Xpeng Boss Says Only Eight Chinese EV Makers Will Survive by 2030

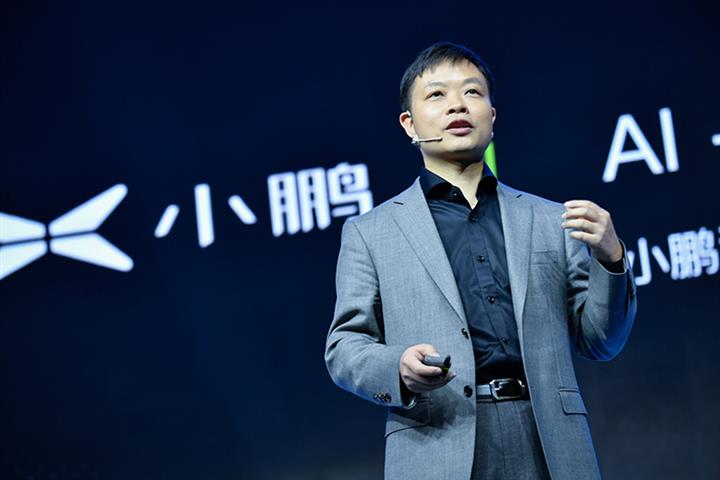

Xpeng Boss Says Only Eight Chinese EV Makers Will Survive by 2030(Yicai Global) April 19 -- Intensifying market competition will cut the number of new energy vehicle manufacturers in China to eight by 2030, according to He Xiaopeng, founder of Xpeng Motors.

The surviving companies will need to have annual sales of 3 million vehicles, He said at a press conference, and they must also have efficient research and development, balance their costs, and build up high-end experience.

At the Shanghai Auto Shanghai, which opened yesterday, Xpeng unveiled the G6, a pure electric sports utility vehicle that uses the company’s latest SEPA2.0 architecture. The model is expected to be launched in the middle of the year, but the price has not yet been announced.

In the past five years, Xpeng has invested more than CNY10 billion (USD1.5 billion) in the research and development of SEPA2.0, and will continue to invest more than CNY30 billion in the next five years to develop it further, said He, who is also the Guangzhou-based carmaker’s chairman and chief executive.

As well as boosting R&D, Xpeng has also improved operational efficiency through management adjustment, with the R&D, production and supply chain departments reporting directly to He. Wang Fengying, Xpeng president who joined from Great Wall Motor at the beginning of this year, is responsible for product planning and the sales service system, Yicai Global reported recently.

Xpeng’s net loss last year widened 88 percent from 2021 to CNY9.1 billion (USD1.3 billion) due to higher R&D expenses and costs, according to its recently published annual earnings report. Its revenue rose 28 percent to CNY26.9 billion, and vehicle deliveries climbed 23 percent to 120,757 units.

Entering 2023, China’s new energy vehicle market slowed, and Xpeng underperformed, with first-quarter deliveries falling 47 percent from a year earlier to 18,230, lagging behind rivals Li Auto, which sold 52,584 cars, and Nio, which sold 31,041.

Editors: Dou Shicong, Tom Litting