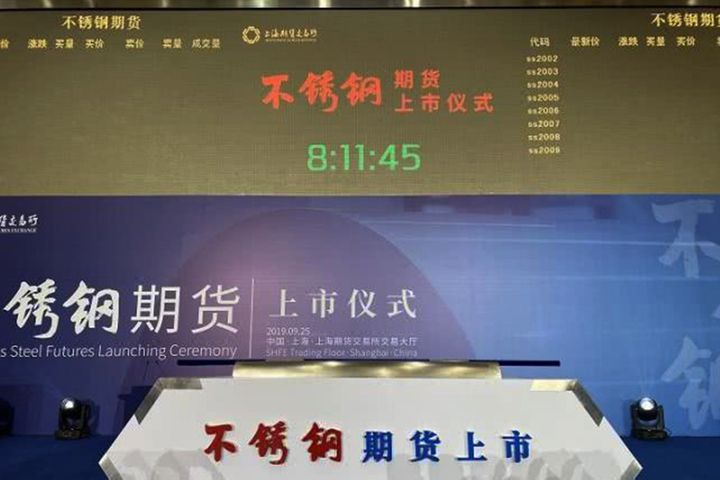

Shanghai Futures Exchange Kicks Off World's First Stainless Steel Futures Today

Shanghai Futures Exchange Kicks Off World's First Stainless Steel Futures Today(Yicai Global) Sept. 25 -- Shanghai Futures Exchange released the world's first stainless steel futures at 9.00 a.m. today. The benchmark price of the standard contracts was CNY15,585 (USD2,190) per ton, the SHFE announced yesterday.

The object of the contracts is the 304 stainless steel cold-rolled coil, since the 300-series stainless steel makes up in fact the majority of market trades, Shanghai-based Shenyin & Wanguo Futures said in introducing the new futures on its website.

China is not only the world's largest producer of stainless steel, but also its largest consumer. The nation uses 45 percent of its stainless steel in tableware and home appliances, 19 percent in the building and decoration industries, 16 percent in manufacturing, 12 percent in chemical energy, and 7 percent in transport.

Stainless steel production and trading companies were formerly only able to lock in raw material costs and finished product prices through listed futures, including re-bar, hot-rolled coil, nickel and iron ore. Though the spot prices of these futures varieties correlate highly with those of stainless steel, they were unable to directly reflect the supply and demand and price changes in the stainless steel market, Zhai Hepan, head of ferrous metal research at CCB Futures, told Futures Daily. The inauguration of these futures will thus further enhance China's pricing influence in the international market and provide price risk management tools for related industrial chain companies.

China's stainless steel output reached 26.7 million tons last year, more than half of the global total of 51 million tons in the same period.

The country's stainless exports outstripped imports for the first time in May 2010 as China went from a net stainless-steel importer to a net exporter. It landed some 2 million tons of stainless steel from January to July in a 19.1 percent drop over the year before, Futures Daily reported.

Editor: Ben Armour