UAE’s Third-Largest Sovereign Wealth Fund Sets Up Office in Beijing

UAE’s Third-Largest Sovereign Wealth Fund Sets Up Office in Beijing(Yicai) Sept. 13 -- The third-largest sovereign wealth fund of the United Arab Emirates, which manages assets of USD276 billion, has reportedly set up an office in Beijing.

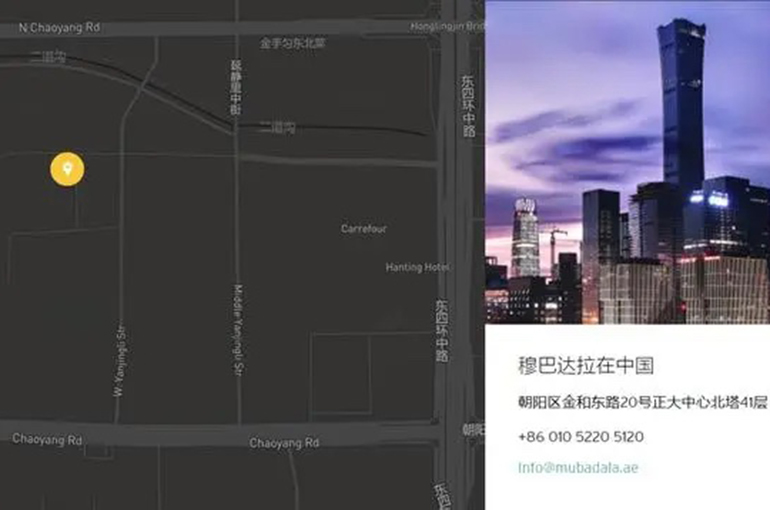

The Beijing office that opened last week is the sixth Mubadala Investment established outside of the UAE after those in New York, San Francisco, London, Moscow, and Rio de Janeiro. According to the fund’s official website, its China team has seven members, with Mohammad Abu Dalu in charge.

Mubadala entered the Chinese market in 2015. It co-invested USD10 billion with China Development Bank and the State Administration of Foreign Exchange to establish the China-Arab Fund to invest in Chinese business projects, the fund’s website also showed.

The first phase of the China-Arab Fund invested USD4 billion, with each party contributing half. Its investment direction was traditional energy, infrastructure construction, high-end manufacturing, clean energy, and other high-growth industries.

Mubadala reached an investment scale of USD500 million to USD2.5 billion in China, with targets including many well-known Chinese companies, such as short-video platform Kuaishou Technology, online recruitment platform Boss Zhipin, and new energy vehicle startup Xpeng Motors.

Mubadala has been very active in China since the beginning of the year. It participated in online budget retailer Shein’s USD2 billion fundraiser and led a USD300 million Series-B financing round of Chinese e-commerce giant JD.Com.

Middle Eastern sovereign funds have become increasingly popular in China this year.

The Abu Dhabi Investment Authority and Kuwait Investment Authority appeared in the list of the top 10 outstanding shareholders of 61 Chinese mainland-listed companies, according to their semiannual reports. The two largest sovereign wealth funds in the Middle East held a total of CNY13.7 billion (USD1.9 billion) worth of Chinese mainland-listed shares as of June 30.

Benefiting from Saudi Arabia’s Vision 2030 and the UAE’s Energy Strategy 2050, Middle Eastern capital is particularly fond of the new energy industry.

Nio, HiPhi, Enovate, CH-Auto Technology, and other Chinese EV startups have received investments from Middle Eastern funds this year. Moreover, Saudi Arabia co-founded a new electric vehicle brand Ceer Motors in cooperation with Foxconn last November, planning to build a 1 million square meter factory in the country.

Editor: Futura Costaglione