Weak Foreign Demand and Real Estate Difficulties Weigh on Economy in July

Weak Foreign Demand and Real Estate Difficulties Weigh on Economy in July(Yicai) Aug. 17 -- The macroeconomic data recently released by the National Bureau of Statistics reveal the extent to which headwinds from difficulties in the property market and weakness in foreign demand weigh on the Chinese economy.

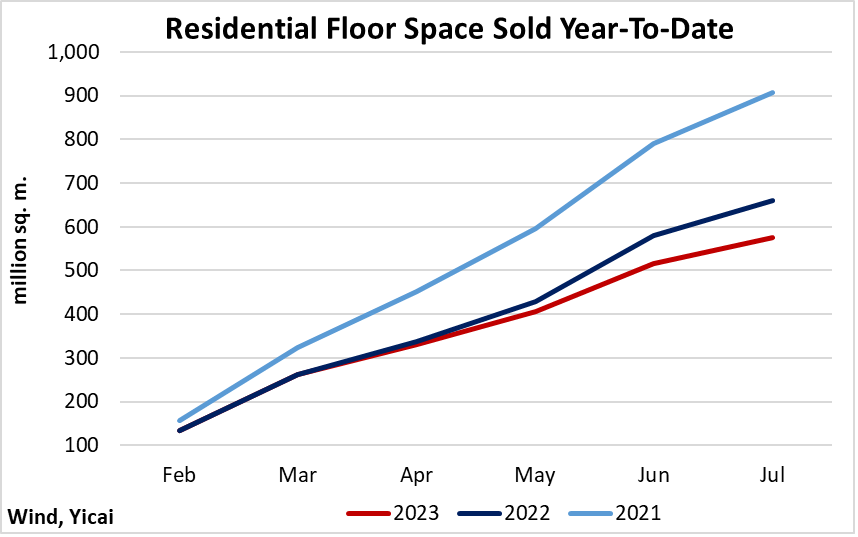

So far this year, the volume of residential property sales is down 13 percent from last year and 36 percent from 2021 (Figure 1). Moreover, the gap between this year’s and last year’s sales is growing – in May, this year’s sales only lagged 2022’s by 5 percent. This indicates that sales growth is decelerating.

Figure 1

The decline in new construction has been even sharper than the one in sales.

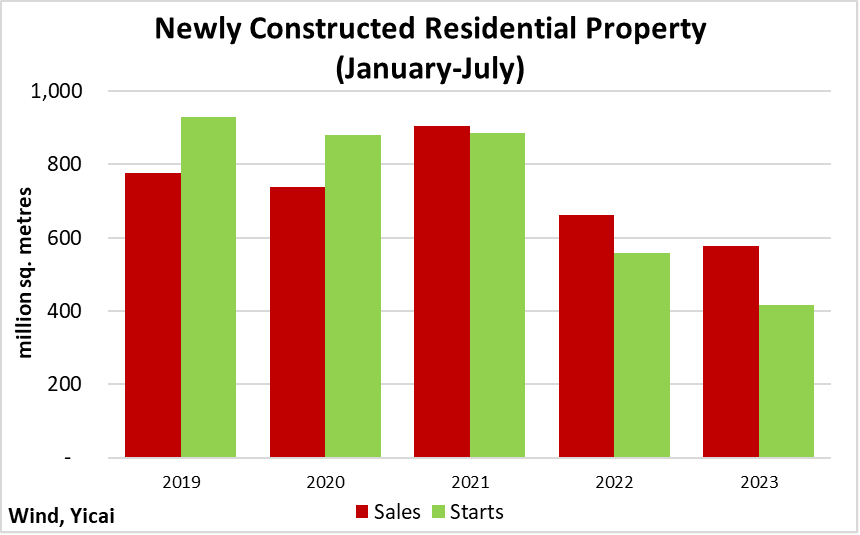

The volume of new home starts is down 26 percent from last year and 53 percent from 2021 (Figure 2). So far this year, only 0.7 square meters have been started for every meter sold. This is down sharply from the 1.1 meters started during the January-to-July period over 2017-21.

Figure 2

Part of the reason fewer apartments are being built is that it is difficult for developers to obtain financing.

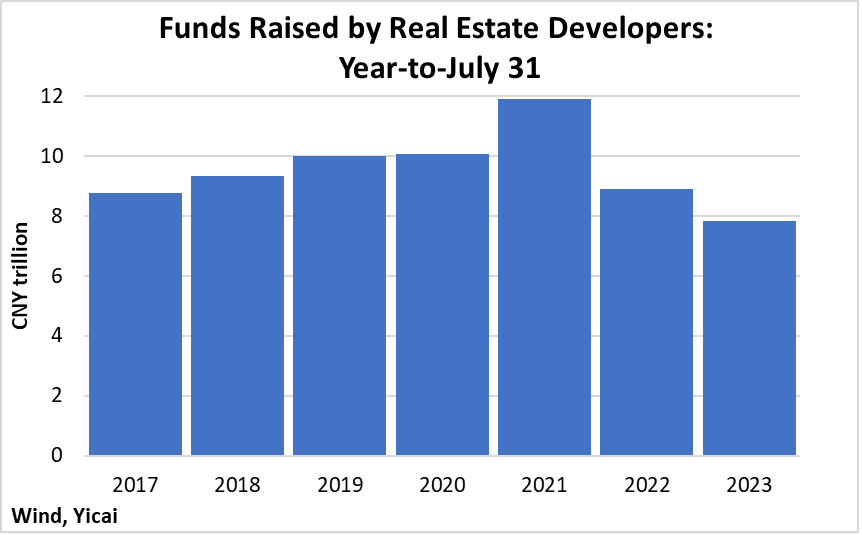

So far this year, developers have raised CNY 7.8 trillion, 12 percent less than last year and a third less than in 2021 (Figure 3). Despite measures taken to ease developers’ liquidity issues, lenders remain wary. The difficulties of Country Garden, one of China’s biggest property developers, will only reenforce their caution.

Figure 3

Sales growing faster than starts provides the potential for a demand-supply imbalance that could lead to higher home prices and a rebound in construction.

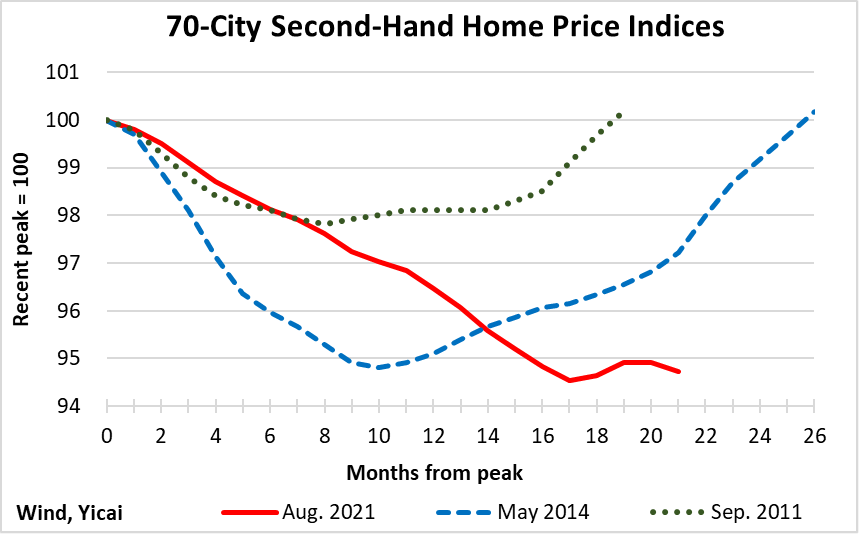

So far, however, this has not happened. Close to two years after they peaked in August 2021, second-hand home prices are down some 5 percent (we reckon the price of our place in Pudong is down 10 percent). By this time, in earlier cycles, prices had either fully recovered or were well on their way to their previous peaks (Figure 4).

Figure 4

The weakness in the property market is showing up in broader consumption measures.

The growth of retail sales slowed to 2.5 percent in July from 3.1 percent in June. The outturn was below the 4 percent median forecast by the Chief Economists surveyed by the Yicai Research Institute.

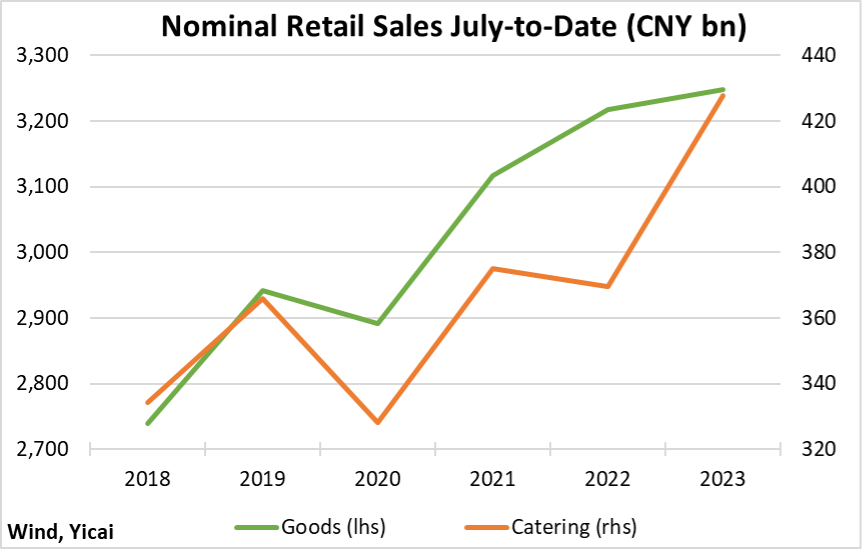

Sales of goods were only up 1 percent while catering sales rose by 16 percent. The recovery in catering sales, so far this year, reflects the release of pent-up demand accumulated during the pandemic (Figure 5). Households’ willingness to spend on dining out, hotels and travel shows that the extreme consumer caution of the last three years has faded.

Figure 5

Within the consumption of goods, the sales of those related to the property market – appliances, furniture and decoration – have been particularly weak so far this year. While sales of passenger cars stalled in July, they are still 7 percent higher than last year and 15 percent higher than 2019 on a year-to-date basis. The willingness of households to spend on big-ticket consumer durables, like cars, reenforces the message that some of the weakness in retail sales is not pervasive but can be traced back to the property market.

It will come as no surprise that developers’ reluctance to build new homes is depressing investment demand.

In 2018-19, investment in real estate development grew by 10 percent, on average. So far this year, it is down 9 percent. Manufacturing investment has held up fairly well, growing by 6 percent so far this year, just slightly slower than in 2018-19. The authorities have relied on infrastructure investment to offset the weakness in the property market. So far this year, infrastructure investment is up 7 percent, compared to 3 percent growth in 2018-19.

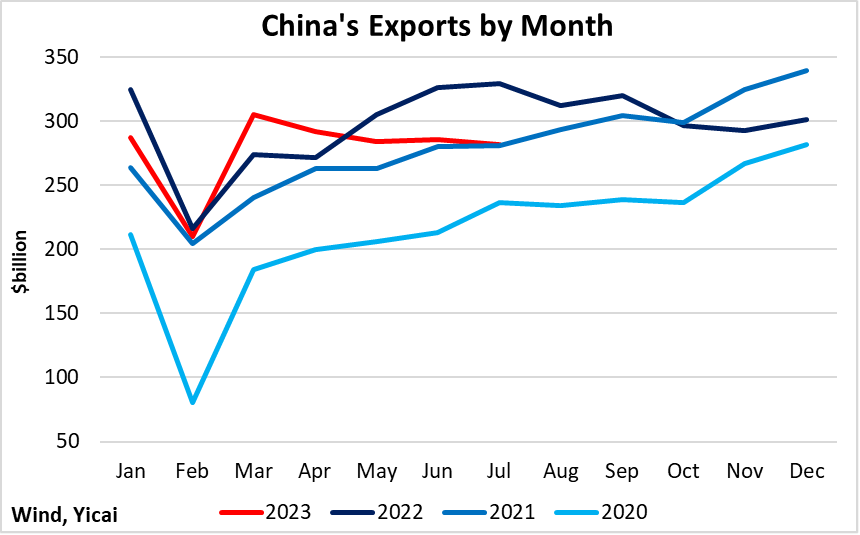

Monetary policy in China’s trading partners has tightened to rein in inflation. As a result, their demand for imported products has fallen. China’s exports have not been immune. They fell 12 percent, year-over-year, in July and 5 percent on a year-to-date basis (Figure 6).

Figure 6

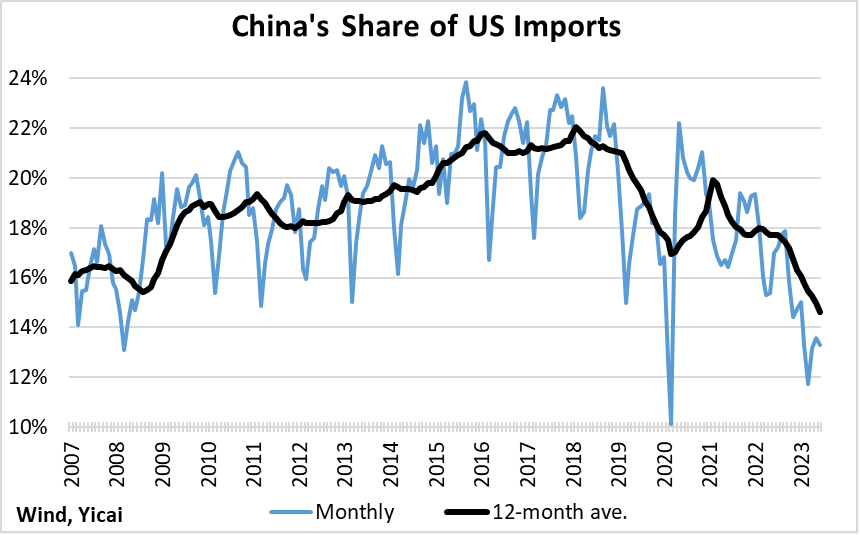

China’s exports to the US have been particularly weak. They fell below 2020 levels in July. As a result of the tariffs imposed in 2018, China has lost market share in the US. Indeed, the share of imports the US buys from China continues to fall over time, as Americans find alternative sources of supply (Figure 7).

Figure 7

We can estimate the effect that these tariffs have had on Chinese exports by performing a simple counter-factual experiment.

Figure 8 shows the US’s actual imports from China and a counter-factual based on China’s imports having maintained their peak market share from January 2018 through June 2023. The monetary-policy-induced weakness in US imports is evident from the decline of counter-factual imports from their March 2022 peak.

Of course, actual imports have fallen by much more and, from January to June this year, they are 40 percent below counter-factual levels.

Figure 8

We can also estimate the effect of the tariffs on China’s overall export growth by assuming that the percent decline in China’s exports to the US is equal to that of the US’s imports from China (export and import data never match perfectly).

Had China been able to maintain its market share in the US, its total exports would have been 9 percent higher, on average, during the first six months of this year (Figure 9). While counter-factual exports would still have declined year-over-year, it appears that the tariffs have played a significant role in dampening export sales.

Figure 9

The US’s tariffs on imports from China are an excellent example of a lose-lose economic policy.

According to Jaravel and Sager, US households benefitted from increased trade with China between 2000 and 2007 through a reduction in prices (a boost in real incomes). They find that this price effect came largely through lower prices for US-produced goods in areas in which domestic producers competed with Chinese imports. Specifically, they estimate that a 1 percentage-point increase in China’s import share reduced consumer prices by 2 percentage points.

If we assume that a decrease in China’s import share leads to a similar rise in prices, then the 7 percentage point decline illustrated in Figure 7 (from 22 to 15 percent) implies a 14 percentage point increase in consumer prices – or a 14 percent decline in households’ real incomes – over five and a half years.

The decline in China’s exports has been a major factor behind the weakness in industrial value added. In July, the growth of industrial value added dipped to 3.7 percent, well below the 4.6 percent forecast by the Chief Economists.

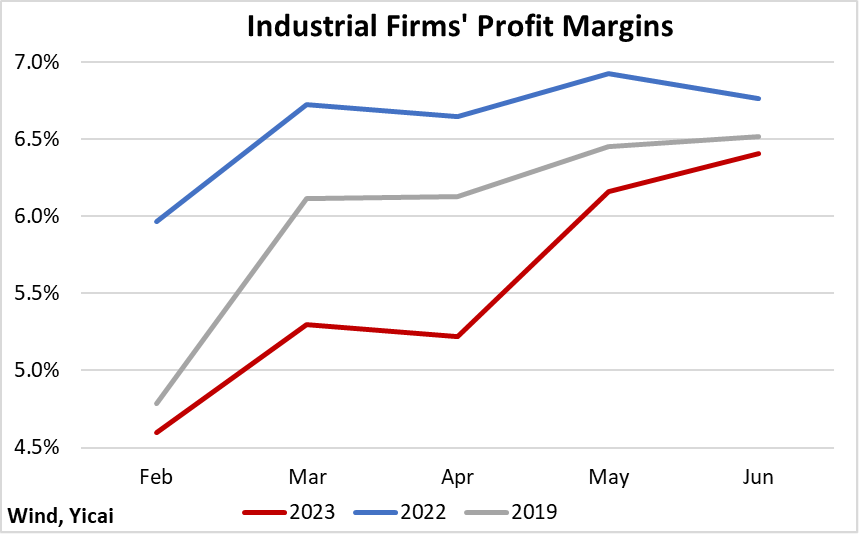

The encouraging news was that industrial firms continue to report improved profit margins (Figure 10). June’s margins show a convergence to those reported last year and to pre-pandemic rates. As industrial value added appears to be linked to profitability, this positive trend suggests that the growth of industrial value added could accelerate later this year.

Figure 10

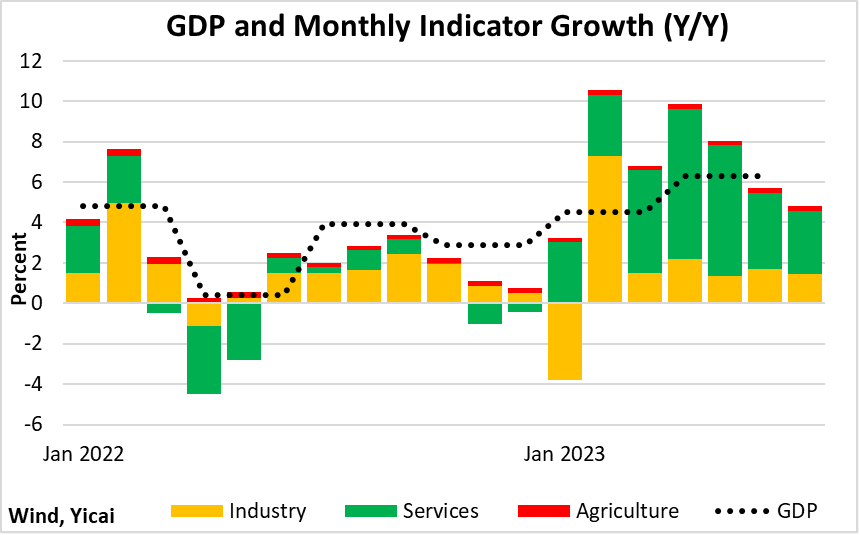

Our monthly GDP indicator points to growth of 4.8 percent in July. While this is the slowest monthly rate of growth this year, it is sufficient for the economy to reach the government’s 5 percent target should it be maintained through December.

Figure 11

Notwithstanding the weaker-than-expected macroeconomic data, the government has refrained from implementing large-scale counter-cyclical stimulus. With the GDP target in sight and the labour market stable – the unemployment rate in July was the same as in July 2019 – it has focused on longer-term structural issues to boost the economy’s productive capacity.

On July 19, the Party’s Central Committee and the State Council announced measures designed to support the private sector. These include reducing market-access barriers, increasing financing options, improving human resource management and enhancing policy communication.

On August 13, the State Council released 24 policy measures designed to attract foreign investment. Key among these were improving the quality of foreign investment, ensuring equal treatment with domestic businesses and enhancing financial and tax support.

These measures are not designed to be a quick fix for the economy’s cyclical woes. Rather they are designed to boost business confidence. Looking through the property market weakness, the Chinese consumer is spending again. Thus, the pieces could be in place for a sustainable recovery.