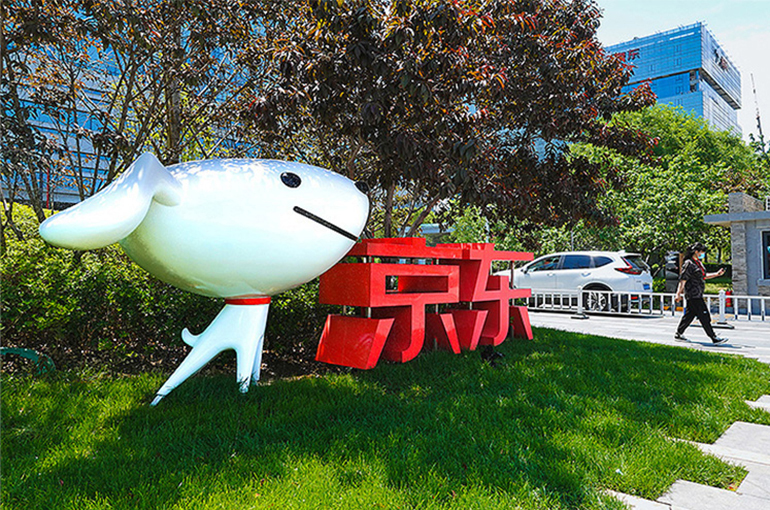

JD.Com Drops Despite Chinese E-Commerce Giant's Annual Profit Surging 71%

JD.Com Drops Despite Chinese E-Commerce Giant's Annual Profit Surging 71%(Yicai) March 7 -- JD.Com’s shares fell despite the Chinese online shopping giant saying profit soared 71 percent last year amid a rebound in consumer spending in China.

JD.Com [HKG: 9618] ended down 5 percent at HKD170.10 (USD21.89) a share in Hong Kong today, though the stock is still up 25 percent this year. In pre-market trading in New York, the company [NASDAQ: JD] was trading 0.9 percent lower at USD43.54 a share as of 7.04 a.m. local time.

Net profit was CNY41.4 billion (USD5.7 billion) in the 12 months ended Dec. 31, the Beijing-based company said in an annual financial report released yesterday. Revenue rose 6.8 percent to CNY1.16 trillion (USD159.8 billion).

For the fourth quarter, profit soared 191 percent to CNY9.9 billion (USD1.4 billion) from a year earlier, while revenue jumped 13.4 percent to CNY347 billion (USD47.9 billion).

“Our top-line growth returned to double digits year-on-year, and the bottom line also achieved healthy expansion,” Chief Executive Sandy Xu said on an earnings conference call. “Most of our product categories as well as key metrics, such as our quarterly active users and shopping frequency, saw strong double-digit growth year-on-year in the fourth quarter.”

Consumer spending has begun to pick up in China, particularly retail sales, with this growth mainly driven by an economic stimulus package released in late September. That along with costs controls and improved efficiency helped to boost both the top and bottom lines at JD, particularly in the fourth quarter, when sales of electronics and home appliances as well as general merchandise returned to double-digit growth.

“Heading into 2025, with the government stimulus policies adding to the tailwind, we are well-positioned to benefit from this rebound in consumption,” she noted.

Last month, JD.Com drew widespread attention after making a high-profile entrance into the food delivery business with JD Takeaway. The service is in a relatively early stage of development, Xu noted. The firm will strategically test and invest in this area, dynamically adjusting its approach based on the gradual development of the business, she added.

JD.Com began enticing restaurants to join JD Takeaway on Feb. 11 by offering a year free of commission fees if they sign up by May 1. Those that had already signed contracts will also have their commissions waived.

Instant retail is a natural extension of the core retail business, and food delivery is one of the high-frequency services, Xu pointed out. Investing in instant retail and food delivery services helps enrich consumption scenarios, meet user needs, and enhance the overall user experience, she said.

JD.Com's goal is to enhance the overall efficiency of its delivery network, benefiting its core retail, e-commerce, and instant retail businesses, Xu noted. The company will enhance the quality supply by recruiting and supporting top merchants and improving the rights and benefits of delivery riders, she added.

Editor: Martin Kadiev