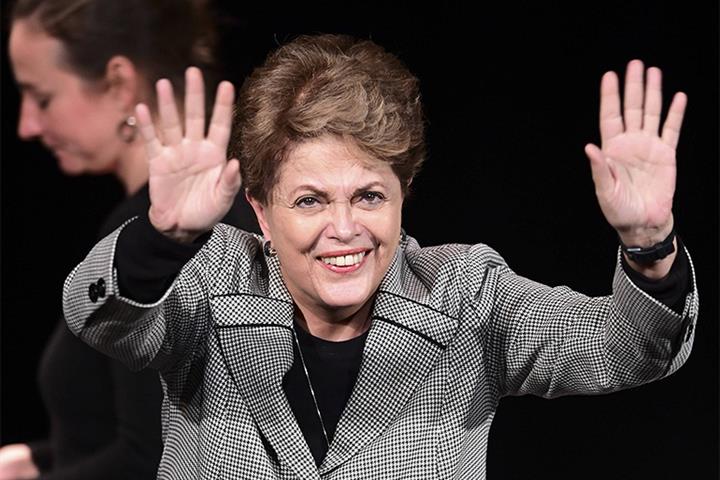

New NDB Head Rousseff to Build Lender Into Global Bank, Expert Says

New NDB Head Rousseff to Build Lender Into Global Bank, Expert Says(Yicai Global) April 14 -- Former Brazilian leader Dilma Vana Rousseff, the newly appointed head of the New Development Bank, will push the implementation of its second five-year strategy to transform the multilateral development bank for emerging economies into a global lender, an expert said.

The five-year strategy states that during 2022 to 2026, 40 percent of the NDB’s funds will be used to support projects to address climate change, 30 percent will be invested in non-sovereign businesses, 30 percent will be denominated in relevant local currencies, and 20 percent will be co-financed with other multilateral development banks.

The strategy further clarifies the development of the NDB as a global bank, Zhu Jiejin of the School of International Relations and Public Affairs of Fudan University, who specializes in NDB research, told Yicai Global.

The appointment of a new president who is influential internationally will be an unprecedented opportunity for the Shanghai-based bank, he said.

The NDB hosted the inauguration ceremony for its new head in Shanghai yesterday, when Rousseff officially took office and embarked on a two-year term.

But the NDB still faces many challenges to achieve the goals of the five-year strategy, Zhu noted. According to information disclosed in February, the proportion of the bank’s non-sovereign business is only 14 percent of the total, which is still some way off from the target of 30 percent.

Non-sovereign business is the current development trend of multilateral banks around the world because the traditional sovereign business is not enough to meet the needs of developing countries, and more private capital needs to be mobilized, he said.

The premise for the provision of local currency loans is the issuance of bonds in the capital markets of corresponding countries. The NDB has claimed to issue local currency-denominated bonds, including Indian rupee bonds and South African rand bonds, since 2016. But so far only China’s panda bonds have been successfully issued, Zhu pointed out.

The NDB’s local currency target will also be a good opportunity for the internationalization of the Chinese yuan, Zhu explained. And as Brazil and Russia increase the proportion of yuan settlement in trade, the bank may issue more panda bonds and use the yuan for overseas project investment, he added.

Founded in 2015 by the quintet of Brazil, Russia, India, China and South Africa, namely the BRICS countries, the NDB subsequently attracted the United Arab Emirates, Uruguay, Bangladesh, and Egypt to join.

As per plans, the bank will provide USD30 billion of financial support to member nations in the second five-year period, so that the total amount of approved project financing will reach USD60 billion by the end of 2026.

Editors: Dou Shicong, Peter Thomas