Polysilicon Is Too Cheap for Chinese Producers to Make a Profit, Solar Industry Body Says

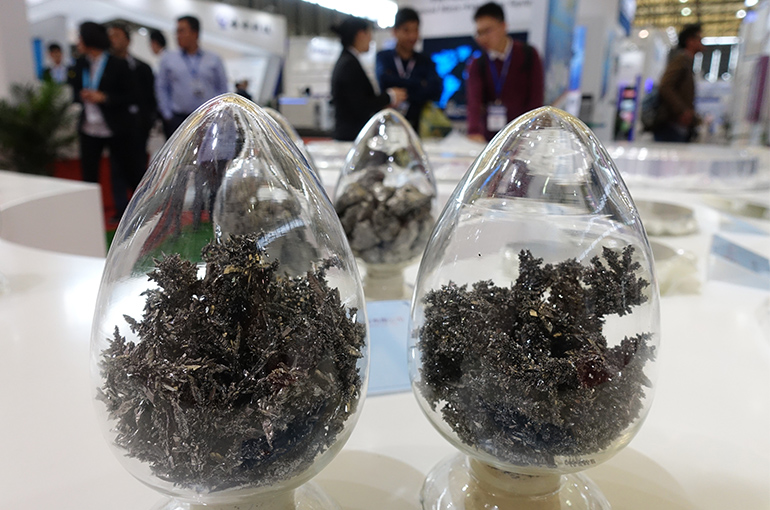

Polysilicon Is Too Cheap for Chinese Producers to Make a Profit, Solar Industry Body Says(Yicai) May 17 -- The price of high-purity polycrystalline silicon, the raw material used to make solar panels, has plunged below cost for all producers in China, according to an industry association.

The average price of N-type silicon, used to make more efficient solar panels, fell as low as CNY41,000 (USD5,670) per ton in the past week, while that of conventional P-type silicon slid as low as CNY34,000 per ton, both below production cost, the silicon industry branch of the China Nonferrous Metals Industry Association said in a report yesterday.

Over the past month, the average price for both types of silicon has tumbled by nearly 30 percent, the report said.

Squeezed profit margins mean even big players such as GLC Technology Holdings, Tongwei, and Daqo New Energy, which should have better cost controls than smaller firms, could be losing money at the moment. Last year, it cost Chengdu-based Tongwei just under CNY42,000 to make one ton of high-purity polysilicon, while smaller firms spent CNY50,000 to CNY60,000 to do the same.

The situation has forced some suppliers to halt production, according to the report. As of this week, five of 17 makers of polysilicon in China have cut output for maintenance and the remainder plan to do so. Most are reluctant to sell at current prices, risking higher inventories of old products.

As a result of dormant factories, supply will decline to some extent this month as the total production could fall to 180,000 tons, per the report. But since there are no signs of a rebound in silicon wafer prices, producers are not expected to increase their budgets to buy more raw ingredients.

Crashing Profit Margins

Silicon prices have been volatile in the past few years, as the market went from shortages to overcapacity. Prices peaked in 2022, surging to around CNY260,000 (USD35,980) per ton, but a rapid run-up in output held back further gains.

China's annual output of polysilicon soared almost 70 percent to 1.4 million tons last year, after increasing by about 64 percent in 2022, according to figures from the Ministry of Industry and Information Technology.

Soaring product prices in 2022 helped industry giant Tongwei more than triple its annual net profit for the year to CNY25.7 billion (USD3.6 billion), its earnings report showed. But as prices declined, profit sank 47 percent last year CNY13.6 billion last year.

In the first quarter of 2024, Tongwei skidded to a net loss of CNY787 million (USD108.9 million) and this quarter is expected to be even worse due to sliding prices.

Editors: Tang Shihua, Emmi Laine