Forging Ahead, Greeting Opportunities and Challenges

Forging Ahead, Greeting Opportunities and ChallengesNew Thoughts on Hong Kong international Financial Center Construction and RMB Internationalization

(Yicai) Dec. 23 -- As an important international financial center in Asia, Hong Kong has for many years played an instrumental function in the international financial system. Yet looking to the future, both challenges and opportunities present. These will require us to engage in planning from a more expansive field of view, and promote relevant work to attain sustainable development.

The Shanghai-Hong Kong Stock Connect recently commemorated its 10th anniversary and successfully hosted an investors’ summit. Vice Premier He Lifeng's speech in particular underscored the importance of these activities to the construction of Hong Kong into an international financial center. In general, the overall development trend of Hong Kong as an international financial center is positive. Competition will however be savage in the future, and Hong Kong will still jave to rise to this challenge.

In the relevant work of promoting the construction of Hong Kong as an international financial center, the market connectivity of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect is a key issue. Though the connectivity has indeed been achieved, much room remains for improvement of scope and convenience. Connectivity should not be limited to the mainland capital market, but should be expanded to Asia and even the countries along the ‘Belt and Road.’ Although this process will meet with many difficulties, in view of the changes in the international situation and the needs of the countries straddling the route, overcoming difficulties and furthering connectivity is imperative.

Currently, with the development of the information industry and the popularization of the internet, the competitive advantages of conventional financial centers are undergoing sea changes. The processing, analysis, and transmission of information are becoming ever more important, and the business and institutional pattern is exhibiting a decentralized trend that demands that we rethink key elements of the formation and maintenance of financial centers.

Furthermore, creating beneficial financial products is also crucial. To identify whether such products can fulfill the needs of the Asian economy, avert side effects, and aid economic growth will be necessary. Financial markets must also develop new tools and products targeting emerging industries, such as the new features of financing and risk management wrought by the ascent of AI.

Worth noting is that SDRs (Special Drawing Rights) have a potential part in innovating financial products. Although this is a sound notion and, in the early 1980s, many financial instruments in the capital market also chose to use SDR for pricing in response to the high barriers of the US dollar and the backdrop of a sharply appreciating exchange rate, but, due to the complex composition of SDRs and the lack of supporting foreign exchange markets, many difficulties currently beset actual operation. It is recommended that the International Monetary Fund take the lead in extending the application of SDRs in e.g., financing, and statistical accounting to help form SDR foreign exchange and exchange rate markets, and promote their acceptance and use by financial centers.

RMB internationalization is another important dimension. RMB internationalization will make Hong Kong the core area of the RMB offshore center, causing Hong Kong's role in the international financial market to become more diversified and further cementing its position in global financial markets. At the same time, as an international financial center, Hong Kong also plays a unique and important role in RMB internationalization.

Looking back on this process, the initial goal of the cross-border use of RMB primarily focused on trade settlements, and the 2008 financial crisis was a key turning point. At that time, Asia confronted a liquidity shortage, and China started to conduct currency swaps with many countries, promoting the steady extension of cross-border use of RMB. External fluctuations in US dollar policies and changes in liquidity demand in various countries, coupled with China's domestic financial reforms to promote the free use of the RMB, have generated opportunities for RMB internationalization. With the diversification of the global economic landscape and the bolstering of China's economic strength, the RMB will surely play a more important role on the international stage. Of course, this process will be impacted by multiple internal and external factors and will have to proceed step by step.

Thus, in the future course of promoting RMB internationalization, the reform and opening up of some policies and rules in the mainland can be strengthened. Issues such as free RMB convertibility, exchange rate reform, local currency swaps and fund pool settings often entail the interests of multiple parties and demand careful weighing and consensus building. The inclusion of RMB in the SDR currency basket is a prime example.

Moreover, with the development of the mainland economy, the influence of the RMB in Asia is rising. Hong Kong has played an important role. In the future, we must adapt to the international situation, promote its greater effectiveness in the countries along the ‘Belt and Road,’ and utilize the resources of mainland listed companies and the advantages of high savings rates to assist the RMB in playing a more important role.

I believe that through the joint endeavors of all parties, Hong Kong's position as an international financial center will be more stable, and the internationalization of the RMB will also be steadily advanced, playing a greater role in the global financial system. This will favor not only Hong Kong's own development, but also infuse fresh vitality into the Asian and even the global economy.

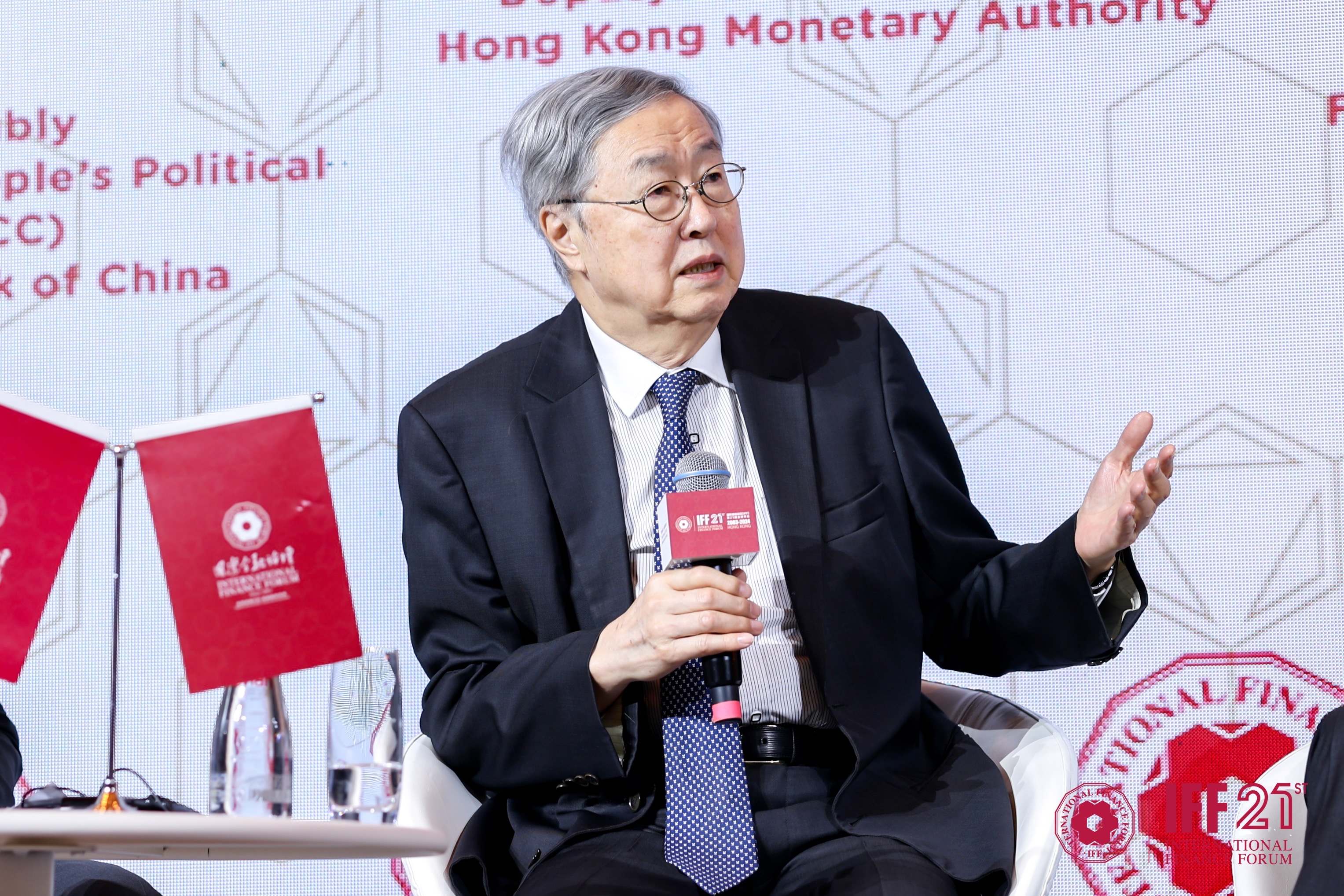

(This article is adapted from the keynote speech delivered by Zhou Xiaochuan, Chairman of the International Finance Forum (IFF), former Vice Chairman of the National Committee of the Chinese People's Political Consultative Conference, and former Governor of the People's Bank of China, at the ‘Hong Kong Focus: Strengthening the International Financial Center Development’ session of the International Finance Forum (IFF) Global Annual Meeting on November 23, and authorized to be published in this column.)