Five Percent GDP Growth Within Sight

Five Percent GDP Growth Within Sight(Yicai) Dec. 23 -- The November data released by the National Bureau of Statistics suggest that China’s economy rebounded significantly in the fourth quarter and it is on track to meet the 5 percent target set by the authorities.

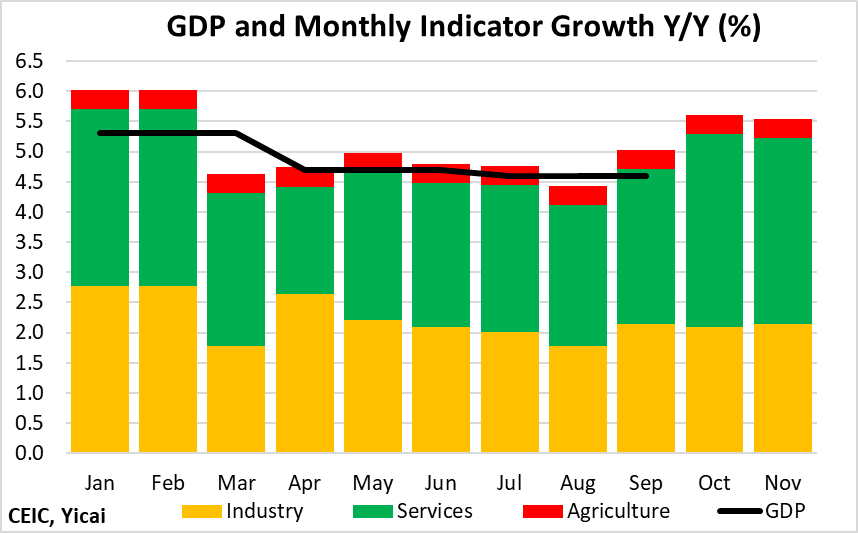

Our monthly indicator attempts to provide a broad measure of economic activity and a short-term assessment of GDP growth. It averages the growth of industrial value added, service production and the agricultural sector.

Our indicator suggests that economic activity grew more rapidly in October and November compared to the rates recorded in the third quarter (Figure 1). Most of this acceleration came from the service sector, which grew by 6.2 percent year-over-year in October-November, up from 4.8 percent in Q3. The growth of industrial value added also accelerated by a modest 0.4 percentage points. In sum, our indicator averaged 5.6 percent over October-November, compared to 4.7 percent in Q3.

Figure 1

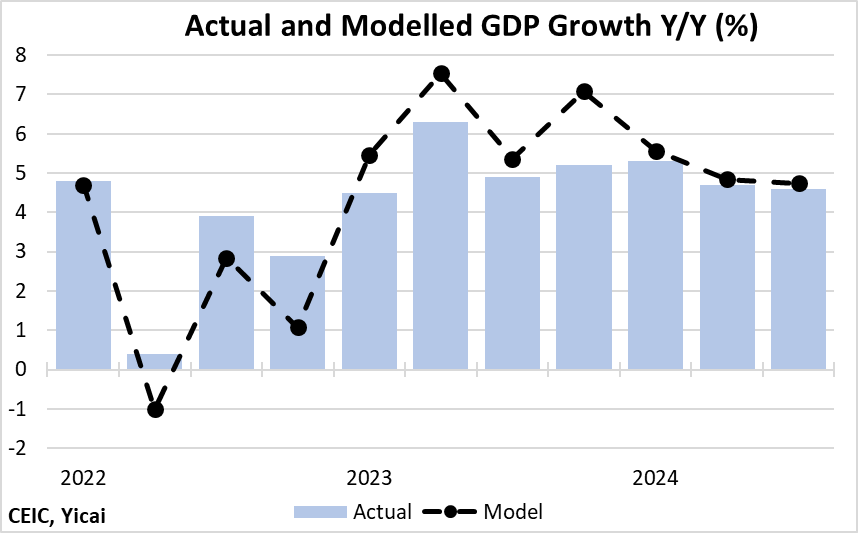

No model is perfect. Our monthly indicator makes relatively large errors when GDP growth is faster or slower than average – it tends to predict more variation than reported in the actual GDP data. However, it does a pretty good job when GDP grows at a moderate rate. This year, for example, the model has been only slightly over-optimistic. On average, for the first three quarters, GDP growth was just 0.2 percentage points slower than predicted (Figure 2).

Figure 2

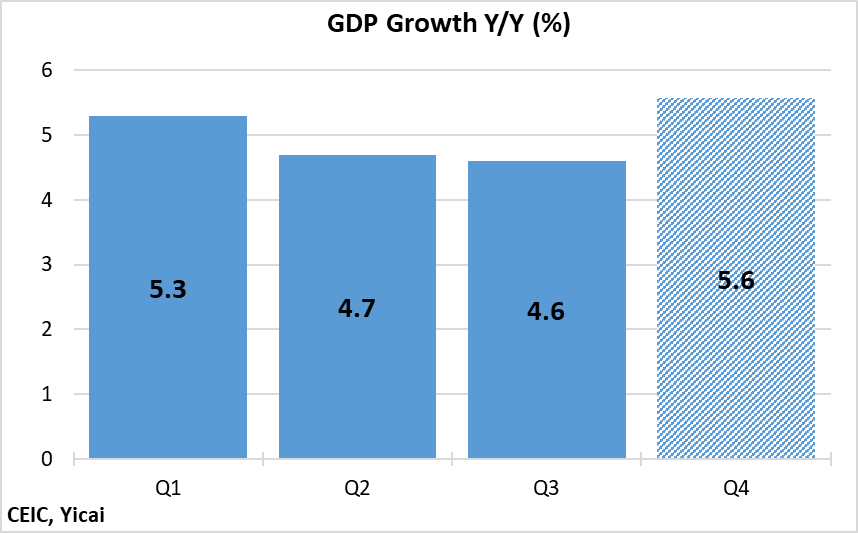

If December’s economic activity comes in close to the model’s October-November average, then our indicator predicts that GDP will grow by 5.6 percent in Q4. This would be a percentage point faster than the actual outturn in Q3. For the year, growth would average 5 percent.

Figure 3

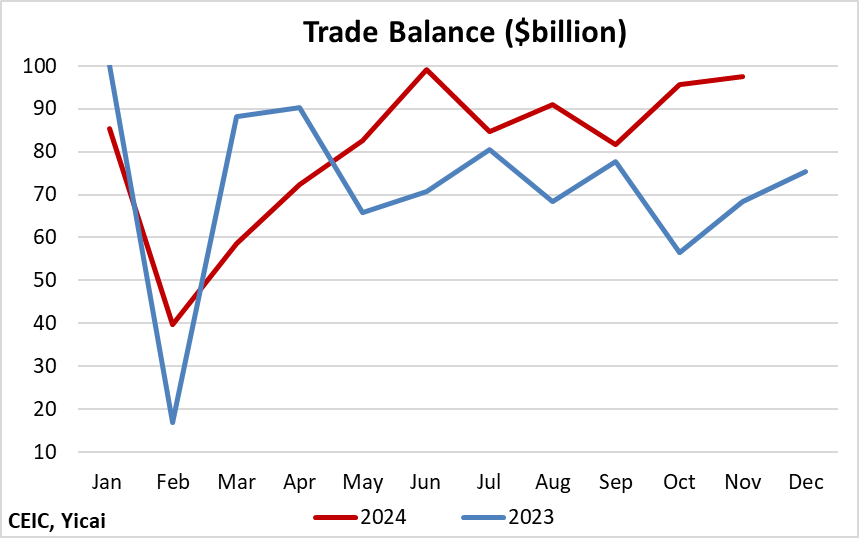

Net exports have made large contributions to GDP growth all year long. The monthly data on merchandise trade suggest that their contribution could increase further in Q4. Relative to last year, the trade balance in October-November increased markedly (Figure 3). Moreover, indications are that December will be another strong month for exports.

Figure 4

What about domestic demand?

We have already pointed to the acceleration in service production. Most of the services China produces are consumed domestically.

The property market remains a drag on investment. In addition, infrastructure investment has slowed somewhat in the second half of the year as government finances are squeezed. However, investment in manufacturing has been particularly robust, growing at more than 9 percent year-over-year. This is much more rapid than the 6 percent recorded, on average, over 2018-19. Since investment in manufacturing typically pays off in terms of productivity increases, this is certainly a bright spot.

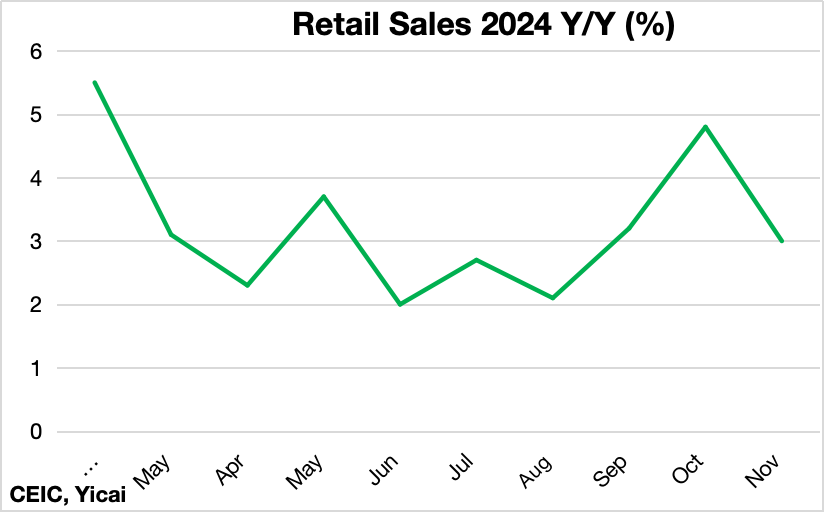

Much of the media coverage of the November data focused on the weakness in retail sales. The November reading came in at 3.0 percent year-over-year, below the 4.8 percent increase in October and the 4.6 percent analysts predicted (Figure 4).

Figure 5

One problem with the retail sales data is that they are nominal and do a bad job of representing the volume of purchases when there are large price changes.

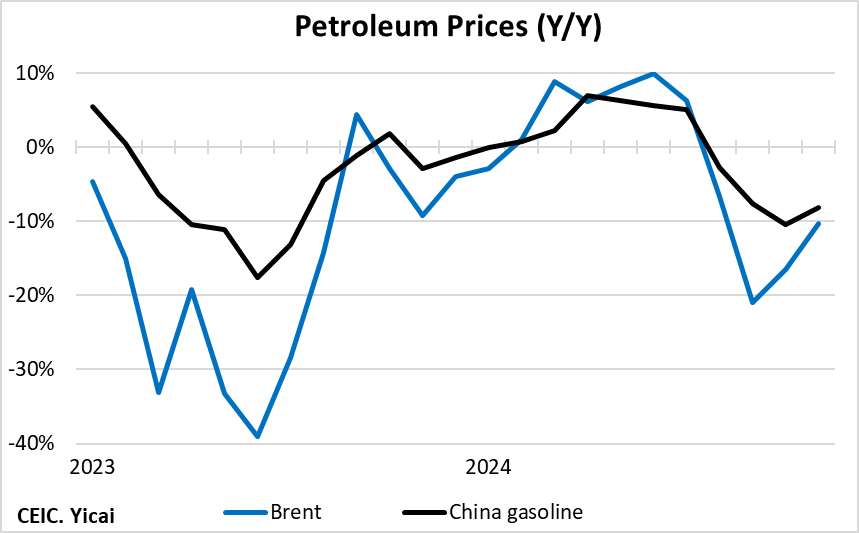

Take gasoline prices, for example. The data from large retail enterprises indicate that purchases of petroleum products account for some 14 percent of their overall sales. Year-to-November purchases of petroleum products are up a modest 3 percent in nominal terms. But, as the price of crude oil has fallen in global markets, the amount Chinese consumers pay to fill up has also declined (Figure 5). Indeed, the retail price of petroleum fell by 9 percent, year-over-year in October-November, significantly understating the amount of petroleum products actually consumed.

Figure 6

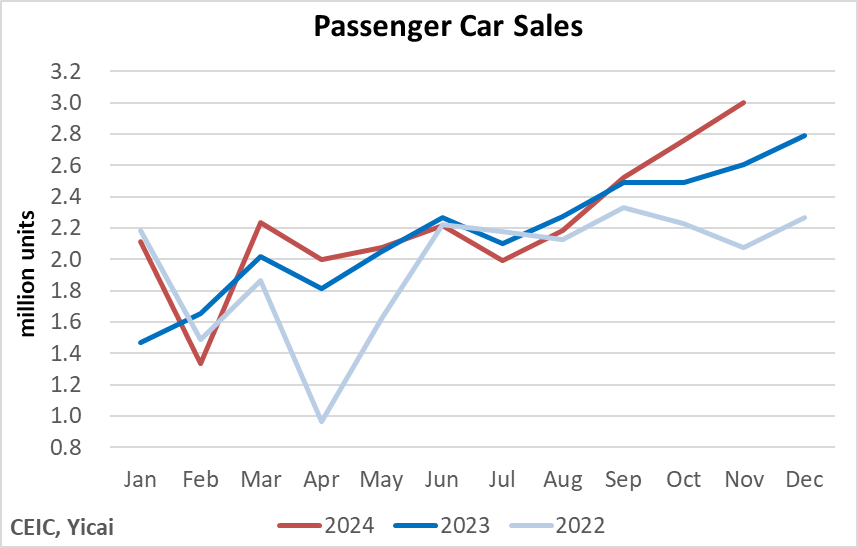

It is also instructive that sales of passenger cars – a big ticket item – remain strong. A record 3 million passenger cars were sold in November (Figure 6). Year-to-date, passenger car sales are 5 percent higher than last year and 15 percent higher than in 2022.

Figure 7

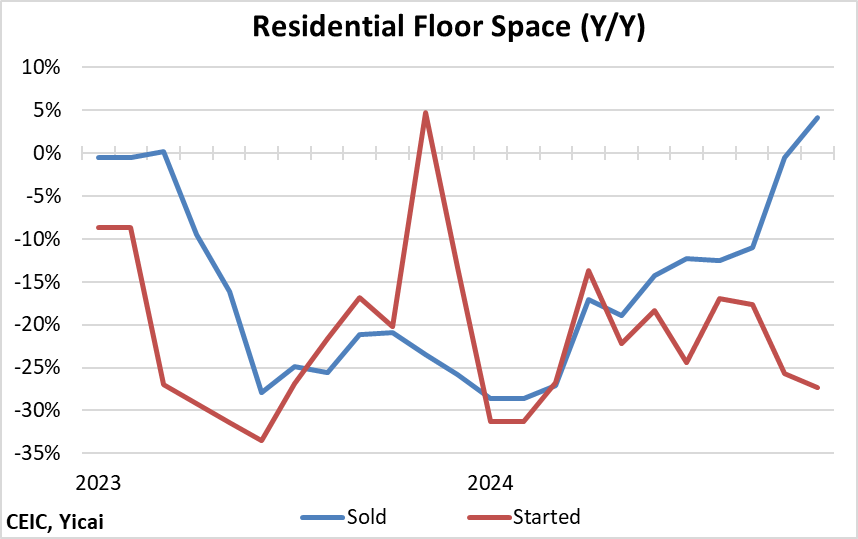

Perhaps the most important piece of good news about domestic demand came from the property sector. The volume of new home sales increased by 4 percent in November, continuing the recovery that started earlier this year (Figure 7). This modest monthly increase was the fastest since June 2021.

Because of a large inventory of unsold homes, the improvement in sales will not translate into more construction in the near term. Indeed, the volume of new home starts continues to fall precipitously. New homes typically lead to purchases of new appliances and furniture. Thus, the return of home-buyer confidence could still provide important support to domestic demand in 2025.

Figure 8

Next year is bound to be a challenging one for the economy, as the incoming Trump administration threatens to impose additional tariffs on China. To offset the weakness in the external environment, China needs to strengthen its domestic demand. The authorities have already reoriented policy in this direction by promising to increase the fiscal deficit and implement a “moderately loose” monetary policy. Importantly, the economy’s ability to accelerate in Q4 and meet the 5 percent growth target will go a long way in reinforcing consumer and investor confidence and set the stage for more robust domestic spending.