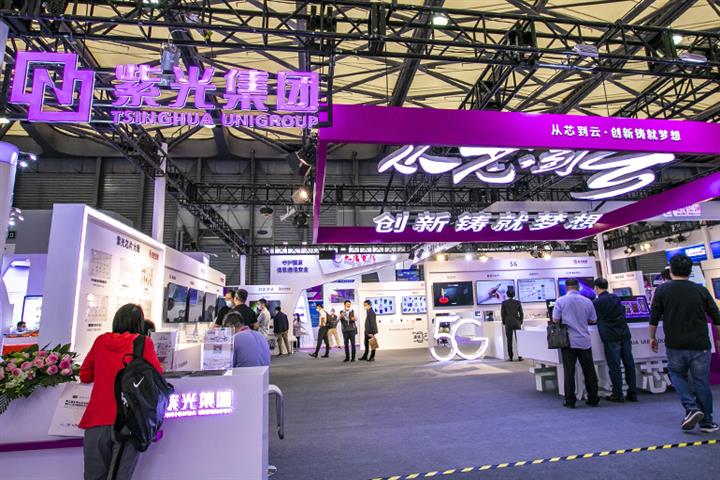

Debt-Ridden Chinese Chipmaker Tsinghua Unigroup Is in Lifeline Talks With Investors

Debt-Ridden Chinese Chipmaker Tsinghua Unigroup Is in Lifeline Talks With Investors(Yicai Global) Oct. 19 -- Tsinghua Unigroup is in negotiations with seven potential investors to help resolve its financial crisis as the Chinese chipmaker fights to avoid bankruptcy.

Tsinghua Unigroup held a creditors’ meeting yesterday, exactly three months to the day when it began the restructuring process, to discuss how CNY108.2 billion (USD16.9 billion) worth of debts will be repaid, the firm said on its WeChat account. A compensation plan is expected to be ready by Feb. 27 next year for creditors to vote on, according to the Securities Times.

Investors should have audited assets of at least CNY50 billion (USD7.8 billion) within the last year or those attributable to the parent should be no less than CNY20 billion, Tsinghua Unigroup said. They should have experience in running semiconductor and cloud-network businesses and be able to manage Tsinghua Unigroup’s core assets so as to support and spur the further growth of the group. No specific names were mentioned.

Established in 1988, Tsinghua Unigroup invested heavily in memory chip manufacturing but its big spending caused the firm to run up huge debts. Operations continue as normal, though. The chipmaker logged revenue of CNY62.2 billion (USD9.7 billion) in the first eight months, a jump of 32 percent from the same period last year.

Editor: Kim Taylor