Shall the Twain Never Meet?

Shall the Twain Never Meet?(Yicai Global) Aug. 2 -- If you follow the news like I do, you could be forgiven for thinking that China and the West are drifting ever further apart. The headlines evoke Rudyard Kipling’s 1889 , which begins “Oh, East is East, and West is West, and never the twain shall meet, Till Earth and Sky stand presently at God's great Judgment Seat.”

But there is another perspective – an important one, I think. It comes from the American and European companies that are here, on the ground, doing business in China. We are lucky that local American and European business associations have, for many years, surveyed these firms. These indispensable surveys provide a snapshot of how their members actually feel about China’s current business environment. Moreover, they give a sense of how that sentiment has evolved over time.

The American Chamber of Commerce in the People’s Republic of China (AmCham) traces its roots back to 1919. Its membership includes representatives from 900 companies. It has been publishing surveys of its members for 23 years. You can find its 2021 China Business Climate Survey Report . Similarly, the European Union Chamber of Commerce in China (European Chamber) was founded in 2000 and now has more than 1700 member companies. It has published its surveys since 2004 and you can find the Business Confidence Survey 2021 . These documents provide a wealth of information on foreign firms’ successes and challenges in navigating the China market. I commend both of them to you.

In combing through these surveys, four points stood out. First, rather than decoupling, American and European firms are increasingly committed to China. Second, these firms’ China operations are becoming relatively more profitable. Third, the business environment for foreign firms is improving. Fourth, notwithstanding these positive developments, foreign firms would make even greater investments if they had the same opportunities as their domestic Chinese competitors.

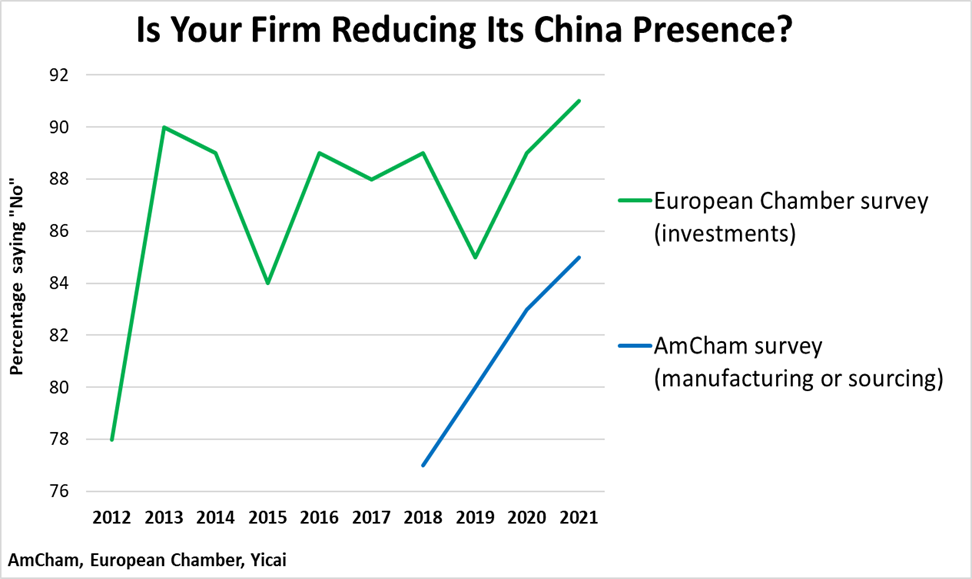

I found it striking that, notwithstanding high-profile political frictions, there is little sign that American and European firms are deserting China. European firms were asked if they were considering shifting current or planned China investments to other markets. Ninety-one percent of the respondents said they were not – the highest share recorded over the past decade (Figure 1). According to the European Chamber, its business community “… has steadily come to the conclusion that a company cannot be globally competitive without a strong presence in China.”

In the same vein, American firms were asked if they were considering, or had already begun, the process of relocating manufacturing or sourcing outside of China. Eighty-five percent of the respondents said that their manufacturing and sourcing were staying put. This share has steadily risen from 77 percent in the 2018 survey (Figure 1). According to the AmCham, its commitment to the China market has increased “[d]espite widespread reports of pandemic-fueled supply chain disruptions and bilateral trade tension-inspired reviews of risks and vulnerabilities …”

Figure 1

European firms are not simply staying put. The share of companies that intends to invest more in China reached 59 percent in the most recent survey, the highest ratio in the last eight years (Figure 2). Last year, a quarter of the European firms which have joint ventures increased their ownership shares, with many obtaining control. It is likely that this trend will persist in 2021.

Figure 2

In general, American firms have been more eager to increase their investments in China than their European counterparts (Figure 2). Investment intentions rebounded for 2021 but remain somewhat below those of previous years. Firms in the consumer sector are planning to invest less than in 2020, perhaps reflecting ongoing Covid-related challenges. Firms in all other sectors are planning to invest more than last year.It will come as no surprise that 2020 was a difficult

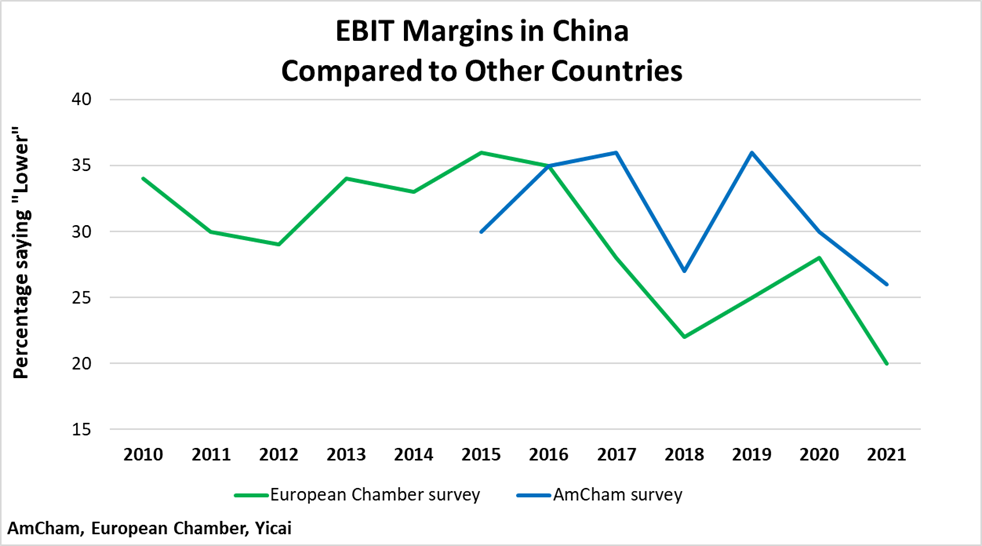

year for foreign firms’ China operations. Indeed, a greater share of companies reported falling revenues and losses than in past years. However, it was a tough year everywhere. In relative terms, profitability in China fell by less than in other countries. Fewer American and European firms reported that their earnings before interest and tax (EBIT) margins were lower in China than in other countries (Figure 3). In fact, the surveys show that, in relative terms, China appears to be an increasingly profitable market in which to operate.

Figure 3

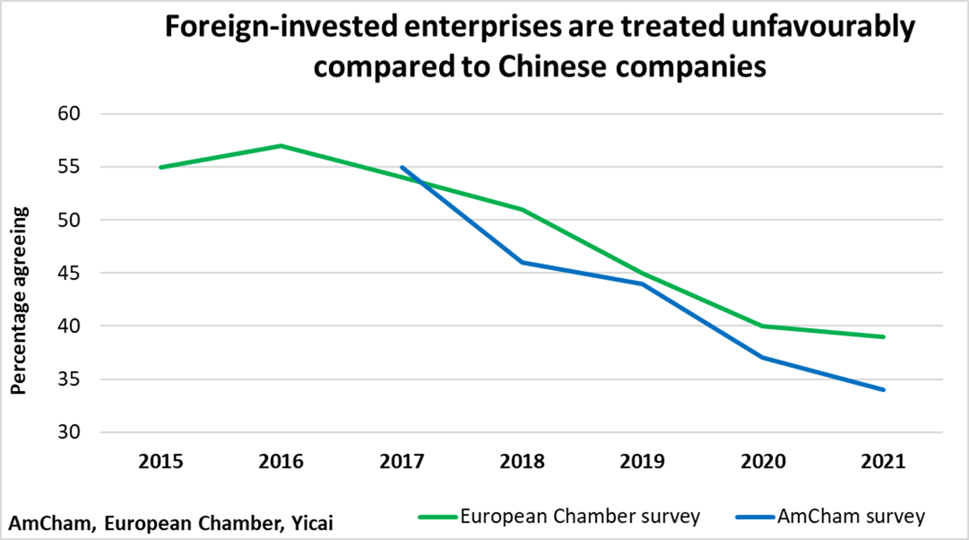

The business environment for foreign firms is improving. Just over a third of American and European firms say that they are treated less favourably than their Chinese counterparts, down from 55 percent only four years ago (Figure 4). While this improvement is welcome, it suggests that there is still work to be done before full national treatment is achieved.

Figure 4

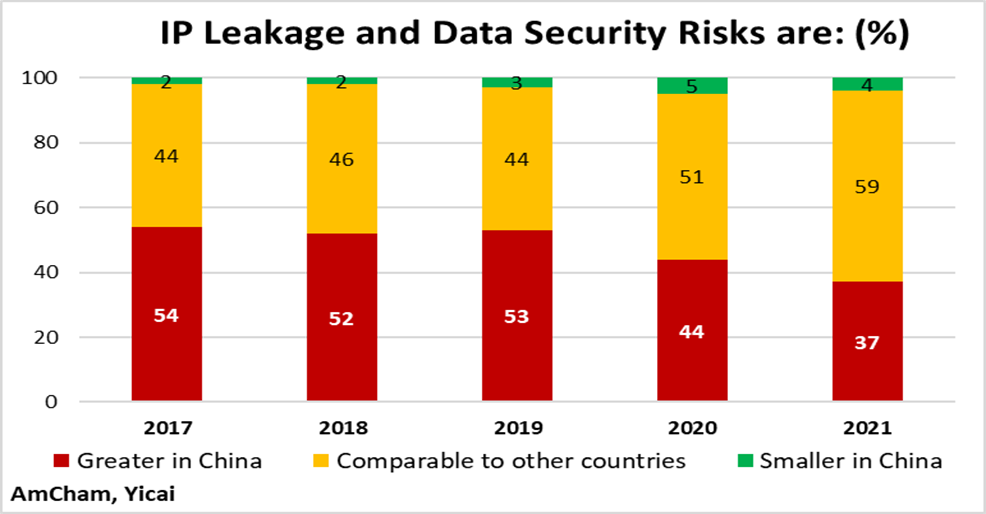

The difficulty of protecting intellectual property (IP) in China is an issue that receives a lot of press. However, American firms see IP leakage and data security risks in China increasingly becoming comparable with what they experience in other countries (Figure 5). The AmCham survey indicates improved IP protection is one of the key areas in which the Foreign Investment Law, which took effect on January 1, 2020, is having a positive impact.

Figure 5

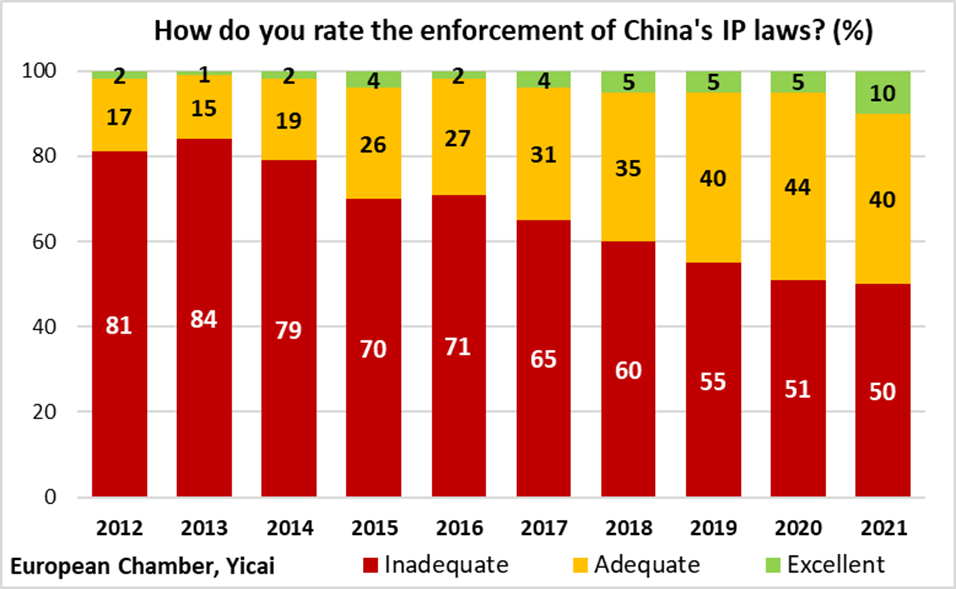

European firms see the quality of IP law enforcement slowly getting better over time (Figure 6). However, with half the firms still characterizing enforcement as “Inadequate” there is still room for further improvement.

Figure 6

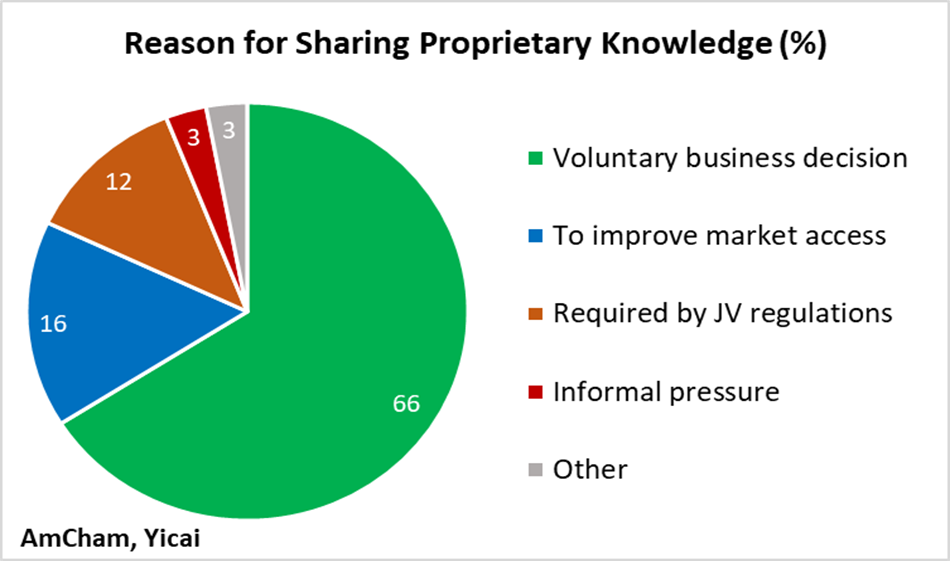

Forced technology transfer is another hot-button issue for foreign firms and the surveys highlight the scope of this problem. According to AmCham, two-thirds of US firms shared proprietary knowledge voluntarily. An additional 16 percent did so to improve their market access. A further 15 percent did so either because of joint venture regulations or because of informal pressure (Figure 7).

Figure 7

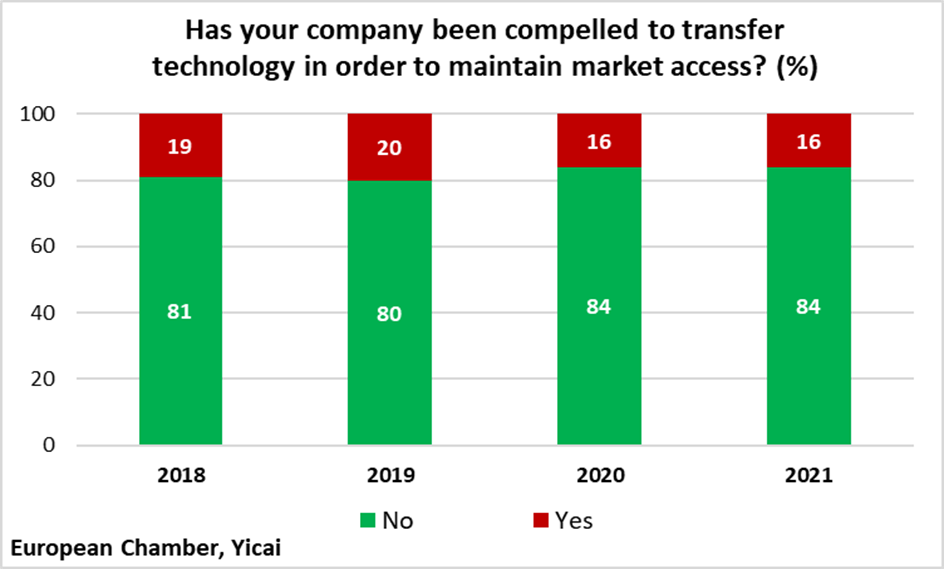

The European Chamber’s survey shows that a similar share of firms was compelled to transfer technology in order to maintain market access (Figure 8). While this share is falling slowly over time, European firms would have hoped for even greater progress given that the Foreign Investment Law expressly prohibits unfair technology transfers.

Figure 8

Foreign firms are clearly in China for the long haul. Nevertheless, the surveys indicate that further reform would lead to even deeper levels of engagement.

For American firms, the priority reforms are (i) increasing the transparency, predictability and fairness of the regulatory environment; (ii) greater IP protection; (iii) limiting the use of industrial policies that create barriers and (iv) opening business or product segments that are currently restricted.

European firms emphasize the importance of increasing market access, with only one-third of survey respondents saying that their industry is fully open to foreign participation. Forty-five percent say that market access restrictions or regulatory barriers resulted in their missing out on business opportunities. This share has been fairly stable over time. Almost two-thirds of respondents say that they would increase their investments if market access barriers were to be removed.

Rudyard Kipling’s famous poem goes on to say, “But there is neither East nor West, Border, nor Breed, nor Birth, When two strong men stand face to face, though they come from the ends of the earth!” Indeed, beneath the surface, East and West are more similar than they first appear. In recognizing these similarities and building trust, East and West can increase opportunities for mutually-beneficial enterprises.