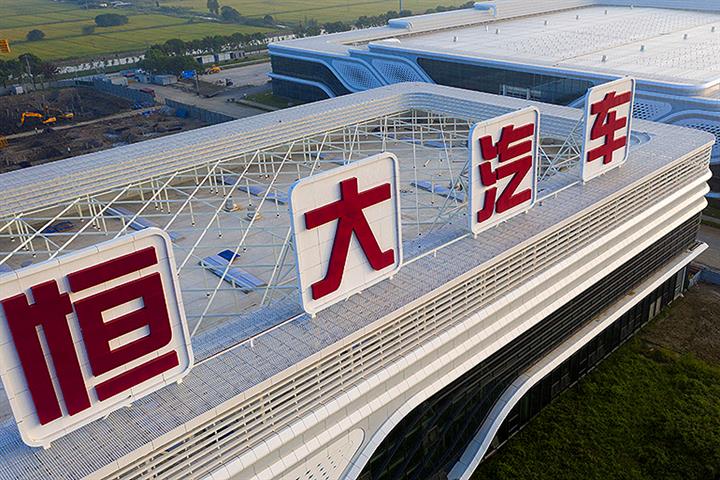

Evergrande NEV Needs to Clarify Funding Sources, Goodwill Impairments Before It Can List, Broker Says

Evergrande NEV Needs to Clarify Funding Sources, Goodwill Impairments Before It Can List, Broker Says(Yicai Global) Oct. 29 -- The source of borrowed funds, the size of goodwill impairment and a number of other issues need to straightened out before China Evergrande New Energy Vehicle can proceed with its secondary listing on the Shanghai Stock Exchange’s Nasdaq-style Star Market, according to a report by the brokerage hired to handle the pre-listing tutorial procedure.

The electric carmaking arm of property giant Evergrande Group must declare the source of any funds it has borrowed, the Shenzhen securities regulator said on Oct. 27, citing a report from Shanghai-based Haitong Securities which completed the first step in the listing process on Oct. 13.

It needs to replace some of its independent directors who hold similar positions in companies with more than 5 percent equity in Evergrande NEV, such as the parent company, the brokerage said.

As Evergrande NEV's electric car business is still in the development stage and does not yet have a product to sell, the company needs to be clear about the risks involved in its journey towards mass production.

The Guangzhou-based firm should allow for substantial goodwill impairments in the value of a number of firms that it took over recently, including Swedish electric carmaker NEVS, British in-wheel motor maker Protean and Shanghai Kanai New Energy. This is the difference in the inflated price paid, or goodwill price, and the actual fair value of the companies.

Due to the number of overseas acquisitions that it has made, the company is in possession of overseas patents in over ten countries, including England, Germany, Japan and Holland. These patents need to be collated and verified.

The timing of the next step in the listing process has not yet been revealed.

Editor: Kim Taylor