Is India the Next China?

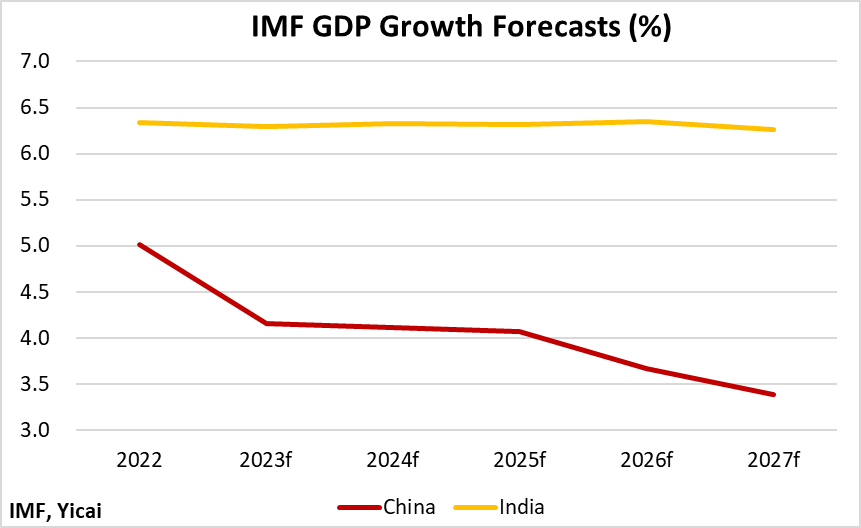

Is India the Next China?(Yicai) Jan. 5 -- In its October 2023 World Economic Outlook, the IMF forecast that the Indian economy would grow at an average annual rate of 6.3 percent between 2023 and 2028. This is more than two percentage points faster than the Fund’s projection for China’s GDP growth (Figure 1). Moreover, India’s per capita GDP is only one-seventh that of China’s, suggesting that one can participate in its rapidly growing economy on reasonable terms. For firms looking to de-risk themselves from China, India’s favourable growth prospects and its low costs make it attractive both as a market and a production base.

Figure 1

The Indian government is eager to position itself as a viable alternative to China.

It recently ramped up its subsidies under the Production Linked Incentive (PLI), which provides rebates to companies that exceed sales targets. In November, it approved applications by 27 companies for the manufacture of IT hardware under the PLI, including those of Dell, HP and Foxconn.

India has a strong incentive to attract foreign investment. Even though its economy has grown rapidly, it has failed to generate sufficient jobs to fully employ its expanding labour force.

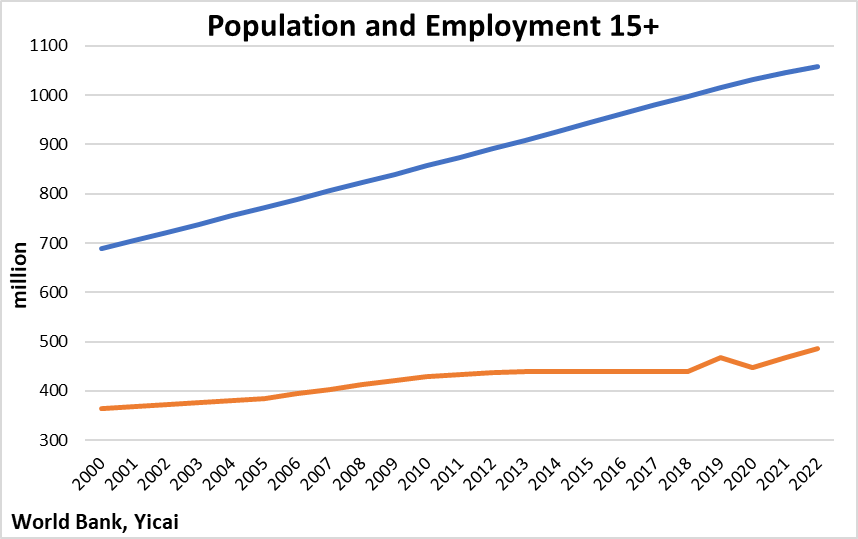

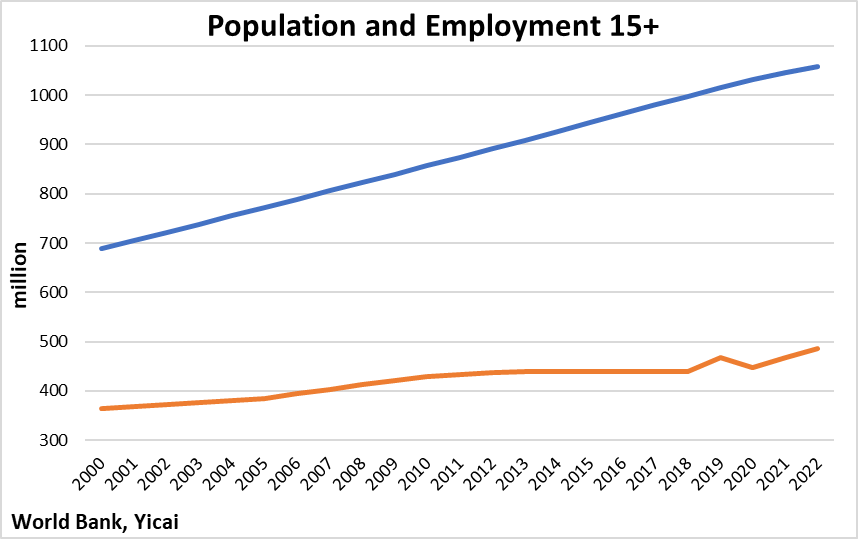

Since 2000, India’s population aged 15 and over rose by 54 percent, but employment only grew by 34 percent (Figure 1). As a result, just 46 percent of its population was employed in 2022, down from 49 percent in 2012 and 53 percent in 2000.

In addition, good jobs are . Much of India’s employment is in the informal sector, with more than half of all Indian workers being self-employed and an additional 25 percent only working casually. Just 23 percent of the workforce is employed on a regular, salaried basis. India is looking to the to directly create 50,000 jobs and an additional 150,000 indirectly.

Figure 2

To consider the extent to which India can displace China as a market, we turn to the World Economic League Tables (WELT) published by the Centre for Economics and Business Research (Cebr). The Cebr is a UK forecasting firm that has been publishing the WELT, 15-year economic forecasts for a large set of countries, since 2009.

A simple way to think of the opportunity a country’s market offers is the increase in its US dollar GDP between 2023 and 2038, as forecast by the Cebr.

The Cebr expects that India will maintain a very rapid pace of growth over the medium term, with real GDP increasing by 6.4 percent per year, on average. In US dollar terms, the Cebr expects the Indian economy to grow by 8.8 percent per year, with higher prices and/or a more appreciated rupee-dollar exchange rate accounting for the additional 2.4 percentage points.

The Cebr is less bullish on China’s growth prospects. It sees its real GDP only growing at 4.1 percent over the 15-year period. The US dollar value of the Chinese economy is projected to increase by 7.0 percent, with prices and/or a more appreciated CNY-US dollar exchange rate adding 2.9 percentage points.

While China is forecast to grow more slowly than India, in 2022, its economy was more than five times as big. According to the Cebr’s projections, China’s economy will increase by USD31 trillion over the next 15 years, while India’s will only grow by USD9 trillion (Figure 3). The Cebr’s forecasts indicate that the market opportunity in China is more than three times India’s.

By 2038, India’s per capita GDP is expected to exceed USD8000. This is the same level that China attained in 2009. In 2038, the average Indian consumer will not be especially well off and unable to afford a wide range of imported products. According to the Cebr’s projection, China’s per capita GDP will be more than USD35,000 in 2038, suggesting that its consumers will be much wealthier.

It is worth noting that the Cebr forecasts the US economy to increase by USD21 trillion between 2023 and 2038. According to these projections, China offers the biggest market opportunity of any national economy over the next 15 years.

Figure 3

In thinking through India’s prospects as a production base, it is useful to consider the iPhone.

Apple to produce more than 50 million iPhones annually in India within the next two to three years. If these plans are achieved, India would account for a quarter of global iPhone production, up from its current . Apple currently produces the rest of its iPhones in China.

But the word “produce” here is a bit of a misnomer. The iPhone is composed of myriad components that are produced all over the world. Its final assembly takes place in China and India. The assembly itself is a fairly low value-added undertaking and accounts for a small portion of the phone’s final cost.

Careful by Xing Yuqing, a Professor of Economics at Tokyo’s’ National Graduate Institute for Policy Studies, documents how the production of the iPhone has evolved in China. In 2009, assembly (by Foxconn) was the only portion of the iPhone 3G’s overall value added that could be attributed to Apple’s China operations. It accounted for 3.6 percent of the phone’s overall value. By 2018, Chinese firms had become more sophisticated and were able to supply several components that had previously been imported. As a result, 25.4 percent of the iPhone X’s value was added in China.

Unlike India, China must wrestle with a shrinking labour force. So, it is in its interest for its workers to transition to higher value-added activities and let phone assembly migrate to India.

In fact, iPhone production in India could represent an important new source of demand for Chinese component manufacturers. As a result of high import tariffs, the iPhone 14 cost the equivalent of USD980 in India, than in the US. Since domestically produced iPhones will not face this tariff, the number of phones sold in India could rise significantly, increasing the demand for Chinese-made components and making India, China and Apple all better off.

India needs to create “backward linkages” to domestic producers of components to raise local value added. This will be a challenge. With 44 percent of its labour force employed in agriculture, India has yet to develop a strong manufacturing base from which these components can be sourced (Figure 4). Indeed, there have been some teething pains reported in Apple’s Indian supply chain. The casings supplied by a producer in were of such that only one out of two was good enough to be sent to Foxconn, which is assembling Apple’s Indian iPhones.

Figure 4

Over the longer term, India’s ability to raise domestic value added will depend on how fast it can improve its human and physical capital.

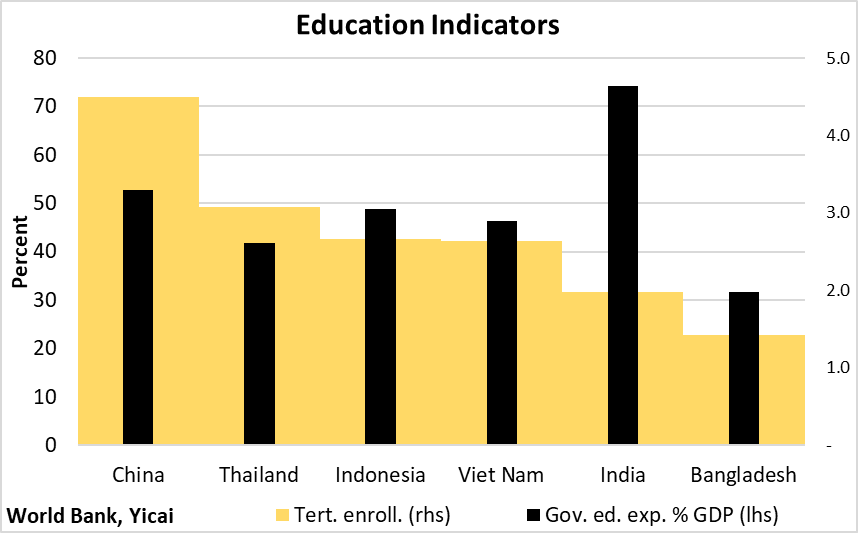

The Indian government spends 4.6 percent of GDP on education – the highest ratio among the comparator countries shown in Figure 5. Nevertheless, its enrollment rate in tertiary education (broadly defined) is second worst, suggesting its education spending could be more efficient.

Given its low educational outcomes, it is not surprising that India lags China in many of the knowledge and technology indicators tracked by the Global Innovation Index. For example, China is well ahead in the number of (52.4 vs. 0.2) and the number of scholarly and technical articles (21.9 vs. 8.9) per unit PPP GDP.

Figure 5

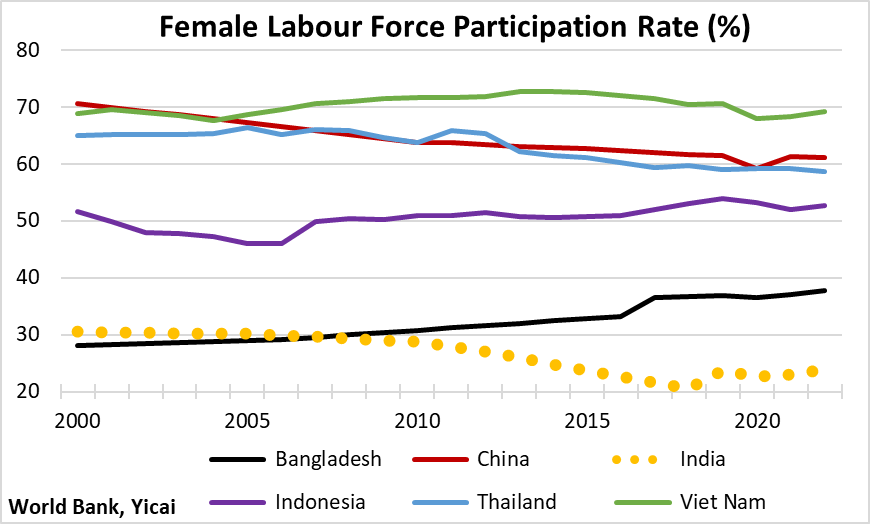

India’s female labour force participation rate is much lower than those of comparator countries (Figure 6). Moreover, it has fallen since the early 2000s despite strong economic growth and increases in female educational attainment. Social mores and a fear of violence are two factors that keep Indian women from working. This waste of human capital is clearly costly. The World Bank that India could increase its GDP growth rate by 1.5 percentage points if half of its women joined the labour force.

Figure 6

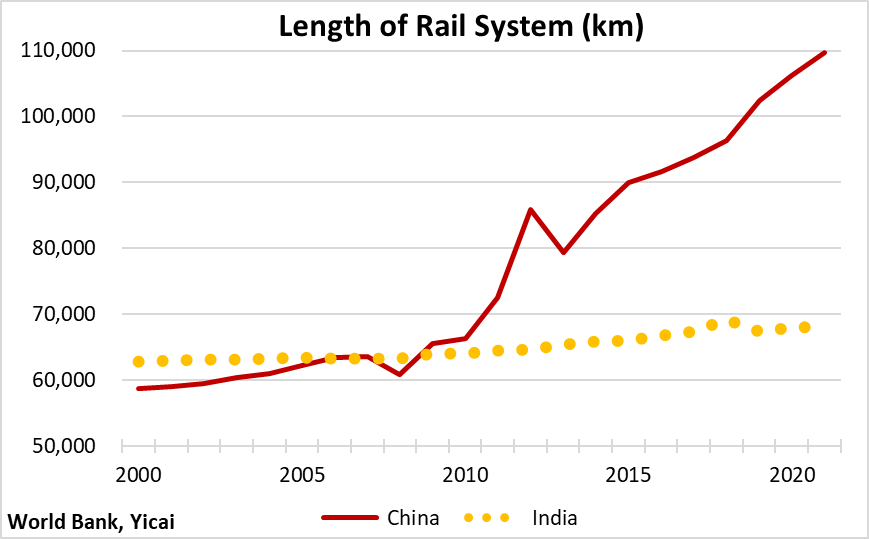

The World Bank India’s trade and transportation infrastructure as lying between Thailand’s and Viet Nam’s and far behind China’s. Comparing India’s rail system with China’s is instructive. Until the mid-2000s, the two countries’ networks were roughly the same size. Subsequently, China invested heavily in rail infrastructure and it now has 60 percent more track (Figure 7). This allows China to significantly more freight over a longer distance than India: 3,018 vs. 719 billion ton-km.

A recent article by notes that China’s high-speed rail network supports speeds of up to 350 km/hour while the top speed of India’s fastest passenger train is only 128 km/hour. Thus, the 1880 km trip from Beijing to Guangzhou takes 7 hours and 38 minutes while the 1778 km trip between Meerut and Chennai takes 39 hours and 15 minutes.

Figure 7

To summarize, it does not appear that India will be the next China, in terms of market opportunity or production prowess, in the medium term. Indeed, rather than fearing its rise, China should seek out opportunities to participate in labour-rich India’s development to accelerate the realization of its own comparative advantage.