Economy Rebounds but Further Acceleration Needed

Economy Rebounds but Further Acceleration Needed(Yicai Global) March 17 -- The National Bureau of Statistics’ (NBS) release of gives us our first glimpse of how quickly the economy might rebound in 2023. Last year, GDP only grew by 3 percent, as the authorities implemented policies to stop the spread of the pandemic. This year, the government is targeting growth of .

The NBS only reports GDP on a quarterly basis. It does not provide an interim monthly estimate. The NBS did tell us that industrial value added rose by 2.4 percent, year-over-year, in January-February and that its index of service production was up 5.5 percent.

The increase in industrial value added was disappointing. It had risen by 2.8 percent in the fourth quarter of 2022 and by 3.8 percent last year. However, the growth in service production was encouraging given that it had fallen by 0.1 percent last year and by 0.9 percent in the fourth quarter.

With these key indicators pointing in different directions, how should we think about GDP?

We can take industrial value added as a proxy for China’s industrial sector, which accounts for 39 percent of GDP. We can also take the service production index as a proxy for its service sector, which accounts for 54 percent of GDP. And we can assume that the agricultural sector, which accounts for 7 percent of GDP, grew at the same pace as in 2022Q4.

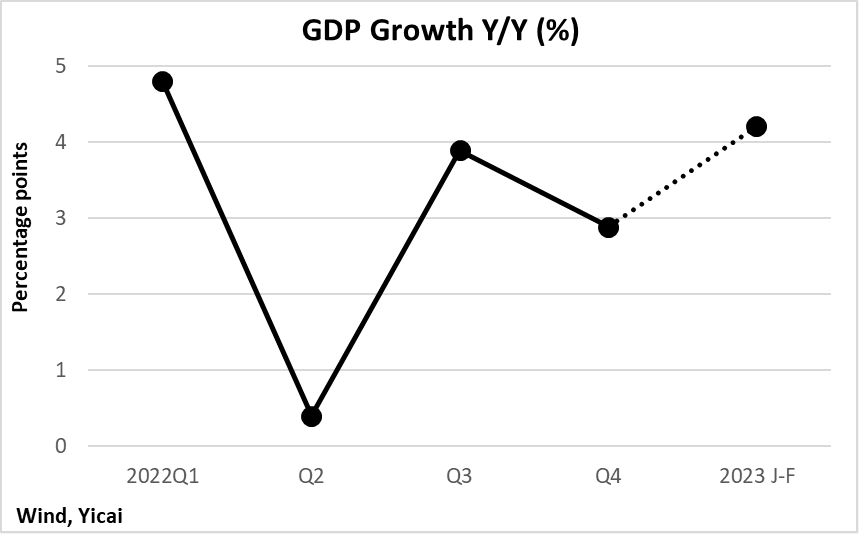

These three assumptions suggest that GDP growth in January-February was 4.2 percent, which would be faster than each of the last three quarters of 2022 (Figure 1). It, nevertheless, implies that the economy will have to grow faster to meet the government’s target.

Figure 1

The strong rebound of the service economy is palpable. Here in Shanghai, the malls are crowded. And when my wife and I go out to eat on Saturday evenings, we need to reserve a table or risk a very long wait to get seated.

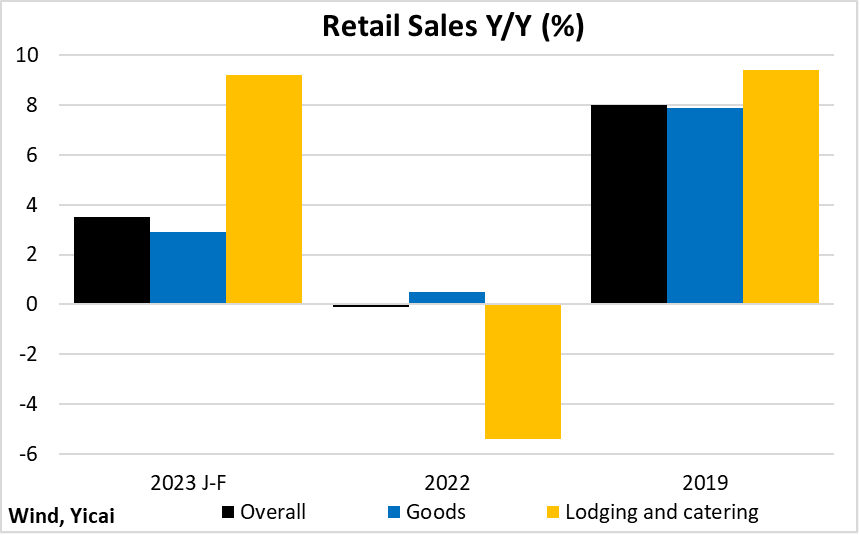

Last year, retail sales did not grow. This stagnation compares to 8 percent growth in 2019 before the pandemic hit. In the first two months of this year, retail sales were up 3.5 percent. In particular, lodging and catering sales returned to their pre-pandemic rates, while sales of goods remained subdued (Figure 2).

Figure 2

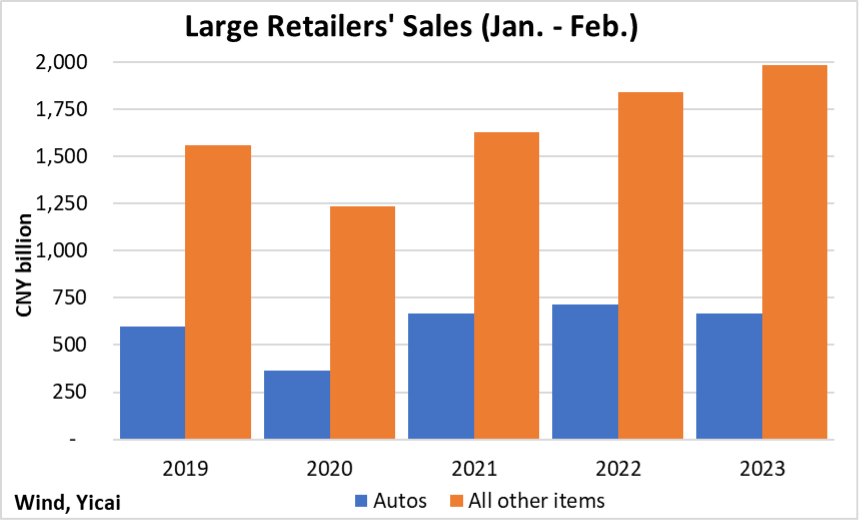

Much of the weakness in the goods market appears to be coming from the auto sector.

Car sales account for some 30 percent of large retailers’ business. In the first two months of the year, the value of auto sales at large retailers was down 6.5 percent year-over-year. These falling car sales stand in sharp contrast to the 7.8 percent increase in the rest of large retailers’ business (Figure 3).

Figure 3

The expiry of government subsidies on new energy vehicles appears to be one of the special factors depressing auto sales so far this year.

These subsidies were originally offered in 2010. They were seen as a way of supporting this cleaner form of transportation by offsetting some of the electric vehicles’ higher cost. Policymakers had planned to the subsidies in 2020, but they were retained, at reduced rates, in the aftermath of the dislocation caused by the pandemic. Last year, the amounted to RMB 12,600 ($1,836) for fully-electric cars and RMB 4,800 ($689) for plug-in hybrids. New energy vehicle prices from CNY100,000 to 300,000.

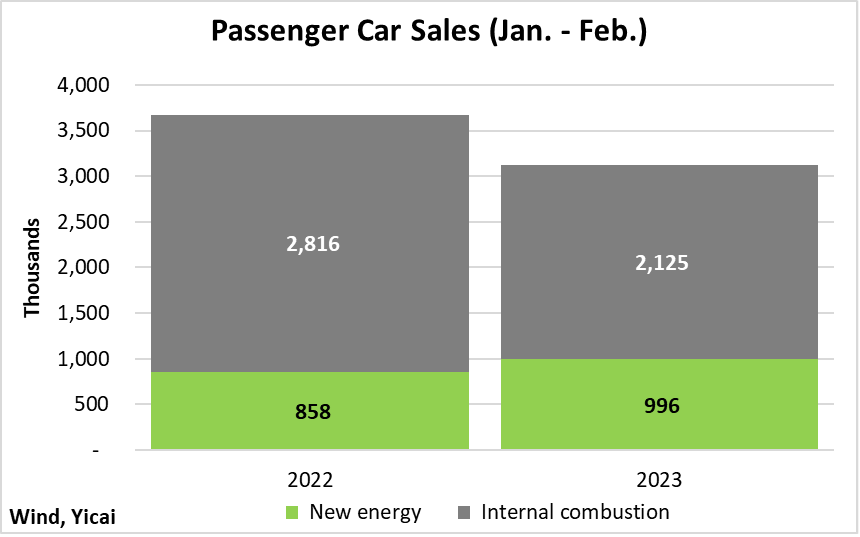

Notwithstanding the removal of the subsidies, new energy vehicle sales were up 16 percent year-over-year in January-February (Figure 4). While this seems like rapid growth, sales in 2022, as a whole, grew by 88 percent. Some of last year’s purchases could have been front-loaded, in anticipation of the end of the subsidies this year.

Sales of cars with internal combustion engines have been sluggish. They were down 8 percent in 2022. In the first two months of this year, they fell by 25 percent. This year’s deterioration may have been driven by automakers’ . While individual firms hope to spur sales by reducing prices, industry-wide discounting could lead prospective car buyers to postpone their purchases in anticipation of even better deals in the future.

Figure 4

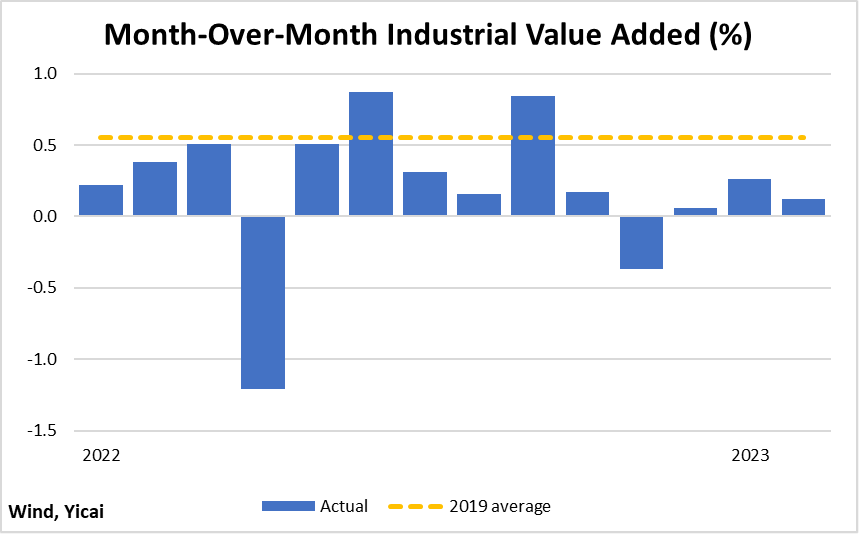

Weak auto sales, along with tepid exports, contributed to sluggish Chinese factory activity. The month-over-month growth rates of industrial value added in January and February were well below recent trends (Figure 5).

Figure 5

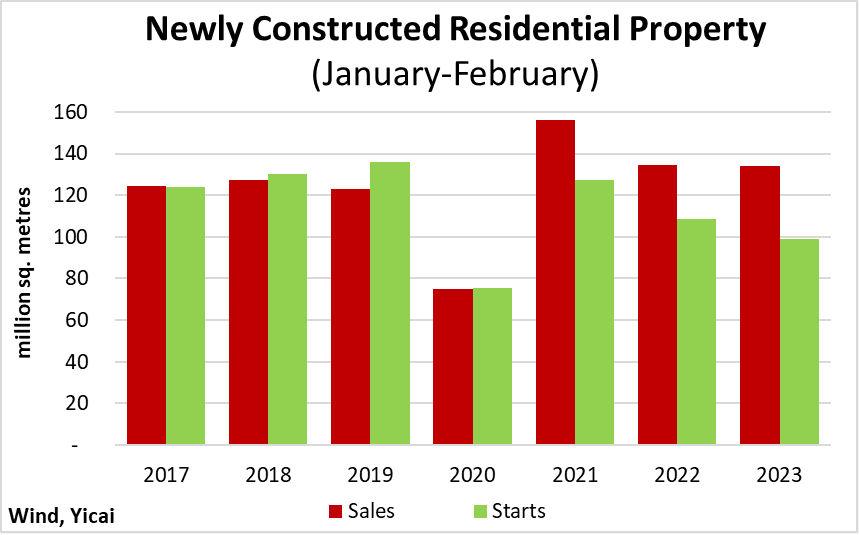

There are emerging signs that the property market is beginning to bottom out. The volume of new home sales dropped by 27 percent last year. Through the first two months of this year, sales are essentially unchanged from year-ago levels (Figure 6). However, housing starts, which fell by 40 percent last year, have continued to decline.

Figure 6

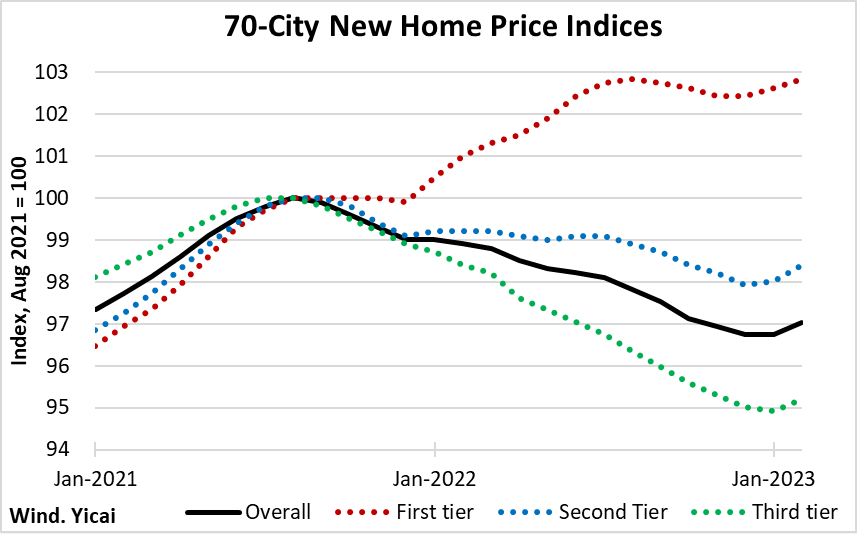

If demand holds up and supply keeps falling, we should see the kind of price increases that will put the market back on a more solid footing. In February, new home prices in second- and third-tier cities rose significantly, suggesting that this process may already be underway (Figure 7).

Figure 7

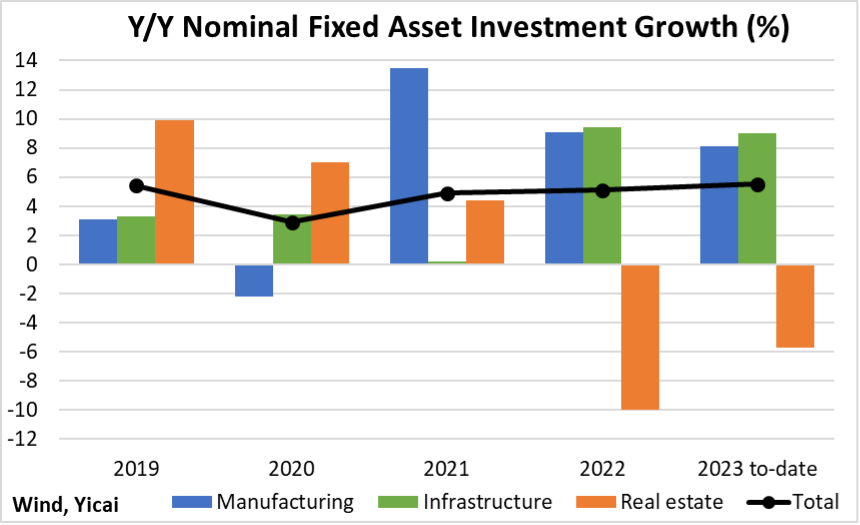

The ongoing weakness in the property sector makes the composition of fixed asset investment, so far this year, look a lot like 2022’s. Investment in real estate development continues to fall, albeit at a reduced pace. Its weakness is more than offset by robust spending on manufacturing and infrastructure (Figure 8). Overall, fixed asset investment expanded by 5.5 percent, year-over-year, in January-February, slightly faster than the 5.1 percent recorded last year.

Figure 8

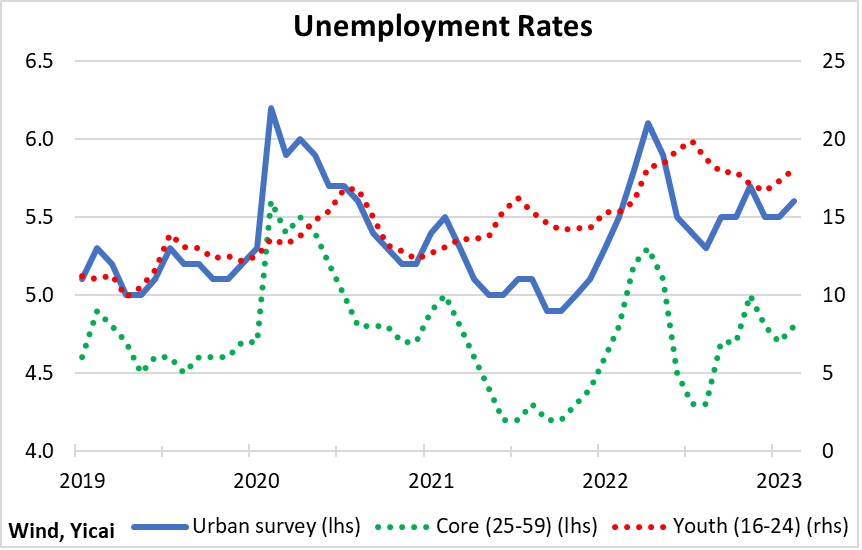

In February, the urban unemployment rate ticked up to 5.6 percent (Figure 9). Outgoing Prime Minister Li Keqiang, in his to the National People’s Congress, announced a target for the unemployment rate of “around 5.5 percent”. This implies that the government is likely satisfied with current labour market conditions.

Figure 9

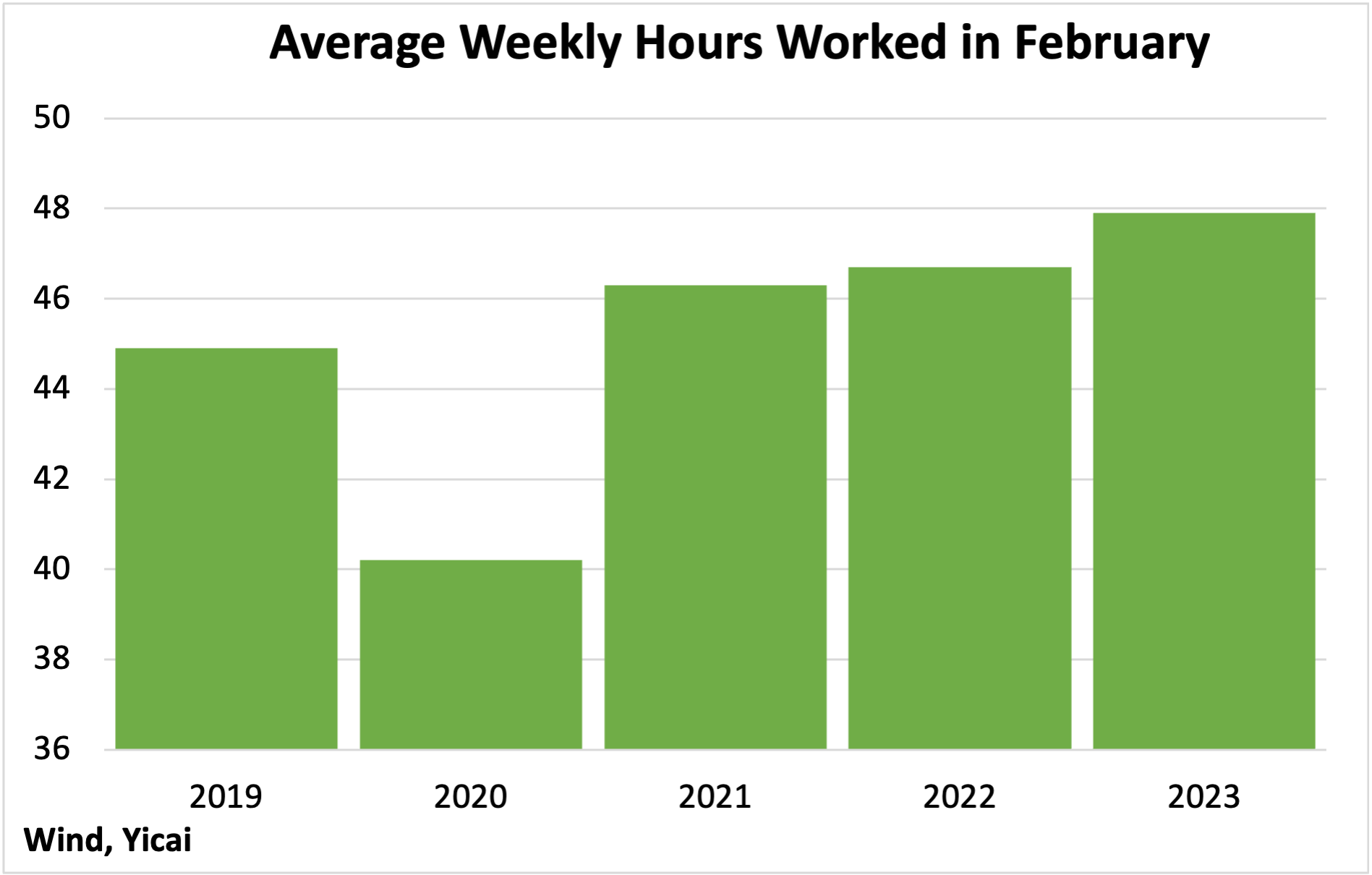

It appears that employers are working their staff harder rather than hiring more workers. Thus, the relatively elevated hours worked in February suggests that unemployment could fall further as the recovery takes hold (Figure 10).

Figure 10

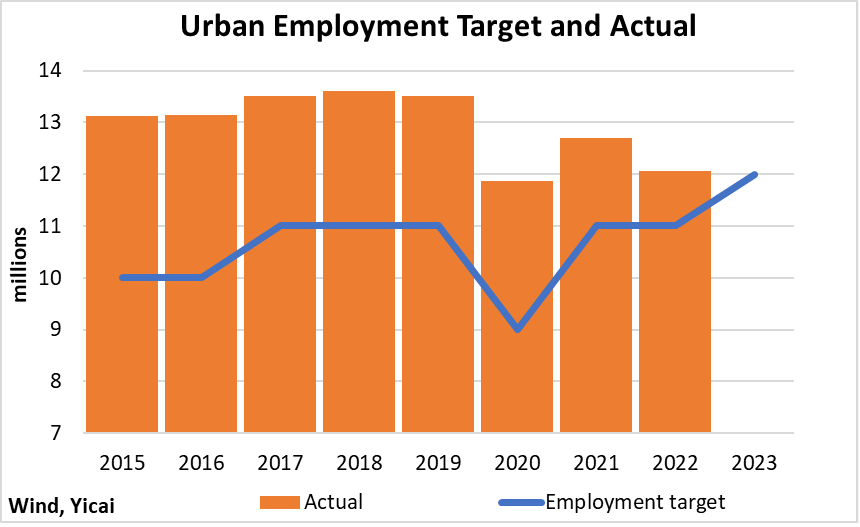

The Work Report also targeted the creation of 12 million new jobs in the formal urban labour market.

This is slightly more ambitious than last year’s target of 11 million workers. Indeed, this year’s job creation target is the highest the government has ever set. The economy typically creates more than the targeted number of jobs (Figure 11). Nevertheless, with the labour force shrinking, a higher job creation target is a sign of policymakers’ optimism about the economy’s prospects.

Figure 11

We are still very early in the year and China faces both internal and external risks. But, the risk that preoccupied us most over the last three years – Covid – appears to have been resolved. The rebound in the service sector and the potential bottoming out of the real estate market are two important pieces of good news. Let’s hope they form the basis for an acceleration of GDP growth over the rest of the year.