Silicon's Sliding Price Boosts China’s Solar Wafer, Panel Makers

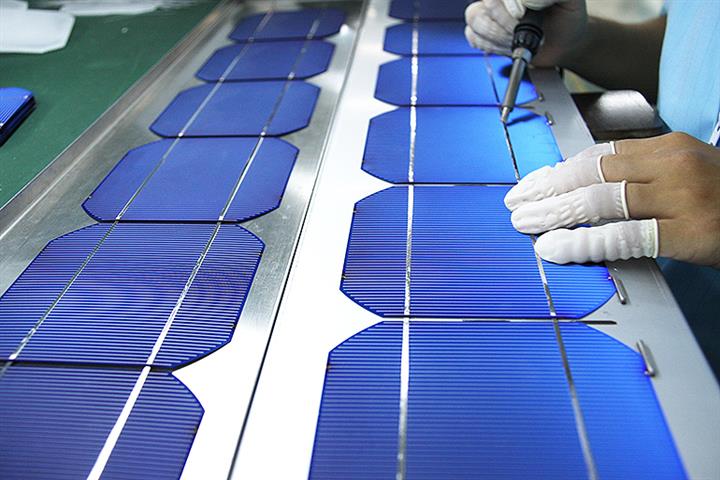

Silicon's Sliding Price Boosts China’s Solar Wafer, Panel Makers(Yicai Global) Dec. 13 -- The price of silicon, which is the key raw material used to make solar panels, has been tumbling in China in the last few months as more capacity comes online. The lower prices are taking the pressure off companies in the mid- and downstream of the industrial chain who are in turn lowering their prices.

"Last week we adjusted the purchase price of silicon in previously signed contracts with our suppliers," an executive at a solar wafer manufacturer told Yicai Global.

The average price of polysilicon has plunged nearly 13 percent since reaching a peak of CNY330 (USD47) per kilogram in the third quarter, according to industry data provider PV Infolink. Prices slumped 2.4 percent in the week ended Dec. 11 from the previous week to CNY288 per kg(USD41).

The sliding price of silicon is being passed onto businesses downstream. The average price of solar wafers of all sizes dipped between 0.7 percent and 2.6 percent in the week ended Dec. 11 from the week before, according to PV Infolink. The price of large 210-millimeter wafers dropped 2.6 percent, more than the fall in silicon prices over the same period.

It is a big turnaround from earlier in the year when wafer, battery and solar panel makers were battling with surging prices as demand for silicon outstripped supply. It meant that silicon producers were making a fortune, bagging 70 percent of the profits in the whole industrial chain. Wafer and battery manufacturers were able to stay profitable but PV panel makers’ margins were very thin.

As new capacity for silicon comes on the market there is likely to be a surplus next year, the executive said. Next year, price games in the PV industrial chain are likely to shift downstream from the silicon end, he added.

The downward spiral of silicon prices will not affect the bottom line of silicon suppliers, the executive said. "Large suppliers have mature technologies and their production costs are about CNY80 (USD11) to CNY90 per kg. So even if the price drops to CNY120 (USD17) per kg, they can still profit. It is just that their profit margins will no longer be as ridiculously high as they were this year," he added.

The supply shortage will ease significantly and will no longer be the main restricting factor on the industry, the executive said. The actual rate of decline in silicon prices depends on demand. But there is unlikely to be a collapse in silicon prices, as there should still be strong installation demand that will continue to support silicon prices.

However, not wanting to take any chances, silicon giants such as Tongwei are beginning to invest in downstream sectors. Chengdu, southwestern Sichuan province-based Tongwei said last night that it will invest CNY4 billion (USD570 million) to build a 25-gigawatt solar panel factory in Nantong, eastern Jiangsu province which should be ready by the end of next year.

Editors: Tang Shihua, Kim Taylor