Major Advanced Economies’ Services Activity Stayed Strong in August

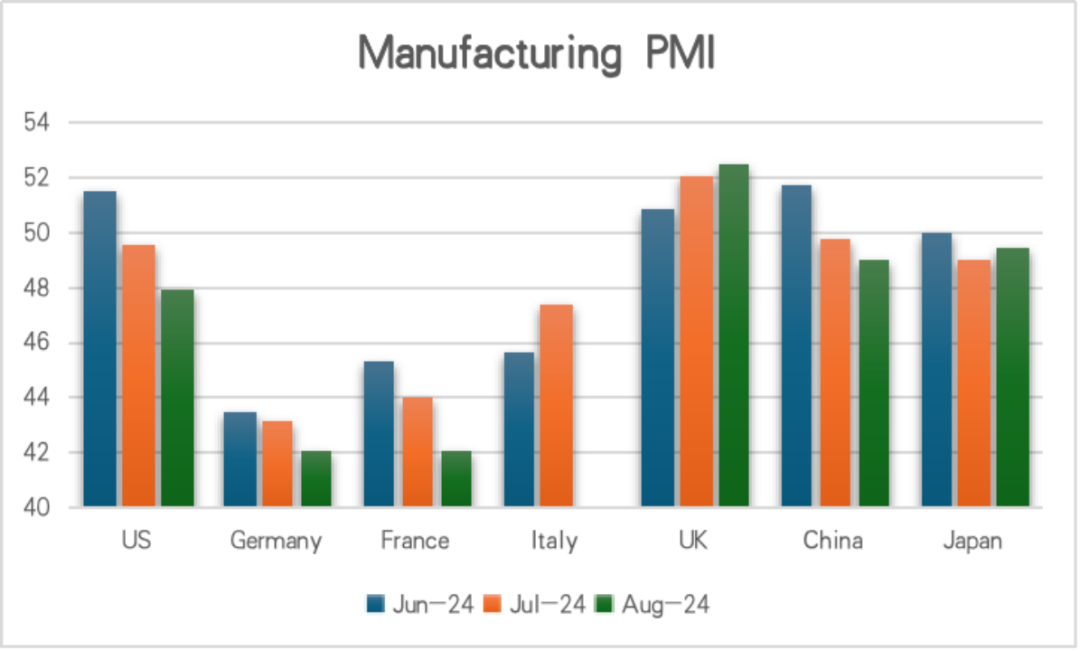

Major Advanced Economies’ Services Activity Stayed Strong in August(Yicai) Sept. 3 -- Manufacturing activity in major advanced economies continued to weaken last month. The United States Manufacturing Purchasing Managers’ Index (PMI) edged down in July to 48 from 49.6, marking the second straight month of contraction. The manufacturing PMI for the euro area dropped to an eight-month low of 45.6 in August, largely driven by declining export orders in Germany, while factory activity appeared to have recovered in Japan, with Manufacturing PMI rising to a four-month high of 49.5, but coming in under the market expectation of 49.8, for which external demand seems to have also been the main drag.

Source: S&P Global, based on available data

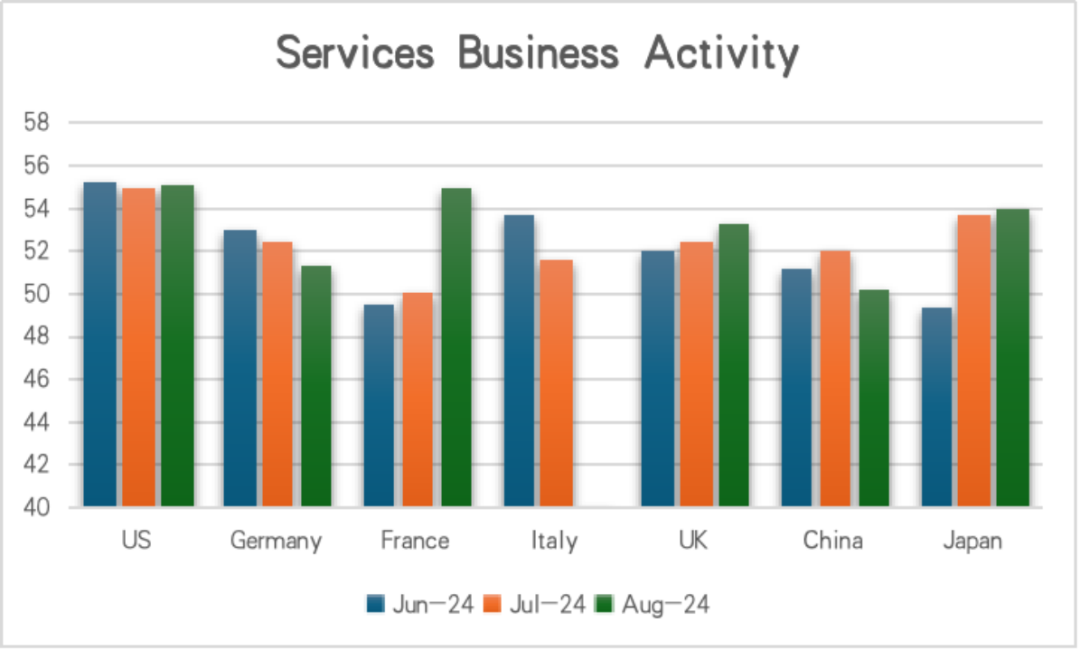

Conversely, services activity appear to have been stronger than expected last month. The US Services PMI accelerated to 55.2 from 55 in July. The Services PMI for the euro area also advanced significantly to 53.3 in August from 51.9 in July, with France being the key driver following its Olympics. Japan’s Flash Services PMI - an early growth indicator - rose to 54 from 53.7 in July, marking the seventh consecutive month of expansion and at the fastest pace since April.

The strength in services activity may reflect solid consumer demand in advanced markets. US consumer confidence rose in July, despite the significant downward revision of the Nonfarm Payrolls Index, even as the consumer confidence in the euro area kept to an upward trend in July.

Source: S&P Global, based on available data

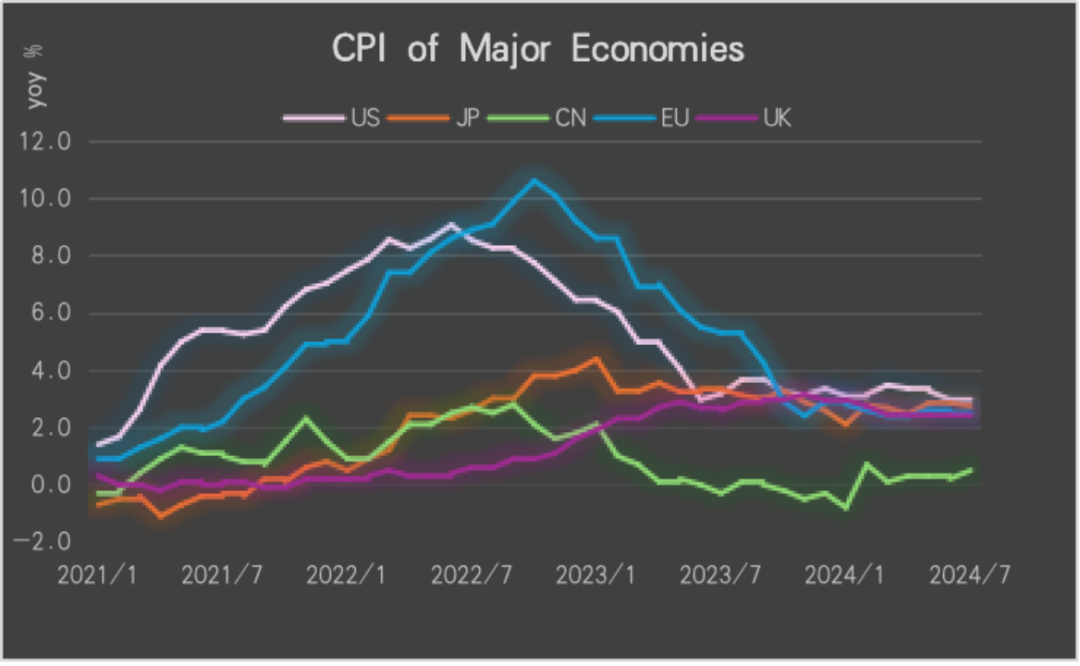

Inflation in advanced economies was stable as consumer demand remained solid. The US Consumer Price Index (CPI) held steady at 0.2 percent sequentially from July at the same pace with the June data and in line with market expectations. The CPI in the euro area cooled to 0 percent sequentially in July from 0.2 in June, though annual inflation inched up to 2.6 percent from 2.5 percent in June. Core inflation held steady at 2.9 percent annually in July.

Source: US Bureau of Labor Statistics, Statistical Bureau of Japan, China National Bureau of Statistics, Eurostat, Office for National Statistics UK

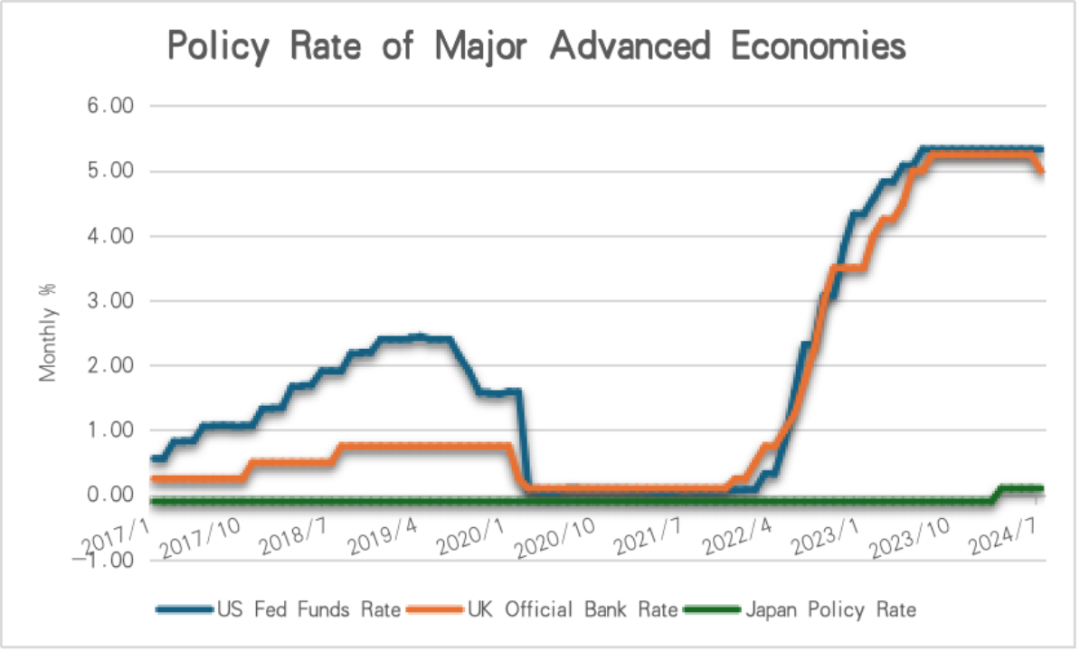

On monetary policies, US Federal Reserve Chairman Jerome Powell highlighted the likelihood of a rate cut in September in his annual speech at Jackson Hole, Wyoming. He also emphasized that the actual rate cut will mainly hinge on the release of the Nonfarm Payrolls Index - which gauges changes in the number of persons in employment during the preceding month, minus farm workers - in September, and in particular the forthcoming labor market indicators will be pivotal in determining the pace of policy easing. Bank of Japan (BoJ) Deputy Governor Ryozo Himino stated on August 27 that the central bank’s monetary policy stance will remain unchanged as long as inflation stays in line with the bank’s outlook. Market expectations for another BoJ rate hike were bolstered as core inflation hit a five-month high of 2.7 percent in July.

Source: Federal Reserve Board, Bank of England, Bank of Japan

In terms of growth indicators, the US Bureau of Economic Analysis has released a second revision of growth in second-quarter gross domestic product growth, which now stands at a 3 percent annualized rate. This represents an increase from the initial estimate of 2.8 percent and a significant rise from the 1.4 percent growth rate in the first quarter. The main drivers of this growth were private inventory investment and domestic demand, though residential fixed investment was a drag on the overall figure.

GONG Siming, Analyst from IFF Research Institute.