SinoHytec, Sino-Synergy’s Losses Widen in First Half as China’s Fuel Cell Sector Stutters

SinoHytec, Sino-Synergy’s Losses Widen in First Half as China’s Fuel Cell Sector Stutters(Yicai) Sept. 6 -- Beijing SinoHytec, one of China‘s leading fuel cell systems providers and technology developers, and Sino-Synergy Hydrogen Energy Technology Jiaxing, which supplies hydrogen fuel cell stacks and battery systems, both posted expanding losses in the first six months from a year earlier as China’s hydrogen-powered energy systems sector struggles to gain ground.

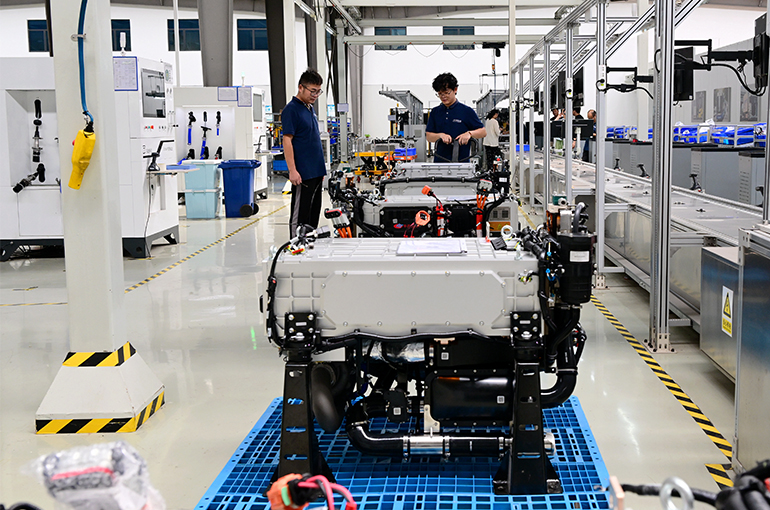

SinoHytec’s net losses widened 84.9 percent in the six months ended June 30 from the same period last year to CNY141 million (USD19.9 million), according to the semi-annual financial report of the company, whose products can be found in hydrogen-powered commercial vehicles such as buses, logistics vans, heavy-duty trucks.

Sino-Synergy’s losses expanded 70.8 percent over the period to CNY212 million, according to its interim report.

The price of products dropped more than the decrease in production costs, SinoHytec said. Interest payments are heavier due to its growing debt burden and it has also been negatively affected by exchange rate fluctuations.

Sino-Synergy’s poor performance was mainly due to weak sales as it takes time to bring its new production facility to full capacity, the Jiaxing-based company said in the report.

Other factors also weighed on performance including the failure to recover outstanding amounts owed, increased expenditure, negative operating cash flow, and the delay in receiving policy allowances, the two firms said.

SinoHytec’s account receivables surged 39.4 percent in the six months ended June 30 from a year earlier to CNY1.6 billion (USD225.8 million). This was 10 times its operating revenue over the period. While Sino-Synergy’s account receivables also amounted to CNY1.6 billion, 11 times its revenue.

Sino-Synergy’s expenses jumped 19.9 percent over the period. Expenditure on research and development surged 34.1 percent and that on administrative matters soared 30.8 percent.

Whether a fuel cell firm can stay afloat depends on whether it can raise enough funds to ensure adequate cashflow. "If SinoHytec is not able to effectively broaden its financing channels it might run out of cash," the company said in the report.

Many fuel cell firms see going public as a good way to raise funds, Tian Lihui, head of Nankai University’s Institute of Finance and Development, told Yicai. And those that are loss making usually opt for the Hong Kong bourse, which is a more inclusive market.

SinoHytec, which was the first Chinese hydrogen energy company to go public, has been hemorrhaging cash since it listed on the Shanghai Stock Exchange’s Nasdaq-style Star Market in 2020 and this has impacted its share price.

SinoHytec’s shares [SHA:688339] closed down 2 percent today at CNY20.70 (USD3). The stock has lost 84 percent of its value since hitting a record high of CNY127.02 (USD18) in August 2021.

Its Hong Kong-traded shares [HKG:2402] dipped 0.6 percent to close at HKD23.55 (USD3). The stock has lost 65 percent of its value since the company went public in Hong Kong in a secondary listing in January last year, becoming the first fuel cell firm to be listed on both the mainland and Hong Kong bourses.

Sino-Synergy’s stock price [HKG:9663] closed up 6.5 percent at HKD18.24 (USD2.34) in Hong Kong.

Editors: Tang Shihua, Kim Taylor