US Ups Foreign Investment Review, Broadens CFIUS' Authority to Cover Minority Position Investments

US Ups Foreign Investment Review, Broadens CFIUS' Authority to Cover Minority Position Investments(Yicai Global) Oct. 30 -- The US government has been mulling reform of the US Committee on Foreign Investment -- known colloquially as CFIUS -- and is now set to go ahead with it.

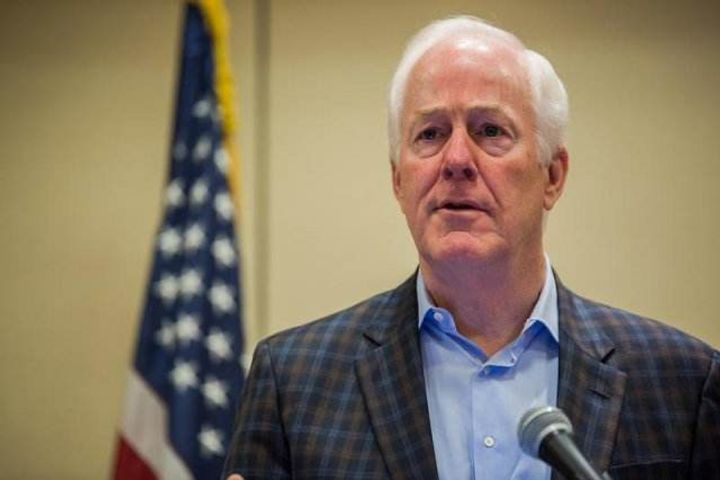

The CFIUS reform bill has been in the works for a long time and will soon issue, two senators, John Cornyn (R-Texas) and Robert Pittenger (R-North Carolina) confirmed.

Cornyn previously disclosed that the first reform of the national security watchdog since 2007 might land on the agenda by Nov. 1. The new legislation submitted to the congress seeks to ratchet up scrutiny of foreign investments by CFIUS, increasing the range of investment deals subject to review to encompass joint ventures and minority position investments, as well as real estate transactions on land adjacent to military bases. Lawmakers have eliminated the list of 'countries under scrutiny' from this version, however.

The legislation was spawned by concerns over business acquisitions by Chinese companies in the US, Cornyn said. He talked about the threat Chinese investors pose to America's national security and how the CFIUS review process should improve at a Senate Banking Committee hearing last month centered on CFIUS reform.

Acquisitions by Chinese enterprises undermines the US' comparative advantages and industrial infrastructure, he suggested. He called for four reforms of the foreign investment committee: the committee's authority should be broadened to cover deals such as intellectual property transfers, regardless of whether the deals involve a change in company ownership. CFIUS should be allowed to review real estate transactions. A list of 'countries under scrutiny' should be drafted, and special transaction requirements should be imposed on sensitive technologies and on investors from 'countries under scrutiny.' The committee should further have the power to scrutinize joint-venture and minority position investment deals.

If the bill passes, even minority equity purchases and joint ventures involving foreign investors will be subject to review by CFIUS, the senator noted. Some foreign investors have entered the US market by setting up joint ventures, acquiring minority stakes or investing in startups where the investors' shareholdings are usually less than 10 percent, thus exempting them from CFIUS review. They may therefore have acquired sensitive technologies by circumventing the regulatory measures.

The bill may come up for debate next week.

The numbers of company acquisitions by Chinese investors in the US by CFIUS has reviewed or rejected has continued to increase each year since 2007, and the number of reviewed cases as a percentage of the number of deals carried out rose from 1.56 percent in 2005 to 21.6 percent in 2013, a study of CFIUS' annual reports from 2001 to 2016 shows.