Covid’s Spectre Hangs Over Chinese Economy

Covid’s Spectre Hangs Over Chinese EconomyNew Covid infections averaged just over 600 per day in July. This was a material improvement from April’s 20,000. Still, people are worried about catching the virus or bumping into someone who is a “close contact” of an infected person.

We recently took a short family vacation on lovely Hainan Island. We were lucky to return when we did. The following week, many travellers were trapped by a Covid outbreak and unable to leave. Even the Chinese football league was affected as the mobility restrictions prevented caught in Haikou from playing their scheduled games.

The released by the National Bureau of Statistics (NBS) shows just how large an impact the spectre of Covid is having on the macroeconomy.

Retail sales disappointed by growing 2.7 percent year-over-year in July. This was slower than the 3.1 percent growth they recorded in June and well below the 4.8 percent expected by the Yicai Research Institute’s of Chief Economists.

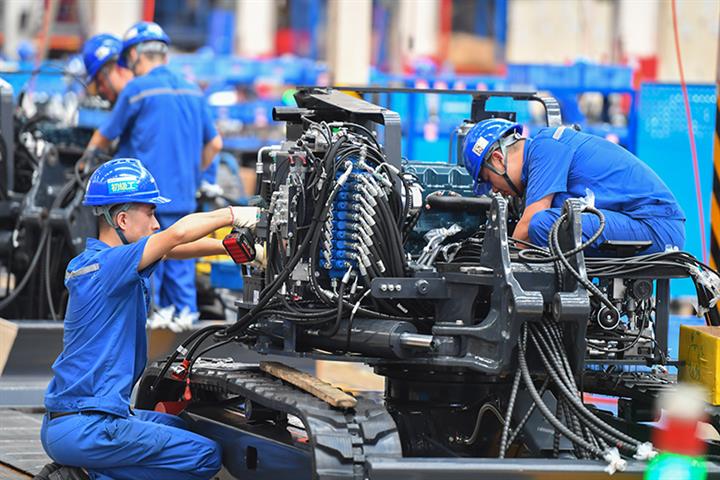

The consumption of services – in particular those that involve a high degree of human contact – remains especially weak. Catering sales were down 1.5 percent year-over-year. Travel for business purposes, as well as for leisure, is down sharply. The NBS’s spokesman, Fu Linghui, that there are fewer trade shows and conventions than normal. Indeed, in the first half of the year, rail and domestic air traffic are down some 60 percent from their pre-pandemic levels (Figure 1).

Figure 1

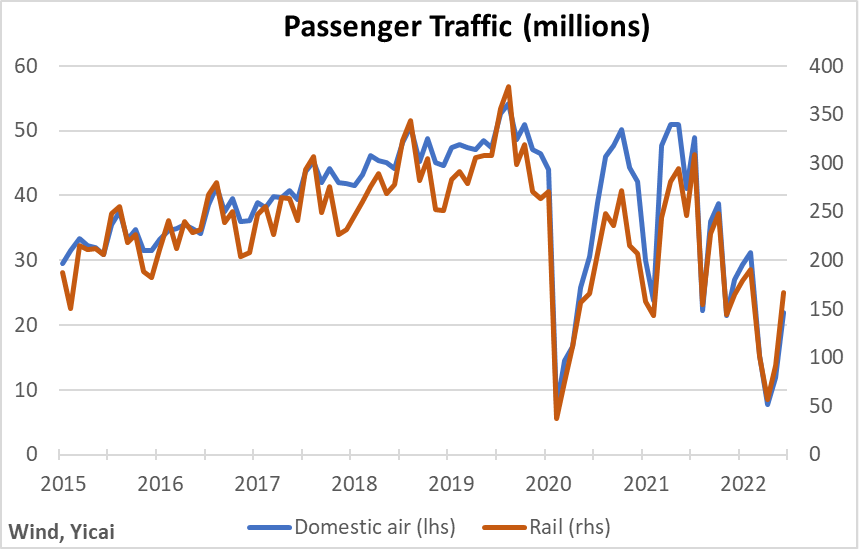

The auto sector is one of the bright spots. Unit sales of passenger cars exceeded 2 million for the second consecutive month. They are up 40 percent from a year-ago levels (Figure 2). Last summer’s sales were impacted by the chip shortage, so it is hard to tell if we are seeing a new trend or simply payback for past weakness.

Figure 2

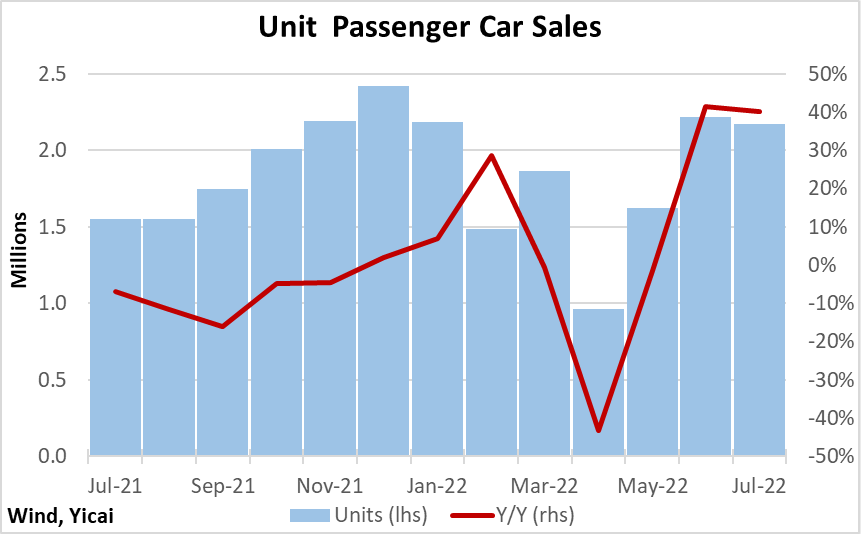

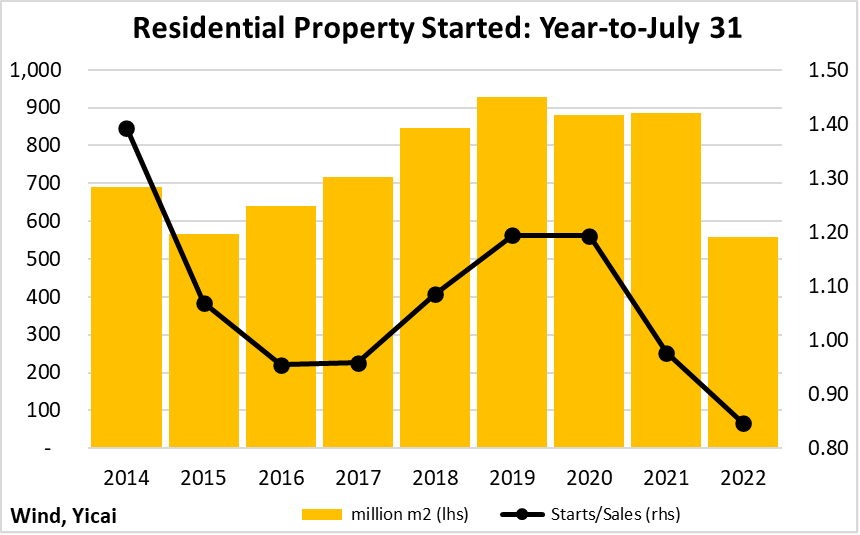

An anemic property market is also weighing on the economy. In the first seven months of the year, the volume of new residential property started fell by 37 percent from last year’s level (Figure 3). Weak demand and tighter financial conditions have led developers to begin only as much housing as they did in 2015, which was the bottom of the last cycle.

While starts have fallen to the same level as seven years ago, sales this year are 25 percent higher than they were in 2015. Thus, the ratio of starts to sales has fallen sharply. This suggests that either developers are pessimistic the current level of sales can be maintained or that the financial constraints they face prevent them from building as many homes as they would like.

Figure 3

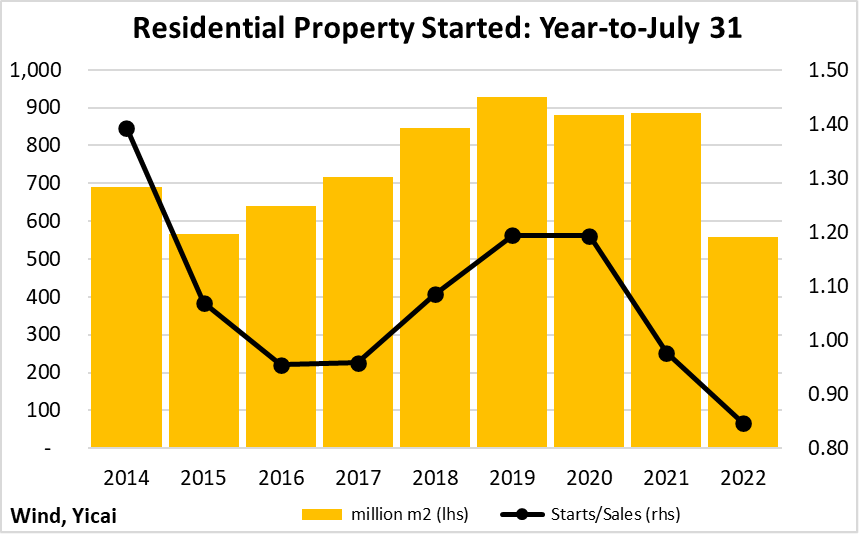

Some of the weakness in the property market is the desired result of a policy to reduce the risks associated with excessive leverage. Thus, rather than aggressively support the real estate sector, policymakers’ approach has been to offset the impact of its deleveraging on the macro economy by boosting infrastructure investment and providing tax and fee reductions to incentivize increased investment in manufacturing (Figure 4). The stability of fixed asset investment growth suggests this approach is working.

Figure 4

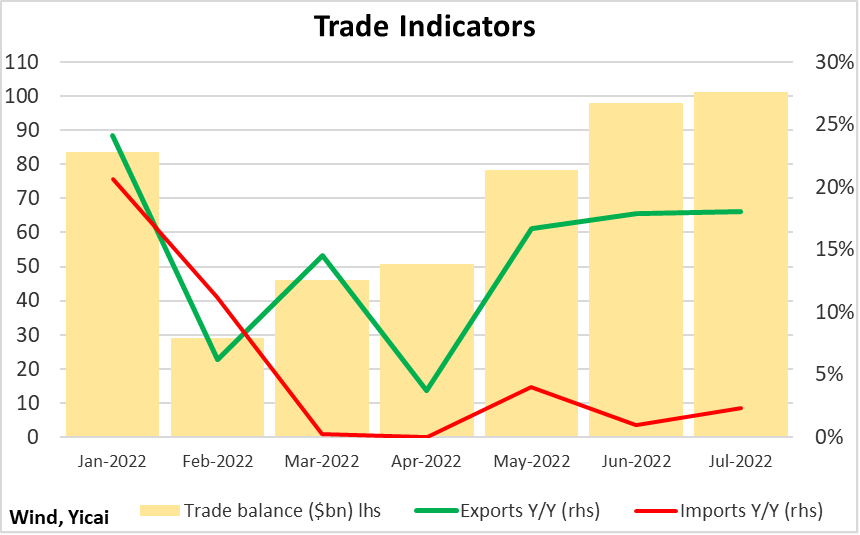

Since domestic demand has been weak, China’s import growth has been rather modest, only up 5 percent year-over-year in dollar terms. However, the economy has benefitted from very strong export sales, which are up 15 percent year-to-date. This year, exports to the EU and ASEAN countries have grown particularly rapidly.

As a result of strong exports and modest imports, the monthly trade balance hit a record, surpassing $100 billion in July (Figure 5).

Figure 5

This year’s strong export performance comes as something of a surprise. Last year, China’s exports were up 30 percent. This provides a high base from which this year’s exports need to grow. Moreover, with central banks around the world taking measures to combat inflation, China’s trading partners’ import demand was expected to slow.

The composition of China’s exports this year is also surprising since many of the fastest-growing items are low-value-added footwear and toys rather than high-tech products, like computers and cell phones, which have sold well in previous years (Table 1).

The diversity of its exports, across both product lines and trading partners, is a welcome source of strength for the Chinese economy.

Table 1: Year-to-Date Performance of Major Exports

| Category | Y/Y Growth Rate | Value ($bn) |

| Footwear | 33% | 33 |

| Toys | 25% | 27 |

| Agricultural | 24% | 56 |

| Plastics | 17% | 62 |

| Total | 15% | 2,065 |

| Machinery | 13% | 33 |

| Garments | 13% | 100 |

| Textiles | 12% | 90 |

| Data proc. | 4% | 142 |

| Cell phones | 2% | 77 |

| Furniture | 1% | 41 |

| Appliances | -7% | 52 |

The weakness of domestic demand is acting like a break on industrial output. Industrial value-added only grew by 3.8 percent year-over-year in July. This was down a touch from June and at the bottom of the range of the Chief Economists’ expectations. Their consensus was for 4.9 percent growth. According to Fu Linghui, the processing of raw materials was especially weak, falling by 1.6 percent year-over-year in July. Consistent with stronger sales, auto production was robust.

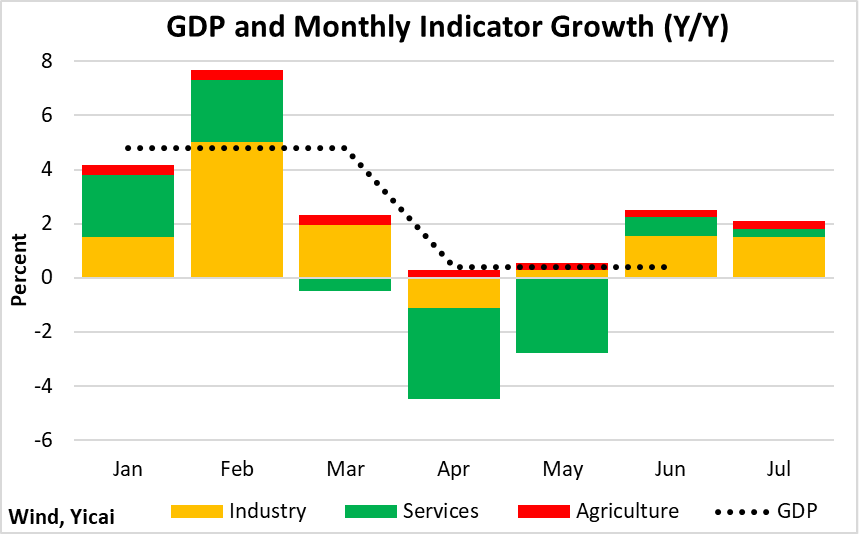

Our monthly GDP indicator suggests that the economy grew at just over 2 percent year-over-year in July (Figure 6). This would represent the second consecutive month of growth following the contractions in April and May. However, it is about half a percentage point slower than our estimate for June and indicates a halting recovery.

Figure 6

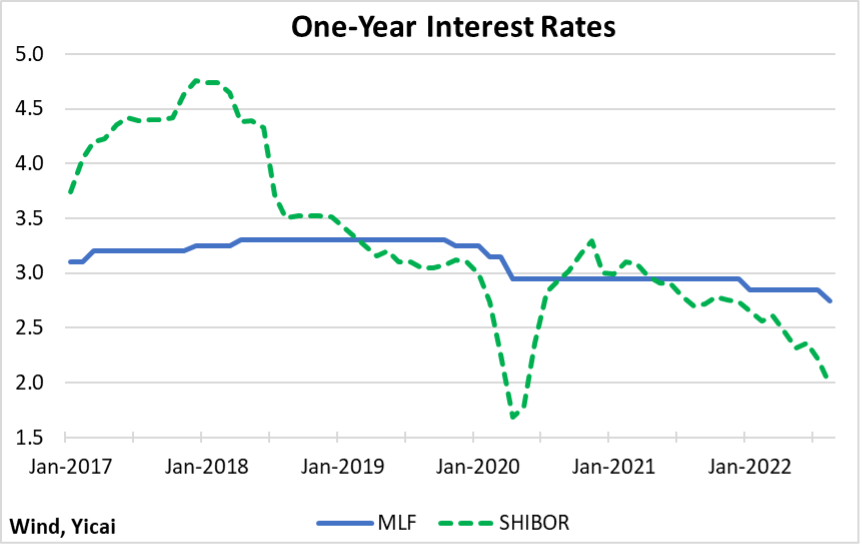

Immediately after the NBS’s release of the insipid July data, the People’s Bank of China announced that it would reduce the interest rate on its one-year Medium-term Lending Facility (MLF) from 2.85 to 2.75 percent. The People’s Bank uses the MLF to lend funds to commercial banks.

The interest rate reduction was a surprise. However, it does not mean that the People’s Bank is panicking in the face of weaker than expected data. In fact, the rate cut simply validated the ongoing fall in market rates. The People’s Bank previously cut the one-year MLF lending rate by 10 basis points in January. Since that time, the one-year SHIBOR rate fell by 70 basis points (Figure 7).

Figure 7

Despite the slowdown in growth, Chinese policymakers have been adamant that they will not resort to “” stimulus to support the economy. Their cautious approach is consistent with a gradual improvement in the labour market.

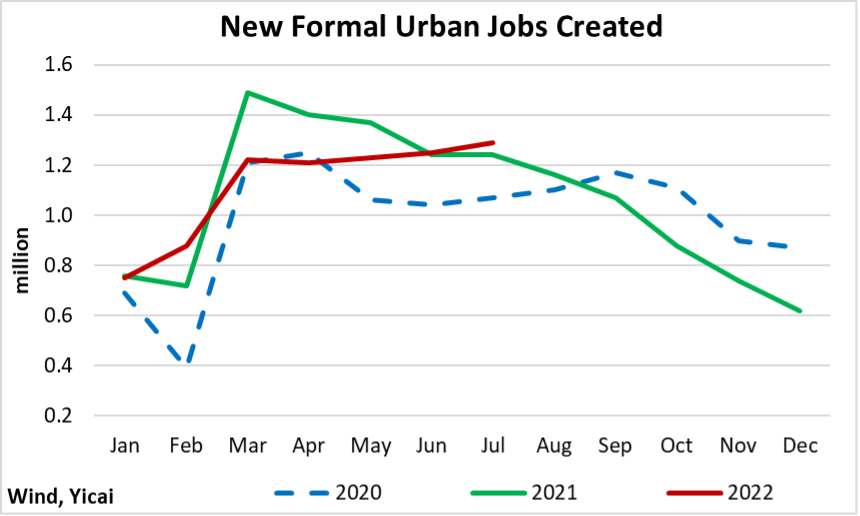

The economy created 1.3 million new jobs in July, slightly more than last year (Figure 8).

Figure 8

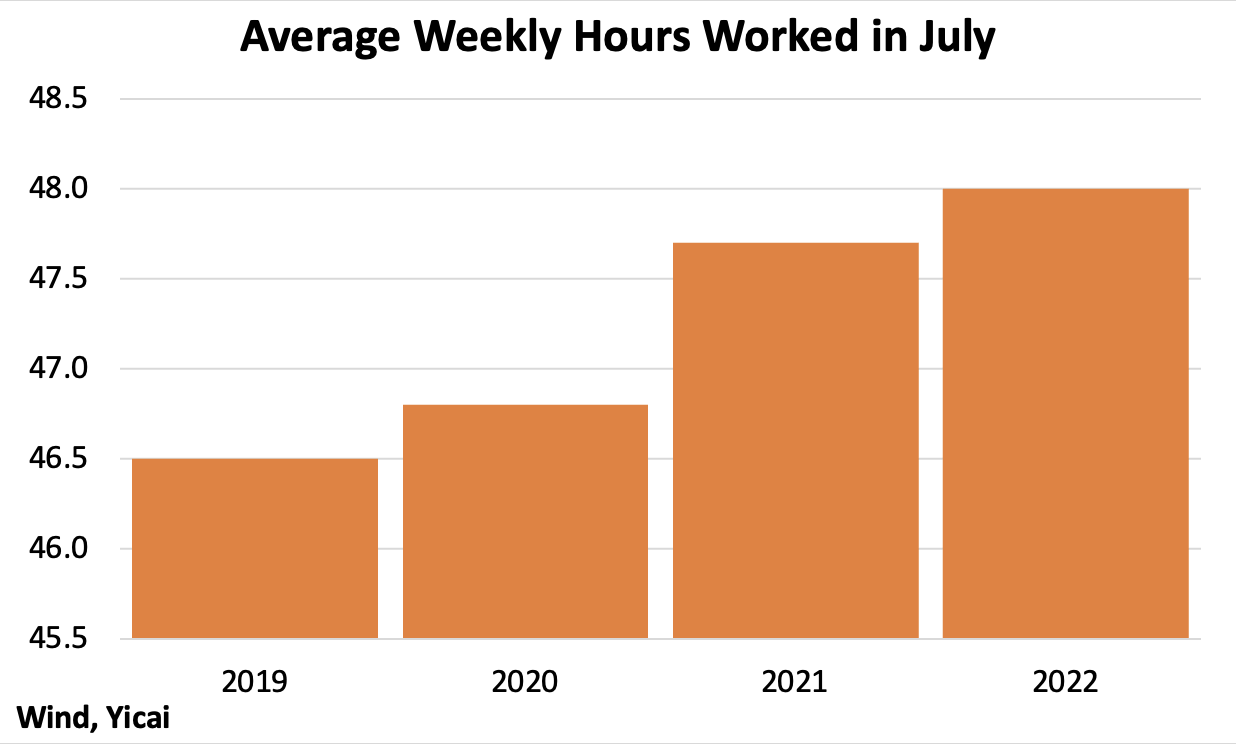

In addition, hours worked in July were quite high compared to recent years (Figure 9). This means that, despite the weak growth, there is more than enough work to keep existing employees busy and that firms could begin hiring again as uncertainty over the economy’s prospects fades.

Figure 9

While the headline unemployment rate is still somewhat higher than last year, this is principally due to youth unemployment hitting a record 19.9 percent. Fu Linghui attributed this to a very large number of new graduates entering the labour force at a time when firms are uncertain about their prospects and unwilling to take on new hires. Fu also noted the gap between young people’s employment expectations and the actual demand for labour.

The unemployment rate for core workers (aged 25-59) is just slightly higher than last year. I would only expect a major increase in stimulus if unemployment among core workers’ was to increase sharply.

Economic activity is likely to remain subdued in the near term. Daily average Covid cases, so far in August, are about double what we saw in July. This will continue to dampen consumption. However, ongoing labour market improvement could help boost spending. I expect growth to be slow but steady.