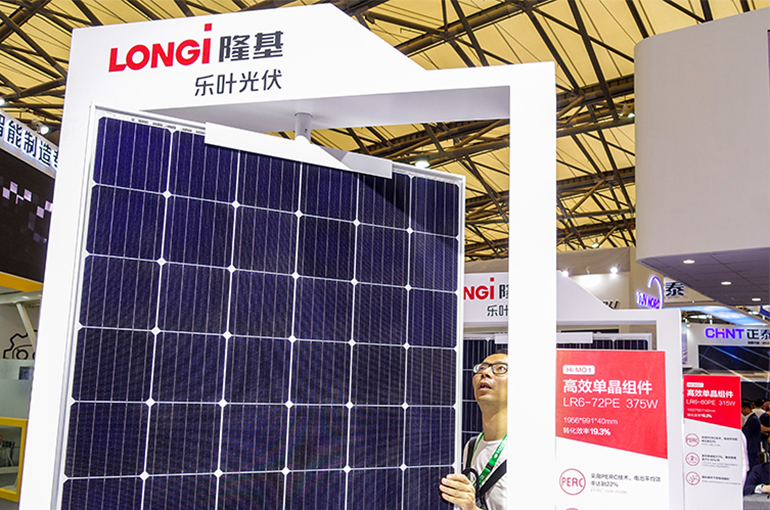

Longi Sues Rival Jinko Solar as Patent War in China's PV Sector Intensifies

Longi Sues Rival Jinko Solar as Patent War in China's PV Sector Intensifies(Yicai) Feb. 14 -- Longi Green Energy Technology said the Chinese solar panel giant has filed a patent infringement lawsuit against domestic rival Jinko Solar amid an escalating patent war in the photovoltaic sector.

The Intermediate People's Court of Jinan in eastern Shandong province has accepted the case, with a hearing scheduled for March 20, Xi'an-based Longi told Yicai.

Patent litigations between PV companies have surged since the start of last year, with six major domestic solar module manufacturers currently involved in related cases.

The "patent war" in China's PV sector keeps intensifying and infringements have become a serious issue, industry insiders told Yicai. With plunging PV supply chain prices, research and development investment growth has fallen below 10 percent from 20 percent in 2020, weakening tech innovation and causing over CNY30 billion in losses to the domestic sector, they noted.

Longi and Jinko went to court over cell patent infringement issues early last year, while Jinko recently filed lawsuits against Longi in the Chinese mainland, Tokyo, and Australia, demanding it to cease patent infringements and compensation for economic losses. In addition, Trina Solar has filed lawsuits against CSI Solar and its Changshu unit over alleged infringement of two core patents, seeking nearly CNY1.1 billion (USD145 million) in compensation.

"Previously, technical research was mostly conducted independently," an executive of a Chinese mainland-listed PV firm said to Yicai. "However, many firms in this industry have been poaching tech staff from R&D leaders, and while some invest CNY5 billion to CNY7 billion annually in R&D, others start production simply by recruiting key personnel."

Respecting intellectual property protection is a corporate responsibility, Li Xiande, chairman of Jinko Solar, previously said. The Shanghai-based firm holds most patents for TOPCon, or tunnel oxide passivated contact, technology, so others would need to pay fees to use it, he noted. "We have reached patent licensing agreements with at least two firms."

With TOPCon tech accounting for over 70 percent of global PV production capacity, the normalization of patent disputes is forcing rapid industry consolidation, industry insiders pointed out.

Editor: Martin Kadiev