No Letup in China's Brutal Auto Market War in Coming Years, Changan’s EV Arm CEO Says

No Letup in China's Brutal Auto Market War in Coming Years, Changan’s EV Arm CEO Says(Yicai) Nov. 25 -- The competition in China’s auto market will be ruthless over the next few years and will not cease before many of the newly emerged brands have failed, according to the chief executive of Changan Automobile’s electric vehicle unit.

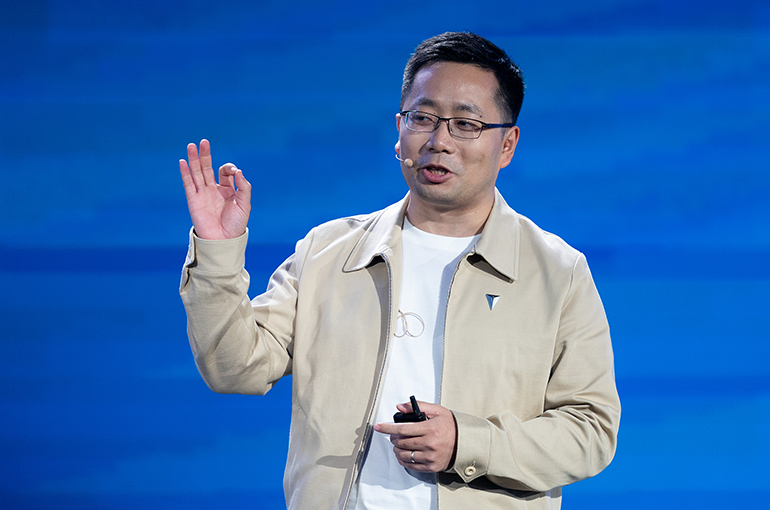

A carmaker needs a gross profit margin of at least 15 percent to survive, Deepal Automobile Technology’s Deng Chenghao said in a recent interview with Yicai. If the margin is below that, a company will lose money with every sale and likely shutter in the end, he added.

New energy vehicles have benefited from generous government subsidies in China this year, leading to excessive buying that may result in weaker demand in the first half of next year, Deng noted, adding that there is considerable uncertainty about whether these subsidies will continue in 2025.

Chongqing-based Deepal, which was formed in 2018, saw year-on-year vehicles sales surge 80 percent to 27,862 units last month, with deliveries up 75 percent at 179,371 in the 10 months ended Oct. 31 from a year earlier.

The world’s largest auto market is in the grip of intensifying competition from a flood of NEV startups and traditional carmakers pivoting to EVs, with the ongoing price war and rising production expected to further shake out weaker competitors.

Lower demand and more new factories going live in the first half of next year may lead to an intensified price war, forcing out the less competitive players, Deng said.

Competition from plug-in hybrid and extended-range vehicles, combined with the lure of small all-electric cars priced between CNY100,000 and CNY150,000 (USD13,800 and USD20,705), is likely to take significant market share from traditional fuel vehicles, according to Deng.

One of the notable market shifts in recent months, according to Deng, is that the NEV brands of traditional automakers have been gaining momentum, with sales and growth rates generally surpassing those of startups.

Part of the reason is that EV-making units such as Deepal can focus resources on intelligence and electrification, leveraging the existing manufacturing platform of their parent company, he said. In Deepal’s case, it only needs to pay market-oriented manufacturing fees to Changan Auto, resulting in near-zero fixed asset investment.

The pair can also share product quality management, sales channels, overseas markets, and overseas factory resources, which are advantages that rival NEV startups do not have, Deng noted.

Deng revealed that Deepal will likely become profitable this month and remains on track to achieve full-year profitability in 2025, with the potential to become the first state-owned new energy brand to turn a profit.

Editors: Tang Shihua, Martin Kadiev