Yicai Big Data Project Ranks China’s Cities for Business Attractiveness

Yicai Big Data Project Ranks China’s Cities for Business Attractiveness(Yicai Global) May 27 -- Last year was exceptionally challenging for cities worldwide. The huge size of modern cities and their close interconnections allowed the Covid-19 pandemic to spread rapidly. But only cities could repel the virus in an organized way and find a systematic solution, recalling one of the reasons why they were built in the first place: to help resist foreign invasion.

We were almost entirely deprived of normal city life. Now we see urban areas returning to normal in terms of their social life, commerce and culture. Their fundamental strengths are driving the recovery from last year’s low ebb.

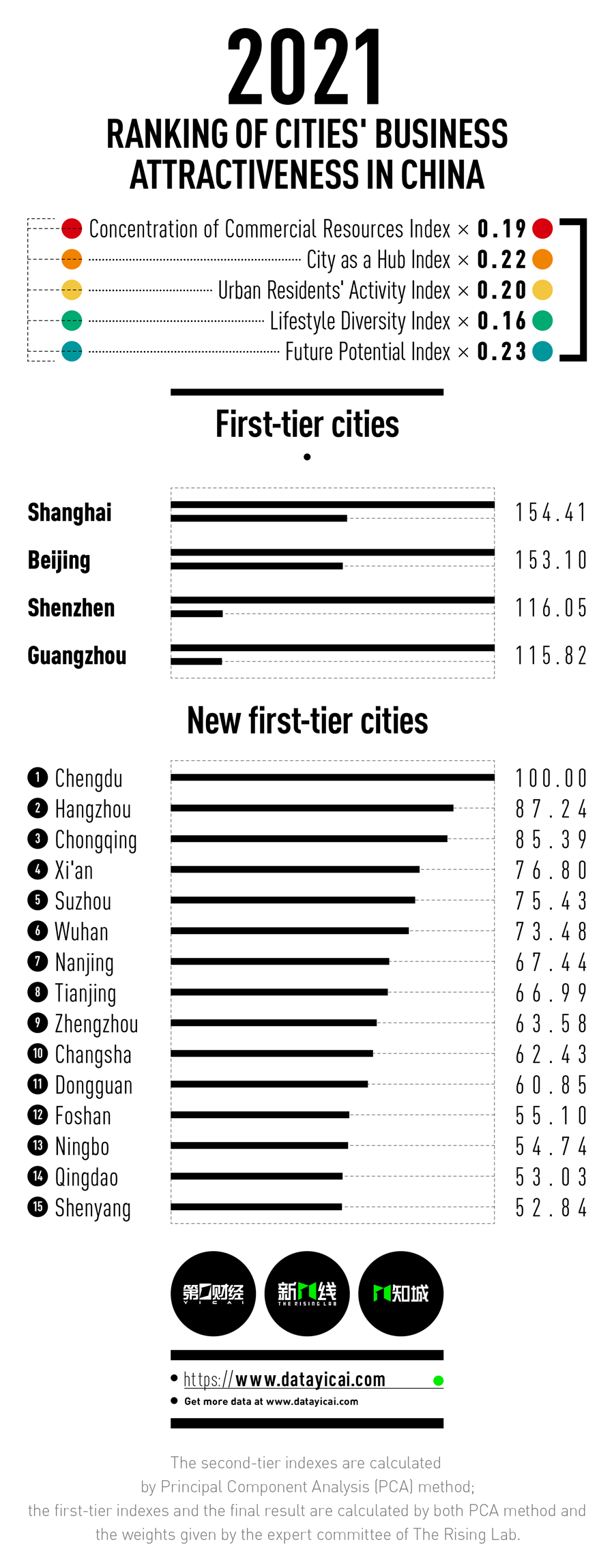

The Rising Lab, a big data project of Yicai Media Group, the owner of Yicai Global, has assessed the business attractiveness of 337 Chinese cities at the prefectural level and above to compile the Ranking of Cities’ Business Attractiveness for the sixth consecutive year.

The rankings look at the concentration of commercial resources, connectivity, urban residents' activity, diversity of lifestyle, and future potential based on commercial data from 170 major consumer brands, user behavior data from 17 leading internet firms, and urban big data.

The rankings look at the concentration of commercial resources, connectivity, urban residents' activity, diversity of lifestyle, and future potential based on commercial data from 170 major consumer brands, user behavior data from 17 leading internet firms, and urban big data.

Chengdu, Hangzhou, Chongqing, Xi’an, Suzhou, Wuhan, Nanjing, Tianjin, Zhengzhou, Changsha, Dongguan, Foshan, Ningbo, Qingdao and Shenyang are China's new emerging first-tier cities, per the rankings for 2021.

Shanghai, Beijing, Shenzhen and Guangzhou were also again ranked as first-tier cities, however in a different order which appeared shortly in 2018.

The task of all Chinese cities last year was to get back to running normally and revive their creativity amid infection prevention measures as well as sporadic coronavirus outbreaks. Based on the data, most cities achieved this task, including Wuhan, which shut down the longest. Wuhan slipped two places in the rankings, but was still among the emerging first-tier cities.

The rankings did not include any new cities, but Ningbo was back on the list this year after being left out in 2020.

China's list of emerging first-tier cities, in which 11 cities stayed six years in a row and 20 cities entered at least once, may not see any new names over the next few years as rivalry heats up amongst the aspirational second-tier cities.

Hefei, Kunming, and Wuxi, once on the list of emerging first-tier cities, fell back to now lead the group of second-tier cities. Cities that remain in the crowded transition zone need to explore their unique advantages over their peers, and make use of their urban appeal.

The biggest power within municipalities comes from their people. And it is people who benefit from their environments. First and foremost, cities should serve their residents before seeking to enlarge their regional influence.

This year, The Rising Lab fine-tuned its emerging first-tier city ranking. The list's data indicators are upgraded based on The Rising Lab's new knowledge of the areas. Meanwhile, the findings may offer some interesting ideas and solutions to second and third-tier cities, or even fourth and fifth-tier ones.

Some of the changes are forward-looking. For example, the indicator of Strategic Emerging Industries Advantage was added to the Future Potential dimension. The presence of these new and nimble industries may reflect these medium-sized cities' broader industrial innovation capacity.

The rising trend of live-streaming is also factored in. The level of acceptance of live-streaming e-commerce was included in the dimension of Urban Residents’ Activity. Cities with younger demographics are expected to adopt such new trends faster.

In the dimension of City as a Hub, two cargo indexes were added. Urban Freight Volume Index and Freight Intercity Connectivity Index should reflect how closely cities are linked through the flow of goods.

Urban areas require a balance of vitality, originating from their residents, and resource supply. But the usual misunderstanding is that as long as the resources are there, people will follow and move into big cities. Instead, a virtuous cycle always begins with a continuous increase of vitality.

It is time to return to the essence of urban hubs and their natural appeal. For all cities, what's important is to find a development vision that fits the conditions of the population, economic scale, history, and location, and to build resilience.

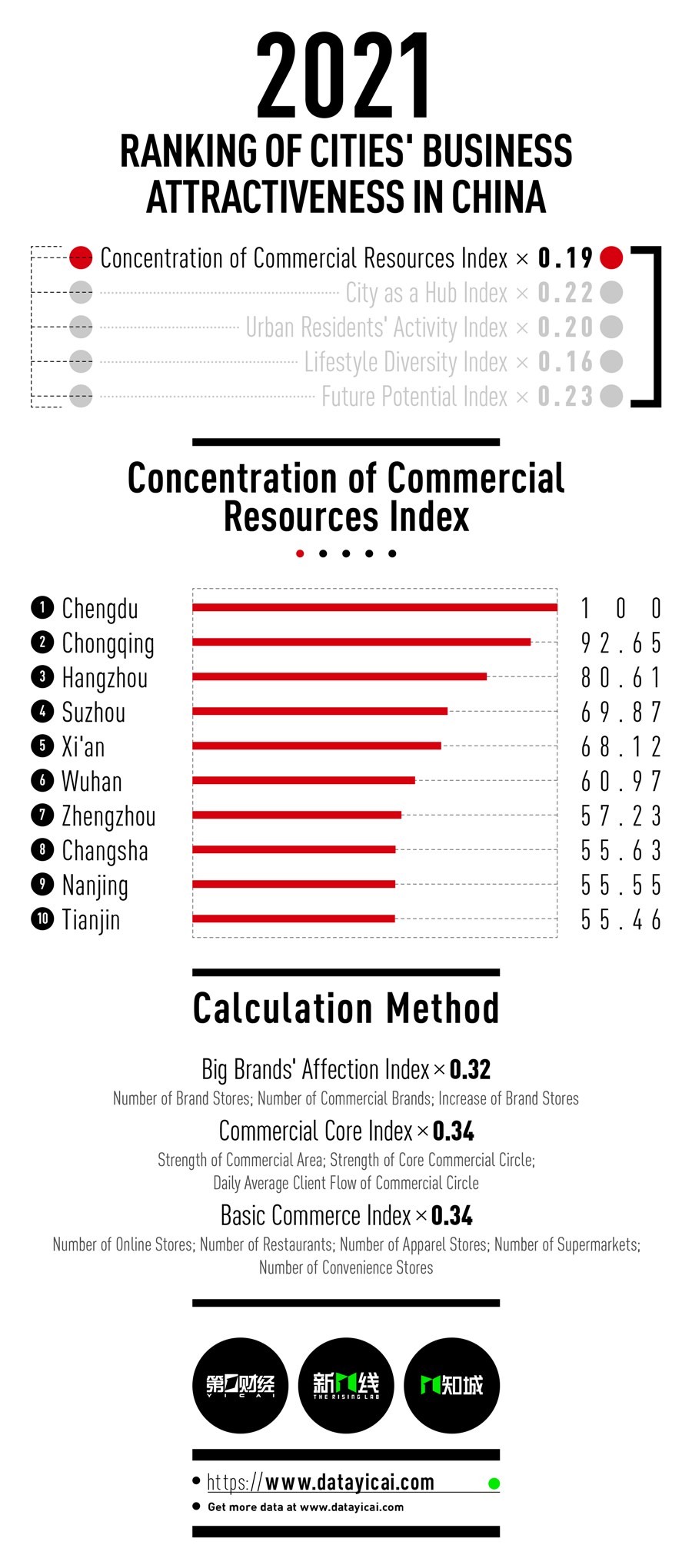

A. Concentration of Commercial Resources Index

Judging from the changes in commercial resources in Chinese cities last year, most brands will not immediately adjust their strategies because of some temporary hurdles. In the concentration of commercial resources, the major brand preference index and the commercial core index are still the preferred indicators to measure the commercial charm of a city.

External changes have not stopped the commercial resources concentration index to rise in some cities. Amongst the emerging first-tier cities, Zhengzhou logged the biggest jump in its position in this regard, as the east-central city moved to No. 11 this year from last year's No. 15.

Clients of luxury brands shifted consumption to domestic channels amid the international travel bans due to the Covid-19 pandemic. It follows that high-end brands have full confidence in Chinese cities. Premium make-up brands continued expanding into second and third-tier cities, and even the cautious jewelry brands were starting to place more stores in smaller cities.

These changes prove that the innovations of supply will not disappear so long as the demand exists. Evidently, in 2020, the number of catering outlets dropped by about 20,000 in each emerging first-tier city. But some cities, including Xiamen, Zhanjiang, and Jieyang, managed to add more eateries.

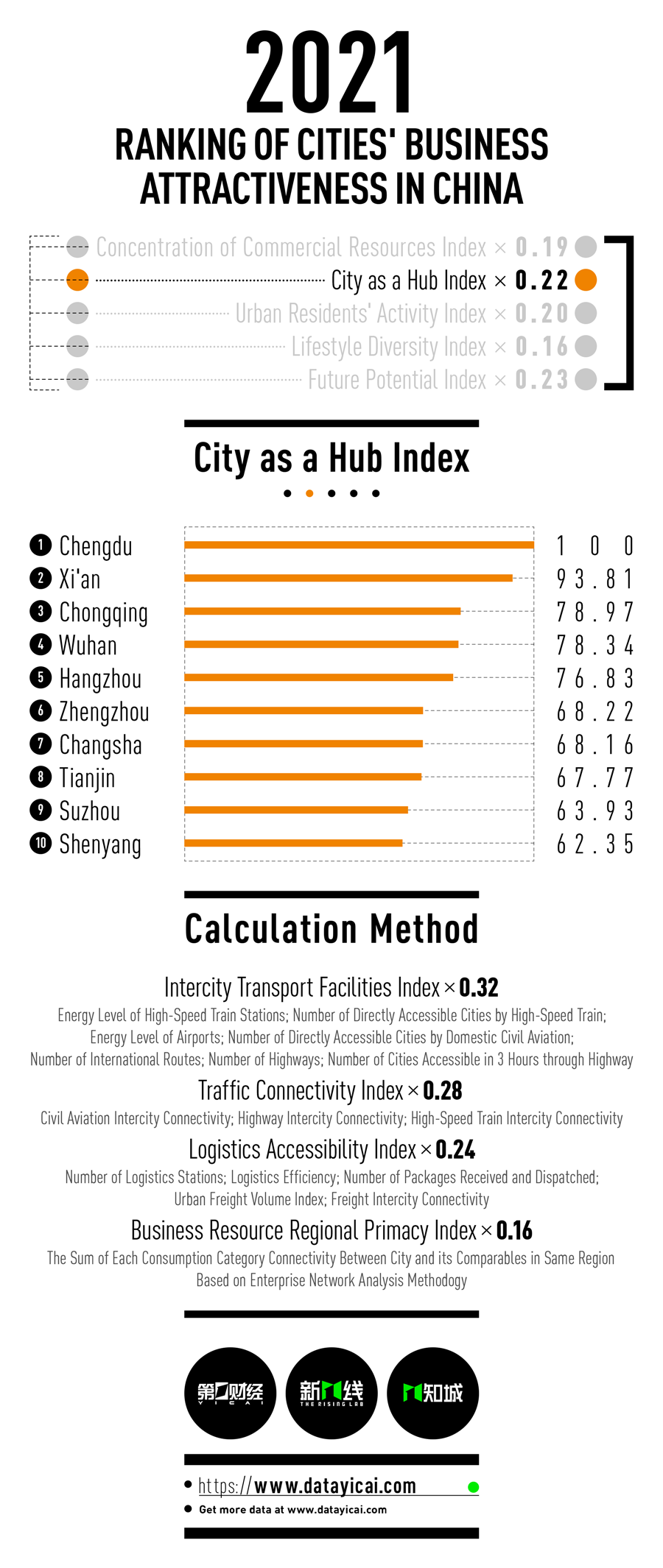

B. City as a Hub Index

City as a hub is an index that considers how important a city is in a network of others as China constructs more transport infrastructure even though the intercity transport capacity has not yet fully recovered.

Tapping into domestic potential has been the tourism sector's focus over the past year amid the strict control of the number of international flights. Hence, many Chinese cities are adding domestic flights faster than international ones. Zhengzhou, for example, raised its number of domestic routes by 32 percent last year.

High-speed railways are covering a bigger share of the nation's map. Eastern Jiangsu province basically finished the main part of its high-speed railway last year to integrate with the nationwide network, as well as to revitalize its central and northern areas that previously lacked efficient links to other regions in the Yangtze River Delta.

For the first time, The Rising Lab used data from G7 Networks, a Beijing-based Internet of Things platform, to enhance the way that intercity road cargo transport could be analyzed within the Logistics Accessibility Index. The data was utilized to create the two dimensions of urban freight volumes and intercity freight traffic links. Shandong province's Linyi ranked second in the Logistics Accessibility Index. The rising logistics hub made it to the list of second-tier cities for the first time this year.

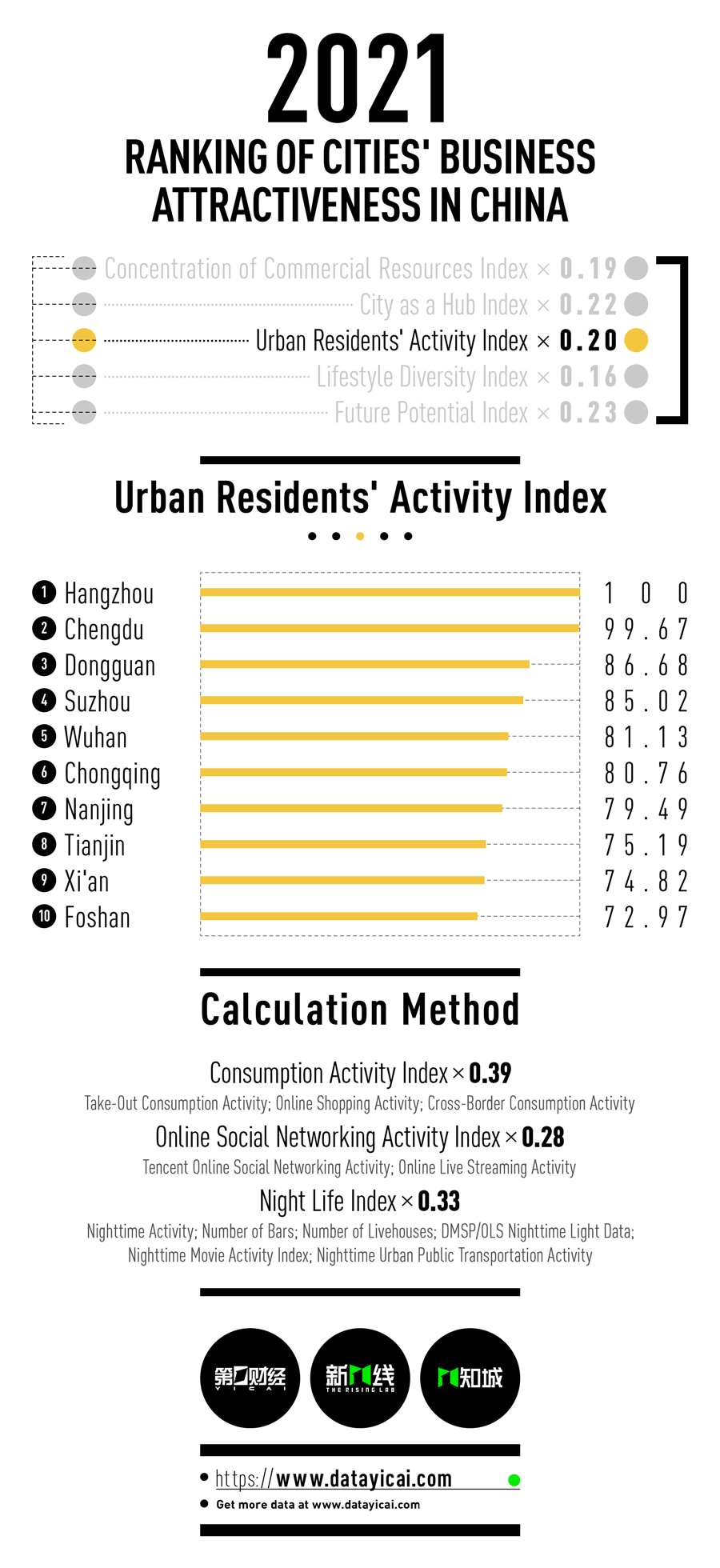

C. Urban Residents' Activity Index

Despite the Covid-19 pandemic, urban residents' needs for interaction, communication, consumption, and creation remain.

Despite the Covid-19 pandemic, urban residents' needs for interaction, communication, consumption, and creation remain.

Takeout, online shopping, and overseas e-commerce give some insights into residents' consumption behaviors. By the end of 2020, food delivery on Alibaba's Ele.me in big Chinese cities, including Shanghai and Hangzhou, recovered to the levels seen a year ago.

This year, the urban residents' activity index, which measures people's acceptance of new things, was expanded with the dimension of live-streaming.

The new live-streaming activity index, based on the number of live interactions and viewers on Alibaba's platforms, proved how people in China's first-tier and emerging first-tier cities are the most active followers of the new trend.

People in some other Chinese cities, including Kunming and Shijiazhuang, may watch these shows but not buy the advertised products. Meanwhile, those in Putian, Zhuhai, and Ningde tend to purchase products directly without paying attention to live-streaming.

The nightlife index reveals whether a city has truly come back to life. Last year, people in Beijing made 840,000 fewer outings late in the evening from 2019 as the capital city dealt with local outbreaks twice over the year. But Shanghai residents went out 920,000 times more at night in 2020.

Shanghai, Xi'an, Dali, and Chengdu were becoming increasingly nocturnal as the number of live performance venues grew the fastest in these cities. Beijing and Guangzhou added more pubs but southwestern China's Chengdu still logs the biggest number of bars amongst all even its number has dropped in 2020.

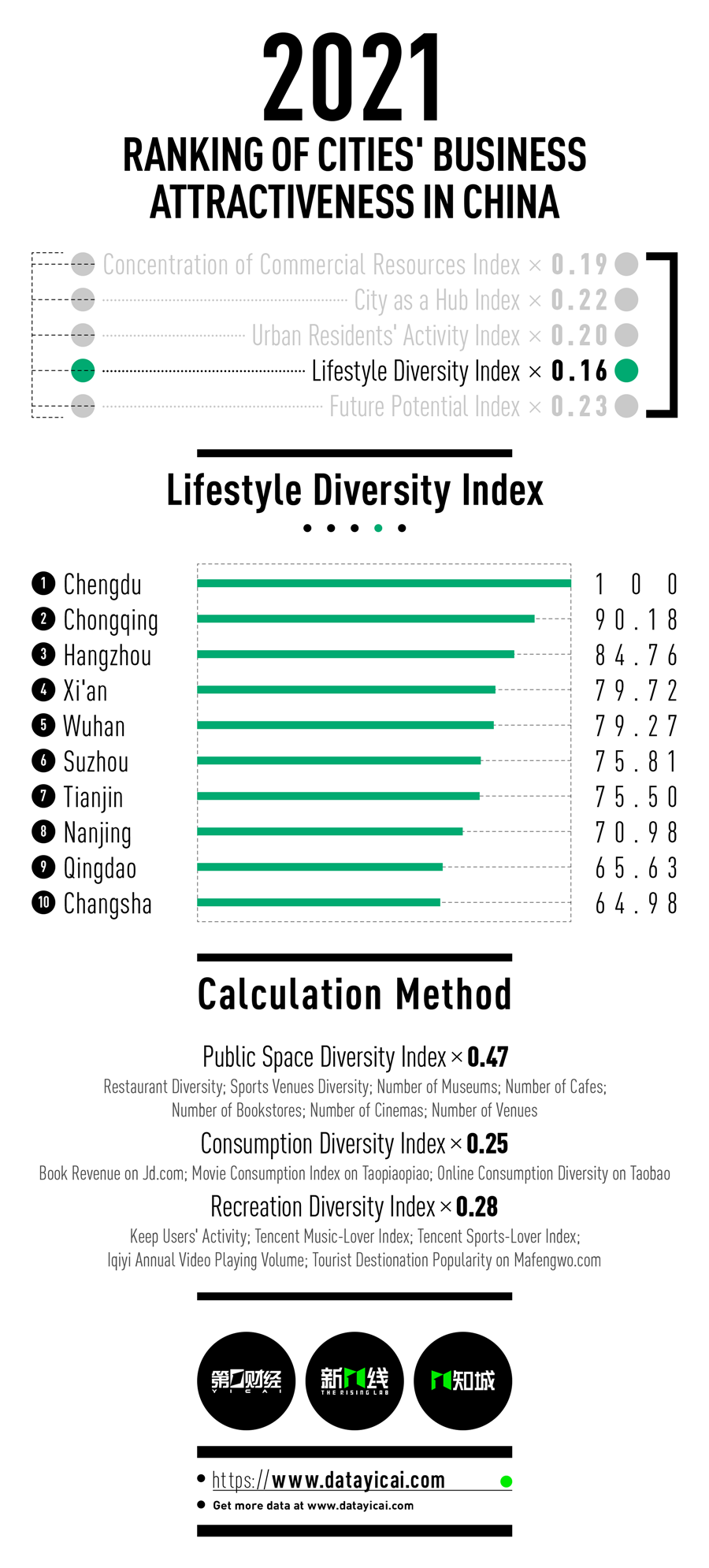

D. Lifestyle Diversity Index

The lifestyle diversity index, which reflects residents' leisure and consumption behaviors, shows how entertainment venues across China reacted to the Covid-19 pandemic in different ways.

The lifestyle diversity index, which reflects residents' leisure and consumption behaviors, shows how entertainment venues across China reacted to the Covid-19 pandemic in different ways.

Last year, China's box office slumped nearly 70 percent from 2019. In China's top 20 cities for cinemagoers, people spent 36 percent less on movie tickets.

Despite the outbreaks, Wuhan's movie theaters recovered quickly. The central Chinese city's box office reached almost CNY440 million (USD68.7 million), remaining No. 4 in the list of emerging first-tier cities in this regard.

Tourism was down. Travelers across China made 56 percent fewer trips to different destinations in 2020 from a year ago, according to tourism data website Mafengwo. Still, urban residents in 38 Chinese cities visited over 300 destinations over the year.

Exercise was on people's minds despite the social distancing measures. Residents of Tianjin, Zhengzhou, and Shijiazhuang were most keen to hold onto their exercise routines even when the epidemic forced many to stay home, according to fitness app Keep. Meanwhile, people in Chengdu, Hangzhou, and Xi'an were reading a lot of sports news, according to Tencent.

The index shows that despite the temporary limitations, as long as people have creative options, lifestyles in Chinese cities remain diverse.

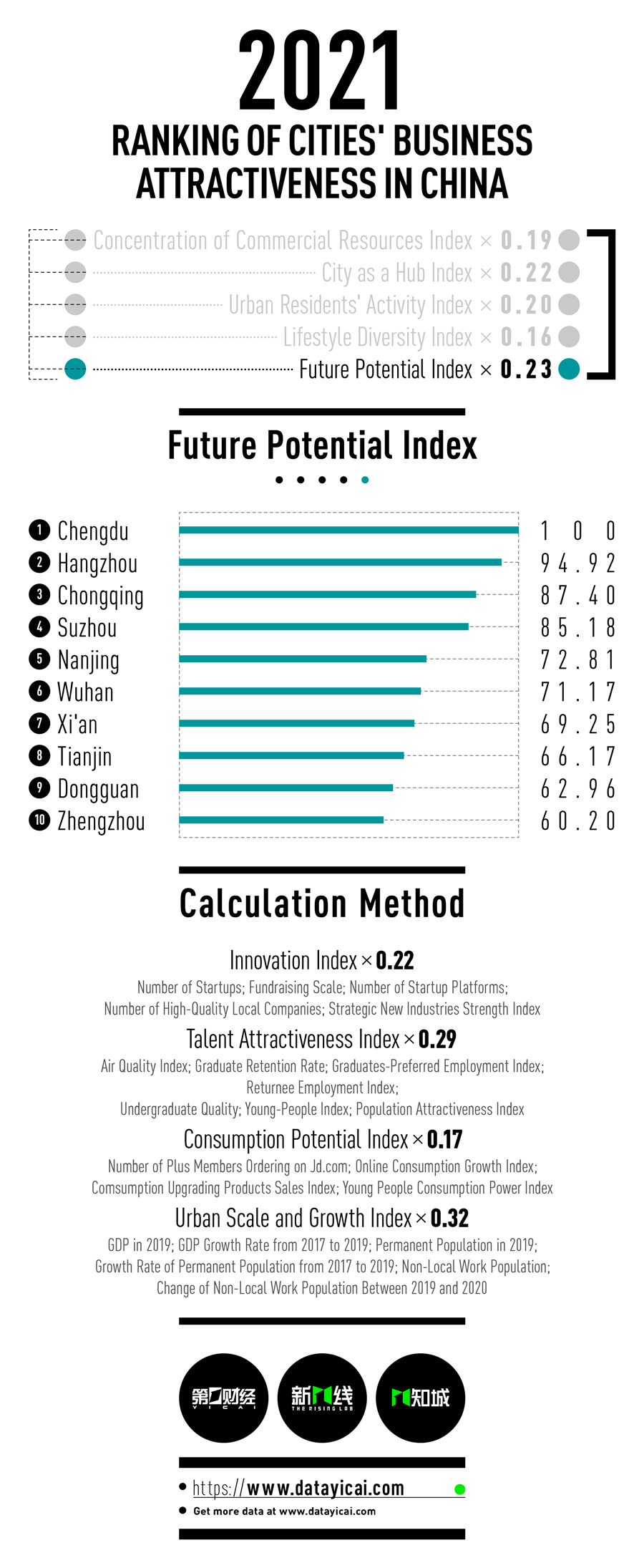

E. Future Potential Index

Only a handful of Chinese cities can attract startups and drive capital into urban innovation to form a virtuous cycle. For most cities, industrial innovation is easier to attain.

Only a handful of Chinese cities can attract startups and drive capital into urban innovation to form a virtuous cycle. For most cities, industrial innovation is easier to attain.

Still, a group of municipalities that have sizeable traditional industries is transforming. For example, the manufacturing hub of Taiyuan in northwestern Shanxi province has managed to double the number of high-tech enterprises, as well as small and medium-sized tech businesses, in 2020 from 2019.

The innovation index has a new contributor involving emerging industries. The dimension of strategic emerging industries advantage evaluates a city's capacity for industrial innovation and upgrading based on the number of different sectors and patents.

Some cities rise above others in certain fields. Wuxi has the biggest number of businesses in the fields of high-end equipment manufacturing, energy conservation and environmental protection, as well as new energy. Cangzhou has a focus on new materials. Anhui province's Hefei is home to many new infrastructure firms and Hebei's Shijiazhuang has a strong presence of Big Data healthcare companies.

Industrial strength can help attract migrants, including adolescents who can add to the city's community life and productivity in a broad sense.

The talent attractiveness index was widened with the dimension of new permanent residents to reflect this mobility. Huizhou, Jinhua, Wenzhou, Wuxi, Zhongshan, and Jiaxing are leading the way in gaining the largest numbers of new permanent residents amongst China's second and third-tier cities.