China's Phone Makers Set Sights on Premium Market in Global Growth Push

China's Phone Makers Set Sights on Premium Market in Global Growth Push(Yicai) Feb. 27 -- Chinese mobile phone manufacturers are speeding up their expansion into Southeast Asia, Europe, Latin America, and Africa. With devices that now compete with those of industry leaders Apple and Samsung Group, coupled with robust production capabilities, they are targeting the mid- to high-end market segments as key areas of growth.

Since last year, an increasing number of smartphone manufacturers have been sending teams overseas to explore these markets. They are not just focusing on the familiar Southeast Asian market, but Latin America and Europe are also becoming focal points for these companies to invest in.

"Last year, I went to Brazil four times," Billy Zhang, president of overseas marketing, sales and services at Oppo, told Yicai. "I spent a lot of time on airplanes, traveling from Southeast Asia to Latin America, then from Latin America to Europe, hopping from city to city."

"Oppo plans to invest more resources into markets with high demand for mid- to high-end phones, such as Europe and Latin America. I believe that in areas where Samsung and Apple currently have a strong presence, there will be significant growth opportunities for our business," Zhang said.

After resolving its patent dispute with Finland’s Nokia, Oppo is confident it can continue growing in Europe, Zhang said. “This year, we will focus even more on developing the European market," he added.

The firm’s Europe strategy will target three key markets at first, namely Germany, Spain, and Italy. The Dongguan-based firm expects to complete its business layout in these countries within three years.

Meanwhile, Honor said in January that it is entering the Indonesian market through a strategic tie-up with Indonesia’s largest mobile device and electronics retailer, Erajaya.

Honor’s decision to enter Indonesia wasn’t made lightly, Li Jing, head of the Shenzhen-based company’s South Pacific region, told Yicai. Mid- to high-end smartphones hold around 15 percent of market share in Indonesia at the moment and there is roughly 5 million units of market potential. Right now, Apple and Seoul-based Samsung dominate this segment, and Honor wants to claim some of that share from them.

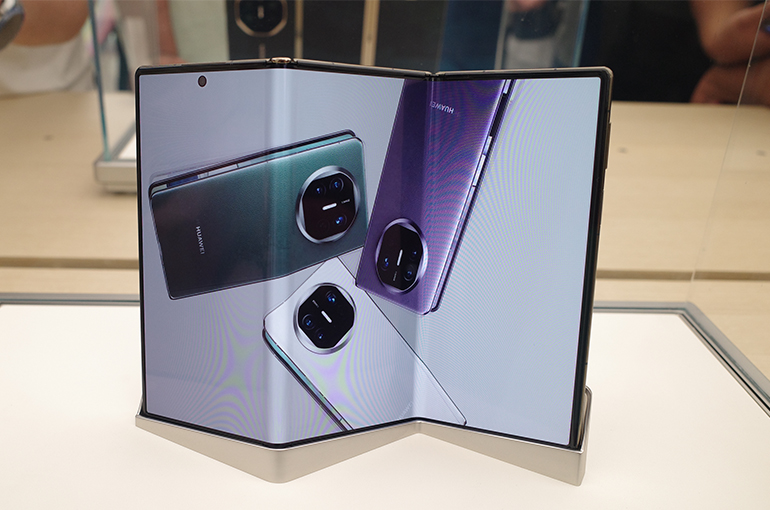

Chinese phones are closing the gap with Cupertino-based Apple in key areas such as imaging, system performance, and gaming. In fact, Chinese brands have even started to take the lead in imaging technology and are now confident enough to directly compete with Apple and Samsung, a tech director from a leading Chinese handset manufacturer said, adding that his company plans to take its investment in overseas markets to a new level this year.

Chinese phone makers are piling the pressure on their international competitors. For example, Samsung’s market share in Indonesia dropped sharply last year to 48 percent in the third quarter from 59 percent in the first quarter, Zhu Jiatang, senior analyst at market research firm Canalys, told Yicai. Apple’s share tumbled to 9 percent from 10 percent in the first quarter, while Chinese brands' combined market share jumped to 43 percent from 31 percent, over the same period.

Editors: Tang Shihua, Kim Taylor