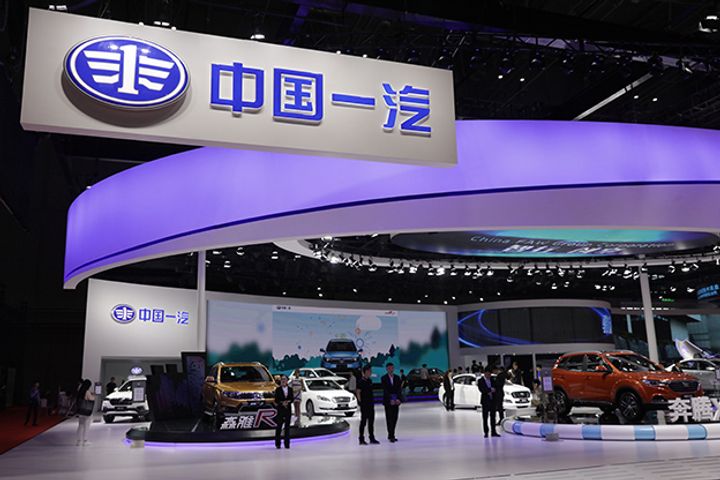

FAW Group Gets Over USD145 Billion Credit Line From 16 Banks

FAW Group Gets Over USD145 Billion Credit Line From 16 Banks(Yicai Global) Oct. 25 -- FAW Group, a state-owned Chinese automaker, has secured a credit line worth more than CNY1 trillion (USD145 billion) from 16 lenders.

FAW Group's chief accountant and a member of its party committee, Zeng Xiangxin, signed the deal with bank officials on Oct. 21 at an event held as part of a campaign to revive the rustbelt provincial economies of northeast China with the financial sector's help.

The deal further strengthens cooperation between the automaker and lenders, providing "firm financial support" for FAW Group to progress its businesses, the Jilin province-based company said in a statement posted on official communication channels including its website and WeChat social media account.

The shares of two of FAW's listed subsidiaries surged in trading today. FAW Car [SHE:000800] gained almost 10 percent to CNY6.18 (89 US cents), whileTianjin FAW Xiali Automobile [SHE:000927] soared just over 10 percent to close at CNY3.04.

The banks offering the credit line include the state-owned big five -- Bank of China, Agricultural Bank of China, Industrial and Commercial Bank of China, China Construction Bank and Bank of Communications -- as well as commercial lenders such as China Everbright Bank, China Guangfa Bank, China Merchants Bank and China Citic Bank. The China Development Bank, a policy bank under the State Council, or cabinet, also extended a credit line to FAW.

The company will also cooperate with these banks on developing its Hongqi luxury car marque as well as in the areas of financing, cash management, international finance, new energy and smart-connected vehicles.

With revenue of CNY470 billion (USD67 billion) and 3.35 million vehicles sold last year, FAW Group owns a brand valued at CNY272 billion and various units and makes, among them FAW Jiefang Automotive, FAW-Volkswagen Automobile, FAW Toyota Motor, FAW Car, Tianjin FAW Xiali Automobile and Faw Fuwei Automobile Components.

Editor: Ben Armour