Past Performance Not Indicative of Future Results

Past Performance Not Indicative of Future Results(Yicai Global) April 20 -- China’s National Bureau of Statistics (NBS) released its National Accounts for the first quarter of 2022 on April 18. GDP growth came in at 4.8 percent year-over-year, well above the 4.5 percent the economists surveyed by the Yicai Research Institute expected.

For the quarter as a whole, domestic demand remained robust and most of the shortfall with respect to the previous three years was due to a smaller contribution from net exports (Figure 1).

Figure 1

But, as they say in the investment world, “Past performance is not indicative of future results.” The Omicron outbreak in March means that the quarterly GDP number provides very little information about the economy’s underlying momentum.

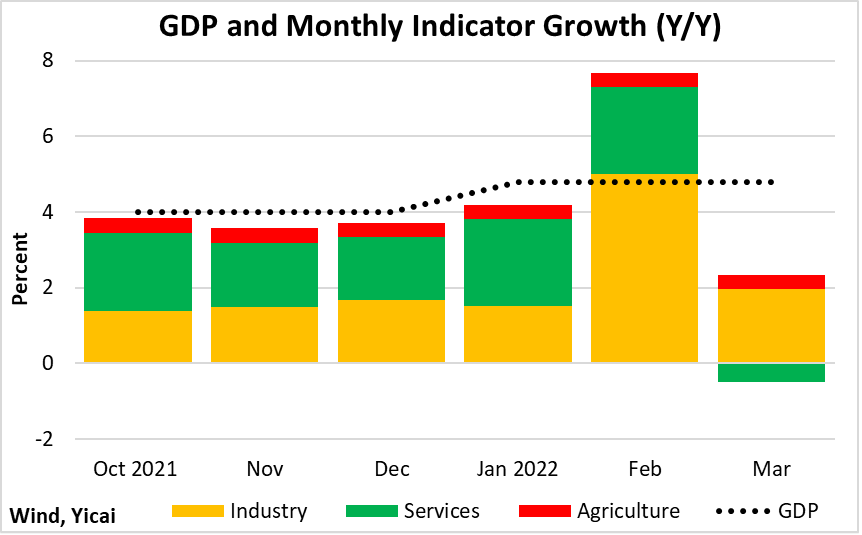

To get a sense of how the pandemic is impacting intra-quarter growth, we rely on our monthly GDP model. This model is based on the NBS’s monthly industrial value-added and service activity series and an estimate for the agricultural sector.

The monthly model shows that GDP was fairly strong in January and February, with growth averaging just under 6 percent, before slowing to something less than 2 percent in March. Almost all of March’s weakness came from the service sector. The NBS’s index of service production declined by close to 1 percent from the reading a year ago (Figure 2).

Figure 2

The NBS’s spokesperson, Fu Linghui, emphasized the impact Covid had in March on “contact” services – wholesale and retail trade, accommodation, transportation and cultural activities like tourism.

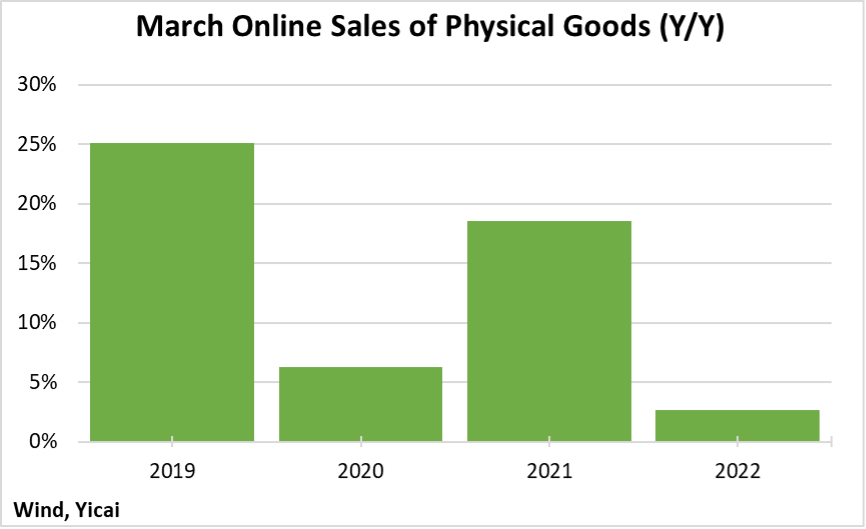

It is understandable that people tried to minimize contact to lower their risk of becoming infected. However, data for online sales of physical goods – a fairly low-risk undertaking – indicate a more generalized sense of caution among consumers. Online sales of physical goods only grew by 3 percent in March (Figure 3), well below their 12 percent trend. Notwithstanding the possibility that Covid can be transmitted on the surfaces of packages, the fall in online sales suggests an increase in precautionary savings that will weigh on consumption.

Figure 3

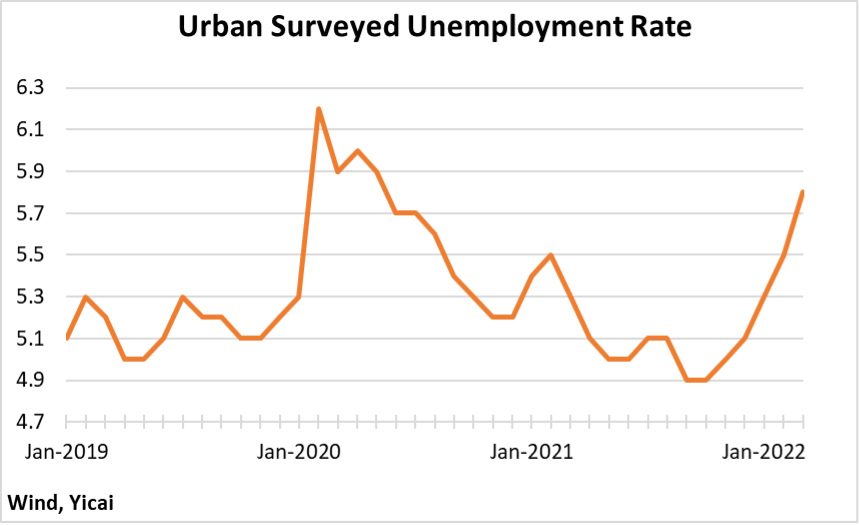

The weakness of the economy in March was also reflected in key labour market indicators. The urban surveyed unemployment rate jumped to 5.8 percent, its highest level since May 2020 (Figure 4). According to Fu Linghui, the Covid outbreak made it harder for some people to find work, as firms’ production and operational difficulties discouraged them from hiring.

Figure 4

Instead of engaging new workers, employers opted to get more out of their existing staff. Thus, average hours worked rose to 47.3 from 46.9 in March 2021 and 46.0 in March 2019 (Figure 5).

Figure 5

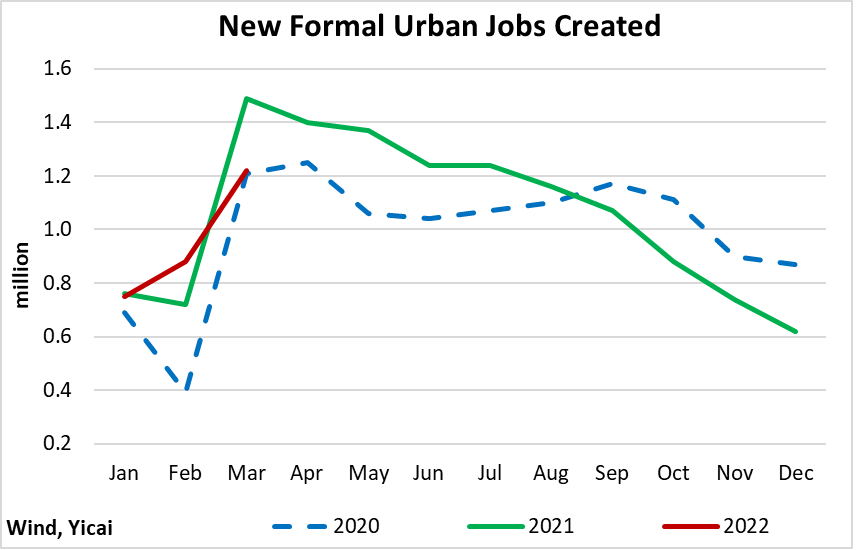

The economy created 1.2 million new urban jobs in March. That is 18 percent less than in March 2021 (Figure 6). In the first three months of the year, job creation is lagging last year’s pace, but the annual target of 11 million new urban jobs still seems within reach. The economy created 12.7 million jobs last year. Nevertheless, the authorities will be watching the evolution of the labour market very carefully.

Figure 6

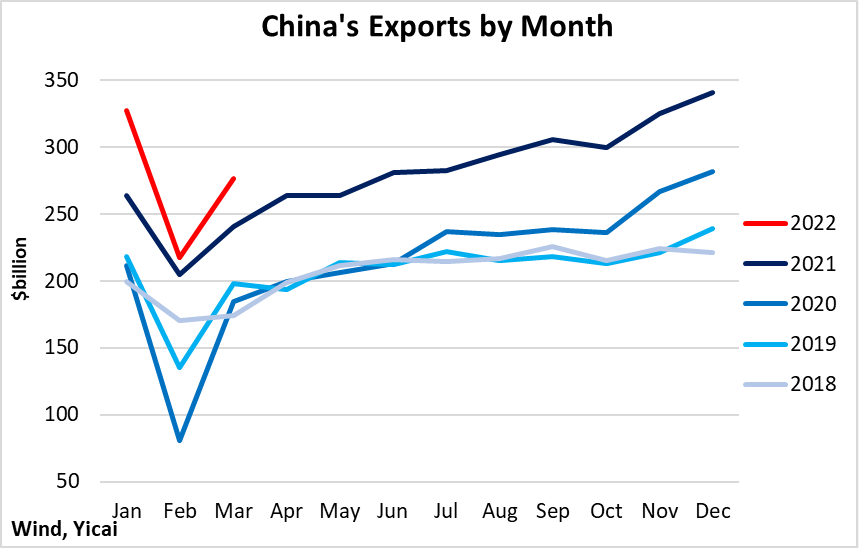

Exports remained a bright spot in the quarter. They grew by 16 percent after having grown by 30 percent in 2021. Despite the outbreak of the pandemic, the export supply chain remained resilient in March (Figure 7).

Figure 7

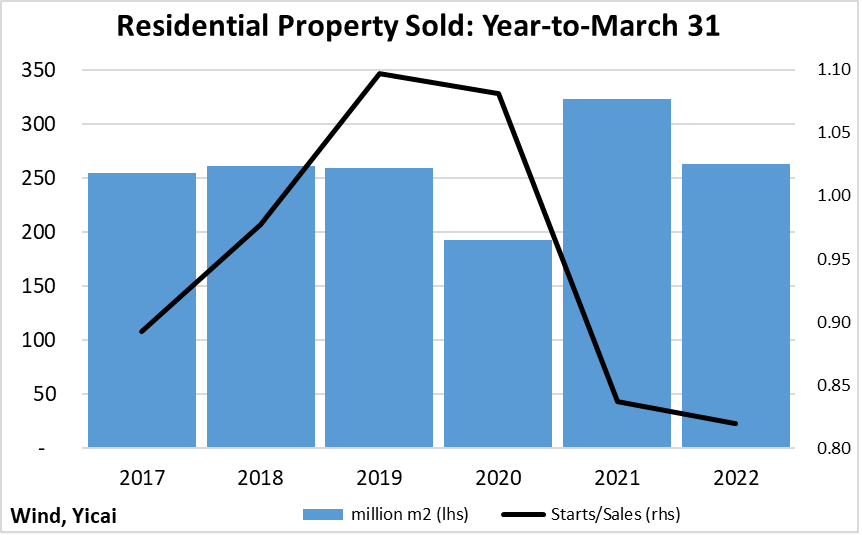

You might have thought that the housing market was in the process of melting down, having heard that new homes sales fell by 19 percent in the first quarter. However, the rapid rate of decline owes much to the high base in 2021, itself the result of payback from the weakness in 2020 when the pandemic reduced sales (Figure 8).

The volume of home sales in the quarter was in line with pre-pandemic levels (and the 2020-2021 average). Moreover, the ratio of new homes started to new homes sold remains rather low. This suggests that housing demand is sufficient to support a higher level of construction activity.

Still, local governments are worried that the Omicron outbreak will only exacerbate the effect of falling home prices on buyers’ confidence. As a result, more than 60 municipal governments have taken steps to support their local housing markets by reducing mortgage costs and supporting developers. In addition, some cities, like Dongguan and Quzhou, have loosened home purchase restrictions by allowing individuals who do not have local hukou (i.e. who are not registered as living in those cities) to buy homes. In a very uncertain environment, these measures will help put a floor under housing demand.

Figure 8

Given the mobility indicators, I estimate that my proxy for monthly GDP growth could fall to 0-1 percent in April from 2 percent in March. Indeed, the authorities are well aware of how much impact the outbreak is having on the economy and they are taking counter-cyclical measures.

On April 15, the People’s Bank of China announced that it will cut the banks’ reserve requirement ratio by 25 basis points effective April 25. Moreover, on April 18, it released a series of measures designed to increase the availability and lower the cost of finance, especially for firms affected by the pandemic. Financial institutions and the platform companies are expected to exercise forbearance when the pandemic has made it difficult for borrowers to service their loans. Similar tactics were used during the first outbreak of the pandemic in 2020.

Credit growth accelerated through the first quarter, as monetary policy had already turned more accommodative (Figure 9). The central bank’s recent moves will further support this trend.

Figure 9

Fiscal policy is offering supply-side support in the form of tax and fee reductions designed to lower the cost of doing business. Fu Linghui said that, for the year as a whole, the amount firms have to pay in taxes and fees will fall by CNY2.5 trillion (2.2 percent of GDP).

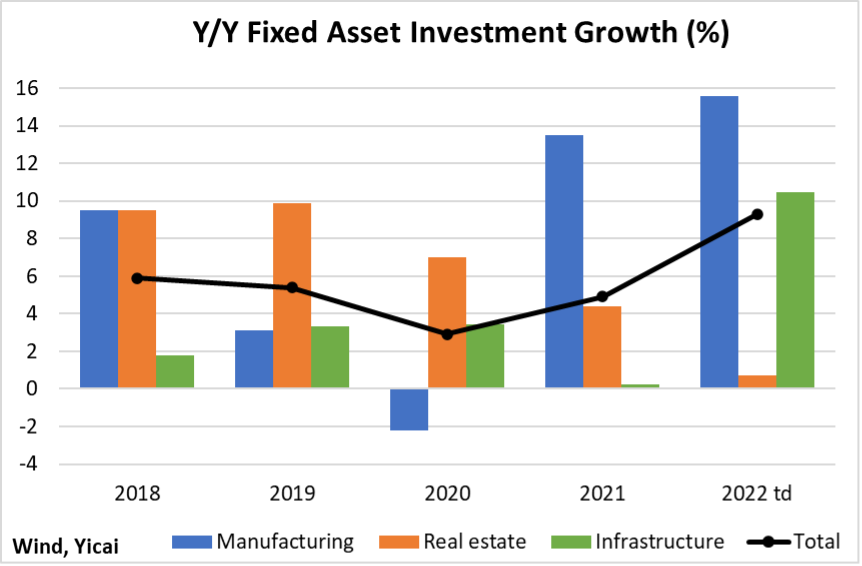

The economy will also be supported by more rapid infrastructure investment, much of which is state-led. Already in the first quarter, infrastructure investment grew by more than 10 percent from the same period in 2021 (Figure 10). Over the previous four years, infrastructure investment growth was in the 2 percent range.

Figure 10

At a recent press conference, officials at the National Development and Reform Commission (NDRC) indicated that they were expediting investment approvals, including some of the 102 key projects identified under the 14th Five Year Plan. The NDRC will focus on projects in four areas: infrastructure, high-tech manufacturing, the environment and social services. The officials emphasized that they will ensure the projects have sufficient funding and that their implementation is accelerated.

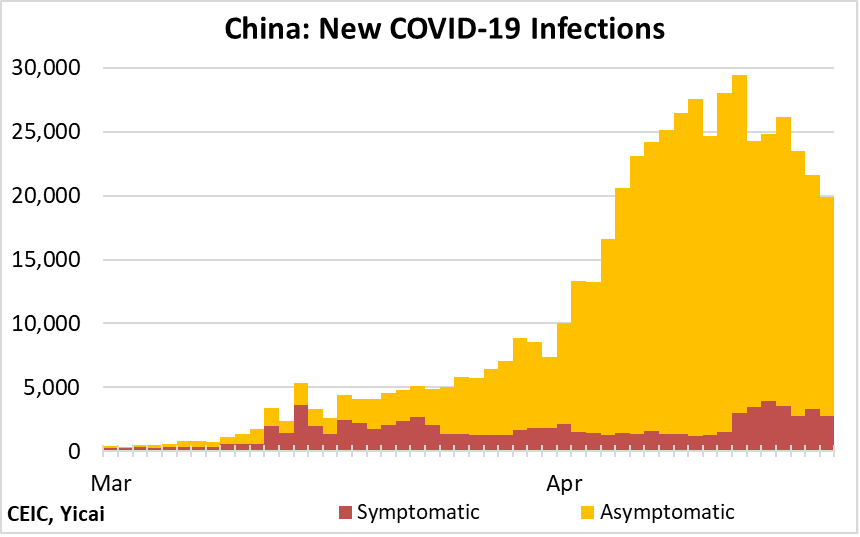

The speed with which this wave of Covid can be managed is the key variable for assessing the future course of the economy. The good news it that the infection rate has peaked (Figure 11). On April 18, new infections fell below 20,000 for the first time since April 4 and they remain well below the peak of 29,411, which was reached on April 13.

On April 16, the City of Shanghai encouraged a group of 666 companies – many of which are in the automotive sector – to resume operations under “closed-loop” management which entails keeping staff on-site full time.

All of us who have been under lockdown for close to a month now hope that progress on containing the virus will continue and that all of the restrictions will be lifted by the end of the month.

Figure 11