Chinese TV Makers Open Plants in Mexico to Supply US Market

Chinese TV Makers Open Plants in Mexico to Supply US Market(Yicai Global) July 20 -- Mexico’s zero-tariff trade agreement with the US has made the Central American country very attractive to Chinese television manufacturers, stymied by the trade dispute between China and the US and wishing to gain better access to the world’s biggest market for color TV sets.

A color TV industrial chain is being formed between China, Mexico and the US, several industry insiders told Yicai Global. Although the main components are still made in China, the TVs are assembled in Mexico and the finished products are sold in the US, Central and South America.

Hisense Group took over the Mexican plant of Japanese TV manufacturer Sharp Corp. in 2016, said Yu Tao, general manager of the Chinese white goods maker’s color TV factory in Mexico. The facility produced 8.5 million units last year, most of which are destined for the US market.

Hisense is also constructing an industrial park for household appliances, such as fridges and washing machines in Mexico, Yu said, adding that the park should be ready this year.

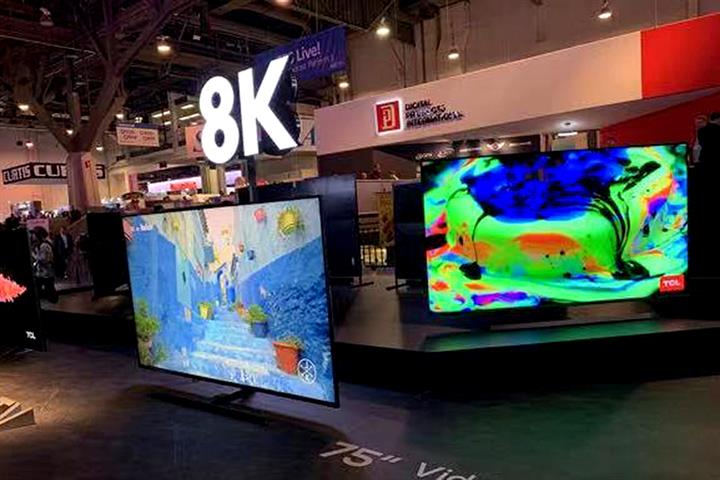

Rival TCL Technology bought Japanese electronics firm Sanyo Electric’s Mexican plant in 2014. It used to only produce large-sized TVs, which are expensive to transport. But with the hike in US tariffs and transport costs, it now makes television sets of all sizes.

Chinese display manufacturer BOE Technology Group also set up a TV plant in Mexico last year. And other companies such as TPV Technology and Hon Hai Precision Industry have established original equipment manufacturer foundries for TVs in Mexico.

The China-US trade tiff is the main reason why Chinese manufacturers are building factories in Mexico, said Hu Hai, head of the Hofushan Industrial Park in Monterrey, northeastern Nuevo León state.

To reduce costs, Hisense has increased localized raw materials and parts production, such as injection molding and sheet metal manufacturing, so that over 20 percent of the TVs’ main parts are now sourced locally. The liquid crystal display panels, a core component, still come from the Chinese mainland and Taiwan.

Mexico’s TV exports hold the biggest share of the US market at 60 percent. This is largely due to the United States-Mexico-Canada Agreement, which is a free-trade pact between the three nations.

By contrast, Chinese TV sets sold in the US are subject to a 11.4 percent levy. As a result, China’s share of the US market slumped to 20 percent last year from 55 percent in 2018, according to the China Chamber of Commerce for Import and Export of Machinery and Electronic Products.

Trade barriers and the fallout from the Covid-19 pandemic are making global industries shrink closer to local markets, said Zhou Nan, secretary-general of the home appliance branch of the China Chamber of Commerce for Import and Export of Machinery and Electronic Products.

Companies used to choose manufacturing locations based on cost, but now they are looking for places that are safer and more reliable, Zhou said. Mexico has become an important base for the production of home appliances after China. Chinese white goods makers should keep in mind their long-term targets when positioning their global supply chains.

Editors:Shi Yi, Kim Taylor