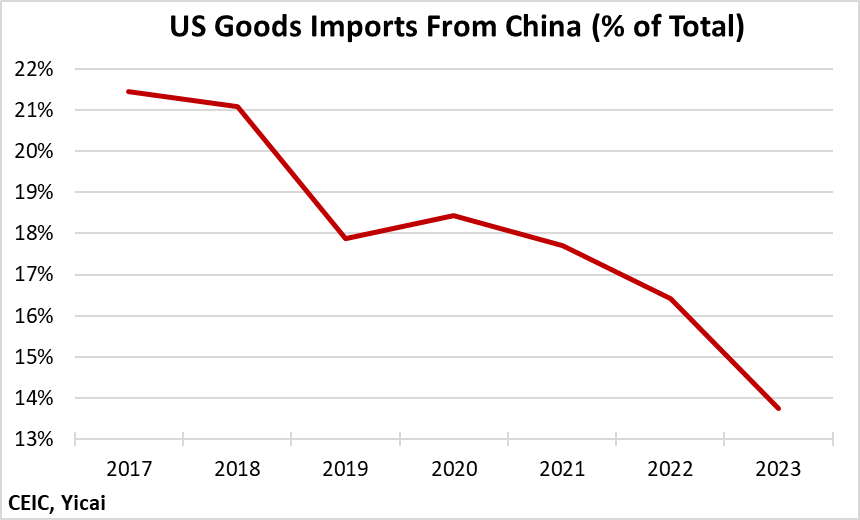

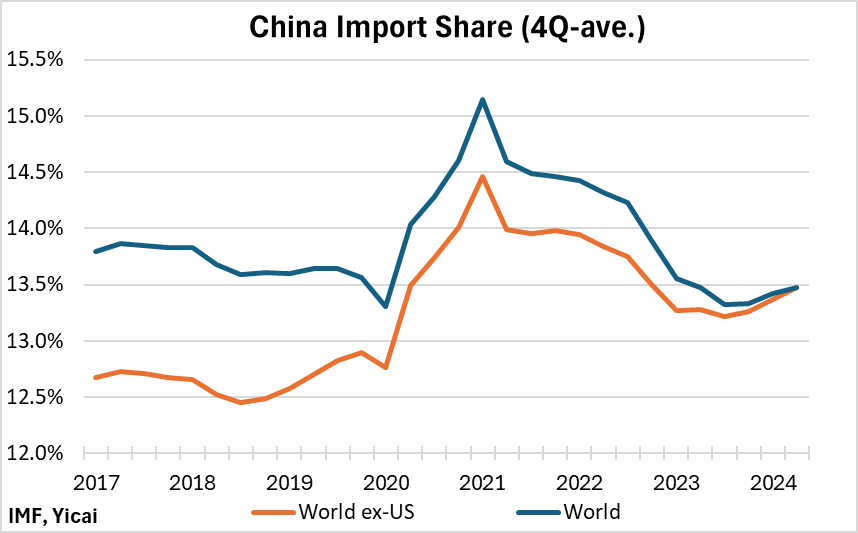

If implemented, this would be a painful policy for China. During his first Administration, Mr. Trump tariffs of just over 21 percent on some two-thirds of the goods the US imports from China. As a result, China’s share of US goods imports fell from 21.5 percent in 2017 to 13.8 percent in 2023 (Figure 4).

Figure 4

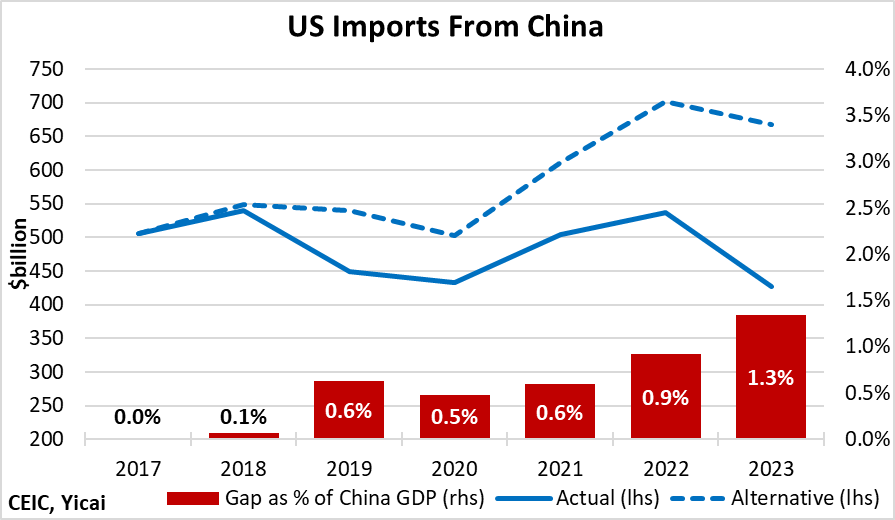

We can estimate the cost of these tariffs, in terms of lost exports, by constructing an alternative scenario in which the US continued to import 21.5 percent of its goods from China. Figure 5 shows actual imports from China (the solid blue line) and what imports from China would have been under the alternative scenario (the dashed blue line). In 2023, the gap between these two lines was $239 billion or the equivalent of 1.3 percent of Chinese GDP. However, since China’s exports typically contain imported components, the loss on a value-added basis would be some smaller.

Figure 5

Notwithstanding the US’s imposition of tariffs, Chinese overall exports grew by 50 percent between 2017 and 2023. The market share it lost in the US was largely offset by gains in the rest of the world. By the second quarter of 2024, China’s share of global imports reached 13.5 percent, only a touch lower than the 13.8 percent it recorded in 2017 (Figure 6).

Figure 6

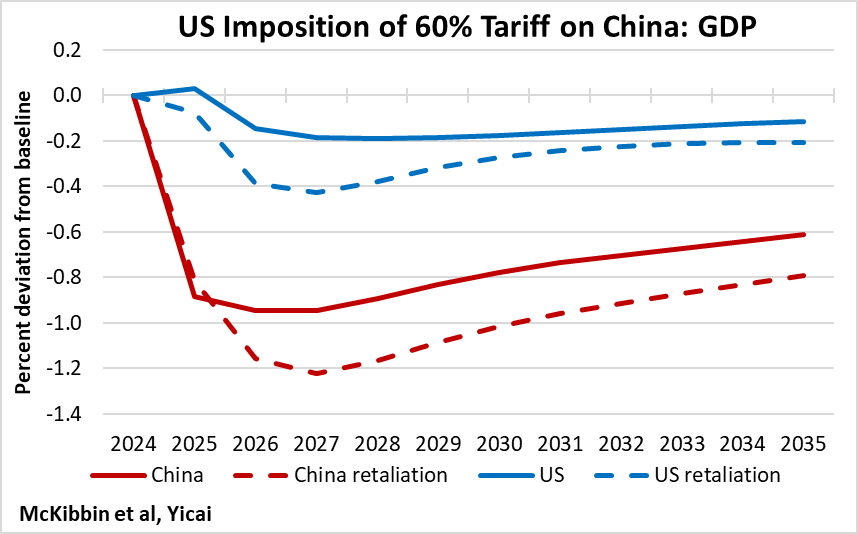

It will be difficult for Chinese exporters to adjust if Mr. Trump imposes a 60 percent tariff on all their sales to the US. In a recent , McKibbin and co-authors look at the suite of policies proposed by Mr. Trump. They calculate that the imposition of a 60 percent tariff on all imports from China would be a lose-lose policy. Over the period 2025-2035, lost annual GDP would average 0.8 percent for China and 0.1 percent for the US (Figure 7). If China were to retaliate by imposing tariffs of its own, average annual losses would grow to 1.0 percent for China and 0.3 percent for the US.

Figure 7

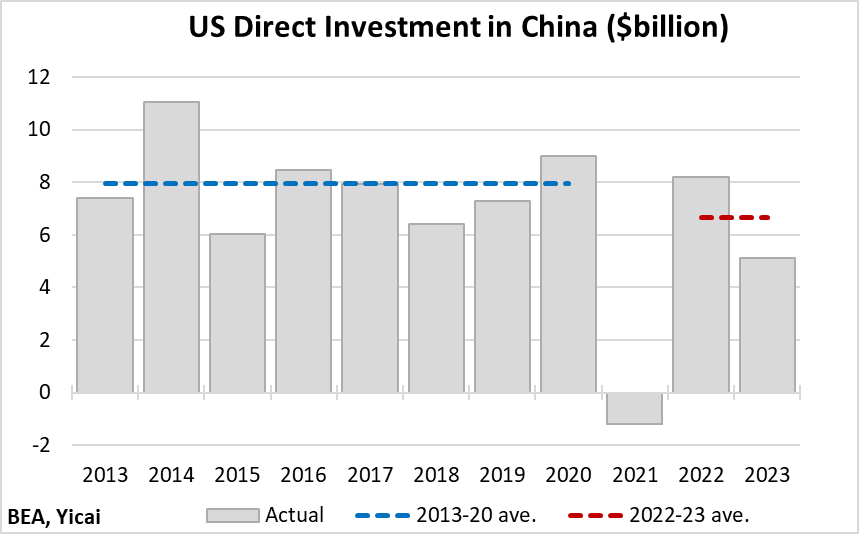

Mr. Trump’s protectionist policies could also reduce the willingness of US firms to invest in China. He has that he would impose tariffs on companies that move manufacturing from the US to another country. While China does not depend on direct investment as a source of finance (it continues to run a current account surplus), inward investment flows are often an important channel of technology transfer. We have seen a fall in direct investment from the US. Inflows were down 16 percent in 2022-23 from the 2013-2020 average (Figure 8).

Figure 8

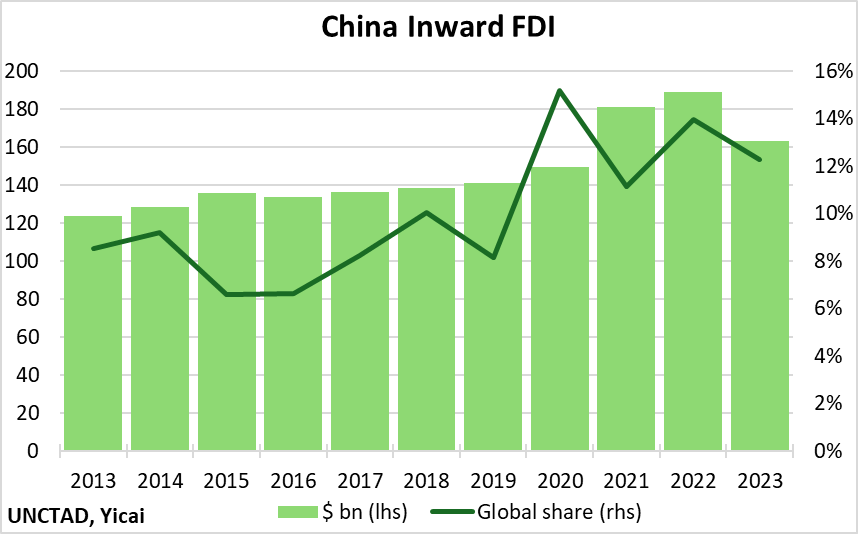

Zooming out beyond the US, China remains a favourable investment destination. Its share of global FDI inflows rose from 9.6 percent in 2013-19 to 12.3 percent in 2023 (Figure 9). This suggests that, owing to its large internal market, China may be resilient to the direct investment collateral damage associated with the increase in tariffs.

Figure 9

Given his posture, it appears that Mr. Trump could prioritize domestic growth and de-emphasize security. He may be to the US chip industry’s claims that it is losing both market share and its leadership in innovation. Indeed, he has that he may replace the CHIPS and Science Act with tariffs and he has accused Taiwan of “stealing” the US’s chip business. Entrepreneurs like Elon Musk, with strong to China, may temper overly aggressive security-driven actions under the new administration.

Limiting carbon emissions does not appear to be a priority for Mr. Trump, who withdrew the US from the Paris climate agreement in 2020. He is committed to increasing fossil fuel production and he dislikes that promote clean energy. His stance provides a sharp contrast with China’s experience where experts carbon emissions are likely to have peaked last year, 7 years ahead of schedule.

There is much that we do not know about the specific policies that Mr. Trump will implement. It does seem clear that his “America First” policy stance will be hugely unpopular with the international community.

As the US abdicates its leadership role, China has the chance to step up and provide a collaborative alternative. In an environment of increased protectionism, China can present itself as a champion of the open, rules-based trading system. Moreover, its achievement in limiting carbon emissions will make China a potentially valuable ally for countries that take the environment seriously.