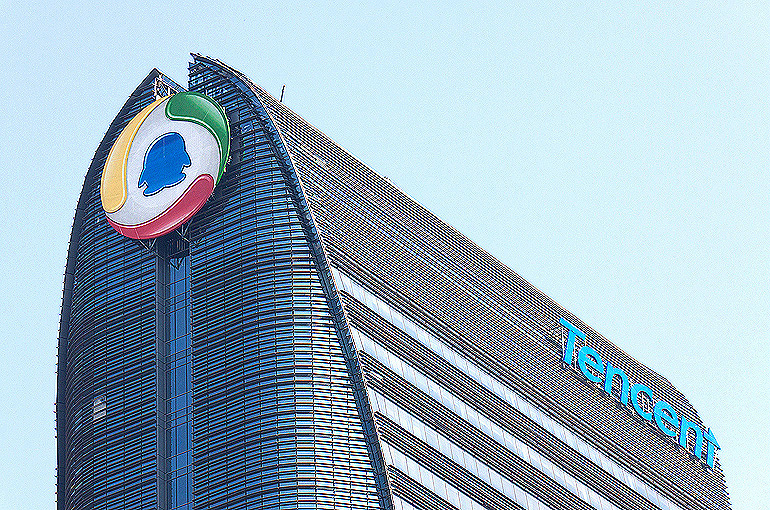

Tencent's Share Count Hits 10-Year Low After Buying Back 307 Million in 2024

Tencent's Share Count Hits 10-Year Low After Buying Back 307 Million in 2024(Yicai) Jan. 3 -- Chinese internet giant Tencent Holdings spent HKD112 billion (USD14.4 billion) on share buybacks and cancellations last year, reducing its total share capital to the most attractive level in a decade.

Tencent repurchased 307 million shares in 2024, bringing its share capital down to 9.2 billion shares, the lowest level since May 2014 when the company executed a 1:5 stock split, the Shenzhen-based firm announced today.

The gaming and social media giant fulfilled its March 2024 pledge to repurchase at least HKD100 billion of its stock, more than doubling the previous year's buyback scale.

Companies typically repurchase and cancel shares to trim their share capital, which increases earnings per share and enhances the stock's attractiveness to investors.

Tencent's expanded buyback program also aims to offset selling pressure from its largest shareholder, South African media giant Naspers. Through its wholly-owned subsidiary Prosus, Naspers has reduced its stake from 28.7 percent to below 24 percent since June 2022.

The buyback strategy has continued into this year. On the first trading day of the year, Tencent spent HKD701 million (USD90.1 million) to repurchase around 1.7 million shares, marking its 32nd consecutive trading day of share repurchases, according to data from the Hong Kong Stock Exchange.

Tencent [HKG: 0700] closed down 0.4 percent at HKD414.2 (USD53.30) today, with a market capitalization of around HKD3.8 trillion (USD488.6 billion). The company's share price rose 42 percent last year, breaking a three-year decline.

Editors: Dou Shicong, Emmi Laine