Strong Economic Data Fail to Impress Chinese Market

Strong Economic Data Fail to Impress Chinese Market(Yicai Global) March 22 -- On March 15, China’s National Bureau of Statistics (NBS) its first batch of economic data for 2022. Because of the lengthy Chinese New Year break, the NBS only publishes composite numbers for January-February in mid-March.

The data were much stronger than expected.

Industrial value-added grew by 7.5 percent year-over-year. On average, the economists by the Yicai Research Institute only expected a 3.4 percent increase. Even the most optimistic among them only projected 5 percent growth. Similarly, retail sales rose by 6.7 percent, compared to an expected 3.9 percent, while fixed-asset investment jumped 12.2 percent, blowing past the 4.5 percent forecast by the economists.

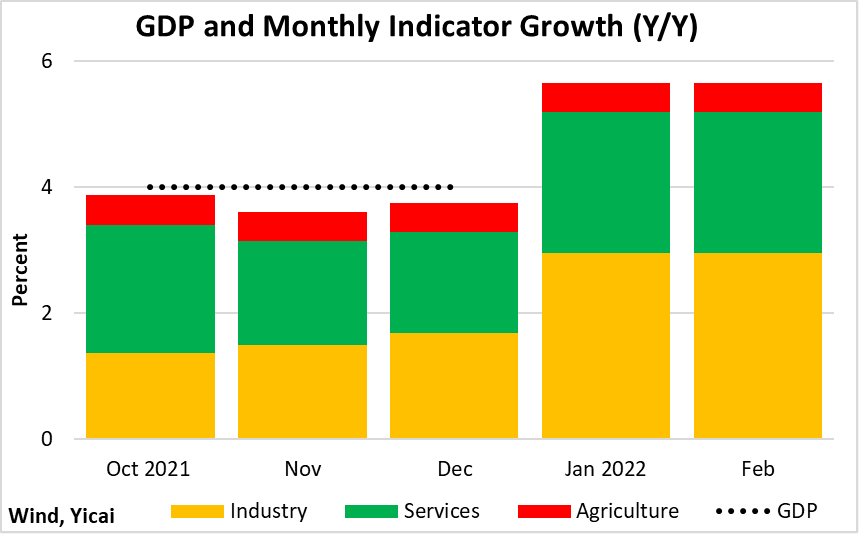

Our monthly model suggests that GDP growth was 5.7 percent in January-February, up from 4 percent in the fourth quarter (Figure 1).

Figure 1

The economy’s early out-performance does not appear to be inflated by excessive government support.

The industrial value-added of state-owned enterprises only grew by 5.9 percent, well below that of domestic private firms, as the production of electricity, gas and water lagged manufacturing output.

Exports remain a major driver of growth. In dollar terms, they rose by 16 percent year-over-year in January-February after 30 percent growth in 2021. China’s exporters are also largely privately-owned firms.

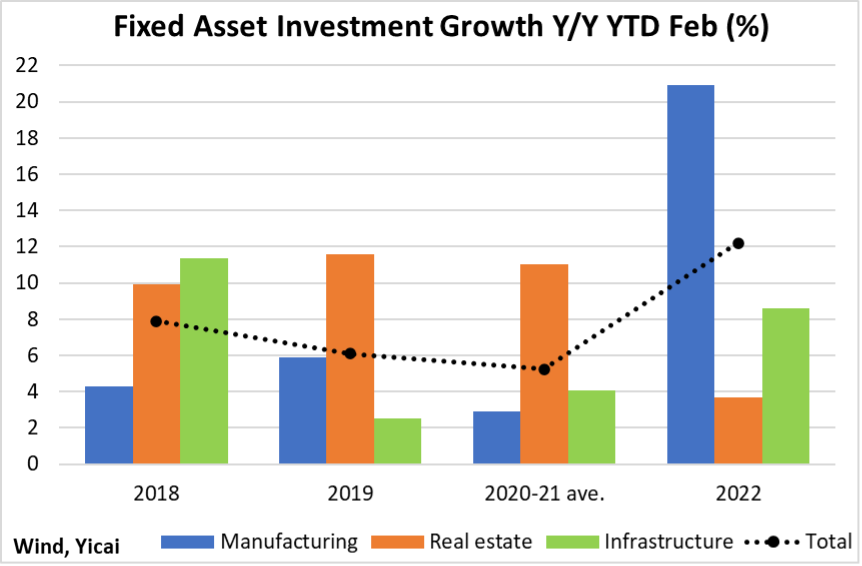

Fixed asset investment by private firms was up 11.4 percent, just slightly slower than aggregate investment. Private firms comprise the lion’s share of the manufacturing sector, where investment has surged this year (Figure 2). Real estate investment was weaker in the year-to-February than it has been over the last few years. However, investment in manufacturing and infrastructure more than offset real estate’s sluggishness.

Figure 2

All of the indicators for real estate were insipid. Sales of residential property were down by close to 14 percent year-over-year. The good news is that their rate of decline is slowing – sales had fallen by 20 percent year-over-year in the fourth quarter of 2021.

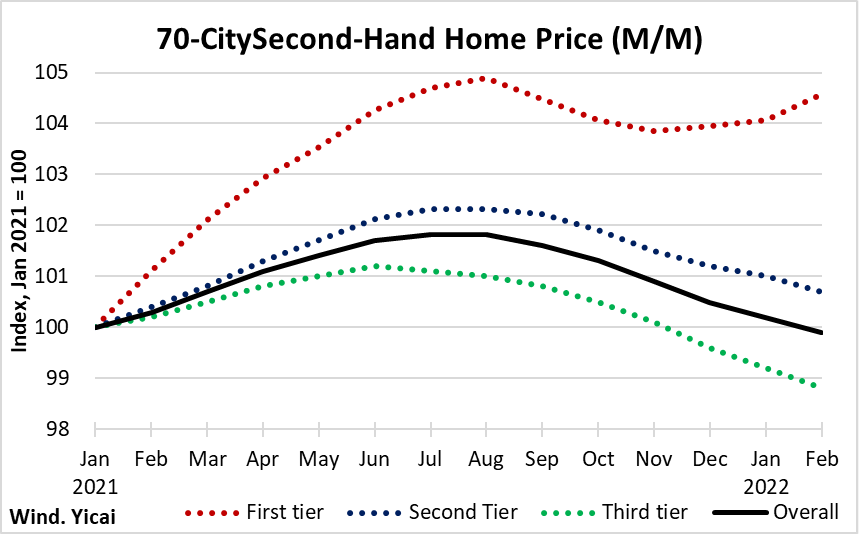

The prices of second-hand apartments in China’s 70 largest cities continued to fall in January and February but the rate of decline slowed, as prices in first-tier cities picked up (Figure 3). Even in third-tier cities, the cumulative decline has been modest, with prices just over 1 percent lower than they were in January 2021. Nevertheless, these price declines encourage a wait-and-see attitude among prospective buyers that limits home sales.

Figure 3

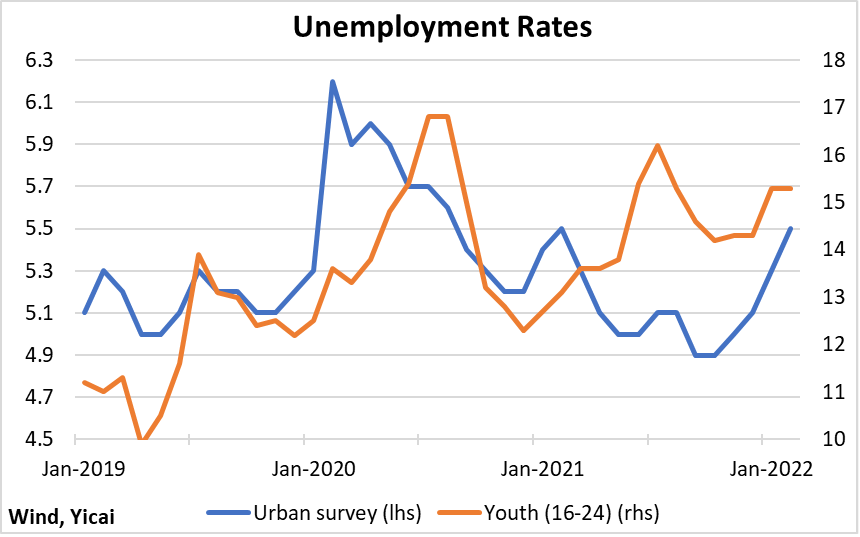

Despite the sharp pickup in production so far this year, the unemployment rates published by the NBS have increased (Figure 4).

Figure 4

The Bureau’s spokesman, Fu Lingui, this puzzling development as a largely seasonal phenomenon, noting that many people change jobs after Chinese New Year. He said that the unemployment rate of 25-59 year-olds was actually 0.2 percentage points lower than in February 2021, suggesting that the employment situation was stable. His assessment is consistent with the hours worked data in February being 9 percent higher than a year ago.

While the youth unemployment rate remains high, Mr. Fu said that the rate for college graduates aged 20-24 actually fell by 0.7 percentage points month-over-month in February, indicating a modest improvement in their situation.

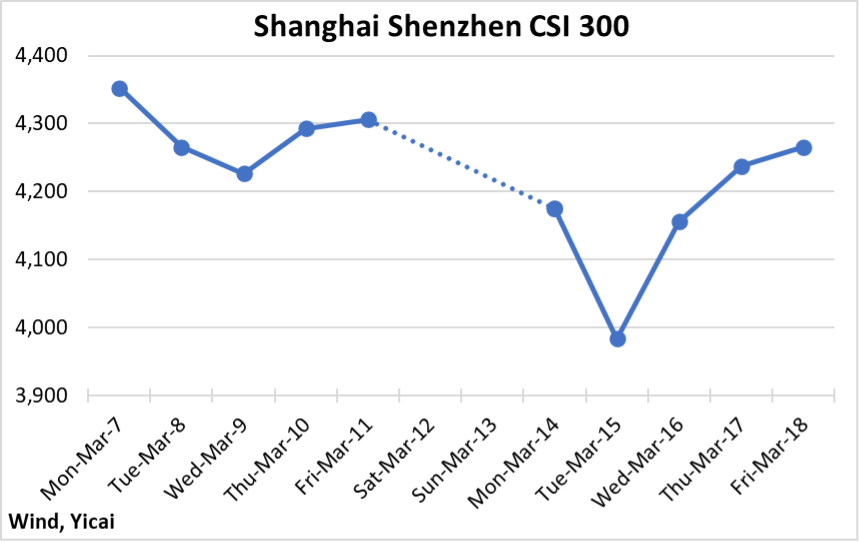

Notwithstanding the much better-than-expected economic news, the Chinese stock market fell sharply the day the NBS released its data (Figure 5). This is not so surprising as the data spoke to the recent past and equity markets are forward-looking. The Chinese market appeared to be focused on the spike in new Covid cases and the potential disruption from the crisis in Ukraine.

Figure 5

On March 16, the markets rebounded as a result of encouraging statements from senior policymakers.

Key among these was the from the meeting of the State Council’s Financial Stability and Development Committee. The Committee, which is chaired by Vice-Premier Liu He, said that monetary policy would proactively ensure a sufficient supply of new loans. Moreover, the government would support firms listing overseas and talks were ongoing with US regulators to manage longstanding issues. The Committee also spoke of increasing the transparency and predictability of the regulatory framework for the platform companies. It pointed to the use of both “red lights” and “green lights” to promote their healthy development and international competitiveness.

The Committee’s comments were echoed by the central bank and the securities regulator. Moreover, in an effort to improve sentiment in the real estate market, China’s Finance Ministry announced that there would be no further expansion of the property tax pilot projects this year.

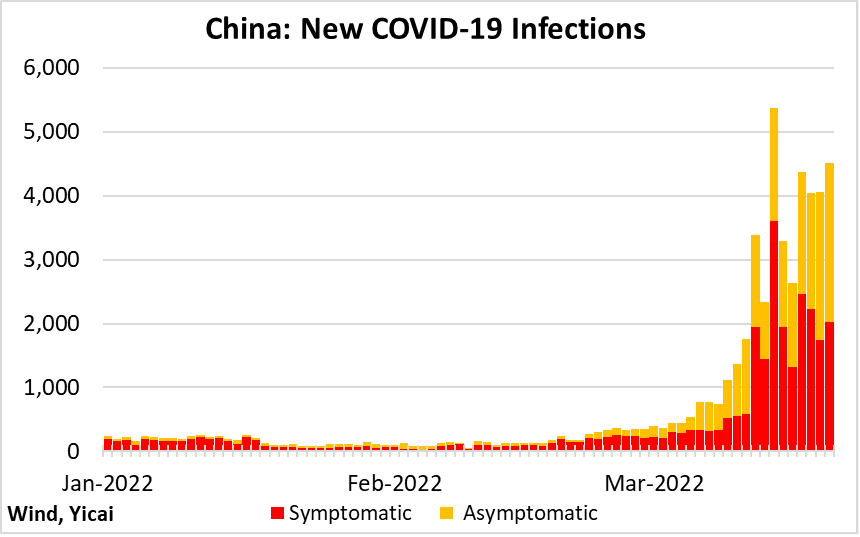

While the government is doing its best to build the market’s confidence, perhaps the most encouraging news was the fall in new Covid cases. On March 14, new Covid cases peaked at 5370, including 3602 symptomatic and 1768 asymptomatic infections (Figure 6). By March 16, they had fallen to less than half that level. Subsequently, they have averaged just over 4000 per day, well above the February average of 181 and we can expect continued vigilance.

Figure 6

The vast majority of the new cases are in the northern province of Jilin where the provincial government has moved quickly to manage the outbreak. On March 14, it suspended inter-provincial and inter-city travel. As of March 16, it had constructed eight with 11,488 beds. Moreover, two more hospitals and five quarantine sites are under construction.

Strict measures are being imposed country-wide where there are pockets of new infection, including the important commercial centers of Shenzhen and Dongguan in the south.

Here in Shanghai, the schools are closed and my daughters are following online courses at home. Restaurants no longer offer eat-in dining, just take-out. Shoppers are busy stocking up on essential groceries. Increasingly, people are working from home and, all around the city, neighbourhoods are being sealed – typically for 48 hours – as their residents are tested for Covid.

My friend Peter’s neighbourhood is once again under lockdown for two weeks as a single positive case was found among its 1790 residents. Our compound is under lockdown for two days as all of the neighbours are tested. We are holding our breath and hoping no positive cases will be found.

The risk of contracting Covid in China is small and there have been few Covid-related deaths this year. Still, the preventative measures are disrupting both consumption and production and it is pretty clear that the March data will not look nearly as rosy as January-February’s.

On March 17, the Standing Committee of the Politburo met to how to best control the Covid outbreak. While stressing the overriding importance of preserving public health, President Xi emphasized that measures to prevent and control the pandemic should impose as small a cost as possible to minimize their impact on the economy. With more targeted measures and the number of cases declining, we can expect the economy to rebound in April.