Hua Hong Gains in Hong Kong as Chinese Chipmaker Eyes Secondary Listing in Shanghai

Hua Hong Gains in Hong Kong as Chinese Chipmaker Eyes Secondary Listing in Shanghai(Yicai Global) March 22 -- Shares in Hua Hong Semiconductor jumped today and yesterday in Hong Kong after mainland China’s second biggest wafer foundry said it is planning to go public on the Shanghai Stock Exchange’s Nasdaq-style Star Market.

Hong Semiconductor’s share price [HKG:1347] was trading up 3.55 percent at HKD35 (USD4.50) as of 12 p.m. China time. Earlier in the day it had advanced 4.8 percent to HKD35.45.

The board has approved the initial proposal for a secondary listing on the Star Market, Shanghai-based Hua Hong Semiconductor said yesterday. If it goes ahead, it would mean that China’s three biggest chipmakers, including Semiconductor Manufacturing International Corporation and Nexchip Semiconductor, are all listed on the mainland.

Hua Hong Semiconductor ranked sixth in the world with a 2.9 percent share of the global semiconductor market in the fourth quarter last year, according to market research firm TrendForce. It came behind Taiwan Semiconductor Manufacturing, South Korea’s Samsung, Taiwan’s United Microelectronics, the US’ GlobalFoundries and SMIC.

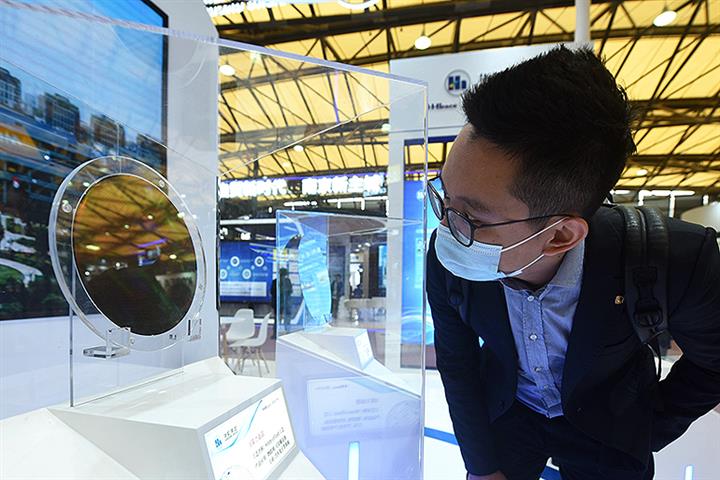

The company runs three 8-inch chip factories in Shanghai’s Jinqiao and Zhangjiang districts with a monthly output of 180,000 wafers. It also has a 12-inch wafer factory in Wuxi with an output of 48,000 chips per month.

Profit more than doubled last year from the year before to USD212 million and revenue jumped 69.6 percent to USD1.6 billion. By comparison, rival SMIC also saw profit more than double to USD1.7 billion and revenue was up 39 percent to USD5.4 billion over the same period.

Parent firm Hua Hong Group includes the manufacturing capacity of two chipmakers Shanghai Huahong Grace Semiconductor Manufacturing and Shanghai Huali Microelectronics, but Hua Hong Semiconductor only encompasses the latter.

Hua Hong Group is owned by the Shanghai Municipal State-owned Assets Supervision and Administration Commission which had a stake of 26.9 percent as of June last year. The National Integrated Circuit Industry Investment Fund holds 16.9 percent equity.

Editor: Kim Taylor